TVA may revive Bellefonte

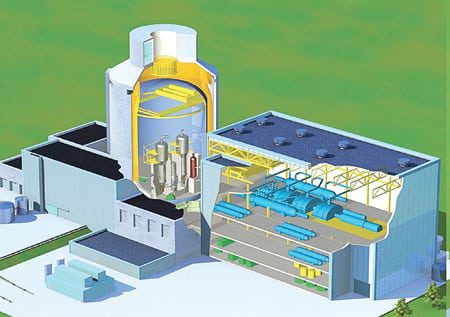

The U.S. Nuclear Regulatory Commission (NRC) has received the second complete application to build a new nuclear plant in as many months. On October 30, Tennessee Valley Authority (TVA) and the NuStart consortium of nuclear utilities and reactor vendors applied for a combined construction and operating license (COL) for two advanced pressurized water reactors (PWRs) at TVA’s 1,600-acre Bellefonte Nuclear Plant site in Jackson County, Ala. (Figure 1).

|

1. Back from the dead. Tennessee Valley Authority, with support from the NuStart Consortium, has asked the NRC for permission to build two Westinghouse AP1000 next-generation pressurized water reactors on the site of the utility’s unfinished Bellefonte Nuclear Plant in Alabama. Source: TVA

|

In September, NRG Energy Inc. became the first U.S. energy company in 29 years—since before the Three Mile Island accident—to fully apply for a license for a new nuclear plant (see POWER, November 2007, Global Monitor). NRG and the operator of two PWRs at South Texas Project would like to build two next-generation 1,350-MW boiling water reactors (BWRs) designed by General Electric adjacent to the existing units, to more than double the site’s generating capacity.

Bellefonte should be a familiar name to industry graybeards. In December 1974, the NRC issued TVA permits to build two PWRs there. Fourteen years later, with Unit 1 90% complete and Unit 2 a little more than half-done, TVA’s board of directors deferred further construction in response to lower-than-expected load growth. The project remained in limbo until November 2005, when TVA officially notified the NRC that it was cancelled. The construction permits then were withdrawn.

Ducks in a row. TVA’s COL application for Bellefonte specifies the use of two AP1000 “advanced passive” reactors from Westinghouse Electric Co., which was bought by Toshiba Corp. in 2006. This July, Westinghouse signed contracts with the Chinese government to build four plants based on the AP1000 by 2015. Since one of the deals calls for transferring details of the reactor’s technology (Figure 2) to a government agency, the AP1000 will likely be a linchpin of China’s nuclear power future.

|

2. Passive design, aggressive marketing. An artist’s conceptual rendering of the containment and power building of a nuclear unit based on the AP1000, an “advanced passive” next-generation reactor rated at 1,117 MW to 1,154 MW. Courtesy: Westinghouse Electric Co.

|

Although TVA has not yet committed to build the new reactors, industry observers cite several reasons for believing that Bellefonte 2.0 has a good chance of coming to fruition. For one, the federal utility does not face the financial pressures that make investor-owned utilities risk-averse. What’s more, the Bellefonte site still has intact and useful infrastructure built for the aborted project, including plenty of transmission lines. And TVA has the support of NuStart, which has been working with it on the Bellefonte COL submittal for the past two years.

“Participating with NuStart in this application is a cost-effective way to preserve TVA’s nuclear power option for the future as we continue to explore and develop the best alternatives to meet growing demand for electricity in the Tennessee Valley,” said Bill McCollum, TVA’s chief operating officer. “Like other utilities, we face long lead times to build and start new plants needed to meet around-the-clock baseload power demand.”

Timing is everything. NuStart chose Bellefonte in September 2005 as one of two sites for which it said it would develop and submit COL applications. The other is Entergy Nuclear’s Grand Gulf plant in Mississippi; if the NRC approves a future application, the site would add an advanced BWR of the same type that NRG envisions building at South Texas.

If the NRC approves the Bellefonte application, its COL license would be issued to TVA. But NuStart’s members also would benefit by being able to “reference” TVA’s Bellefonte application for any AP1000 reactor designs they might submit. Indeed, four of the consortium’s utilities have announced plans to submit COL applications for AP1000 projects to the NRC by the end of 2008 that will make that reference.

Support by NuStart (which is itself backed by a U.S. Department of Energy subsidy) made the decision to apply for the Bellefonte COL a no-brainer for TVA. While the utility is addressing the last nagging problems at Browns Ferry Unit 1 (see POWER, November 2007, Browns Ferry Nuclear Power Plant for an inside look at the Alabama reactor’s restart this May), it is preparing to spend an estimated $2.5 billion over the next five years to complete the unfinished Unit 2 at its Watts Bar Nuclear Plant in Tennessee. If all goes according to plan, the Watts Bar 2 project will be wrapping up when the NRC issues a COL for Bellefonte, freeing up funds for a construction project that could cost $10 billion or more.

The NRC says it expects to receive up to 21 applications for as many as 30 new reactors over the next few years. The proposed new units have enjoyed tremendous support from the Bush administration and the U.S. Congress, which included in the Energy Policy Act of 2005 loan guarantees and cost-overrun support of up to $2 billion, spread over as many as six plants, as well as a production tax credit of 1.8 cents/kWh for six years, totaling as much as $125 million annually.

GE’s globetrotting Jenbachers

A nation’s wealth determines its ability to reduce emissions of the greenhouse gases we now know contribute to global warming and climate change. That is clear from a survey of recent installations of GE Energy’s Jenbacher reciprocating engines in three countries.

Those in the two richer countries burn coal-mine methane that would otherwise be released, or make municipal energy systems more efficient, thereby reducing their average fuel consumption and emissions. Of necessity, the rationale for the reciprocating plants in the poorest country is increasing reliability, rather than mitigating environmental impact.

First stop: China. The reciprocating engine plant powered by coal mine methane that Shanxi Yang Quan Coal Industry (Group) Co. Ltd. built this May (and that GE commissioned three months later) is atypical because it isn’t a mine-mouth plant. Its fuel is extracted from an active coal mine and delivered via pumps, storage tanks, and pipelines several miles to the company’s Shentangzui Power Plant in Yang Quan, 60 miles north of Taiyuan City, the capital of coal-rich Shanxi Province.

The new plant has four Jenbacher Model JGS 620 GS-S.L. engine-generators with a maximum output of 3 MW and a thermal efficiency of 40.6%. The gensets were manufactured at GE’s gas engine headquarters and manufacturing center in Jenbach, Austria.

Next stop: Bangladesh. One of the world’s poorest nations, Bangladesh desperately needs reliable electricity—whatever its carbon footprint—to support its industrial economy and raise its citizens’ standard of living. Because factories can’t depend on power from the public grid, on-site generation is an attractive alternative, and one made even more so by the regional abundance of low-cost natural gas (Figure 3), as demonstrated by these installations:

- The textile companies Parity Fashion and R.K. Spinning, both owned by Mohammad Abdul Hamid, are now satisfied Jenbacher customers. Parity commissioned three Model JMS 320 GS-N.L. cogeneration modules in 2006, two years after R.K. Spinning installed four Model JGS 320 GS-N.L. gensets. Both factories are in Narayangonj, 18 miles south of Bangladesh’s capital city of Dhaka. Together, the three cogen units at the Parity Fashion plant deliver 3 MW of electricity, as well as 1.7 MW of heat energy (from their water jackets) for use by an absorption chiller. The engines’ exhaust gas heat also is used to produce steam needed for dyeing fabric. The four gensets at R.K. Spinning provide only one kind of energy: 4.2 MW of reliable electricity.

- The Sinha Textile Group of Kanchpur, 15 miles southeast of Dhaka, ordered 12 JGS 320 GS-N.L. gensets between 2000 and the beginning of 2007 to provide 12.5 MW for several of the company’s mills in the region. Six of the engines, which operate in island mode, have already accumulated 40,000 operating hours.

- In mid-2005, AFBL, a division of the Akij Group, installed four JGS 320 GS-N.L. gensets with a combined rating of 4.2 MW to power its beverage plant in Manikgonj, 30 miles southwest of Dhaka. There, the company produces a variety of locally popular libations, including a cola, a lemon drink, and an energy drink.

|

3. Do it yourself. GE’s Jenbacher engines have been a boon to Bangladesh’s burgeoning industrial economy. Examples include these three Model JGS 320 GS-N.L. units, which produce 3.1 MW of on-site power for a Roshawa Spinning Mills Ltd. facility in Dhaka. Courtesy: GE Energy

|

Last stop: Hungary. Since the Iron Curtain parted and fell in 1989, the countries of Central and Eastern Europe have adapted to capitalism and global competition, some more effectively than others. Hungary exemplifies the successes. In 2002, realizing that it needed to modernize its economy, the Hungarian government passed several initiatives that encourage greater energy efficiency.

One of the rules specifically promotes greater use of combined heat and power (CHP) plants for district heating of cities. Since the rules went into effect, Hungarian municipalities have ordered and installed roughly 220 MW worth of Jenbacher reciprocating engine gensets tailored for CHP service.

Dunaujvaros, 40 miles south of Budapest, is one such city. This October, it commissioned a plant whose 12 natural gas–fueled Model 620 GS-N.LC. gensets together deliver 36.5 MW of electricity and 36.8 MW of thermal power, making it the largest district heating project in Hungary to date.

The plant in Dunaujvaros, which operates at an overall thermal efficiency of 86.4%, was developed by its owner, the general contractor Energott Kft. Last year, the firm completed another cogen plant with eight similar gensets (Figure 4); it now supports the local grid and district heating system of the industrial city of Székesfehérvár, 40 miles southwest of Budapest. That plant can generate 24.4 MW of electricity and 22.4 MW of thermal power.

|

4. Efficiency expert. GE Energy recently celebrated the commissioning of 12 of its 3-MW Jenbacher natural gas–fired gensets at Hungary’s largest district heating plant to date in the city of Dunaujvaros. The units are similar to the one shown being delivered to a cogeneration plant in Székesfehérvár in 2006. Courtesy: GE Energy

|

Largest PV plant taking shape

Although the 40-MW Solarpark Waldpolenz project near Leipzig, Germany, won’t be completed until the end of 2009, it is already supplying 8.4 MW of sunlight-generated electricity to the local grid. The project’s developer is The Juwi Group (www.juwi.de), a wind and solar power specialist based in Mainz, Germany, with U.S. offices in Kansas, Ohio, and Pennsylvania.

The photovoltaic (PV) power station is being built in the townships of Brandis and Bennewitz in eastern Saxony on half of a 540-acre site formerly occupied by a military airbase. The installation (Figure 5) covers an area equivalent to 200 football fields. With 11,000 posts in place, the first 2,600 aluminum substructures assembled, and 100,000 solar modules mounted and wired, the first phase of the project now is complete. When it is finished, the plant will aggregate current from 550,000 thin-film PV modules.

|

5. Deutschland Über alles. Solarpark Waldpolenz is on track to become the world’s largest photovoltaic power plant when it finishes expanding in 2009. The plant is now sending 8.4 MW to the grid. Courtesy: Juwi Group

|

Construction has moved at a rapid pace; the first six megawatts were completed in just four months. The estimated cost of the finished project is $188 million, or $4,700/kW. When completed, Solarpark Waldpolenz will take a commanding lead in the ever-changing list of the world’s largest-capacity PV projects (see table).

|

The world’s 15 largest photovoltaic power plants (as of October 2007). Source: www.pvresources.com

|

If you’re wondering how such an expensive plant is being financed, look no further than Germany’s Renewable Energy Sources Act. Since August 2004, it has required the country’s grid operators to pay owners of hydroelectric and geothermal plants, wind farms and PV plants, and plants fueled by landfill gas, sewage treatment gas, methane from mines, or biomass a fixed fee for every kilowatt-hour of their production over a period of 15, 20, or 30 years (depending on plant type). For PV plants, the current rate is a whopping 51 cents/kWh, which makes the use of innovative technologies—such as Solar Waldpolenz’s thin-film arrays—commercially cost-effective (at least for plant developers and owners).

Naturally, the cost of subsidizing “green” electricity is passed on to end users. According to Eurostat, the statistical arm of the European Commission, on January 1, 2007, the average European household consuming more than 3,500 kWh annually was paying 28.21 cents/kWh for electricity, including taxes. By contrast, the U.S. Department of Energy’s Energy Information Administration reports that the average U.S. household electricity price was 10.53 cents/kWh in July 2007. Nationwide, the lowest prices were 7.12 cents/kWh in Washington and 7.2 cents in Kentucky. The highest were Hawaii’s 22.8 cents, Connecticut’s 18.84 cents, New York’s 16.89 cents, and California’s 14.4 cents.

When will PV be competitive?

A report released in September by Greenpeace and the European Photovoltaic Industry Association (EPIA) predicts that grid-connected solar power will be able to compete on cost with electricity generated by conventional means (burning fossil fuels, nuclear fission, spinning hydroturbines) by 2015 in parts of Europe and by 2020 in many regions of the world.

“Solar Generation 2007” concludes that in Europe, the price of conventionally produced power is likely to continue a 15-year upward trend. As a result, solar power is likely to be cost-competitive in southern Europe as early as the end of this decade, and throughout Europe by 2020. Under the most conservative of the three scenarios used to model the growth of solar through 2030, PV would supply 5.35% of global demand in that year.

In the press release announcing the report, Dr. Winfried Hoffmann, president of the EPIA, said, “Between now and 2010, the solar photovoltaic industry will invest 14 billion euros [$19.1 billion] globally [to expand] PV factories. Mass production will enable us to reduce prices and we expect to be competitive, in some regions, with end consumer prices by 2015. In the future there is no doubt that PV will become a first-choice technology for electricity consumers to provide price-stable and reliable electricity for private households and other users.”

Global installed solar capacity in 2006 exceeded 6,600 MW. That’s more than four times the 1,200 MW in service in 2000. Installation of PV cells and modules around the world has been growing at an annual rate of more than 35% since 1998.

According to the report, large-scale grid-connected PV arrays larger than 1 MW represent 10% of the European PV market. They are also driving the current boom in projects, most of them in Organization for Economic Cooperation and Development (OECD) countries. In 1994, only 20% of PV capacity was connected to the grid. By 2006, nearly 85% was. That kind of explosive growth was exactly what many OECD countries envisioned when they created big government subsidies for renewable energy development.

At the end of 2006, Germany led the world in total installed PV capacity, with 2,530 MW. It was followed by Japan (1,708 MW), the U.S. (620 MW), and Spain (120 MW). Germany also was the world leader in capacity installed in 2006, with 750 MW. Japan and the U.S. were a distant second and third, with 290 MW and 141 MW installed, respectively.

Interestingly, the report acknowledges that the two organizations’ predictions of likely installed solar capacity worldwide in past reports have consistently fallen way short of what the industry has produced. That may be the case again, particularly if new PV module factories under construction allow supply to catch up with demand.

Siemens goes to the wall with solar

In two projects that could be poster children for dual-use environmental technology, Siemens Power Transmission and Distribution (www.siemens.com/ptd) has clad the façades of a waste recycling plant and a biomass-fired power plant in different cities in Italy with solar modules and linked each system to the local power grid.

Both plants are owned by the same company: Ecosesto, a subsidiary of the Milan-based Actelios Group, whose core business includes power generation from renewable energy sources. On both projects, Siemens installed the arrays, grid-connected the systems, and is responsible for servicing and maintaining them.

The waste recycling plant is in Trezzo, Lombardy. Its 100-foot-wide by 400-foot-high façade now is covered with PV arrays that have a combined peak output of 70 kW. According to Siemens PTD, it is the first photovoltaic system of this size to have been integrated into an Italian building.

The biomass-fired power plant is in Rende in southern Italy. A 40-foot by 500-foot steel structure on its façade supports 5,500 single-crystal solar modules (Figure 6) from Sharp Electronics Corp. (www.sharpusa.com). Each module has a rated maximum output of 180 watts, so the system can generate 1.4 GWh—enough to supply 450 households.

|

6. Climbing the wall. Siemens Power Transmission and Distribution recently commissioned a PV system it mounted on the façade of a biomass-fired power plant in Rende in southern Italy. Courtesy: Siemens

|

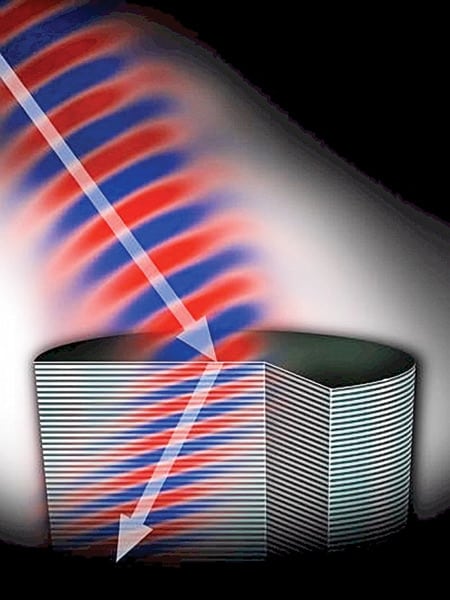

Breakthrough in metamaterials

A Princeton-led research team has demonstrated an easier and more reliable way to manufacture “metamaterials”—those with a negative index of refraction—using conventional semiconductors and commercial techniques and tools for stacking them in layers.

Metamaterials are unique for their ability to refract, or bend, light in the opposite direction (Figure 7). They can do that because their internal structural dimensions are much smaller than the wavelengths of light passing through them. Because any wave passing through a metamaterial goes through multiple layers at once, it behaves as if manipulated by a single material with properties unlike those of any semiconductor layer alone.

|

7. Curved optical backboard. A computer simulation of a “metamaterial” with a negative index of refraction. Researchers at Princeton have succeeded in manufacturing several types with layers of the semiconductors gallium arsenide and aluminum indium arsenide using common integrated-circuit manufacturing techniques. Courtesy: Keith Drake, Princeton University

|

Simplifying the manufacture of metamaterials may lead to advances in many areas, including high-speed communications, medical diagnostics, superior lenses and lasers, smaller laser-based sensors, and detection of terrorist threats.

Previous metamaterials were two-dimensional arrangements of metals, which limited their usefulness. The Princeton invention is the first 3-D metamaterial constructed entirely from semiconductors.

All non-opaque materials have an index of refraction, a measure of the degree and direction in which light is bent as it passes through them. Though materials found in nature have positive indices of refraction, the metamaterials manufactured by the Princeton researchers have a negative index of refraction.

Negative refraction holds promise for the development of superior lenses. The positive indices of refraction of normal materials necessitate the use of curved lenses, which inherently distort some of the light passing through them in devices such as telescopes and microscopes. Flat lenses made from materials that exhibit negative refraction could compensate for this aberration and enable far more powerful microscopes capable of seeing things as small as molecules of DNA.

Significantly, the Princeton metamaterials also can negatively refract light in the mid-infrared region, which is used in a wide range of sensing and communications applications. Their unique composition results in less lost light than from previous metamaterials, which were made of extremely small arrangements of metal wires and rings. The semiconductors that constitute the layers of the new materials are grown from crystals and fabricated using proven manufacturing techniques.

The Princeton researchers next plan to incorporate the new metamaterials into lasers. They will also continue to modify them and strive to make their features ever smaller, which would expand the range of light wavelengths capable of being manipulated.

POWER digest

News items of interest to power industry professionals.

ConocoPhillips and Peabody studying coal-to-gas prospects. ConocoPhillips and Peabody Energy have announced their selection of a site in Kentucky for studying the feasibility of developing a commercial-scale coal-to-gas facility. The optimal facility would be a state-of-the-art mine-mouth gasification plant that uses ConocoPhillips’ E-Gas technology to produce as much as 1.5 trillion cubic feet of natural gas from coal over its lifetime. The feasibility study will vet several possible designs and sites and will continue into 2008.

The study will focus on assessing designs that meet or exceed state and federal environmental protection regulations and technologies for reducing carbon footprints. For example, the two firms plan to work with the Midwest Geological Sequestration Consortium and the Kentucky Geological Survey to examine carbon capture and storage options.

GE lands big wind turbine deal with EDP. GE Energy has signed a $730 million contract to supply Energias de Portugal, SA (EDP)—the world’s fourth-largest wind farm developer—with 281 wind turbines totaling more than 500 MW of capacity for wind projects to be built during 2008 and 2009 in Europe and the U.S.

Under the terms of the contract, GE will supply Neo Energia, the European renewables subsidiary of EDP, with 80 wind turbines rated at 2.5 MW each for projects in Europe, and Horizon Wind Energy LLC (EDP’s American subsidiary) with 201 turbines rated at 1.5 MW for projects in the U.S. at sites yet to be determined. EDP purchased Houston-based Horizon earlier this year as part of an expansion into the North American wind energy market.

All of the U.S. projects will be owned by Horizon Wind Energy or affiliates. Sixty-seven of their turbines, and 30 of the turbines for the European projects, are expected to be commissioned before the end of next year.

The wind industry is well established on the Iberian peninsula. According to the European Wind Energy Association, Spain had 11,615 MW of installed wind capacity at the beginning of 2007. That puts it in third place globally—behind Germany and the U.S. Portugal ranks much lower, with 1,716 MW.

Basin Electric to build new CC plant in South Dakota. An area near White, S.D., has been selected as the site for a new Basin Electric Power Cooperative combined-cycle power plant with a capacity of about 300 MW to be fueled by natural gas. The proposed plant has been named the Deer Creek Station and is scheduled to be operational in 2012, pending permit approvals. White is about 12 miles northeast of Brookings in the eastern part of the state.

The additional capacity is needed to meet member load requirements and will serve as an intermediate power supply, said Dave Raatz, manager of marketing and power supply planning. Intermediate power supply is categorized as somewhere between baseload and peaking capacity, he explained. It is designed to “cycle” with demand, typically running about 12 to 16 hours a day when demand for electricity is higher.

This new generating resource is the best fit for Basin Electric’s members, Raatz explained, because of the site’s proximity to fuel supply and transmission. The plant’s fuel will be supplied by Basin Electric’s Dakota Gasification Co. via the Northern Border Pipeline.

Proposed Canadian project to feature CO2 recovery. GE Energy and Bechtel Overseas Power Corp. have signed an agreement with Calgary-based TransCanada Corp. to develop the first polygeneration facility in Canada capable of using petroleum coke as a feedstock and incorporating carbon capture and storage.

The proposed facility, to be located in Belle Plaine, Saskatchewan, would convert pet coke to hydrogen, nitrogen, steam, and carbon dioxide for fertilizer production and enhanced oil recovery. It also would have an installed electricity generation capacity of about 300 MW.

The plant would use GE Energy’s gasification and flexible-fuel technology to generate power and support local industrial processes. GE’s scope of supply is the gasification island and the power island equipment, which includes two GE Frame 7FB gas turbines designed to run on syngas with high hydrogen content.

Under the agreement with TransCanada, GE and Bechtel Overseas Power Corp., which have already done the project’s preliminary engineering, will advance to the next engineering phase early next year. If studies indicate that the project is economically viable, detailed engineering design would follow. Assuming timely receipt of construction and environmental permits, the polygeneration plant could come on-line as soon as 2013.

Foster Wheeler considers capturing Spanish CO2. Foster Wheeler Ltd. recently announced that the Spanish subsidiary of its Global Power Group has signed an agreement with Fundación Ciudad de la Energía (CIUDEN) to develop an oxy-combustion process and CO2 capture solution for a coal-fired demonstration facility in Spain.

The agreement hires Foster Wheeler to handle the initial phase of this project (including providing engineering services and technical specifications) and to review CIUDEN’s conceptual and basic design for the demo plant’s combustion island. The island will incorporate both pulverized-coal and circulating fluidized-bed technologies. The demonstration plant is scheduled to become operational in mid-2009.

First Chinese CC plant fired by blast furnace gas. GE Energy has signed a multimillion-dollar contract with Wuhan Iron and Steel Co., Ltd. to supply two combustion turbine-generators and associated blast furnace gas (BFG) compressors for a combined-cycle power plant in China. Each package will comprise one Frame 9E gas turbine, one generator, and one BFG compressor.

BFG is created during the production of pig iron in steel mills and as a by-product of coke combustion and iron ore melt in blast furnaces. It can be recovered and used as fuel in a combined cycle with higher efficiency and lower emissions than a traditional BFG boiler power generation system.

Delivery of the gas turbines is scheduled for late 2008. The plant is slated to be commissioned in late 2009.

AEP buys unfinished Dresden plant. American Electric Power says it has completed the purchase of a natural gas–fired combined-cycle power plant still under construction near Dresden, Ohio, from Dresden Energy LLC, a subsidiary of Dominion, for $85 million.

Construction of the 580-MW Dresden plant began in 2001 after its major equipment began arriving on-site. AEP expects to finish the plant in 2009 or 2010 and add to its generation portfolio.

Covanta NSPS waste-to-energy plant debuts. In late October, Covanta Holding Corp. announced that it has begun operating the first waste-to-energy unit built in compliance with the U.S. Environmental Protection Agency’s New Source Performance Standards.

The new unit expands the Lee County Solid Waste Resource Recovery Facility in southwest Florida, which entered commercial service in December 1994. Before the $120 million expansion, Lee County was able to convert 1,200 tons per day of solid waste into up to 39.7 MW of generating capacity, for sale to Seminole Electric Cooperative. Now it can process an additional 636 tons daily and produce an additional 18 MW.

Notably, the facility uses the secondary sewage treatment effluent from a nearby waste treatment plant for the majority of its process water. It uses both ferrous and nonferrous recovery systems to remove all metals from the residue.