Finance

-

Legal & Regulatory

Renewables Face Chills and Thrills in Project Financing

The winter of 2010-2011 has been a cold one for financing renewable energy projects. That’s the weather report from a recent project financing meeting in New Orleans, a survey of developers and builders done by a large Minnesota construction company, and accounts from those in the financial trenches.

-

Finance

TREND: Hydro on the Rise

Although it doesn’t get much attention, the world’s first and largest source of renewable electricity, water power, is still a major player on the world stage. Though viewed as politically incorrect by some folks, mostly in the developed world, and despite its well-known environmental impacts, using water to turn turbines to generate electricity represents an attractive way to generate electricity with no fuel costs, even in the U.S. Here’s what’s being talked about in the U.S., India, Turkey, Nigeria, and China.

-

Legal & Regulatory

Postmortem: U.S. Electric Transmission Siting Policy

Despite high-powered congressional legislation in 2005, the U.S. is still unable to site high-voltage interstate transmission lines in a timely fashion. Two new reports suggest ways out of the gridlock.

-

Finance

MIT: Uranium Supplies Adequate

Uranium remains plentiful around the world, says a new resource study from MIT, obviating the need to "close" the nuclear fuel cycle by reprocessing and developing breeder reactors.

-

Finance

The Pitfalls of Pollution Allowance Trading

The process of banking allowances under the existing schemes for creating markets for pollution reductions has created a set of difficult problems as those programs have changed, wiping out significant value from the allowances.

-

Legal & Regulatory

TREND: Smart Grid Complications

Despite a trendy moniker and lots of hype and interest, the smart grid has been facing some major setbacks of late, as regulators and customers begin challenging some of the claims for what interconnected smart meters will deliver in the way of tangible benefits.

-

Legal & Regulatory

Uranium Enrichment: Boom or Bust?

The prospects of a worldwide nuclear power renaissance have spawned many plans for increasing uranium enrichment capacity. Could those plans swamp the world in SWUs?

-

Legal & Regulatory

Dodd-Frank: Legislation and Magical Misdirection

Here’s how, with almost no attention, recent financial reform legislation changes how business must deal with whistleblower employees and affects other seemingly nongermane issues.

-

Finance

Bid Smartly . . . or Walk Away

With some industries reeling in today’s economy, future revenue growth is still uncertain in certain markets. The bright exception is the "new energy" arena of renewables and sustainables. But that’s a tough market, with lots of competitors for the business and lots of opportunities to misfire and miss the boat. A key to success is bidding smartly on contract opportunities. Otherwise, don’t bid at all.

-

Legal & Regulatory

Rethinking Revenue Assurance for Utilities

Should utilities take a new look at their approaches to maximizing profit margins?

-

Finance

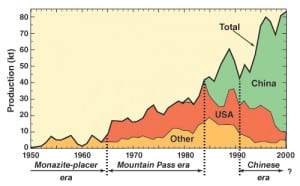

Rare Earth and Lithium Supplies Cloud Renewables

Ensuring an adequate supply of rare earth elements and minerals may be a hurdle in the renewable energy supply chain. The metals and their compounds are used in battery technologies, windmills, catalysts, and communications technologies. Add lithium (not a rare earth) to that mix, as Latin American politics could cloud the prospects for new lithium supplies.

-

Legal & Regulatory

Computing in the Clouds, Part II: It’s About Security

What do Gmail, YouTube, Twitter, and Facebook have in common? All are examples of cloud computing. All present serious data security challenges.

-

Legal & Regulatory

Power Owners in Strong Position to Collect Liquidated Damages

Although law varies by jurisdiction, a recent case demonstrates arbitration panels’ willingness to uphold liquidated damages clauses in power plant engineering, procurement, and construction contracts.

-

Finance

U.S. Wind Capacity Soars, Manufacturing Doesn’t

Wind generating capacity hit new highs in 2009, but that didn’t mean much for the wind power manufacturing sector, meaning fewer “green” jobs than the Obama administration hoped to see.

-

Legal & Regulatory

An Economist Looks at Climate Policy

An economist scratches his head in consternation as he looks at the discussion about climate change and energy conservation. Take his quiz to learn why commonly accepted assumptions make poor economic sense.

-

Legal & Regulatory

Where Are the New Engineers?

The U.S. isn’t producing the workforce it needs for the future of energy generation. And forget about “green jobs,” an undefined concept.

-

Legal & Regulatory

Addressing the Intraday Trading Position Conundrum

Power traders need to get faster, more accurate information on how markets are working and how they are swinging. They should look to telecommunications and manufacturing markets for solutions.

-

Legal & Regulatory

TREND: Coal in a Hole

While pundits opine that the U.S. economy is in recovery, that doesn’t show up in the world of coal-fired electric power plants (perhaps lagging economic indicators). For proof, see these recent stories.

-

Legal & Regulatory

Flipping the Switch: Why Utilities Need to Shed Light Now on Carbon Risk

Carbon is poised to become an auditable and verifiable reporting requirement for American business. Because utilities are among the organizations with the most at stake in a carbon-constrained economy, they should proactively tackle carbon management and carbon accounting in spite of uncertainties about the precise formulation of the final regulatory framework. In short, whether a carbon accounting requirement is legislative, administrative, or driven by business partners and consumers, now is the time for utilities to act.

-

Legal & Regulatory

DOE Mission Support

The National Academy of Public Administration faults the U.S. Department of Energy on human resource management, contract controls, and financial management.

-

-

Legal & Regulatory

Falling Demand Leads TVA to Trim New Reactor Plans

TVA scales back plans to revitalize new nuclear construction at its Bellefonte plant, suggesting that it will scrap plans for new units at the site and perhaps focus on its unbuilt unit that has been mothballed for 25 years.

-

Finance

TREND: Wind Power Becalmed?

U.S. wind power appears becalmed, partially stymied by transmission constraints, and also by financing difficulties in the current recession. Read the details.

-

Legal & Regulatory

Utility Customer Satisfaction: A Faith-Based Initiative?

Does customer satisfaction play a meaningful role in guiding utility operations? Many utilities think it does, as do many regulators. The market apparently doesn’t. Data suggest that the jury is out on the question, and the intuitive answer may not match the empirical evidence.

-

Legal & Regulatory

TREND: Coal Industry’s Future Faces Challenges

What role will coal play as the nation moves toward trying to reduce greenhouse gases? The picture is mixed, as these news stories from around the country demonstrate.

-

Legal & Regulatory

Coal Companies Peabody, CONSOL, and Arch Are Weathering the Economic Storm

Coal continues to demonstrate considerable financial muscle in the current economic downturn, despite anti-coal rhetoric and concerns about climate change.

-

Legal & Regulatory

Nuclear Loan Guarantees Have Failed

Nuclear loan guarantees in the 2005 Energy Policy Act have proven to be a failure: not just too little, but far too late.

-

Finance

Utilities Survive Credit Woes, So Far

So far, U.S. electricity generators have managed to survive the current credit slump and financial collapse, but their viability could suffer if the economy continues to deteriorate and credit markets remain tight.

-

Finance

Uranium Prices Fall with Those of Other Commodities

Market watchers predict that uranium prices will remain low in the short term. But low prices don’t necessarily mean that the fuel’s sales will increase.