The North American Electric Reliability Corp. (NERC) is warning that large swathes of the North American bulk power system (BPS) could face “elevated risks” of energy shortfalls this summer, especially if temperatures surge beyond normal peaks. But in California, risks are even more pronounced, owing to its reliance on imports to offset falling solar PV output in the late afternoon.

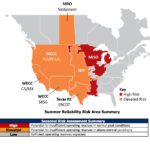

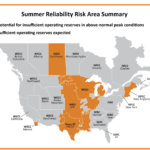

In its May 26-issued 2021 Summer Reliability Assessment (SRA), the nation’s designated Electric Reliability Organization (ERO) cautions that “above-normal” heat events pose “elevated risks” for energy emergencies in Texas, New England, the Midcontinent Independent System Operator (MISO), and parts of the West. While grid operators in these regions have resources to meet normal peak summer demand, during abnormally hot events, they could see soaring demand from temperature-dependent loads, such as air-conditioning and refrigeration, or a reduction to power supplies stemming from “lower-than-capacity resource output or increased outages,” the entity said.

But in California, which suffered rolling outages owing to extreme heatwaves last summer, NERC warns of more pronounced risks of energy emergencies, even during periods of normal peak summer demand. NERC’s risk scenario analysis suggests the area will face “high risk” if above-normal demand is widespread in the West.

While unprecedented, the SRA is just another indicator that illustrates NERC’s “increased concern” about changes the ERO is seeing on the grid and their potentially dangerous consequences for reliability, NERC President and CEO Jim Robb underscored on Wednesday. “Many of you have been covering NERC for a while, and you’ve heard me talk about the challenges to the reliability paradigm created by a BPS that’s rapidly becoming more decarbonized, more distributed, and more digitized,” he told reporters. When viewed in terms of these multiple disruptors—which industry has termed a “three-D” transformation—the energy transition has offered “significant benefits to the industry and to consumers,” including “a substantially reduced carbon and environmental footprint, improved economics and improved operating and control efficiencies.”

However, changes are occurring at a “cost of rapidly increasing operating complexity on an increased cyberattack surface. In addition, we’re witnessing the reliability impacts of extreme weather, both hot and cold, as evidenced in California last summer in Texas earlier this year,” Robb said.

“The events of this past year and the outlook for summer is a stark reminder that in our hurry to develop a cleaner resource base, reliability and energy adequacy has to be taken into consideration,” he warned.

California’s Precarious Reliability Conditions

NERC’s precarious outlook for California is especially emphatic owing to California Independent System Operator’s (CAISO’s) generation and transmission capacity struggle to keep up with increased demand last summer, and its two prominent firm load-shed events of 1,087 MW on Aug. 14, 2020, and 692 MW on Aug. 15, 2020. In a final root cause analysis released on Jan. 13, CAISO, the California Public Utilities Commission (CPUC), and the California Energy Commission (CEC) pinned the events on a climate change–induced heat wave that drove power demand beyond existing electricity resource planning targets. The analysis suggests that the supply gap was exacerbated by an underperformance of CAISO’s natural gas fleet, numerous wildfires that threatened the loss of major transmission lines, and high clouds from a storm that covered parts of the state, reducing output from solar facilities. California typically imports a lot of energy from neighboring states, but because the heatwave was affecting most of the Western region, fewer imports were available than usual.

The Western Interconnection, notably, set a peak demand record of 162,017 MW on Aug. 18, days after the load-shedding events, which regional entities managed through calls for conservation. Responding to the supply shortages and under a directive from the CPUC, California utilities have since procured additional generating capacity, and around 3.4 GW of new resources are in late-stage planning for addition this summer.

However, as Mark Olson, manager of NERC’s Reliability Assessment division, underscored on Wednesday, though the SRA anticipates a reserve margin of 23.8%, well above the 18.4% reference margin level (which was raised from 13.7% last year), probabilistic studies suggest 10,185 MWh of energy in the area could go unserved this summer. “Resource additions since 2020 in California help at time of peak demand, but because they are mainly solar PV, they have limited capabilities in the afternoon and early evening, which continues to be a particularly challenging time of day,” he explained during a media briefing.

Compounding the issue is that while the region will need imports to manage these risks, “the availability of imports is overall lower than in past years, and this is a particular vulnerability in wide-area heat events,” he said.

Elevated risks otherwise also shroud the entirety of the Western Electricity Coordinating Council (WECC), the entity that promotes reliability for the Western Interconnection system, owing to a projected surge in peak demand and lower resource capacity, NERC said. Under normal conditions, most WECC regions have enough energy and resource capacity, as well as adequate transmission to transfer power between areas to meet system ramping needs.

“However, conditions such as wide-area heat events can reduce the availability of resources for transfer as areas serve higher internal demands. Additionally, transmission networks can become stressed when events such as wildfires or wide-area heatwaves cause network congestion,” NERC warned. The growing reliance on transfers within the Western Interconnection and falling resource capacity in many adjacent areas also increases the risk that extreme events will lead to load interruption, it said.

According to Olson, NERC’s probabilistic analysis for WECC—which “provides results that encompass the range of expected and more extreme conditions” and is based on modeling of demand and resource profiles across all summer hours—found that “the expected unserved energy in California for this summer is over 10,000 MWh.” During an extreme event, up to 11 GW of additional transfers could be needed in the late afternoon to offset reduced solar output, NERC explained. “This is in contrast to 1 GW of transfer needed on a normal peak day.”

Conditions at ERCOT Tighten if Demand Soars and Wind/Solar Output is Low

Within the Electric Reliability Council of Texas (ERCOT)—the grid that saw its own share of debilitating statewide blackouts during Winter Storm Uri this February—on-peak planning reserve margins have jumped to 15.3%. That compares planning reserve margins of 12.9% last summer, which fell below the region’s reference reserve margin of 13.75%. The planning reserve margin has benefited from additions of 7,858 MW in wind, solar, and battery resources since 2020.

On May 6, ERCOT said, citing its final summer seasonal assessment of resource adequacy (SARA) that it should have enough generation to meet a summer 2021 peak demand of 77,144 MW—which is nearly 5 GW higher than the current summer system-wide peak demand record of 74,820 MW set on Aug. 12, 2019. The SARA anticipates 86,862 MW of resource capacity will be available during summer peak demand hours, and it suggests the region will have a 15.7% reserve margin this summer, slightly higher than NERC’s evaluation. ERCOT’s reserve margin is based on “an accounting of load reduction resources that can be deployed by ERCOT during Energy Emergency events,” the grid entity said. ERCOT’s total resource capacity figure of 86.9 GW, however, includes only 64.1 GW of thermal and hydro resources, and it is counting on 4,808 MW of planned gas-fired, solar, and wind capacity additions.

Notably, to ensure reliability and prevent weather-related generator outages, ERCOT has since May 17 begun visiting “select” thermal power plants to review their summer weatherization plans, prioritizing sites that have had “one or more” forms of outages during summer conditions in past years. “While plant visits have occurred in the past for winter weatherization, this is the first time officials will visit plants for summer,” the grid operator said.

According to ERCOT’s Vice President of Grid Planning and Operations Woody Rickerson, the final SARA points to a “low risk” for emergency conditions. However, conditions could tighten if the grid sees a combination of factors in real-time, including record demand, high thermal generation outages, and low wind/solar output, he said.

NERC’s Olson offered a similar analysis on Wednesday, pointing to a list of risks facing the Texas grid this summer. “Weather conditions can cause lower levels of generator performance, causing an elevated risk of a shortfall,” he said. Another factor is that “a significant portion of the electricity supply comes from wind generation in Texas, which is variable and dependent on weather conditions,” he said. NERC’s low-wind scenario—which represents a 75% reduction in on-peak wind resource output—puts ERCOT “at or near” their required operating reserve levels, Olson noted.

Abnormal Conditions Could Challenge MISO, ISO-NE, Southwest

For MISO, which also shed load during Winter Storm Uri in February, NERC’s summer scenarios suggest expected resources will meet operating reserve requirements under normal peak demand scenarios. MISO will have 141.4 GW of summer anticipated resources—the majority which is fired by gas and coal and nuclear—compared to a net internal peak demand of 116.4 GW. But, “Above-normal summer peak load and outage conditions,” however, could require “operating mitigations,” like demand response and short-term interruption, NERC said.

ISO–New England (ISO–NE), which serves six New England states—Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont—will also have “sufficient resources” to meet periods of peak demand. However, “above-normal” levels of demand in a 90/10 forecast—where the forecast has a 10% probability of being exceeded by the actual peak—will likely exceed capacity resources and require additional non-firm transfers from surrounding areas, the SRA says. A similar situation could occur in the Southwest U.S., said Olson.

A Dire Warning: Energy Deficiencies Almost Certain

NERC’s outlook is especially dire because weather officials—including from Natural Resources Canada and the U.S. National Weather Service—indicate above-normal temperatures are likely across much of North America, said John Moura, director of NERC Reliability Assessment and Performance Analysis, on Wednesday. Risks are additionally posed by another active wildfire season in the Western U.S., as well as drought conditions, which could extend to more than the western half of the U.S. and central Canada.

Moura, who has overseen NERC’s crucial task of watching BPS reliability and security since 2008, suggested with extraordinary emphasis that NERC’s outlook for the period between June and September constitutes one of the “highest-risk cautionary warnings that the assessment has provided as long as I’ve been doing it—and that’s quite some time.”

NERC, he said, is at the point where it can “almost confidently” predict that “there will likely be energy deficiencies in at least one part of the country,” this summer.

The entity has raised “yellow flags” for years, urging caution around the changing resource mix, including the rapid retirement of conventional generation and the installation of more variable generation, like wind and solar, Moura noted. “I think we’re now really at that edge where we’ve eaten into the margin we’ve had over time,” he said. “We can now be much more assured and have more confidence that some of our warnings and our cautionary tales are coming true. We’ve seen some of the issues arise last year in California, again in the winter, and we really want to make sure our message and our warning is heard here,” he said.

To prepare for potential summer reliability shortfalls, NERC is urging all load-serving utilities to work with reliability coordinators “to ensure clear lines of communication, and to ensure operators are reviewing outage scheduling,” Moura said.

In California, efforts must span “across the [Western] interconnection for resources.” he said. That will mean “doing a lot of engineering studies and generator transmission studies that look and evaluate the ability of a system to transmit power from long distances,” he said.

Secondly, system operators in affected areas must be ready to act when energy shortfalls occur. “They have particular alert programs to ensure they’re prepared to signal the need for conservative operations,” he said. “There are certain public appeals that can be made voltage reduction, several different operational procedures, and getting those in order and be prepared to utilize those are important at this point in time,” he said.

But as NERC’s head Robb stressed on Wednesday, the broader problem begs long-term solutions—which is to build resource adequacy, factoring in long lead times needed to build generation and transmission resources.

As the “breadth and fidelity” of NERC’s assessments has evolved with its understanding of risk, the bigger picture must provide a “technical platform for important policy discussions,” he said. Since 2017, NERC has urged more vigilance of the growing interrelationship between natural gas infrastructure and supply and electric reliability as conventional generation retires and more variable resources are added to the system, he noted.

“Policymakers and market operators need to carefully manage the pace of change of that transition to ensure that reliability can be maintained,” Robb stressed.

“And I want to be clear, this is not a call against the transition, but rather, a plea for attention to the pace of change in the challenges created for system operators,” Robb said. “I know that operators and planners are working very, very hard to preserve reliability, but they’re continually asked to do so and manage your grid under more and more challenging conditions.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).