Following key regulatory approvals in the UK and U.S. of Westinghouse’s AP1000 and AREVA’s EPR Generation III+ reactor designs, France’s nuclear safety authority in February determined that the little-known ATMEA 1 reactor design met international safety criteria for Generation III+ reactors. The reactor is a 1,100-MW pressurized water reactor (PWR) developed and marketed by ATMEA, a 2007-created joint venture between France’s AREVA and Japan’s Mitsubishi Heavy Industries (MHI).

France’s Autorité De Sûreté Nucléaire (ASN) noted that the 18-month review of the safety options of what ATMEA calls a “mid-size reactor” was requested by AREVA and MHI. The review was therefore not performed as part of a licensing procedure for the reactor design but “in the same conditions as those applicable to the creation of basic nuclear installations in France,” it said, concluding the project would “on the whole satisfy the French requirements.”

The “positive opinion” followed 2011 approvals from France’s advisory committees for nuclear reactors (GPR) and for nuclear pressure equipment (GPESPN) concerning the safety options for this new reactor. The reviews took into account internal and external hazards as well as lessons learned from the Fukushima accident.

ATMEA describes the ATMEA1 as a three-loop PWR that uses the same steam generators as AREVA’s 1,630-MWe EPR reactor design. The ATMEA1 with a 60-year design life also has extended fuel cycles, 37% net thermal efficiency, 157 fuel assemblies, and a capacity to use mixed-oxide fuel only (Figure 1). With emphasis on its smaller size, the reactor design has so far been marketed to developing countries with nuclear power ambitions.

|

| 1. A small fish in a big pond. French regulators in February deemed safe the ATMEA1, a Generation III+ reactor design developed and marketed by an AREVA–Mitsubishi Heavy Industries joint venture. Courtesy: AREVA |

Interest is growing, however. French company GDF Suez, owner of seven Belgian nuclear plants, recently expressed interest in developing the first ATMEA1 reactor in France’s Rhone River Valley. AREVA and MHI have also been contending with Russian and Canadian companies to sell a reactor to Jordan for a $4.5 billion contract. Meanwhile, majority French government–owned AREVA in February signed a key agreement with state-owned China Guangdong Nuclear Power Group to develop another midsize PWR, possibly based on that company’s Chinese-designed CPR1000. Officials told reporters in February that AREVA will persuade China to base the 1,000-MW nuclear reactor on the ATMEA1 model. “It would be a shame to have two 1,000-megawatt reactors on the market,” AREVA’s senior vice-president for reactors and services, Claude Jaouen, said.

Interest in midsize Generation III+ reactor designs marks a new era in the evolution of nuclear reactor technology, which has been pronounced over the past five decades. Generation IV designs are still in the conceptual stage and may not be operational before 2020, while the first generation of reactors—those developed in the 1950s and 1960s—are almost obsolete.

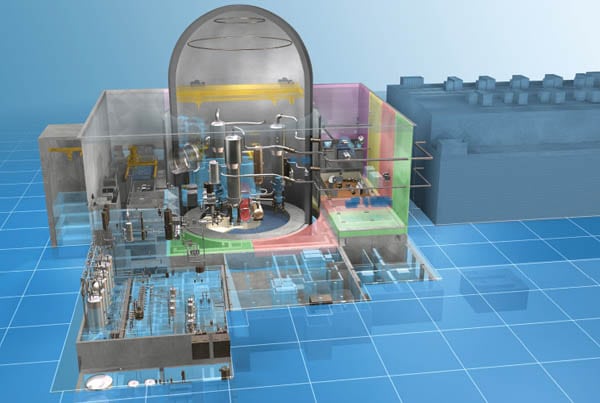

Only two first-generation plants (550-MW Magnox reactors, which are pressurized, carbon dioxide–cooled, graphite-moderated reactors using unenriched uranium as fuel and magnox alloy as fuel cladding) are currently operating at the Wylfa nuclear power station, on Anglesey, in the UK. But these are to be shut down later this year, close on the heels of shuttering the UK’s two other Magnox reactors at the Oldbury nuclear power station near Bristol. That 45-year-old station—the world’s oldest nuclear plant—was permanently shut down at the end of February (Figure 2).

|

| 2. A generation gap. The last of the 1967-opened Oldbury twin reactors near Bristol in the UK was shut down in late February, after generating 137.5 TWh of power. The plant was one of 11 based on the pioneering post–World War II Magnox design, the first reactor design in the world to generate power on a commercial scale. Oldbury was also the first reactor in the world to have a concrete pressure vessel. Ten Magnox plants are now in various stages of decommissioning; only Wylfa on Anglesey still operates. Oldbury and Wylfa are potential sites for new reactors. The Horizon consortium intends to build at least 6 GW of new nuclear capacity there. Courtesy: UK Nuclear Decommissioning Authority |

Generation II reactors—a class built up to the end of the 1990s that characteristically includes PWRs, Canadian-invented CANDUs, boiling water reactors (BWRs), British advanced gas reactors, and Russian-built VVERs—are widely used all around the world.

Meanwhile, the first set of Generation III and III+ reactors have been put into operation in Japan and several others are under construction in China, Europe, and the U.S. Prominent designs include Westinghouse’s AP1000, AREVA’s EPR, GE’s advanced boiling water reactor and ESBWR, and MHI’s APWR.

The focus has been narrowed on these five designs presumably because of highly publicized design certification processes in various countries. But several lesser-known Generation III designs exist, and technologies such as Gidropress’ AES-92 and AREVA’S Kerena have even been certified in accordance with safety criteria set out by the European Utilities Requirements. The AES-92 from Gidropress—a Rosatom enterprise—is already under construction in China and India, and it will be the reactor of choice for Unit 1 of Bulgaria’s Belene Nuclear Power Plant. The reactor with a 60-year-lifetime is described as a late-model VVER-1000 pressurized water reactor with four first-stage coolant circulation loops per reactor. It is rated at 3,000 MWt.

AREVA’s 1,250-MWe (3,370 MWt) Kerena reactor is a BWR whose design is based on the Siemens-built Gundremmingen plant. AREVA, which says the reactor with a 60-year-design life is ready for commercial deployment, sought U.S. certification of the reactor in 1999 but then postponed its decision. Kerena joins a list of reactor designs whose preapplication reviews with the U.S. Nuclear Regulatory Commission (NRC) seem to be at a halt. (The NRC has said that it is so busy that it won’t work on applications for technologies that lack a firm U.S. customer.) Other designs include Atomic Energy of Canada Ltd.’s ACR-700, a 700-MWe design that is supposedly 40% cheaper than the CANDU-6; Westinghouse’s IRIS reactor; the South African–developed Pebble Bed Modular Reactor; Toshiba’s 4S; and General Atomics’ GT-MHR.

Then there are obscure Asian-certified Generation III designs. Perhaps the most significant is South Korea’s APR-1400 advanced PWR, whose trademark is owned by Korea Hydro & Nuclear Power Co. That reactor design, certified by the Korean Institute of Nuclear Safety in 2003, is already under construction at Shin-Kori 3 and 4, and could become operational by 2013. The reactor design has also been chosen as the basis of the United Arab Emirates nuclear program. The design’s developers are reportedly discussing applying for U.S. certification later this year, and plans could soon be under way to develop a European version of the reactor.

—Sonal Patel is POWER’s senior writer.