Since its inception as Florida Power & Light Co. in 1925, NextEra Energy has transformed into the world’s largest utility company. The company’s history is symbolic of the growth and uncertainty that has characterized the history of power.

Here’s some irony: The world’s most formidable clean power firm—a company that has for a decade now aggressively combatted global warming—grew out of a set of generators that were dedicated to making ice.

Historical records suggest that as early as in the 1890s, scattered icemakers across several cities in Florida began to kick off a rudimentary build-out of poles and wires to support their wood-fired generators. As efforts across the state grew to embrace electricity—then still a revolutionary convenience—developers began building more extensive, “modern” plants. By 1923, almost all towns had an ice plant, but connectivity was beginning, mainly through the establishment of smaller individual utilities, to meet power demand. In 1924—during a period that marked the heyday of generation system consolidation across the U.S.—holding company American Power & Light Co. began snapping up smaller utilities and laying lines, armed with a vision for a broader integrated system. On Dec. 28, 1925, that effort resulted in the incorporation of Florida Power & Light (FPL).

“In the beginning, FPL owned power plants, water facilities, gas plants, ice companies, laundry services, and even an ice cream business,” the company notes. “In its first year, it served approximately 76,000 customers in 58 communities and had a generating capacity of 70 MW.” But by spring of 1927, FPL’s customer base had already doubled, a growth intensity it has nurtured for nearly a century now.

In 1950, American Power & Light made FPL an independent public corporation listed on the New York Stock Exchange, mainly in response to a Congressional act that limited utility holding companies. In 1984, the company formed holding company FPL Group Inc. to enable further expansion by creating and acquiring companies. As deregulation gained steam in the 1990s, FPL Group in 1998 began FPL Energy, a formidable competitive generator, allowing it to expand outside the regulated space.

In 2009, buoyed by its relative success, FPL Group renamed FPL Energy to “NextEra Energy Resources” to reflect better the entity’s “clean energy mission and market focus.” The subsidiary at the time already held 6.3 GW of wind capacity and 310 MW of solar power, including seven solar plants in California’s Mojave Desert, and portions of several nuclear plants, including the Seabrook Station in New Hampshire, the recently-shuttered Duane Arnold Energy Center in Iowa, and Point Beach Nuclear Plant in Wisconsin.

A year later, FPL Group moved to change its own name to NextEra Energy Inc. The name would both “better reflect the company’s scale as one of the largest and cleanest energy providers in the country, its diverse scope of operations across 28 states and Canada, and its forward-thinking, innovative approach to providing energy-related solutions for customers,” as well as make it more distinct from its still thriving utility subsidiary Florida Power & Light, it said.

A Global Energy Giant

Today, Juno Beach, Florida–based NextEra Energy is one of the largest electric power and energy infrastructure companies in North America. Its structure comprises two principal businesses: FPL, which in 2019 absorbed Gulf Power, a northwest Florida–based rate-regulated electric utility; and NextEra Energy Resources (NEER).

|

|

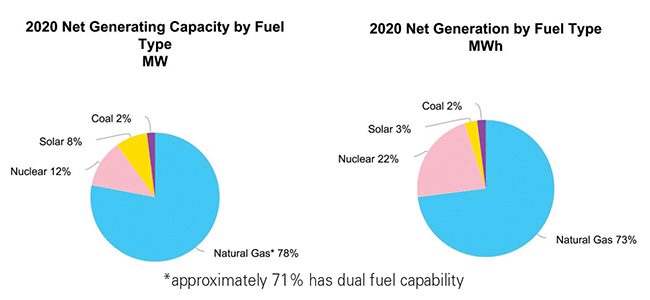

1. Florida Power & Light (FPL) is NextEra Energy’s rate-regulated electric utility engaged primarily in the generation, transmission, distribution, and sale of electric energy in Florida. FPL is the largest electric utility in Florida and one of the largest electric utilities in the U.S. As of December 2020, FPL had about 28.4 GW of net generating capacity, approximately 76,200 circuit miles of transmission and distribution lines, and 673 substations. Courtesy: NextEra Energy |

As the nation’s largest vertically integrated rate-regulated utility, FPL’s strategic focus is centered on investing in generation, transmission, and distribution facilities, NextEra Energy explained. At the end of 2020, FPL owned 28.4 GW of net generating capacity (Figure 1) and more than 76,000 miles of transmission and distribution lines.

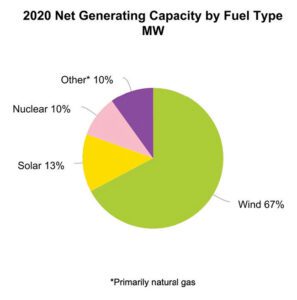

Meanwhile, NEER “is the world’s largest generator of renewable energy from the wind and sun, as well as a world leader in battery storage,” it said. NEER, pivotally, also develops, builds, and operates long-term contracted assets throughout the U.S. and Canada, “primarily consisting of clean energy solutions such as renewable generation facilities and battery storage projects, and electric transmission facilities,” it said. In all, NEER has about 23.9 GW of capacity, most of which is in competitive markets across 38 states, and 520 MW in Canada (Figure 2).

|

|

2. NextEra Energy Resources (NEER) comprises NextEra Energy’s competitive energy and rate-regulated transmission business. NEER had about 23.9 GW of total net generating capacity across 38 U.S. states and Canadian provinces. Courtesy: NextEra Energy |

Driven by Strategy

Over the past decade, NextEra Energy’s immense scope and diversified operations have been mostly governed by a strategy. “This strategy starts with a vision: We want to be the largest, most profitable clean energy provider in the world with the best skills and capabilities across the industry,” James Robo, NextEra Energy’s chairman and CEO, wrote in a letter to stakeholders. The strategy is rooted in environmental, social, and governance (ESG) impacts, which “have been a part of everything we do for more than 25 years,” he said. “We are passionate about generating clean, renewable energy while protecting the environment and giving back to the community.”

According to Robo, capital investment has been central to the company’s ballooning growth. “Over the past decade, we have invested nearly $90 billion in clean energy infrastructure, making us the largest U.S. infrastructure investor in the energy industry and one of the largest capital investors across any industry in the U.S. over this period,” he noted. These investments are the bedrock for the company’s own sustainability within the ever-morphing power landscape, he suggested. “By investing in smart infrastructure and innovative clean energy solutions, we are helping to build a sustainable energy future that is affordable, reliable and clean. Our capital investments also will help us meet our goal of reducing our carbon dioxide (CO2) emissions rate 67% by 2025 from a 2005 baseline. We believe that no company in any industry has done more to reduce carbon emissions and to confront climate change than NextEra Energy,” he said.

One specific triumph Robo has highlighted is NextEra Energy’s commitment to affordable energy. “Our investments at FPL have resulted in best-in-class customer value with typical bills that are about 30% below the national average, record reliability, and a CO2 emissions profile that is nearly 30% better than the national average,” Robo said.

NEER’s mission is similar. Its leadership status around the world in renewable generation and battery storage stems from the desires of customers and their stakeholders, who “want cleaner emissions,” but also “see that renewables and storage can reduce their costs,” he said.

Robo said the strategy is paying off. “Over the past 15 years, NextEra Energy has had a terrific track record of consistently growing adjusted earnings per share, with a compound annual growth rate over this period of nearly 8.5%. These consistent returns have resulted in NextEra Energy outperforming both the S&P 500 and the S&P 500 Utilities indices in terms of total shareholder return on a one-, three-, five-, seven- and 10-year basis,” he said. “Over the past 15 years, we have outperformed all of the other companies in the S&P Utilities Index and 85% of the companies in the S&P 500, while more than tripling the total shareholder return of both indices. As a result, we have grown from an average-sized utility by market capitalization 15 years ago to the largest utility company in the world today.”

Walking a Fine Balance

Like other major utilities, NextEra Energy has fueled changes in the political and public turn to favor its sustainability initiatives through political lobbying. It acknowledges political lobbying at the local, state, and federal level as part of heavyweight trade associations. In the first half of 2020, for example, it spent $4.3 million in dues for trade groups. The majority went to the Edison Electric Institute, the Business Roundtable, the Florida Chamber of Commerce, the New England Power Generation Association, and several energy storage groups.

“Successful political engagement at the state, county, and local levels encourages regulatory and permitting frameworks that support the company in becoming the world’s leading generator of energy from the wind and the sun. Engagement at the U.S. federal level has helped to develop a robust renewable electric generation industry, which supports tens of thousands of U.S.-based jobs,” the company says. In fact, “[w]ithout the company’s active political engagement, it is likely that overall renewable development within the U.S. would have been significantly lower than current levels,” it claims.

Still, the strategy is not without hurdles. In a recent 10-year site plan submitted to Florida regulators in April 2021, FPL described the fine balance it must achieve to provide affordable power while maintaining profitability. Another challenge involves balancing its load and generating capacity, particularly in fast-growing metropolitan areas, like Miami-Dade and Broward counties. FPL suggests the impact on demand from federal and state energy-efficiency codes and standards could reduce summer peak load in 2030 by about 1,500 MW and reduce annual energy usage by 3,800 GWh. At the same time, current load forecasts project “significant” increases in electric vehicle adoption.

Many future-looking decisions are being driven by the same dynamics that have fueled the utility space worldwide over the last two decades: forecasted natural gas costs; projected costs for new generating units; the efficiency with which generating units convert fuel into power; and costs related to environmental impacts. The 10-year site plan envisions additions of about 9,313 MW of additional PV generation in the 2021 through 2030 time period, much of which will still be “fixed-tilt” as opposed to “tracking” solar, considering higher costs for “tracking” technology.

|

|

3. FPL began its first power plant at its Dania Beach location in Broward County in 1927. The plant site was modernized in the 1950s and again in the 1990s. Courtesy: FPL |

Modernizations will also be a priority. Along with battery additions—including a 409-MW battery installation at the 2.8-GW gas- and oil-fired Manatee plant (which is to be imminently retired)—FPL plans to build a pioneering combined cycle (CC) unit at the Dania Beach Clean Energy Center (Figures 3 and 4), a project for which it gained state approval in 2018. Plans also call for upgrades to combustion turbine components, as well as CC units, to ready them for hydrogen combustion. A notable pilot project planned for the existing Okeechobee CC, for example, could fuel its turbines with solar-produced hydrogen. Projected to go into service in late 2023, the project could guide the utility’s “future use of hydrogen in a larger way,” including as a fuel in existing and new CC units, like Dania Beach Unit 7.

|

|

4. As part of another ongoing modernization initiative, the Dania Beach site will host a new combined cycle power plant that will feature two first-of-their-kind GE 7HA.03 gas turbines. The gas turbines will be the “world’s largest, most efficient, and flexible gas turbines” for the 60-Hz market when they begin commercial operation in mid-2022, GE has told POWER. This is a conceptual rendering of the proposed facility and is subject to final engineering. Courtesy: FPL |

Modernizations also extend to NextEra’s nuclear facilities. In December 2019, FPL’s Turkey Point Units 3 and 4, in Miami-Dade County won the Nuclear Regulatory Commission’s first set of subsequent license renewals (SLRs), effectively extending their lifetimes beyond 60 years and up to 80 years—through 2053. Turkey Point’s two 800-MW units entered commercial operation in 1972 and 1973, respectively, and their previous licenses were set to expire in 2032 and 2033. In August 2021, FPL also filed SLR applications for its two units at the 2-GW St. Lucie nuclear station in Jensen Beach, Florida.

A Bright Outlook

The consensus among analysts is that FPL faces a bright future. Moody’s Investors Service has called FPL, NextEra Energy’s principal subsidiary, a “crown jewel.” The firm reports, “A rarity amongst U.S. regulated electric utilities, FPL’s growing population within its service territory generates organic sales and load growth, as well as new investment opportunities that provide steady rate base expansion with earnings and cash flow growth potential.”

Moody’s has also noted that while FPL earns the vast majority of its net income through its base rates, the various clauses “provide for adequate and timely cost recovery and returns on certain other investments. The company has experienced very little in disallowances and regulatory lag in cost recovery. For example, its fuel and capacity clauses are adjusted annually based on expected fuel and purchased power prices and for prior period differences between projected and actual costs,” it said. FPL may also recover pre-construction costs and carrying charges for construction work-in-progress for nuclear capital expenditures. In addition, FPL has an environmental cost recovery clause that is adjusted annually for capital spending and operating expenses related to emission controls, it said.

Outlooks for NEER, a company that accounts for about 25% of NextEra Energy’s returns, are slightly more complex. According to financial documents released last October, NEER’s pipeline of projects for installation by 2024 includes more than 12 wind projects with a combined capacity of 5,823 MW, and more than 50 solar projects, totaling a combined 9,485 MW. But while 85% of NEER’s revenue over 2018, 2019, and 2020 was derived from wholesale electricity markets, the company is seeing significant growth for its regulated and contracted assets. Growing demand for renewable energy backed by federal, state, and local incentives has allowed the company to sell power under long-term contracts to an array of customers, including larger utilities that are looking to meet their own sustainability goals, Moody’s said.

“The long term revenue visibility from the contracted assets that are predominantly renewables, which entail no fuel risk or commodity price exposure, is in contrast to the typically higher risk associated with unregulated power companies that are exposed to wholesale merchant power sales and challenged coal and nuclear plants,” it said. And while NEER faces development and project execution risks, the company “has a strong track record of completing projects on time and within budget,” it said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).