NRG applies for first COL

This September, NRG Energy Inc. and South Texas Project Nuclear Operating Co. filed the first-ever combined construction and operating license (COL) application with the U.S. Nuclear Regulatory Commission (NRC). The two firms would like to build two new 1,350-MW nuclear units on the grounds of the South Texas Project (STP) nuclear power station (Figure 1) and bring them on-line in 2014 and 2015.

1. Room to grow. An aerial view of the sprawling South Texas Project nuclear plant site. Courtesy: South Texas Project

The submittal was the first application for a license for a new U.S. nuclear unit in 29 years.

This July, Constellation Energy Group and UniStar Nuclear—a consortium of Constellation, the French reactor vendor Areva, and the French utility Electricite de France—filed a partial COL application for a potential third reactor at Constellation’s two-unit Calvert Cliffs nuclear station on Chesapeake Bay. But the submission covered environmental issues only. Under NRC rules, the consortium must file the rest of the application for Calvert Cliffs within six months. Since July, Constellation/Unistar has supplemented the original application twice, but has not yet completed it.

The new units in Texas—to be called STP 3 and 4—are being developed as part of an NRG repowering initiative to add about 10,000 MW of clean and efficient capacity to its 23,000-MW North American portfolio. The initiative’s goals are to better leverage NRG’s existing infrastructure, to diversify its fuel mix while reducing its dependence on foreign sources, and to implement technologies that reduce the company’s carbon footprint.

STP Nuclear Operating Co., which operates Units 1 and 2, would operate STP 3 and STP 4 as well. Units 1 and 2 are owned by NRG Energy (44%), CPS Energy (40%), and Austin Energy (16%).

The 12,220-acre STP site in Matagorda County, Texas, is considered one of the best sites in America for nuclear expansion. Its 7,000-acre cooling reservoir was sized to serve four units. The two new units would be built adjacent to Units 1 and 2 (Figure 2).

2. Bigger and still CO2-free. What the site would look like after the addition of Units 3 and 4, in the foreground. Courtesy: South Texas Project

NRG has chosen advanced boiling water reactor (ABWR) technology developed by General Electric Co. for the new units because it combines the best features of current BWR designs with enhancements that improve safety, performance, and longevity. ABWR technology is certified by the NRC and has impressive construction and operational track records, including the shortest time to build a reactor and the completion of many units within their budget.

Four ABWR units are already on-line in Japan, and another three are under construction in Taiwan and Japan. Tokyo Electric Power Co., which has more than a decade of experience using the technology, said it will share its expertise to support STP’s planned expansion.

POWER Contributing Editor Tim Hurst explored the ABWR fast-track construction methods employed by Hitachi in this magazine’s May 2007 issue. In “Transfer ABWR construction techniques to U.S. shores,” Hurst wrote that the “construction practices honed in Japan aren’t just impressive; they’re also eminently suitable for the fleet of new units planned for the U.S.”

Because ABWR technology and construction techniques are well-understood, NRG’s choice seems an excellent one for the first nuclear unit to be built in the U.S. in a generation. “We have chosen NRC-certified, operationally proven technology and the best possible, most experienced team to build STP 3 and 4,” said David Crane, NRG’s president and CEO. “We expect to build these facilities on time, on budget, and to the exacting standards that will guarantee excellence in safe and reliable nuclear operations.”

It took NRG a little over one year to follow up its letter of intent to build STP 3 and STP 4 with the COL application. STP Nuclear Operating Co. and a contracting team led by a joint venture of Hitachi and GE, and including Bechtel Power Corp., helped prepare the latest submittal.

The filing of the COL application kicked off an NRC internal process for formally accepting it that will likely take two months. After that, another agency process of detailed review will begin and last up to 42 months. It will include staff discovery, site visits, company responses, public hearings, and the filing of environmental impact statements.

If all goes well, NRG could receive licenses for STP 3 and 4 and begin construction in 2010. If not, the company could qualify for $1 billion ($500 million per reactor) in “standby support,” or insurance against regulatory delays, included in the Energy Policy Act of 2005.

TVA green-lights Watts Bar 2

Bechtel Power Corp. has announced that it has been chosen by Tennessee Valley Authority (TVA) to lead the effort to complete Unit 2 at the Watts Bar Nuclear Plant (Figure 3) in Spring City, Tenn. Work on the original 1,200-MW unit was stopped in 1985 when it was two-thirds complete. The new, $2.5 billion project will take five years to finish and bring Unit 2 up to all contemporary engineering and safety standards.

3. Bechtel inside. Watts Bar, TVA’s third nuclear plant, is on the shore of Chickamauga Reservoir in Sprint City, Tenn. Major construction began in 1973, and the plant began commercial operation on May 27, 1996. Courtesy: Tennessee Valley Authority

TVA, the nation’s largest public power provider, selected Bechtel after a comprehensive competitive bidding process. Bechtel recently contributed engineering, start-up, and other technical services to the successful May 2007 restart of TVA’s Browns Ferry Unit 1 (see cover story), the first nuclear unit to come on-line in the U.S. in more than a decade (since Watts Bar Unit 1 in 1996). The contractor also worked for TVA on the restart of Browns Ferry Units 2 and 3 in the 1990s, and replaced the steam generators of Watts Bar 1 and of TVA’s Sequoyah Nuclear Plant, Unit 1.

“We are honored to be selected by TVA for this historic assignment,” said Jim Reinsch, president of Bechtel’s nuclear power business. “This cost-effective project will provide clean, safe, and reliable power for TVA’s customers and demonstrate the importance of nuclear power as a contributor to meeting America’s energy needs in the coming decades.”

Southern Co. and Florida muni launch IGCC project

With some hefty financial assistance from the U.S. Department of Energy (DOE), Southern Company and the Orlando (Florida) Utilities Commission have become the first U.S. utilities to begin building a power plant based on an advanced integrated gasification combined-cycle (IGCC) technology.

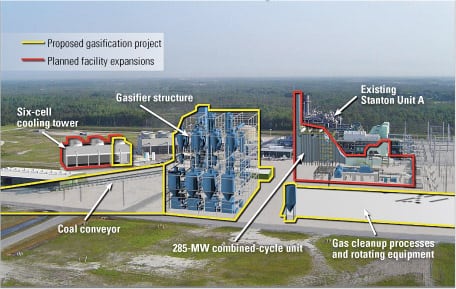

The DOE is subsidizing the project, in Orlando, under its Clean Coal Power Initiative to demonstrate new clean coal combustion technologies such as IGCC. Energy Secretary Samuel Bodman joined David Ratcliffe—Southern’s chairman, president, and CEO—and Orlando officials at the groundbreaking of the 285-MW coal gasification plant, to be built on the grounds of the Orlando Utilities Commission’s Stanton Energy Center (Figure 4).

4. New breed. Southern Company and the Orlando Utilities Commission have broken ground on the first next-generation IGCC plant in the U.S. It will be built on the grounds of the latter’s Stanton Energy Center. Courtesy: Southern Company

The plant will be powered by Transport Integrated Gasification (TRIG) technology developed by Southern at its Power Systems Development Facility in Wilsonville, Ala., in partnership with the DOE and the engineering contractor KBR Inc. According to Southern, TRIG is a superior, proven, and practical method of gasifying coal to produce power, chemicals, and transportation fuels with less environmental impact than conventional IGCC technologies. The company says it can easily handle the high-moisture, high-ash coals that account for more than half of the world’s reserves of the fuel.

The Orlando plant also is expected to produce 20% to 25% less CO2 than a typical coal-fired power plant. However, current plans for the project do not call for capturing any carbon released by its coal combustion.

The gasification project is valued at $844 million, including the costs of permitting, design, construction, and start-up, and four and a half years of O&M and evaluation expenses. The DOE will contribute $294 million of that total, with Southern Company and Orlando’s muni funding the remainder. Commercial operation is scheduled for June 2010.

UK approves wave energy “hub”

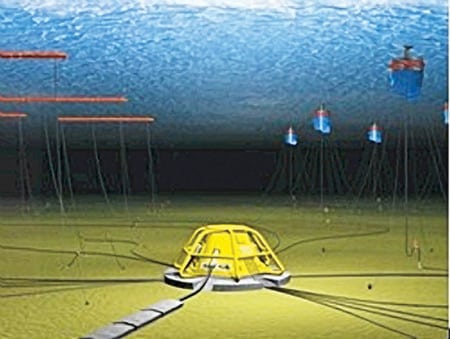

The British government has approved construction of the most ambitious ocean energy facility proposed to date—the $56 million Wave Hub, a deep-sea electricity “socket” that will sit on the seabed 10 miles off the Cornish coast and link as many as 30 wave energy machines to the UK electricity grid.

The project, to be located in waters about 150 feet deep, will enable wave energy developers to “plug in” and test the efficiency and durability of their machines, which convert the kinetic energy of waves to electricity.

Plans call for the Wave Hub (Figure 5) to be connected to the UK grid by a 15-mile undersea cable that will come ashore at a substation at Hayle, in southwest England. All told, Wave Hub could deliver up to 20 MW of electricity, enough power to meet 3% of Cornwall’s electricity needs, according to the South West of England Regional Development Agency (Southwest RDA), the project’s main backer.

5. Current from currents. The UK has approved construction of this “Wave Hub,” which will link up to 30 wave energy plants expected to be built off the country’s southwest coast. Courtesy: South West England Wave Hub Project

Despite broad political support in Britain for Wave Hub as a clean energy innovation, the project encountered some rough waters in the form of protests by local surfers that the deployment of its wave machines, which ride on the surface, might flatten out swells. However, a noted surfers’ group, Surfers Against Sewage, endorsed the project after scientists concluded that that was unlikely.

Four wave energy developers have been chosen for the initial deployment of Wave Hub: Oceanlinx, Ocean Power Technologies Ltd., Fred Olsen Ltd., and WestWave. The last is a consortium led by E.ON AG and Ocean Prospect Ltd. that would use the Pelamis technology of Ocean Power Delivery Ltd. The Wave Hub project will cover an area measuring 2.5 miles by 1 mile; each early developer will be given a 5-to-10-year lease for a space in that area.

Ocean Power Delivery and Ocean Power Technologies are two of the early leaders in the wave energy field. The former company won the world’s first contract to develop a commercial wave power farm by convincing a consortium led by Enersis to let it install 31 Pelamis machines off the coast of Portugal.

Meanwhile, Ocean Power Technologies will be supplying its PowerBuoy technology to a major wave power project off the Oregon coast. This June, the company, which says it has a backlog of orders worth $6.9 million, received a $1.7 million contract from the U.S. Navy to provide an autonomous PowerBuoy in connection with an ocean data gathering system known as the Deep Water Acoustic Detection System.

However, wave energy developers still face significant technical challenges. Among them are proving that their machines can withstand long periods of submersion in the harsh ocean environment and maintain their output despite variable wave conditions.

The British government will subsidize the offshore Cornish project to the tune of $9 million. Southwest RDA, which has already spent more than $4 million on permitting, has approved $43.4 million for Wave Hub, with half of that sum expected to come from the European Regional Development Fund.

New Jersey–New York HV system launched

At the formal dedication of the Neptune Regional Transmission System this summer, officials of the Long Island Power Authority (LIPA) said that the first 100 days of operating the new, 65-mile undersea and underground transmission link between “the island” and New Jersey saved it an estimated $20 million. They expect the $600 million system to deliver more than $1 billion in net benefits to LIPA and its 1.1 million customers over the next 20 years.

The system (www.neptunerts.com)—currently the largest underwater HVDC (high-voltage direct current) system in America—gives LIPA access to 660 MW of reliable, competitively priced electricity from the 13-state PJM energy grid, one of the most diverse wholesale power markets in the U.S.

After taking and culling competitive bids from prospective suppliers in 2004, LIPA began building two converter stations and the 65-mile cable in July 2005. The transmission system commenced operations this June, ahead of schedule and within budget. More than 50 miles of the cable are buried beneath the Raritan River, New York Harbor, and the Atlantic Ocean. The cable brings power from Sayreville, New Jersey, to Long Island (which is chronically short of generating capacity), where it comes ashore near Jones Beach (Figure 6).

6. Island-hopping. This 65-mile underground and undersea HVDC transmission line is now bringing needed power from New Jersey to Long Island. Courtesy: Neptune Regional Transmission System

“The Neptune project is an example of how this type of HVDC technology can bring much-needed electric power and transmission infrastructure to densely populated areas in a cost-effective and environmentally friendly way,” said Edward M. Stern, president and CEO of Neptune Regional Transmission System LLC. “Many American cities that face growing demand for energy would be well-served by implementing projects such as Neptune.”

The Neptune cable is the first 500-kV submarine cable to use mass-impregnated, paper-insulated technology from Prysmian Cables and Systems USA LLC (www.prysmian.com) that makes it all but invulnerable to external damage. According to Prysmian, the installation was done using equipment it engineered to have minimum environmental impact.

A converter station in New Jersey transforms alternating current (AC) power to direct current (DC) power for transmission to Long Island. There, another converter station (Figure 7) transforms the DC power back to AC form for distribution to LIPA customers. The power can move in both directions. Siemens Power Transmission & Distribution Inc. designed, engineered, built, and installed both converter stations and will operate them for the next five years.

7. AC/DC rules. A bird’s-eye view of the Long Island Power Authority’s Duffy Avenue converter station, as of May 2007. Courtesy: Neptune Regional Transmission System

Neptune Regional Transmission System LLC—the developer, owner, and operator of the link—is responsible for its planning, permitting, financing, and construction. Affiliates of Energy Investors Funds and Starwood Capital Group Global are the principal equity investors in the firm.

Membrane strips CO2 from methane faster

A modified plastic material promises much more efficient separation of CO2 from natural gas, according to scientists at The University of Texas at Austin who have analyzed its performance.

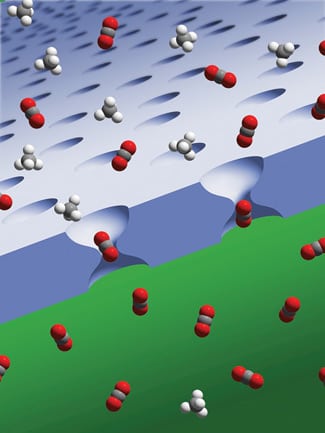

Like a sponge that only soaks up certain chemicals, the new plastic lets CO2 or other small molecules pass through hourglass-shaped pores within it, while impeding natural gas (methane) movement through them (Figure 8). The thermally rearranged (TR) plastic appears to be four times more efficient than conventional membranes at separating carbon dioxide using pores.

8. Carbon traffic cop. A new polymer membrane has pores that mimic those naturally occurring within cell membranes. The pores’ unique hourglass shape effectively segregates gaseous molecules on the basis of shape. The separation of carbon dioxide (gray and red) from methane (gray and white) is illustrated. Courtesy: Commonwealth Scientific and Industrial Research Organization

Dr. Ho Bum Park, a postdoctoral student in the chemical engineering laboratory of Professor Benny Freeman, found that TR plastic membranes also work more quickly, by permitting CO2 to move through them several hundred times faster than through conventional membranes. As part of the process, they also keep natural gas and most other substances from traveling through the pores, improving separation efficiency.

“If this material were used instead of conventional cellulose acetate membranes, processing plants would require 500 times less space to process natural gas for use because of the membranes’ more efficient separation capabilities, and would lose less natural gas in their waste products,” said Freeman. He noted that, pound for pound, natural gas contributes much more to global warming than does carbon dioxide.

If commercialized, the plastic could also be used to isolate natural gas from decomposing garbage, the focus of several experimental projects nationally. The TR plastic described in the current issue of Science also could help recapture CO2 being pumped into oil reservoirs in West Texas and elsewhere to aid in extracting residual oil.

Park initially engineered the membrane while at Hanyang University in Korea. As a research assistant, he investigated whether plastics made of rings of carbon and certain other elements would be efficient separators of CO2 from power plants’ flue gases. Separation of the greenhouse gas from other flue gases usually must be done at temperatures high enough to destroy plastic membranes.

Park not only found that the TR plastic could handle temperatures above 600F, but also that the heat transformed the material into a membrane that breaks a performance barrier thought to affect all plastic membranes.

“I didn’t expect that the TR plastic would work better than any other plastic membranes because thermally stable plastics usually have very low gas transport rates through them,” Park said. “Everyone had thought the performance barrier for plastic membranes could not be surpassed.”

Park said, “These membranes also show the ability to transport ions since they are doped with acid molecules and therefore could be developed as fuel cell membranes. However, a lot of research still needs to be done to understand gas and ion transport through these membranes.”

POWER digest

News items of interest to power industry professionals.

Big run-of-river hydro project advances. In a big step forward for one of the largest of a new breed of environmentally sensitive hydroelectric plants, a small renewable energy company and GE Financial Services have awarded a $500 million fixed-price contract to Peter Kiewit Sons Co. to build a 196-MW run-of-river hydropower facility on two rivers in British Columbia.

Officials of Vancouver-based Plutonic Power Corp. said the engineering, procurement, and construction contract would help finalize financing for the Toba-Montrose project, comprising two power generating stations on the East Toba River and Montrose Creek. At press time, Plutonic said it expected to complete the financing package from lenders by the end of October 2007. The total cost of the project, which includes a 90-mile transmission line, is $660 million. Both stations are expected to be operational by the end of 2010.

The run-of-river hydro project is one of the biggest launched to date. Unlike traditional “storage” hydro facilities, run-of-river plants do not require dams or impoundments that block fish migration or lead to silt buildup or other ecosystem changes. Rather, the plants divert water to riverside powerhouses that produce electricity while minimally disrupting river flow.

General Electric has pledged to invest up to $110 million to acquire a 49% equity stake and a 60% economic interest in the Toba-Montrose project, 118 miles northwest of Vancouver.

Plutonic has proposed an ambitious plan to harness British Columbia’s ample hydropower resources by building 34 run-of-river plants with a total capacity of 1,700 MW.

AEP, MidAmerican look to build grids nationwide. Expanding a partnership that began in the booming Texas electricity market, American Electric Power Co. (AEP) and MidAmerican Energy Holdings Co. have formed a joint venture to build and own high-voltage transmission assets in other states.

The 50-50 joint venture, Electric Transmission America LLC (ETA), combines AEP’s expertise in power line construction and operation with the deep pockets of privately held MidAmerican, the energy investment vehicle of Warren Buffett’s Berkshire Hathaway. This August, POWER named MidAmerican Energy’s Walter Scott, Jr. Energy Center Unit 4 its 2007 Plant of the Year.

The two companies said they intend to invest only in transmission projects that cost at least $100 million. Candidates will be chosen by a board that will include two representatives of Ohio-based AEP and two from MidAmerican, which is headquartered in Iowa.

The companies plan to launch their first project during the first half of 2008, with AEP acting as project manager to develop and build the transmission lines and facilities for ETA.

AEP deploying grid batteries to boost reliability. In a move that it said will enhance reliability and facilitate wind farm development, AEP said it plans to deploy three large sodium-sulfur batteries as the first step of an effort to add 1,000 MW of “advanced” storage capacity to its huge grid within 10 years.

AEP said two of the batteries will be installed in West Virginia and Ohio, and that it was working with wind power developers to identify a third location within AEP’s 11-state service territory. Using batteries to store electricity helps offset the intermittent nature of wind generation.

The first two batteries each will have a capacity of 2 MW. The one planned for West Virginia will be installed near Milton, to enhance local reliability and support continued load growth. The missions of the Ohio battery, to be installed near Findlay, Ohio, will be to improve reliability, bolster weak sub-transmission systems, and avoid equipment overload.

Japan’s NGK Insulators Ltd. and Tokyo Electric Power Co. developed the batteries, which will be delivered in the spring of 2008. According to AEP, it will spend $27 million to buy and install the three batteries and their control systems.

AEP chairman, president, and CEO Michael Morris said the company hopes to have at least 25 MW of battery capacity in place by the end of this decade. In 2006, AEP installed the first megawatt-class sodium-sulfur battery on a U.S. distribution system, at a substation near Charleston, W.Va., operated by AEP subsidiary Appalachian Power.

Barnwell radwaste disposal site to close. In a move that will reduce the nation’s already limited capacity for disposing of low-level radioactive waste, EnergySolutions LLC has announced it will not seek to keep its Barnwell landfill in South Carolina open to waste generators from all states after June 2008. The decision reflects growing opposition to radwaste storage by state lawmakers, as well as a new controversy over groundwater contamination at Barnwell that has drawn the concern of South Carolina’s attorney general.

EnergySolutions officials said they will not try to change a current South Carolina law that requires Barnwell to stop accepting deliveries of nuclear waste from states other than South Carolina, Connecticut, and New Jersey—the three members of the Atlantic interstate compact for low-level radioactive waste disposal.

Barnwell’s closing will leave most utilities and other low-level radwaste generators only two commercial disposal options: a facility in Clive, Utah (also operated by EnergySolutions), and a landfill in Richland, Wash., managed by a subsidiary of American Ecology Corp. under the trade name U.S. Ecology. The Washington site only accepts deliveries of low-level radwaste from states belonging to the Northwest and Rocky Mountain waste disposal compacts.

Barnwell, the nation’s oldest low-level waste disposal site, began operation in 1971 and has since taken in about 28 million cubic feet of waste. The 235-acre site is now 90% full. In recent years, environmentalists have ratcheted up their opposition to Barnwell, saying its disposal practices do not meet modern standards, as evidenced by the burial of some waste in containers with holes in the bottom.

EnergySolutions officials said their decision on Barnwell was largely dictated by political realities in South Carolina. In particular, they noted that the Agriculture Committee in the South Carolina House of Representatives voted 16-0 this April to defeat a proposal that would have kept Barnwell open to all states for another 15 years. The unanimous vote was somewhat surprising because the state government has typically received more than $10 million annually from Barnwell to support education programs—revenues that will doubtless be curtailed by the restriction of access to the landfill.

We Energies transfers ownership of Point Beach Nuclear Plant to FPL Energy. On October 1, We Energies announced completion of the sale of its two-unit Point Beach Nuclear Plant to FPL Energy. On that day, FPL assumed management and operation of Point Beach from Nuclear Management Co., which had operated the plant for We Energies since 2000.

FPL Energy bought the plant, its nuclear fuel, and associated inventories for $924 million. With final closing adjustments, the deal also will release to We Energies decommissioning trust investments worth more than $482 million. All told, the sale will yield more than $882 million of proceeds for the benefit of We Energies’ customers—about $57 million more than originally projected.

The Point Beach plant is located near Two Rivers, Wis. Its first unit entered commercial service in 1970 and is licensed to operate until 2030. The second unit came on-line in 1973 and has an operating license that expires in 2033.

The sale includes a long-term power-purchase agreement that requires FPL Energy to sell 100% of each unit’s production to We Energies until its current license expires. We Energies also has the option to purchase power resulting from any capacity uprates, as well as an option to invest in and own up to 40% of any new generation built at the site.

Australian CO2 reduction project breaks ground. Alstom has hired International Power (Technologies) Pty Ltd. to design, engineer, and build a demonstration plant at its Australia & New Zealand subsidiary’s 8 x 200-MW lignite-fired Hazelwood Power Station. The project will showcase technologies capable of dramatically reducing the plant’s CO2 intensity.

The scope of the project includes demonstrating a new lignite drying technology, developed by Alstom and RWE of Germany, for reducing the moisture content of brown coal from over 60% to 12%. The retrofit will require modifying one of Hazelwood’s eight boilers to reduce its CO2 emissions intensity by 20%, increase its capacity by 10%, and extend its life to 2030. The project also will entail augmenting the unit’s fuel heating system and upgrading its steam turbine-generator.

The project, called Hazelwood 2030, has received strong public support in the forms of a $50 million grant from the Australian government’s Low Emissions Technology Development Fund and a $30 million grant from the government of Victoria State as part of its Energy Technology Innovation Strategy.

Contracts also have been finalized with Alstom for the supply of all equipment and technology. The project will now move into the detailed design phase. Groundbreaking is scheduled for 2008.

The Hazelwood 2030 project also calls for construction of a pilot carbon capture plant by late 2008. Designed to capture 16 to 25 tons of CO2 per day from one of the facility’s generating units, the pilot plant will be one of the world’s biggest. The capture technology to be used will use a solvent solution injected into the flue gas to absorb CO2.

Innovative solar thermal plant planned for Florida. FPL Group says it plans to build what may become a 300-MW solar thermal power plant in Florida. If the project pans out, the plant would be the state’s first commercial facility of its kind.

FPL will begin by building a prototype 10-MW facility using technology from Ausra Inc. that employs flat arrays of Fresnel lenses to focus the sun’s heat. Most solar thermal plants use parabolic mirrors to perform that function, which has not yet been proven commercially viable.

According to FPL, the capacity of the pilot plant will be scaled up to 300 MW only if the Ausra technology meets its cost and performance goals. In a related announcement, FPL said it also plans to develop 200 MW of solar thermal power plants in California over the next seven years.