David K. Owens, executive vice president, Business Operations Group for the Edison Electric Institute, comments on the progress U.S. utilities are making toward a smarter electrical power grid.

Everyone talks about the importance of a stronger and smarter transmission system, but it often seems that little is being done. To get a read on the current state of grid modernization, POWER Editor-in-Chief Dr. Robert Peltier, PE talked with David K. Owens, who has a unique overview of the grid landscape thanks to his position at the Edison Electric Institute (EEI).

What is the role of the electric utility industry in this century?

Owens: The job of every electric company remains the same as it has for the past 100 years—delivering a reliable, affordable electricity supply. But the world in which we are performing that job continues to change dramatically.

We are moving toward a clean energy future. We are building advanced generating stations. We are expanding the use of renewables. And we are creating a smarter grid.

What role is EEI playing in a clean energy future?

Owens: Edison Electric Institute and its member electric companies are particularly excited by the potential that modernizing the grid has to offer the industry and its customers. More than 90% of EEI’s members already are working to modernize their grid. These efforts will:

- Empower customers to better control their electricity use.

- Encourage the development of renewable energy sources.

- Expand the use of distributed generation sources.

- Support the use electricity as a fuel for cars and trucks.

- Enhance the reliability and efficiency of the power grid.

- Improve service restoration.

- Provide the framework and foundation for future economic growth and global competitiveness.

In particular, though, modernizing the grid will help us to transform how we serve our customers. For example, many EEI member companies are now installing advanced metering infrastructure and information technologies to improve their call center functions. These technologies will enable us to push more information out to customers about their electricity service—information about outage response/restoration times, energy usage, and price alerts. And the modern grid will enable us to use multiple modes of communication to do so, including phone, email, and text messaging.

What is a modernized electric grid going to cost?

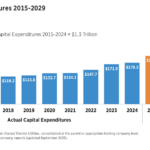

Owens: As part of its overall efforts to modernize the grid, the electric power industry is matching $3.4 billion in grant awards that the U.S. Department of Energy (DOE) disbursed as part of the American Reinvestment and Recovery Act (ARRA) in 2009. This public-private investment will total over $8 billion in new investment in the grid.

As of early February 2011, EEI members have spent approximately $577 million, or about a third of their awarded smart grid ARRA funds. This was a $58 million increase over early January 2011. Con Edison of New York offers one example of how these funds are being spent.

Con Edison is using the approximately $192 million in funding it received from DOE to pursue a number of projects to modernize both its underground distribution system, which spans more than 90,000 miles, and its overhead wire system, which totals more than 30,000 miles. The funding will help Con Edison to reduce costs and improve operational flexibility.

The modernization projects include installing state-of-the-art control and monitoring equipment, as well as new underground switches. Each switch has sensors that measure a variety of information about the power being distributed to customers. This data will be transmitted back to their control centers, where it will be analyzed and the switches will be remotely controlled, as warranted.

As Con Edison completes the installation of a wireless mesh communication system, which will enable data collection and control of underground transformers and network protector switches, the company will be better equipped to prioritize its operational workload and proactively address its findings.

In its continuing effort to engage customers, Con Edison also is developing ways to integrate the control of building management systems, battery storage units, distributed generation, and electric vehicle charging stations. Successfully combining these advanced technologies will enable Con Edison to lower costs, improve reliability and customer service, and reduce its impact on the environment. (For more information, please visit http://www.coned.com.)

Southern Company is another industry leader that is modernizing its grid to improve performance and reliability. The company is matching a $165 million DOE investment grant to complete a three-year project to modernize the grid across the company’s four-state service territory.

This funding will enable the company to continue its long history of investment in its transmission and distribution infrastructure, ensuring that its robust electric grid becomes smarter, more resilient, and more efficient through the application of intelligent electronic devices.

In particular, by applying advanced technologies to reduce stress on the system, increase the control of power flow, and improve power quality and environmental impact, Southern Company will create new opportunities to become even more efficient and better serve its customers. (For more information, please visit http://www.southerncompany.com.)

How do you gauge public acceptance of a new smart grid?

Owens: The customer is in favor of us moving ahead with smart grid and smart meter technology. In fact, our latest research found that over two-thirds of consumers nationwide want us to move ahead. And one in four wants us to do so quickly. But we recognize that we will run into problems if we push the smart grid technology too far too fast.

Although our research found great interest in moving ahead with the smart grid, it also found that less than half of the public has even heard the term “smart grid.” And of those who say they have heard about it, only about one in 10 say they have a fairly complete understanding of the smart grid.

State regulators are another essential audience for our communication efforts. We are working closely with regulators to create a supportive platform for the deployment of smart technology. In addition, we are addressing such issues as cost recovery of new technology investments, prudency determination, accelerated technological obsolescence, data access, privacy, and cyber security.

Not surprisingly, in the economic environment where we find ourselves today, some regulators have been cool to the idea of adding expensive new equipment and redesigned rate systems. To get them on board with our modernization plans, we are in frequent communication with them about what modernizing the grid means and, most importantly, the many benefits it creates on both sides of the meter.

At the same time, we are working to keep the technology development moving. If you can keep the technology moving, it will get the consumer moving as well. Just look at how Apple has stimulated consumer interest in advanced technology with its iPods, iPhones, and now iPads.

Many electric utility customers are happy with the basic service, but we know that others want more:

- They want information about their electricity use and options.

- They want information delivered to them anytime, anywhere, not just printed on a monthly bill.

- They want more choice and control. And, in the long term, they will want energy-related services.

For the modern grid to deliver all the value it is promising, our customers will need to change their attitude about the role that electricity plays in their lives, and the relationship they have with their utility. This will not be easy, as these attitudes have been built over the past 100 years. But electric utilities are ideally suited to take on this task.

Electric utilities differ from other industries in that we have a strong connection with our customers. And these connections extend across all customer classes—from manufacturers to chain stores, and from high-income to low-income residential customers. Our customers—all of them—also know that we will be there to continue to serve them in the smart grid era.

Just as we are changing and modernizing the grid, we are also changing ourselves. Electric companies are resetting their strategic focus—they are rethinking and repositioning themselves for the changes ahead. Among the issues electric companies today are addressing:

- The lines of business they are willing to deemphasize to put more effort elsewhere.

- The partnerships they need to succeed.

- The new technologies and new skills they need to bring into the organization.

What other companies are involved in developing a smart grid?

Owens: In particular, electric companies are well along in building partnerships to benefit from the changing business landscape. Choice and diversity are the key drivers. Electric companies at every point along the value chain are seeking and building partnerships to give themselves and their customers the most options and the most possibilities.

Some of the leading technology companies that the industry is working with now are OPower, IBM, Cisco Systems, and Silver Spring Networks, to name just a few. These partnerships are helping customers to better manage their energy use. They are enabling utilities to deploy advanced networking products, software, and services. And they are making it possible to deploy smart grid systems rapidly and cost effectively.

Electric companies also are learning from others. To help us prepare for this transformation, EEI launched the Smart Technology Scenario Project in 2010. As a part of this project, EEI has held two workshops that brought together 60 industry smart technology leaders—regulators, consumer advocates, Wall Street analysts, manufacturers, and others. The discussions covered the business opportunities/threats that may arise and the regulatory challenges that utilities may face.

The electric power industry’s transition to a more modern grid is well under way. With outreach to customers and continued cooperation and dedication between the industry and its public and private partners, we are confident that this transition will empower consumers to get more value from their electricity dollar, while helping utilities to lower their operational costs and improve reliability.

— Dr. Robert Peltier, PE, POWER’s editor-in-chief, conducted and edited this interview.