Environmentalists renewed their attacks on coal-fired power development in 2010. At the same time, Congress dithered on cap-and-trade legislation while the Environmental Protection Agency marched forward rules to reduce carbon emissions from coal-fired power plants. Couple the regulatory uncertainty with lean economic times that have flatlined electricity demand growth plus low natural gas prices, and the result is predictable: New coal-fired plant construction is in the doldrums.

For developers of coal-fired power generation, 2010 has been a difficult year, and 2011 looks to be more of the same. Long-sought legislative clarity on carbon dioxide (CO2) emissions proved elusive, as Congress was consumed by lengthy debates over the BP oil spill, the economy, and reforms to the health care and financial systems. Despite the Obama administration’s prodding and the potential for the Environmental Protection Agency (EPA) to begin regulating CO2 emissions under its Clean Air Act authority, nothing could move energy legislation on Capitol Hill in 2010.

This lack of clarity—about carbon regulation, the EPA’s Transport Rule, and the EPA’s pending draft regulations on mercury emissions, among other factors—put development of new-build coal-fired power plants in the U.S. in a state of limbo during 2010. As of September, not a single new coal-fired power project has begun construction this year. Industrial Info is tracking 14 coal projects that are currently under construction in the U.S., representing approximately 9,200 MW of new generating capacity. Two additional projects, representing 1,250 MW, are in advanced stages of development, and another 25 projects, representing over 15,000 MW, are in various stages of planning. Balancing out these new projects are the 55 projects, representing over 33,000 MW, that have been placed on hold in 2010.

Prairie Plant Progress

The Prairie State Energy Campus (PSEC) in Marissa, Ill., is one of the few coal-fired projects under construction. In many ways, this plant is emblematic of the state of coal-fired power development in late 2010.

PSEC is a $4 billion power plant and coal mine complex scheduled to go online in late 2011. When completed, PSEC will include two supercritical units, each rated at 800 MW, that promise to produce 15% less CO2 than traditional pulverized coal boilers. Environmental control equipment occupies nearly half of the complex’s footprint, including selective catalytic reduction for NOx reduction, a dry electrostatic precipitator to remove 99.9% of the particulates, a flue gas desulfurization system to remove 98% of the sulfur dioxide, and a final wet electrostatic precipitator to remove any remaining particulates and other constituents in the flue gas. Sufficient mercury will also be removed from the flue gas by the air quality control equipment to be in compliance with Illinois mercury emissions limits.

What’s missing? Opponents of the project argue that the plant should have CO2 emissions controls in anticipation of new carbon reduction regulations. Proponents argue that developers are not required to meet future, undefined regulations but only must comply with those regulations in effect when permits were secured. This is the uncertainty that plagues coal-fired plant developers these days.

Although construction is advanced, PSEC remains a high-value target for many environmental organizations. The “Beyond Coal Campaign,” organized several years ago by the Sierra Club and including the participation of a number of environmental groups, has a goal of stopping all new coal-fired power plants. In hearings held by Congress and state public utility commissions, increasingly sophisticated environmental advocates called attention to the financial, environmental, and regulatory uncertainties posed by construction of new coal-fired power plants.

The “Beyond Coal Campaign” claims to have killed 133 of 237 proposed coal-fired power projects in the U.S. Industrial Info’s data show that 131,000 MW of planned U.S. coal-fired generating capacity have been cancelled in recent years, representing a total investment value in excess of $200 billion. How many of these plants were cancelled due to environmentalist intervention, the drop in electricity demand due to the recession, uncertainty about federal and state regulations, or significant new natural gas reserves (and much lower prices) remains underdetermined.

An Aging Fleet

While the tide of public opinion has been turning against coal, time may be on the side of coal-fired power developers. Roughly half of the nation’s electricity still comes from coal-fired power plants. The U.S. has about 328,000 MW of operating coal-fired power plants, but more than one-third of that capacity—117,397 MW—is more than 40 years old. Among these senior citizens, more than 600 smaller coal-fired generators, totaling over 60,000 MW, have installed no emissions control equipment to comply with EPA rules that are expected to be finalized by the end of 2011. Most analysts expect that many of these older, higher-emitting plants will be shut down once the industry knows the environmental standards to which these plants will be held.

According to Industrial Info’s research, more than 14,000 MW of coal-fired capacity are scheduled to be retired over the next five years. Other sources see as much as 27,000 MW of coal power retirements.

A sizable percentage of the nation’s coal fleet is nearing retirement age, and little is being done today to replace those aging assets. During 2010 considerable natural gas power development took place (see “U.S. Gas-Fired Power Development: Last Man Standing,” POWER, September 2010). But few who lived through the last gas-fired power build-out a decade ago want to see another glut of plants built and operating economics destroyed if gas again soars from $4 to $15/mmBtu. And despite the popular green luster of wind power and solar power, few expect those sources to generate more than a few percentage points of the nation’s electricity over the next decade.

Plenty of Coal Projects

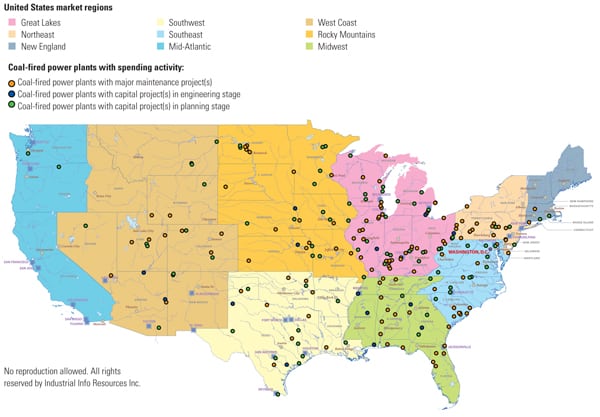

Although no new coal-fired plants may break ground this year, Figure 1 shows a total of 340 upgrade and improvement projects at coal-fired power plants, valued at over $23 billion, which are scheduled to begin construction in 2011. That sum includes $16 billion in new “clean coal” projects, $5 billion in environmental retrofits (including carbon capture and sequestration [CCS]), over $1.5 billion in major maintenance work, and nearly $1 billion in efficiency upgrades.

|

| 1. Expected U.S. coal power projects. This map shows 340 projects scheduled to kick off at coal-fired power plants in 2011, categorized by whether a project is a major maintenance project or a capital project in either the planning or engineering phase. Source: Industrial Info Resources |

Storing Carbon

During 2010 coal power developers and utilities keenly tracked the progress of various post-combustion projects designed to capture and store power plant CO2 emissions, as finding a cost-effective CCS process is at the heart of keeping coal alive as a source of electricity.

AEP’s Mountaineer project, which became operational in late 2009, was the nation’s first integrated CO2 capture and sequestration project at a coal-fired power plant. That project, located in New Haven, W.V., is using Alstom’s chilled ammonia process to capture the CO2 from a flue gas slip stream (see “Alstom’s Chilled Ammonia CO2-Capture Process Advances Toward Commercialization,” February 2008). The Mountaineer CCS project is receiving about $334 million in Department of Energy (DOE) funding.

Early this year, NRG’s Parish Generating Station in Houston received notice of a DOE award of up to $154 million to demonstrate capturing CO2 emissions using Fluor’s Econamine FG Plus as a reagent (see “Commercially Available CO2 Capture Technology,” August 2009). Carbon dioxide captured on that project will be used in enhanced oil recovery projects. NRG expects its CCS project to begin operating in 2013.

Pre-combustion technologies to lower CO2 emissions got a huge boost in August when the DOE announced it was restarting its long-stalled FutureGen project, but the new version, dubbed “FutureGen 2.0,” went in a completely new direction: repowering Ameren Corp.’s shuttered 200-MW Meredosia Unit 4 with advanced oxy-combustion technology. The project also includes construction of a 175-mile pipeline that will transport CO2 from the plant for injection underground. The prior iteration of FutureGen called for construction of a greenfield integrated gasification combined-cycle power plant in Mattoon, Ill., coupled with a CCS system.

— Britt Burt (bburt@industrialinfo.com) is vice president of research, and Shane Mullins (smullins@industrialinfo.com) is vice president of product development for the power industry at Industrial Info Resources (http://www.industrialinfo.com) in Sugar Land, Texas.