The duck curve is named for its resemblance to a duck, with its peaks and valleys highlighting the effect solar production has on the power demanded from thermal generators and hydropower resources throughout the day. Advancements in energy storage technology are providing a new method for narrowing the timing imbalance.

Since 2006, solar energy production has grown at an annual rate of 59%, according to the Solar Energy Industry Association. Solar energy’s share of total U.S. energy generation skyrocketed from just 0.1% in 2010 to almost 2% in 2017. In the past three years, it has comprised an average of about one-third of all new energy capacity additions.

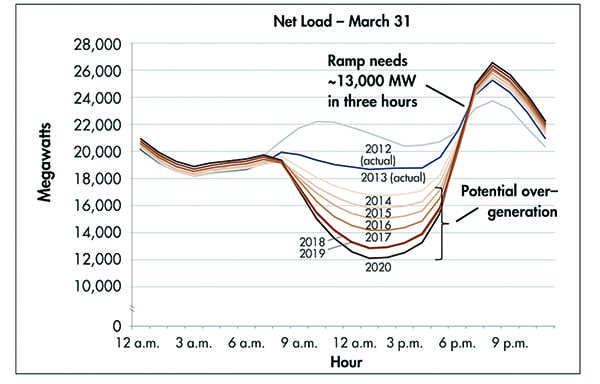

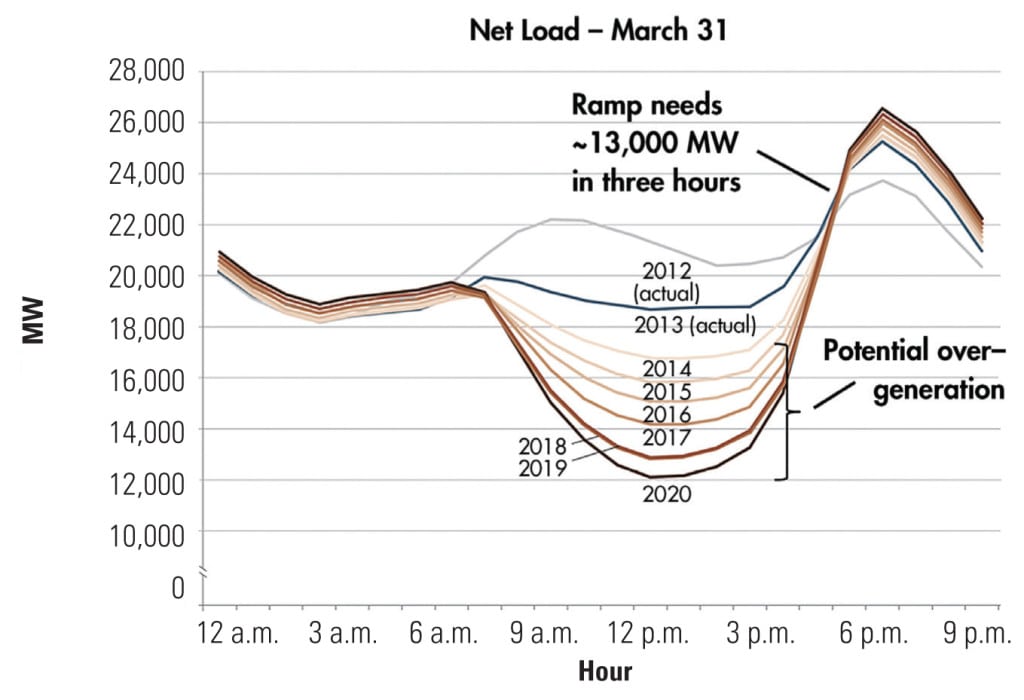

This rapid growth has resulted in a fundamental challenge for system operators by creating an imbalance in the supply and demand of energy on the grid known as the “duck curve.” The duck curve (Figure 1), which derives its name based on a chart published by the California Independent System Operator (CAISO) in 2013 resembling a duck, highlights the sharp midday drop in energy demand resulting from peak solar energy production followed by a short, steep ramp-up in the early evening hours as demand for energy increases and solar energy production falls.

In its report, CAISO noted three major problematic conditions affecting grid management that are exemplified by the duck curve. They are:

- ■ The creation of short, steep ramps caused by system operators being forced to quickly bring on or shut down energy generation to meet demand over a short period of time. To address this condition, CAISO stated that a flexible energy resource is necessary to quickly react to adjust energy production to meet sharp changes in demand.

- ■ The fact that peak midday solar production exceeding demand results in the risk of oversupply, which must be managed to avoid the costly consequences associated with overgeneration, including increased costs from curtailing energy production and reduced environmental benefits as a result of such curtailment.

- ■ The management of such oversupply during the midday hours results in decreased frequency response capabilities, which are caused by fewer energy resources being available to automatically adjust energy generation to maintain grid reliability. That is, as renewable generation resources (which typically do not have automated frequency response capability) deliver energy, conventional generation resources (which can typically provide automated frequency responses) are displaced. As a result, the grid becomes less reliable and is increasingly subject to disruptions. To avoid this risk, the grid needs access to automated frequency response systems that can quickly and automatically ramp up or down in the event of sudden interruptions.

To alleviate the problematic conditions resulting from the duck curve, utilities have traditionally turned to natural gas peaker plants to quickly deliver energy during peak demand periods. These plants have been favored over energy storage resources due to a lack of framework for the deployment of energy storage resources as well as higher storage costs. The problems created by the duck curve resulting from the expansion of solar energy have actually created a supply need that has historically been fulfilled by a fossil fuel resource.

However, recent policy shifts by the Federal Energy Regulatory Commission (FERC) and some pioneering states, coupled with advancements in the energy storage market, are signaling a shift toward utilizing energy storage as a more environmentally friendly and cost-effective alternative to gas-fired peaker plants. If these trends continue, a combined solar and energy storage facility could help provide a clean, renewable energy solution to the problems created by the duck curve.

Recent Policy Trends

Recent policy shifts prioritizing energy storage include a unanimous ruling by FERC issued on February 15, 2018, removing “barriers to the participation by energy storage resources in wholesale capacity, energy and ancillary service markets operated by regional transmission organizations (RTOs) and independent system operators (ISOs).” Under this ruling, RTOs and ISOs must revise their tariff structure to establish a participation model for energy storage resources recognizing the physical and operational characteristics of such resources.

Policy shifts favoring energy storage have also occurred at the state level. For example, California enacted SB 338 in September 2017, directing utilities to evaluate how, among other things, energy storage could be used as a carbon-free alternative to gas generation for meeting peak demand and flattening the duck curve. California also has passed legislation creating an independent body to resolve storage interconnection disputes and setting certain renewable energy procurement targets with energy storage examples (California’s AB 2868 directs utilities to invest in up to 500 MW of additional storage capacity).

Massachusetts Gov. Charlie Baker (R) in December 2017 awarded $20 million in grants to 26 projects (Figure 2) to develop the state’s energy storage market, and in March 2018 Baker introduced legislation to encourage a clean peak standard for his state, similar to California’s. The proposed legislation requires all retail energy suppliers to provide a minimum percentage of sales from clean peak energy resources, including energy storage systems. This proposal supplements the goals of the Energy Storage Initiative, previously announced by Baker, which among other requirements sets a target to install 200 MWh of energy storage by 2020 and creates a long-term sustainable solar incentive program to promote the development of cost-effective solar-plus-storage options.

Arizona’s Energy Modernization Plan, proposed in January 2018, calls for utilities to set a “Clean Peak Target” based on the amount of clean energy deployed during peak demand hours and then increase that baseline clean energy share by 1.5% per year until 2030. According to GTM Research, the largest impact of this target may be felt by the energy storage industry given that storage makes renewable power dispatchable on command.

Energy Storage Market Advancements

To go along with recent policy shifts, advancements in the energy storage market have resulted in significant cost reductions and are making solar-plus-storage projects more competitive. According to GTM Research, lithium-ion batteries are already cost-competitive with natural gas peaker plants in many scenarios, and by 2022, pricing for energy storage will regularly compete with new natural gas peaker plants. In fact, GTM Research predicts that by 2028, energy storage costs across the board will be lower than those associated with new natural gas peaker plants.

This trend of energy storage displacing natural gas peaker plants is not a mere prediction. In November 2017, NRG suspended its application for a natural gas-powered plant in Oxnard, California, after being presented with viable clean energy storage alternatives. Subsequently, in March 2018, NRG further announced that it would retire three existing natural gas plants in California by 2019. In addition, in January 2018, the California Public Utilities Commission instructed Pacific Gas and Electric to procure energy storage or other clean energy resources to replace three existing natural gas plants in California. Arizona regulators took an even bigger step in March 2018 by placing a moratorium until January 1, 2019, on new gas plants larger than 150 MW and requiring utilities to consider energy storage options.

Recent deals in the solar energy market demonstrate that utility-scale solar-plus-storage projects are gaining traction as viable alternatives to supply energy during peak demand hours to offset the effects of the duck curve. In January 2017, AES Distributed Energy and the Kauai Island Utility Cooperative in Hawaii entered into a power purchase agreement (PPA) for a 28-MW solar facility coupled with a 20-MW/100-MWh battery system at a cost of 11¢/kWh. Not to be outdone, in May 2017, Tucson Electric Power and NextEra Energy entered into a PPA for a 100-MW solar array and an accompanying 30-MW/120-MWh energy storage system at a price of less than 4.5¢/kWh, with a historically low price for the solar generation component of under 3¢/kWh.

NextEra, through its subsidiary Florida Power & Light, has also announced additions of battery storage systems to two of its existing solar facilities in Florida during the first quarter of this year. One is a first-of-its-kind, grid-scale, direct current-coupled battery system at its Citrus Solar facility. The other is the largest solar-plus-storage system built in the U.S. to date, which provides 10 MW/40 MWh of battery storage at its Babcock Ranch Solar Energy Center.

In February 2018, Arizona Public Service (APS) and First Solar announced a PPA agreement for an even larger battery storage solution, which will result in a 50-MW/135-MWh battery system powered by a 65-MW solar facility. The project was selected specifically in response to APS’s request for proposals (RFP) for peaking capacity energy resources to deliver energy between 3 p.m. and 8 p.m. to address the problems created by the duck curve. Although this RFP was open to any type of technology and bids received included natural gas peaker plants as well as standalone renewable and battery systems, First Solar’s solar-plus-storage solution was selected as the winner.

If recent policy trends favoring energy storage continue to flourish and advancements in the energy storage market continue to reduce storage costs, solar-plus-storage facilities are likely to take flight by providing a quick, reliable, and cost-effective solution to flatten the duck curve. ■

—Purvin N. Patel is a principal at Squire Patton Boggs, where he focuses on corporate and energy-related matters including renewable energy development.