For many utilities there is a razor-thin difference in the price of electricity generated by natural gas and by coal. Slight changes in fuel price can therefore produce dramatic swings in production costs, creating market opportunities for utilities with both gas- and coal-fired assets and assured fuel supplies. Utilities considering new gas-fired assets have several options.

A Platts report released in August 2013 predicts that retirements of coal-fired plants will “surge” through 2015, when the U.S. Environmental Protection Agency’s (EPA’s) Mercury and Air Toxics Standards go into effect. This will be accompanied by a commensurate increase in the amount of natural gas used to produce electricity. In addition, Platts’ analysts project that if the EPA adopts some form of cap and trade scheme to effect reductions of CO2 in the future, we should expect a “materially larger increase” in natural gas use for power generation.

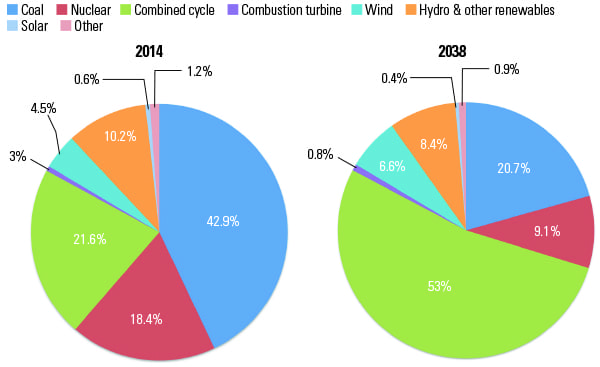

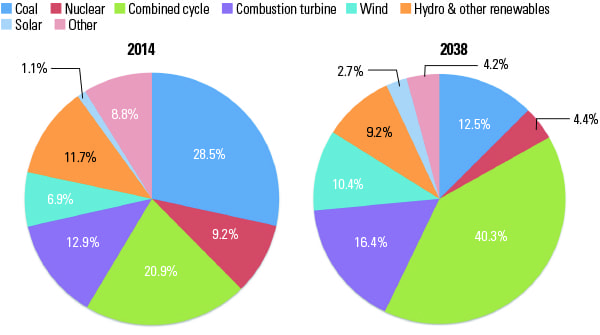

In the meantime, coal, which accounted for 50% of U.S. generation in 2005, will end 2013 at about 40%, with natural gas–fired generation at an expected 27.2%, down slightly from a peak of 30.6% in 2011 but up from 18% in 2004. As former Exelon CEO John Rowe famously observed, “coal will remain King. Gas will be Queen.” That may be true for the short term, but Black & Veatch predicts that over the next 25 years, natural gas will dethrone coal (Figures 1 and 2).

|

| 2. Changing installed capacity mix. The amount of gas-fired capacity is expected to significantly increase during the next 25 years. Source: Black & Veatch |

Projected Coal Rebound in 2013

New construction of efficient combined cycle generation continues, with the majority developed in states that traditionally burn mostly coal. On average, the U.S. coal fleet operated at a 57% capacity factor during 2012 and will likely increase slightly in 2013.

Thomas Fanning, Southern Company’s chairman and CEO, noted in an April 2013 interview that Southern ran its combined cycle fleet at near-record 70% capacity factor during the first quarter of 2013. Southern expects to produce 47% of its power from gas in 2013 and 30% from coal. Five years ago, Southern produced 70% of its power from coal and 16% from gas. PPL Electric Utilities ran its gas-fired units at 92% capacity factor during the first quarter, said CEO William Spence in May. Similarly, PSEG ran its New Jersey and Connecticut coal-fired plants at just 2% capacity factor during the first quarter, heavily favoring natural gas. Conversely, American Electric Power (AEP) president and CEO Nick Akins said during an April 2013 report to shareholders that the price of natural gas has risen to levels where “you’ll see the pendulum swing back toward coal-fired generation.” At the time, AEP was operating its coal plants at a 65% capacity factor and its gas-fired plants in the mid-30% range—almost a complete reversal from 2012.

Power plant emissions are also dropping. Using 2005 as a baseline, the Environmental Integrity Project reports that the changing fuel mix reduced CO2 emissions from power generating plants by 13.1% by the end of 2012. However, as fuel prices rose over the past year, the Energy Information Administration projected an increase of 8.7% in coal-fired generation in 2013, although CO2 emissions are projected to stay below pre-2005 levels.

The operating advantage will go to utilities with a diversified fleet that are able to switch between coal and gas as the market price of fuels seesaws, particularly during periods of flat electricity growth such as that experienced over the past few years.

Four Practical Options

Utility owners of coal-fired power stations that wish to balance their exposure to coal-fired generation with additional natural gas–fired generation have several options to consider. The four most practical options are cofiring coal and gas in the same boiler, converting the coal-fired boiler to gas-only operation, repowering the coal plant with natural gas–fired combustion turbines, or replacing the coal plant with a combined cycle plant.

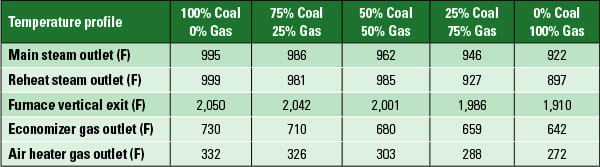

Cofiring Gas and Coal. Cofiring is the lowest-risk option for substituting gas use for coal. Cofiring is defined as burning two different fuels simultaneously to produce heat in the steam generator, and it is typically implemented with natural gas or fuel oil at coal-fired power stations (Table 1).

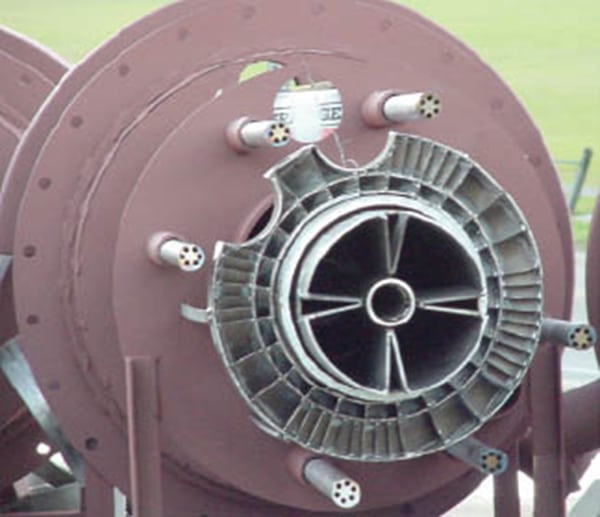

Natural gas cofiring has many advantages that make it attractive (see sidebar). The first is that many power stations already use natural gas as a startup fuel, so a gas fuel supply infrastructure to the steam generator is already in place. Some power stations currently operate their gas igniters or warm-up guns when recovering from coal-related equipment derating. This typically requires only a modest capital project to increase the size and duty cycle capability of the unit. If new waterwall penetrations are required, the capital cost and complexity of the project can increase significantly. Often, gas igniters and warm-up guns can be upsized in-place to yield as much as 20% to 25% total heat input to the steam generator.

| Natural Gas Has the AdvantageNatural gas combustion in general has several advantages when compared to coal:■ Loading and duty cycles of the coal-related equipment are reduced, typically proportional to the overall change in natural gas heat input.■ Regulated emissions tend to decrease proportionally to the change in natural gas heat input, as long as the gas burner design is sound and combustion controls are able to accommodate dual-fuel use.

■ Slagging and fouling in the boiler can be greatly reduced with even modest levels of natural gas cofiring, provided that the gas burner placement does not overheat a specific region of the steam generator while the unit is still burning coal. ■ As the heat input level of natural gas increases, excess air requirements will decrease, which will reduce sensible heat losses and reduce both air and flue gas fan power requirements. ■ Coal mill loading and duty cycles are decreased, which can be especially helpful for coal-fired units that are currently mill-limited or that have frequent mill maintenance outages. The number of spare mills will increase as the natural gas fuel heat input increases, leading to more opportunities for plant staff to perform preventative maintenance and for operators to avoid mill derates during unplanned outages. ■ Erosion and corrosion will decrease throughout the unit as the natural gas heat input increases, most significantly within the steam generator itself. Mill, ash-handling systems, flue gas ductwork, and emissions equipment wear will be reduced, as will corrosion from sulfur, chlorine, and alkali metals. ■ As the natural gas heat input increases, the duty cycles of emissions equipment will decrease. With natural gas cofiring, electrostatic precipitators fields may be de-energized, scrubber recycle pumps or even entire scrubber absorber towers may be turned off, and selective catalytic reduction system catalyst life will be extended. Coal and flue gas stream additive use may be reduced as well. ■ Bottom ash, fly ash, pyrites and mill rejects, scrubber sludge or gypsum, and many other waste products typical of coal combustion will be reduced. Natural gas combustion also poses several problems when used in a cofiring application: ■ Due to the high hydrogen content of natural gas (roughly 25% by mass), latent heat losses resulting from the production of water during the combustion process can be much higher than for all but the wettest coals. ■ Differences in the flame temperature, gas mass flow, soot and ash reflectivity, and slag levels on the boiler waterwalls can result in heat transfer imbalances throughout the steam generator. At gas heat input levels below 50%, these heat transfer imbalances can typically be managed via operations efforts. At higher gas heat input levels, more costly measures are often called for, including heat transfer surface modifications, special coatings on furnace waterwall tubes, or pronounced use of flue gas recirculation to stabilize furnace temperatures. ■ Supply restrictions limit the maximum level of natural gas used, and seasonal restrictions may be put in place to prevent the plant from jeopardizing the gas supply for home heating use. |

The greatest benefit of employing natural gas cofiring with coal is increasing the fuel flexibility of the unit. There are many ways in which increased fuel flexibility can benefit a coal-fired unit, such as these:

■ Lower-cost coals can be purchased with less concern for lost capacity. For example, a unit that operates most efficiently using only coals with moisture content of 27% or less (a typical Southern Powder River Basin coal) can likely push this specification to include the lower-cost, higher-moisture coals from the Northern Powder River Basin (PRB).

■ More aggressive spot market purchasing can be employed. A “finicky” unit that suffers from a variety of exclusively coal-related derates can sometimes find great values on the used equipment market, knowing that if the coal-related equipment isn’t up to the task, natural gas can supplement the heat input and maintain the desired load.

■ Power stations that are unsure about the quality of their coal stockpiles or that suffer from poor or erratic blending practices can put those fears to rest. If for some reason too much poorer-quality coal is stocked into the bunkers or silos, then operators can modulate natural gas use to make up the difference.

■ Unexpected outages of parallel equipment (such as coal mills) can be hedged by having natural gas available to make up lost load.

■ Coal inventory levels can be reduced. In the event that significant unexpected coal supply restrictions occur, natural gas use can be maximized to reduce the coal pile draw-down. Conversely, should natural gas supply restrictions occur unexpectedly, coal use could be increased to maintain the unit generation plan.

■ Some emissions control retrofits may be reduced in scope, delayed, or avoided, depending upon the coal quality, level of gas cofiring that is intended, and the plant’s regulatory environment.

Provided that the gas pipeline is of sufficient size, few fuel-handling system modifications are required for natural gas cofiring. Using recent Black & Veatch studies as a guideline, capital costs for implementing natural gas cofiring (outside of new pipeline costs) can range from $10,000 to $100,000 per MW.

Coal to Natural Gas Conversion. There are advantages to converting an existing coal-fired power station to one fueled entirely by natural gas, although it is a higher-risk option than operating as a dual-fuel unit. Achieving the unit’s maximum continuous rating (MCR) when burning coal or natural gas typically requires significant physical modifications to the boiler. If the goal is to decommission the unit for coal use frequently, the existing burner penetrations can be used for the installation of 100% capacity natural gas burners. Heat transfer surface area modifications are typically required and can be completed during the same outage when the burners are replaced. (See “Natural Gas Conversions of Existing Coal-Fired Boilers” in the August 2011 issue.) Using recent Black & Veatch feasibility studies as a guideline, capital costs for implementing a complete coal to natural gas conversion (outside of new pipeline costs) can range from $100,000 to $250,000 per MW.

A complete coal-to-gas conversion virtually ensures that sulfur and particulate-related emissions upgrades will not be required, although in a tight regulatory scheme controls may be required for NOx and CO emissions. Although CO2 emissions will be much less than when burning coal, CO2 emissions will be higher than with a modern gas-fired combined cycle plant (CCP) because the steam plant has a lower thermal efficiency.

Decommissioning of the coal-related equipment may not be required from a logistics and plant operations point of view, although it may be required by environmental regulators as part of a revised air emissions permit. In a worst-case scenario, the coal yard and ash ponds may need to be environmentally reclaimed. Demolition, removal, and remediation costs vary greatly by site, ranging from $3,000 to $30,000 per MW.

Repowering a Coal-Fired Unit. The next-most-expensive option is to repower the unit by reusing as much as possible of the existing coal unit to form a new CCP. This is typically done by refitting the existing steam turbine to work with one or two gas turbine units in parallel, and reusing such major equipment as the condenser and circulating water systems, cooling tower, site buildings, transformer yard, and so forth. (See “Repowering South Mississippi Electric Power Association’s J.T. Dudley, Sr. Generation Complex” in the August 2013 issue.) The steam turbine may derate 10% to 20% of its original nameplate capacity due to the differences in steam flow between a conventional boiler and a multiple-pressure heat recovery steam generator.

Black & Veatch has found that when a lifecycle cost evaluation is performed, the modest cost savings of the repowering option is quickly cancelled out by the many project risks involved with repowering, the plant outage costs, and the higher efficiency of the CCP over the lifetime of the plant.

Complete Unit Replacement with a Combined Cycle Gas Turbine. The most extreme step in replacing coal-fired generation with natural gas generation is tearing down or mothballing the coal-fired unit to replace it with a new CCP on site or elsewhere in the utility’s service territory. (See “High Bridge Combined Cycle Project” in the September 2009 issue.)

Three Case Studies: Evaluating Natural Gas Cofiring

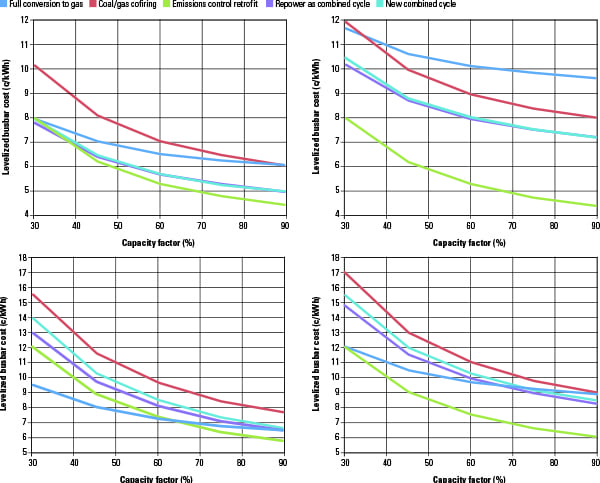

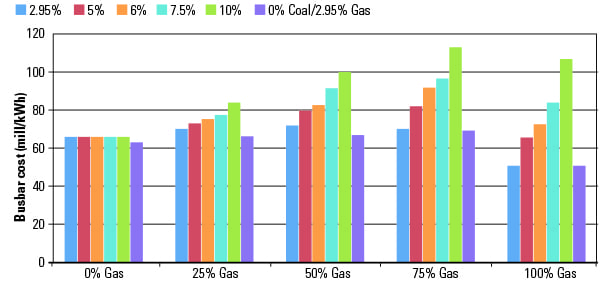

For each of the four options, the expected service life of the power station is of critical importance in an economic analysis. Some options that appear economically attractive in the short term may become unattractive in the long term. Figure 3 illustrates a comparison in the levelized busbar cost between several gas deployment options at a coal-fired power station, for 10-year and 30-year service life options. The impact on the levelized busbar cost of electricity remains a strong function of the plant’s expected capacity factor and the cost of natural gas.

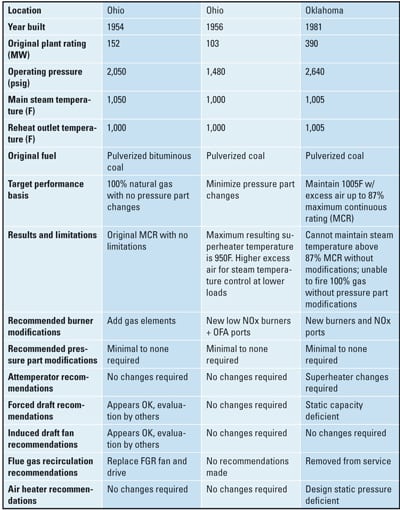

Black & Veatch has performed several case studies for power industry clients on the advantages of increased fuel flexibility at several existing power plants. Three interesting situations were recently studied:

■ Unit 1 was designed to burn bituminous coal, is currently burning 100% PRB coal, and is currently derated.

■ Unit 2 was designed to burn PRB coal and now operates without derates.

■ Unit 3 was designed to burn PRB coal and now faces expensive upgrades to meet best available control technology (BACT)-level emissions limits.

Each case represents a “real-world” situation in which the effect of natural gas cofiring was examined to determine the economics of cofiring. The Electric Power Research Institute’s Vista program was used in this study, which examined more than 2,000 performance, 600 maintenance, 20 emissions, and 60 different economic-related factors at each unit. In each case, the gas cofiring or conversion retrofit capital cost was at an assumed “worst case” value of $100,000/MW.

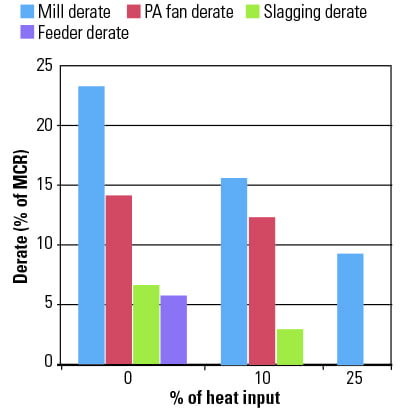

Unit 1: The Currently Derated Case. In typical operation, this unit is derated as much as 24% from its MCR load due to fuel quality limitations. The PRB coal has much lower heat content and a higher moisture content than the unit’s design fuel. As the level of gas cofiring increases, the derates due to fuel quality decrease as well. All unit derates are eliminated with 50% natural gas heat input (Figure 4).

|

| 4. Eliminate a derate. Cofiring natural gas with PRB coal can restore a unit to full capacity. Source: Black & Veatch |

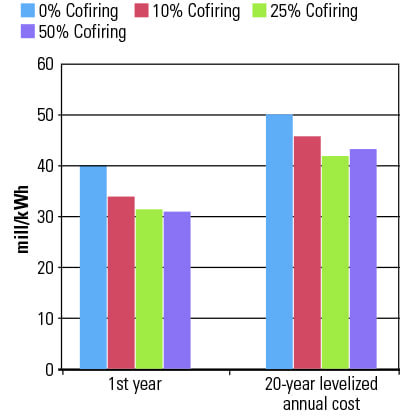

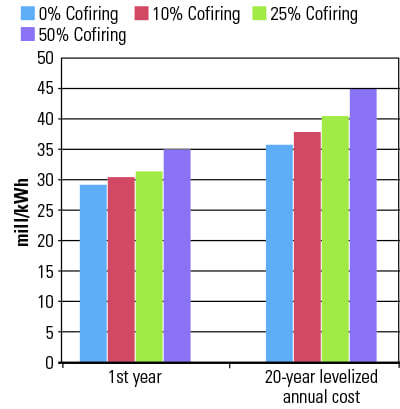

The economic impact from natural gas cofiring for these various gas heat input levels was analyzed on a first-year and 20-year levelized annual cost basis and considered all factors that constitute the total fuel-related cost of the unit (that is, omitting the operations and maintenance of the turbine and water-side, cooling towers, switchyard and generator, and the like). In the short term, derate elimination is the most powerful economic driver, but on a long-term basis, an economic “sweet spot” occurs when cofiring with 25% natural gas.

It must be noted, however, that the primary driver here is the derate cost. If, for example, the power station is not assessed any penalty whatsoever for derate cost (but can benefit from improvements in auxiliary energy use and improved equipment availability), the cost curve changes its shape (Figure 5).

Unit 2: The Non-Derated Case. The non-derated case is similar to the prior case when the derate due to using PRB coal was eliminated. In general, natural gas cofiring at this plant cannot compete with PRB coal on a total fuel-related cost basis (Figure 6).

|

| 6. Does not compete. Cofiring a unit originally designed to burn PRB coal was not economically justified. Source: Black & Veatch |

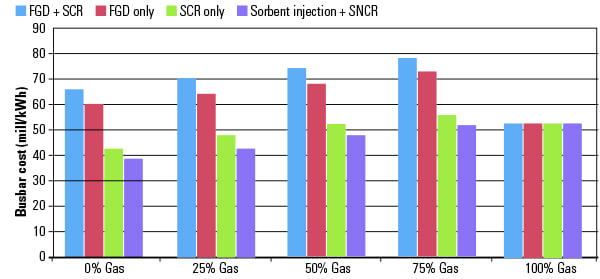

Unit 3: The BACT PRB Unit Case. In this case a unit designed for PRB coal must now install new and expensive emission control equipment to meet tighter emissions limits. The required controls include a wet limestone flue gas desulfurization (FGD) system at 95% removal efficiency, single scrubber booster fan, conversion of a selective noncatalytic reduction (SNCR) system to a selective catalytic reduction (SCR) system at 90% efficiency, trona sorbent injection system, and an activated carbon injection (ACI) system. The capital cost of the FGD is $800/kW and the SCR is $200/kW. The trona sorbent injection and ACI system are estimated to cost $10 million. All operations and maintenance costs (fixed and variable) were estimated by the Vista program. All capital costs were assumed to have a fixed charge rate of 15% and a discount rate of 7%.

The busbar electricity costs were evaluated. The analysis found that at 75% natural gas cofiring the SCR system was no longer needed and at 100% natural gas cofiring the installation of the FGD and all other emissions equipment was avoided (the existing SNCR system was assumed to remain in place for NOx control).

It was determined through the course of this analysis that the estimated future price of natural gas was the primary variable and economic risk factor. Given the recent history of natural gas development and market conditions, it is highly speculative to estimate natural gas prices 10 years from now, let alone 20. Therefore, several economic sensitivity cases were run to examine different levels of natural gas price escalation, ranging from 2.95% (the baseline assumption) to 10%. In addition, a special case that assumed 0% coal price escalation was compared with these cases (Figure 7). We can conclude that the 100% gas case is actually the cheapest alternative for meeting emissions requirements until the gas price escalation exceeds 5% to 6%.

The effect of varying gas cofiring strategies versus varying capital cost scenarios was also compared to evaluate the economic risk should the regulatory requirement be less than assumed. Figure 8 shows that any time the FGD system is required, 100% gas conversion is the least-cost alternative. The study also found that the sorbent injection plus an SNCR option is cheaper than the 100% gas case.

|

| 8. Many upgrade options. The price of electricity changes significantly based on the suite of environmental upgrades required and the amount of natural gas cofired with coal. Source: Black & Veatch |

Each power station occupies a unique economic, emissions, and performance position within a utility’s coal fleet. No one solution is appropriate for every plant. However, many utilities can benefit from increased fuel flexibility and improved unit reliability by implementing natural gas cofiring. Natural gas cofiring allows a utility to maintain a unit’s capability to burn 100% coal while providing a hedge against rising coal prices and the rising cost of complying with new air emissions regulations. ■

— Una Nowling (nowlinguc@bv.com) is a project manager and technology lead for fuels at Black & Veatch. She has worked on fuels-related issues and analyses at more than 550 different units over 20 years, specializing in coal, natural gas, and biofuels. She is also an adjunct professor of mechanical engineering at University of Missouri-Kansas City.