At Tennessee Valley Authority (TVA), repeated generation transitions have marked the giant public power utility’s long history, from hydro, to coal, to nuclear. The latest resource plan points to natural gas, along with renewables and energy efficiency, as the basis for the agency’s generating future.

At the Tennessee Valley Authority (TVA), generation transitions are nothing new. The nation’s largest public power system—with 34 GW of generating capacity, supplying retail distributors with nine million customers in seven states (Alabama, Georgia, Kentucky, Mississippi, North Carolina, Tennessee, and Virginia) and about $11 billion in annual sales—TVA has gone through repeated changes in its generation profile over its 82-year history.

“For the first 20 years,” TVA President and CEO Bill Johnson told POWER in an interview in May, “it was hydro. Then coal. Then nuclear. Now, it is all-of-the-above plus energy efficiency, renewables, and demand response.” And, in a big way, adds Johnson, natural gas (see sidebar).

TVA’s Generating Resources

Tennessee Valley Authority (TVA) has its roots in water—hydropower was its calling card in the beginning. Over time, it has almost every resource available. Here’s how it’s portfolio breaks out today, according to the draft Integrated Resource Plan.

Nuclear. TVA operates six reactors: three at Browns Ferry, two at Sequoyah, and one at Watts Bar, with a second Watts Bar unit likely to come online this year after 36 years of construction. The current nuclear units have a capacity of 6,700 MW; Watts Bar 2 would add another 1,150 MW.

Coal. The TVA coal system consists of 10 coal-fired stations with 41 active generating units, totaling about 11,900 MW. In recent years, TVA has retired 11 coal-fired units and idled another seven. According to the utility’s draft Integrated Resource Plan, by 2016 the coal fleet will decrease to about 32 units with a total capacity of 10,300 MW “as a total of 16 units are expected to be idled to comply with environmental requirements.”

Natural Gas. TVA runs 87 combustion turbines at nine power stations with a combined capacity of about 5,400 MW and 11 combined cycle units at five plants with some 3,900 MW of generating capacity (Figure 1). That combined cycle figure will increase immediately by 700 MW with the recent purchase of an existing plant in Ackerman, Miss.

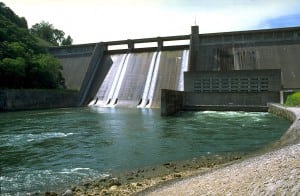

Hydro. The TVA hydro system is made up of 109 conventional units at 29 dams, with generating capacity of about 5,400 MW. TVA also has a long-term power purchase agreement with the U.S. Army Corps of Engineers at eight dams on the Cumberland River system for another 400 MW.

Storage. Raccoon Mountain is a pumped storage project—TVA’s largest hydro facility at 1,616 MW—which stores water off peak for release when demand is high.

Wind. TVA buys all the power produced by the Buffalo Mountain wind farm in Anderson County, Tenn., with 27 MW of nameplate capacity from 18 turbines. The agency also has a long-term power purchase agreement with eight wind farms in Illinois, Kansas, and Iowa, with 1,500 MW of nameplate capacity, and TVA estimates that about 14% of that will be available for summer peaks.

Solar. The agency owns 16 photovoltaic arrays with a combined nameplate capacity of about 300 kW. TVA also buys solar output through several long-term contracts with 72 MW of nameplate capacity; TVA expects about half of that to be available at summer peaks.

Biomass. At the Allen Fossil Plant, TVA cofires methane from a nearby sewage treatment plant and also cofires wood waste at the Colbert Fossil Plant. TVA says, “The co-firing is more like a fuel switch for coal and does not provide addition capacity at either of these plants.” The agency buys about 49 MW of biomass generation from non-utility providers.

Oil. TVA owns five diesel generators, and several others are under contract, providing a total of about 120 MW of capacity.

Energy Efficiency. TVA’s efficiency and demand response programs focus on peak demand reduction. The power agency says that from fiscal 2012 to fiscal 2104, it has seen peak reductions of 451 MW, or 1,843 GWh in energy demand.

A New Sort of Integrated Resource Plan

TVA released a draft Integrated Resource Plan (IRP) in the spring that charts the giant power-generating utility’s likely roadmap for the next 20 years. Johnson is particularly proud of the draft IRP, which is getting good reviews from the system’s many stakeholders, ranging from the Sierra Club and its “Beyond Coal” campaign to the Tennessee Valley Public Power Association, which represents the 155 municipal utilities and rural electric cooperatives that buy TVA’s power to sell to retail customers.

“I’ve been reading IRPs since the mid-1990s. This is a unique IRP because it treats efficiency and renewables as resources.”

—Bill Johnson, President and CEO, TVA

“I’ve been reading IRPs since the mid-1990s,” Johnson said. “This is a unique IRP because it treats efficiency and renewables as resources,” not as afterthoughts. The TVA process creates models to evaluate five scenarios of demand growth for the future and, based on least-cost analysis, lets the judgments flow from that analysis. The IRP draft states, “We paved new ground by developing a unique way to measure and model the financial costs of energy efficiency and renewable resources as if they were traditional power plants. This method is a more disciplined approach than ever before that we believe creates a much better picture on how all resources can be best utilized to support load growth in the Valley.”

According to Johnson, TVA is building its plan on projections of economic growth of 0.9% annually for the region. “We haven’t seen quite that much this year,” he said. The Tennessee Valley, Johnson noted, didn’t get hit as hard as much of the rest of the country by the 2008 “Great Recession,” but it has been slower in recovering. Johnson attributes that to “organic efficiency.” While more things are being plugged into the electric system, they are increasingly using less power than predecessor appliances. He cites LED lighting as an example.

The draft IRP also points to the role of natural gas in displacing electricity. Because of the low cost of TVA power, the region has substantial loads for space and water heating. The IRP notes, “If consumers can heat their homes and water cheaper using natural gas or other energy sources, they may move away from electricity in the long term.”

According to the draft plan, each of the scenarios points to the need for new generation. But baseload generation is not on the utility’s planning radar.

Once the Watts Bar 2 nuclear plant comes online and the Nuclear Regulatory Commission (NRC) approves a 450-MW upgrade at the Browns Ferry nuclear station, TVA needs no additional baseload generation. Both events are likely this year. Johnson told POWER, “We have seen a change in the load shape. The minimum loads have gotten lower and there is more volatility in the intermediate range.”

That suggests, Johnson acknowledged, a move toward gas-fired combined cycle plants, which TVA has been installing for the past five years or so. In the years before that, the power agency was installing combustion turbines at its coal-fired plants for peaking needs. TVA expects natural gas prices to remain low, and the power agency benefits from easy access to gas from the Marcellus shale north and east of the Valley and Gulf resources to the south, as well as good pipeline capacity in between.

In April, TVA closed on the purchase of a 700-MW combined cycle plant in Ackerman, Miss., for $340 million, owned by Quantum Utility Generation. TVA had been buying power from the plant since 2008. According to TVA, the purchase “is the sixth combined cycle gas facility TVA has built or purchased since 2007, with two more under construction.” In a press release, Johnson said, “This was an opportunity to acquire a power plant that already provides electricity to TVA at a price that is significantly less than it would cost to build a comparable plant.”

As the IRP modeling scenarios play out, most of the variations in plant expansions relate to tradeoffs between energy efficiency and natural gas. Across the scenarios, says the IRP, “The addition of natural gas units vary more significantly than other resources.” The analysis suggests an addition of 4.8 GW of combustion turbines at the highest demand scenario to 800 MW at the lowest; the need for additions of combined cycle generation are consistent over the five models.

The Coal Plan

Gas prices and environmental regulations will determine how TVA will deal with its coal-fired plants “in the mid-2020s.” Johnson said, “By the end of this decade, we will have retired 40% of our coal fleet,” in part because of a settlement with the Environmental Protection Agency on coal ash storage, following a massive 2008 coal ash pond spill at the agency’s Kingston coal-fired plant in Tennessee.

Johnson noted that “the average age of TVA’s coal units is 55 years, and some are in good shape; some are not.” What remains on the TVA system, he said, “will be fully scrubbed, fully controlled, and producing only dry ash.”

The Obama administration’s Clean Power Plan to reduce carbon dioxide from existing coal plants is likely to be less of a headache for TVA than for some other coal-heavy utilities, Johnson said. He said TVA already has reduced CO2 emissions by 30% from 2005 levels. The utility is on track for a 40% reduction by 2020. He added that the least-cost planning approach in the resource plan helps guide where TVA can find carbon reductions, including opportunities to use its extensive hydro system more efficiently.

Selective Renewables

When it comes to renewables, the IRP says, “Solar resources begin appearing in the resource plans in the mid 2020s; wind resources appear in the late 2020s.” A recent article in the Chattanooga Times Free Press raised the possibility that TVA might become a customer of the 700-mile high-voltage, direct-current Clean Energy Line bringing Western wind power to the TVA region. It’s a $2 billion project.

TVA quickly reacted. The IRP states that “generally the HVDC wind option is not selected until the early 2030s,” and Joe Hoagland, the TVA vice president who presided over the IRP, told the newspaper the agency wasn’t all that bullish on wind. “The wind blows when the wind blows. What we’re trying to maintain is a balanced portfolio of power.” TVA currently has 1,500 MW of (nameplate) wind capacity, most of it under contract from non-utility suppliers. “We don’t get a lot of energy” from that, Johnson said.

Last February, when the nine-member TVA board authorized the purchase of the Mississippi combined cycle gas plant, it also approved a power purchase agreement with NextEra Energy for electricity from a planned 80-MW utility-scale solar farm in Lauderdale County, Tenn. TVA has an interest in utility-scale solar going back to the 1980s.

But rooftop solar, one of the hottest topics in electricity today, is unlikely to be a major resource in the region, in part because of the governmental structure of the power agency. The Brits have a word that describes TVA: “Quango.” That’s short for “quasi-autonomous non-governmental organization,” or “an organization to which a government has devolved power.” TVA is owned by the U.S. government, which appoints its board of directors and somewhat limits its operations. But TVA is largely self-regulated. It gets no direct funding from Washington and finances its operations with income from sales of power to its distributors and debt that it issues in the conventional debt market.

The power agency has no direct retail customers. Those belong to its munis and co-ops that sell TVA’s wholesale electricity. The agency can regulate its distributors, and not the other way around. According to CEO Johnson, TVA’s board decided some time ago that it would not adopt a net metering regime. According to SimpleEnergyWorks (http://bit.ly/1PLeTgE), a Tennessee solar installer:

TVA has decided that “Net” metering is illegal in their service area. They do this by forbidding all of their distributors from purchasing any electricity from any other source than TVA. All distributors must sign a contract agreeing to only purchase electricity from TVA. And this includes purchasing any electricity from a small power producer (like a home solar system).

So no customers in the TVA region can connect a solar system and then just buy and sell at the retail rate. To connect to the grid a solar customer must connect according to TVA’s rules … and have 2 meters (one dedicated to usage, the other dedicated to production).

TVA pays the wholesale market rate for the solar power, not the retail rate common in net metering programs.

Controversies

TVA has been controversial since President Franklin Delano Roosevelt created the agency in 1933 for flood control and economic development in the depressed region along the banks of the Tennessee River and its tributaries. When TVA, which had great powers and direct federal financing, began building hydro power, local investor-owned utilities (IOUs) launched a campaign to gut the agency. TVA’s first hydropower project, the Norris Dam on the Clinch River (Figure 2), began operating in 1936. By the end of World War II, TVA had become the nation’s largest electricity supplier.

TVA and its private-sector critics warred for decades, culminating in a giant battle over supplying power to Atomic Energy Commission (AEC) facilities in Tennessee, known as the Dixon-Yates controversy. TVA wanted to build capacity to supply the AEC. A consortium of IOUs, with the support of the Eisenhower administration, also wanted to supply the plant. In a dispute that eventually reached the U.S. Supreme Court, TVA won.

TVA opponents, led by Republicans in Washington, consistently blocked TVA from getting appropriated federal funds to build coal-fired capacity, so the agency looked for authority to issue debt financing. (Ironically, TVA last year announced that the coal-fired Allen plant, built 56 years ago near Memphis after the aforementioned court ruling, would be converted to combined cycle gas.) In1959, Congress approved legislation allowing TVA to issue bonds, which became the agency’s primary financing mechanism.

In the 1960s, forecasting enormous economic growth in the region (which didn’t materialize at the scale TVA hoped), TVA went gaga over nuclear. TVA Chairman Aubrey “Red” Wagner eventually ordered a total of 17 nuclear reactors from every vendor in the U.S. (General Electric, Westinghouse, Babcock & Wilcox, Combustion Engineering, and General Atomics). Only a third got built, as the 1970s saw a combination of low economic growth (and electric demand), high inflation, and high interest rates. By the 1980s, TVA’s much-diminished fleet of nuclear units was experiencing widespread operating troubles. The NRC shut down TVA’s five operating reactors for almost five years. It was a low point for TVA and for the nation’s nuclear power program.

As the 1990s progressed, TVA’s nuclear fleet began to improve its performance (as did units at many other U.S. nuclear utilities). At the same time, Congress began moving TVA toward a more private-sector profile, until today, when the agency looks, feels, and behaves much like a large, investor-owned utility—although some advantages of TVA’s relationship with government remain.

The sniping and skirmishing among TVA and its private-sector counterparts has largely subsided. But there are still calls from economic conservatives to end TVA’s status as a government-owned entity. In May 2014, Ken Glozer, a retired veteran of the White House Office of Management and Budget, wrote a Heritage Foundation critique of TVA. He said:

The Tennessee Valley Authority (TVA) has had 80 years of independence from the oversight, review, and budgetary control of a more traditional federal agency, as well as from the rigors of operating as a private shareholder-owned utility.

This lack of effective oversight from either the government or the private sector has resulted in costly decisions, excessive expenses, high electricity rates, and growing liabilities for all U. S. taxpayers.

Glozer argued, “The most effective way to restore efficiency to the TVA system is to sell its assets via a competitive auction and bring it under the rigors of market forces and public utility regulation.” Regardless of the merits of his argument, that’s impossible, given the lobbying clout of TVA, its distributors, and the public power sector of the electricity industry.

—Kennedy Maize is a long-time energy journalist and frequent contributor to POWER.

[A version of this article will appear in the July issue of POWER.]