A company that has corporate roots that go back to the Colonial era, Dominion Energy has been shaped by acquisitions and market forces. It is now in the midst of an extraordinary transformation to expand its footprint as a sustainable provider of power, natural gas, and related services.

In 1787, the Virginia General Assembly established the Upper Appomattox Trustees, a group of seven individuals, including George Washington and James Madison, charged with improving navigation and establishing canals on the James River, which runs through the heart of Virginia, and a major tributary, the Appomattox River. The river had been central to Virginia’s development before and after the establishment of the English colony of Jamestown on its banks, and extended navigation along the Appomattox River was seen as a beneficial project to enable shipments of rum and tobacco into the Virginia highlands. The group, in short order, established the Upper Appomattox Co. and began building the Upper Appomattox canal, completing it in 1807. Over the 1800s, the company grew through mergers with canal and river transportation companies, and in 1888, as the electric industry began burgeoning, it began a consolidation of several hydroelectric stations on the river and added a steam power facility, mainly to power its electric streetcars.

Frank Gould, son of Gilded Age tycoon Jay Gould, bought a successor company in 1909 through his Virginia Railway and Power Co. (VR&P), a firm that operated streetcars in four cities. The firm was acquired by New York engineering firm Stone & Webster in 1925 under a new holding company, Engineers Public Service (EPS), and rebranded as Virginia Electric and Power Co. (VEPCO). VEPCO began a steady growth trajectory, snapping up utilities in North Carolina and transforming into a power-oriented firm during the Depression era. In 1940, the federal government sued EPS under the Public Utility Holding Company Act of 1935—a federal law that broke up electric utility holding companies—forcing EPS to divest everything but VEPCO, which eventually became independent in 1947.

By the early 1950s, thriving on a surge in power demand and a 1940 merger with Virginia Public Service Co., VEPCO doubled its service territory and had become one of the largest U.S. electric utilities. To keep up with demand, the company built a dam and power plant on the Roanoke River at Roanoke Rapids and then a second large hydroelectric dam, Gaston, on the Roanoke River. In the 1960s, it installed possibly the first underground residential distribution system, as well as one the world’s first extra-high-voltage systems at Mount Storm, West Virginia, where VEPCO built its Mine Mouth coal-fired steam station. It also kicked off construction of the Bath County pumped hydropower storage system.

|

|

1. The 1.7-GW Surry Nuclear Power Station is located in southeastern Virginia, on the south bank of the James River across from historic Jamestown. Courtesy: Dominion Energy |

In the 1960s, the company also notably began converting coal stations to oil-fired ones, owing to surging coal prices, which proved a misstep in the early 1970s when the oil embargo roiled the power industry. However, VEPCO’s fleet diversification efforts in the late 1960s also prompted the company to build two nuclear plants: the 1.7-GW Surry station (Figure 1) in southeastern Virginia, which was completed in 1973, and the 1.9-GW North Anna, a “sister” plant northwest of Richmond, which was completed in 1978. Two additional units planned at Surry to prepare for an electricity consumption growth rate of 10.8% were derailed in 1977, however, owing to significant industry hurdles in the 1970s, such as construction delays, labor problems, increasingly stringent environmental regulations, and fuel availability issues. Soaring plant expenditures steeped VEPCO into financial turmoil and set it on a path for restructuring.

Utility SpotlightPOWER magazine is exploring the histories of some of the largest utilities in the U.S. as part of the magazine’s 140th-anniversary celebration. Other features that are part of this exclusive “Utility Spotlight” series are here: New Era for NextEra: A Utility Spotlight (February 2022) History of Power: Duke Energy’s Century-Old Legacy (May 2022) Southern Company: A History of a Prolific Power Technology Pioneer (August 2022) |

A Growing Generating Portfolio

In 1983, VEPCO created Dominion Resources, spinning off the smaller firm as its holding company. Two years later, Dominion Capital was formed, and Dominion Energy followed in 1987. In 1990, Dominion sold its natural gas distribution operations, but it formed a series of joint ventures to develop its natural gas reserves. In 2000, preparing for energy deregulation, it split its generation activities from its transmission, distribution, and retail operations, and it bought Consolidated Natural Gas in a deal that transformed Dominion into one of the largest electric and gas utilities.

Leveraging a business opportunity for competitive generation, the company in 2000 bought, for $1.3 billion, Northeast Utilities’ Millstone nuclear power complex in Connecticut, and, subsequently, in 2005, the 574-MW Kewaunee nuclear plant in Wisconsin. In the 2010s, it expanded its gas business with the $4.4 billion acquisition of gas pipeline and storage firm Questar Corp. In 2017, however, Dominion Resources sought a new identity amid a new phase of rapid industry evolution, changing its name to Dominion Energy.

While the company has since marked several significant acquisitions, its most prominent is perhaps its 2018 purchase of SCANA Corp., a company that was reeling from a decision to abandon two half-built AP1000 reactors at the V.C. Summer project in South Carolina. In 2020, marking another definitive transformation, the firm sold the bulk of its gas transmission and storage assets—more than 7,700 miles of natural gas storage and transmission pipelines, and about 900 billion cubic feet of gas storage—to Berkshire Hathaway Energy for $9.7 billion. The utility envisioned the transaction would accelerate its transformation into a “pure-play” power company with zero-carbon generating assets that are anchored in regulated markets.

Dominion Energy Today: Multiple Prongs

Today, Dominion Energy, headquartered in Richmond, Virginia, holds a portfolio of assets that includes approximately 30.2 GW of electric generating capacity, 10,700 miles of electric transmission lines, 78,000 miles of electric distribution lines, and 95,700 miles of gas distribution mains and related service facilities, which are supported by 6,000 miles of gas transmission, gathering, and storage pipelines. As of December 2021, the company operated in 13 states, serving about 7 million customers.

The company, like other giant utilities in the U.S., has continued a steady march to a more state-regulated earnings mix, and it says about 90% of its earnings are from its primary operating segments that come from state-regulated electric and natural gas utility businesses. Its operations are conducted through various subsidiaries.

SCANA operates as a wholly owned subsidiary and is primarily engaged in the generation, transmission, and distribution of electricity in the central, southern, and southwestern portions of South Carolina, and in the distribution of natural gas in North Carolina and South Carolina. Another massive wholly owned subsidiary, Virginia Power (known as “Dominion Virginia Power” in Virginia and “Dominion Energy North Carolina” in North Carolina), is headquartered in Richmond and functions as a regulated public utility that generates, transmits, and distributes electricity for sale in Virginia and North Carolina. Virginia Power, however, also sells and transmits electricity at wholesale prices to rural electric cooperatives and municipalities. Historically, the subsidiary’s transmission facilities are integrated into PJM Interconnection.

In addition, the company manages its daily operations through four primary segments: Dominion Energy Virginia, Gas Distribution, Dominion Energy South Carolina (DESC), and Contracted Assets. The Dominion Energy Virginia segment is substantially composed of Virginia Power’s regulated electric transmission, distribution (including customer service), and generation (regulated electric utility and its related energy supply) operations, which serve approximately 2.7 million residential, commercial, industrial, and governmental customers in Virginia and North Carolina. The Gas Distribution operating segment includes Dominion Energy’s regulated natural gas sales, transportation, gathering, storage, and distribution operations in Ohio, West Virginia, North Carolina, Utah, southwestern Wyoming, and southeastern Idaho (through East Ohio, Hope, PSNC, and Questar Gas), which collectively serve approximately 3.1 million residential, commercial, and industrial customers.

DESC comprises generation, transmission, and distribution of electricity to approximately 772,000 customers in the central, southern, and southwestern portions of South Carolina, as well as the distribution of natural gas to approximately 419,000 residential, commercial, and industrial customers in South Carolina. DESC, notably, also owns a two-thirds interest in a reactor at the Summer nuclear plant in South Carolina. Finally, the Contracted Assets segment includes operations of Millstone, and associated energy marketing and price risk activities, Dominion Energy’s non-regulated long-term contracted renewable electric generation fleet, solar generation facility development operations, and Dominion Energy’s 50% non-controlling interest in Cove Point, which is a liquefied natural gas import/export and storage facility on the Chesapeake Bay in Lusby, Maryland.

Reliability, Affordability Key Tenets of Current Strategy

Dominion’s interest in a diversified portfolio is grounded by a commitment to achieve net-zero carbon and methane emissions by 2050 under Scope 2 and Scope 3. Scope 2 covers emissions from the company’s power consumption (not generation), while Scope 3 includes emissions from electricity purchased to power the grid, fuel for its power stations and gas distribution systems, and consumption by its natural gas customers.

However, if Dominion operates under a fundamental obligation today, it is to “keep the lights on and the gas flowing—safely, reliably, and cost-effectively,” the company said in September. “This is a public-service responsibility and a moral duty. In most cases, it is also a statutory requirement,” it said. “While it might be possible, in theory, to focus solely on reducing emissions without regard for those values, doing so in practice is neither ethical nor, in fact, possible. To make the energy transition sustainable over the long term, the energy industry must ensure that customers can count on receiving service when they want it and that they can afford to pay for such service. Compromising those requirements would undermine support for clean energy and put the transition to a net-zero future at risk.”

|

|

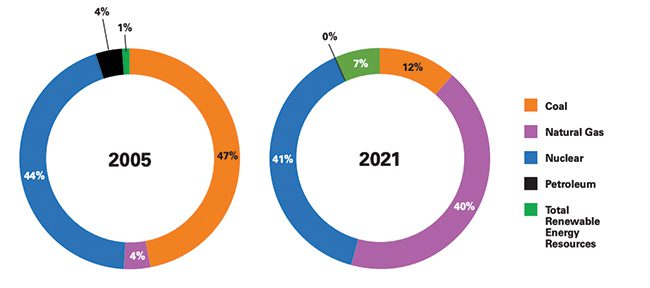

2. This graphic shows Dominion Energy’s mix of power generation resources in 2005 and 2021. In 2021, coal made up only 12% of its electric generation, while natural gas rose to 40%. “These shifts in fuel help us deliver cleaner energy while maintaining the reliability that is essential to our customers,” the company said. Courtesy: Dominion Energy |

The company’s efforts have so far focused primarily on balancing its generating portfolio. The portfolio’s most marked changes over the past two decades (Figure 2) have been driven by a diminished share of coal and its replacement by natural gas. In addition, however, Dominion is working on expanding its renewable portfolio. While Dominion hasn’t announced a phase-out of coal generation like other utility giants, such as Duke Energy and Southern Co., it says it is “studying the eventual retirement of all its remaining coal units in South Carolina.”

A Realm of Future Possibilities

How the company will meet its next-generation energy needs while upholding its reliability, resiliency, and affordability priorities will hinge on a range of factors. An updated integrated resource plan (IRP) filed by Virginia Power in October with regulators in Virginia and North Carolina outlines five alternative plans it could pursue through 2047, taking into account current technologies, market information, and projections, as well as significant ongoing disruptions in global commodity markets, supply chains, and significant federal tax policy changes. The updated IRP notably caters to Virginia’s mandate through its 2020 Virginia Clean Economy Act (VCEA) and North Carolina’s goal to achieve statewide carbon neutrality by 2050.

While Virginia Power’s Plan A offers the “least-cost” option, it does not meet development targets for solar, wind, and energy storage resources under the VCEA. Plan B includes those targets, but it preserves gas generation to address system reliability, stability, and energy independence issues. Plan C, however, incorporates Plan B’s portfolio but assumes they are selected on a “least-cost optimization basis” without regard for the VCEA targets. Plan D assumes Virginia Power will retire all its carbon-emitting units by 2045 and replace them with 6 GW of incremental energy storage, more than 1 GW of incremental small modular reactors (SMRs), and 5 GW of purchased power in 2045. However, Plan D raises reliability and energy independence concerns. Still, Plan D’s inclusion of SMRs is especially notable because it marks the first time Dominion has added advanced nuclear technologies as a resource that could be available as early as 2032. Plan E, meanwhile, assesses a “least-cost optimization” case for Plan D, meaning resources are selected without regard for the VCEA’s targets.

Banking on Innovation

While Dominion acknowledges the transition may be ridden with risks, it intends to explore its options through massive investments. “Through 2035, we see potential for up to $73 billion in climate-focused investments (including up to $32 billion through 2026),” the company said. “To our knowledge, this represents the largest regulated decarbonization investment opportunity for any U.S. public utility company.”

|

|

3. The Coastal Virginia Offshore Wind (CVOW) project consists of two portions: a pilot and a commercial-scale project. Located 27 miles off the coast of Virginia Beach, the CVOW pilot project (shown here), which became operational in October 2020, consists of two wind turbines generating 6 MW each. The pilot is the first offshore wind farm installed in federal waters and the only project developed and owned by an electric utility company. The 2.6-GW commercial-scale project is slated to come online in 2026. It will build on the success of the pilot and will consist of 176 wind turbines. Courtesy: Dominion Energy |

The company could devote an estimated $21 billion to expanding its 2.2-GW solar fleet. However, it is also making significant progress on the 2.6-GW Coastal Virginia Offshore Wind (CVOW) commercial project (Figure 3). The pioneering $10 billion project is slated to reach completion in 2026. “While it represents our first full-scale offshore wind project, we project investments of up to $21 billion for offshore wind through 2035,” it says.

Nuclear will also remain an integral investment over the long term. Recognizing the value of its four plants—Surry, North Anna, Millstone, and V.C. Summer—Dominion says it plans to invest up to $4 billion to extend the plants’ lives through 2035. In May 2021, it received the Nuclear Regulatory Commission’s (NRC’s) approval to extend Surry’s license into the 2050s, and it is pursuing similar approval for North Anna. In tandem, Dominion is “reviewing” SMR designs under review at the NRC “with an eye towards creating options that are safe, cost-effective, reliable, and commercially available for an in-service date as early as the early 2030s.”

At the same time, the company is looking intently at electric transportation, energy storage, and grid improvements, such as strategic undergrounding. To boost gas diversity and reliability, it is also modernizing its natural gas infrastructure and investing in renewable natural gas (RNG) under Align RNG, a joint venture it formed with Smithfield Foods. Finally, it has explored hydrogen blending on a small scale on a distribution system in Utah. “Our pilot project confirmed extensive industry research that at modest blending levels, hydrogen can deliver safe, reliable, and sustainable energy without impacting appliance or system performance,” Dominion said. The company is now in the process of expanding the pilot to a Utah community to field-test blending on a broader scale. It is, meanwhile, also engaged with regional coalitions in support of establishing a national hydrogen hub.

However, much more progress will be needed, the company acknowledges. Achieving Virginia’s, North Carolina’s, and the company’s clean energy goals over the long term will require “supportive legislative and regulatory policies, technological advancements, grid modernization, and broader investments across the economy,” Dominion said. “This includes support for the testing and deployment of technologies, such as large-scale energy storage; renewable natural gas; vehicle-to-grid; hydrogen; advanced nuclear; and carbon capture and sequestration, all of which have the potential to significantly reduce greenhouse gas emissions.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).