Last year when we met, we told you that the electric utility industry was optimistic, ready to tackle the big issues and focused on making the transformation to a low-carbon future. A lot has happened in the past year.

So I am here to tell you today, about one year later to the day, that the electric utility industry is still optimistic, still tackling the big issues and still focused on accelerating the transformation to a low-carbon future.

Thomas Edison once said, “Opportunity is missed by most people because it is dressed in overalls and looks like work.” Make no mistake, the opportunities that we see are not only wearing overalls, but steel-toed shoes as well. And they have their sleeves rolled up.

Today, we would like to talk with you about the electric utility industry’s performance, the challenges we face, and the actions we are taking to address them.

We are great believers in the progress that improves our electric systems and the great ideas that electricity continues to make possible. Maybe next year you can all read this speech on your brand new iPads!

2009 Financial Recap and Current Industry Business Situation

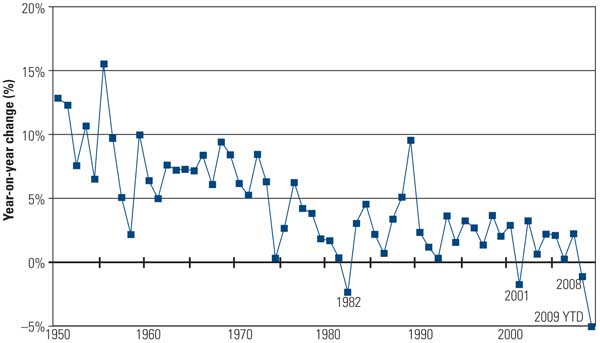

Let’s begin with the overall financial picture. Electric output in the U.S. was down last year by 3.7 percent compared with 2008. There is an historically close relationship between U.S. Gross Domestic Product (GDP) and electricity output, and last year validated that relationship. In addition to the economic downturn, the cool summer weather that much of the country experienced also dampened electricity demand.

Regarding stock performance, electric utilities had far less volatility than the broader market indices over the last 16 months. Despite the economic and regulatory challenges we are facing, the industry’s credit quality (BBB rating) was relatively unchanged in 2009. Notably, the industry’s stability is depicted by the fact that 82 percent of ratings outlooks are currently stable or [sic] and the overall volume of credit rating actions has fallen significantly in recent years.

We have maintained our access to capital during the recession. Despite many challenges investors have faced, our industry has continued to issue long-term debt at traditionally healthy levels. And even though our industry’s capital expenditure projections have fallen modestly since last spring, the industry’s capex remains at historically high levels—approximately $80 billion per year, or about double what it was in 2004.

To help maintain cost-effective risk management of commodity price risk for wholesale power and natural gas, EEI is leading a multi-association campaign to shape effective derivatives reform legislation that preserves the over-the-counter (OTC) derivatives market for utilities and other energy end users. David Owens will tell you more about this and our other financial activities shortly.

We are optimistic about 2010. The surprising jump in GDP for the fourth quarter of 2009 gives us a good foundation to build on. Electricity will be a strong component of our economic recovery. Clean energy jobs will also be a cornerstone of our recovery, with most of them associated with electricity in some form. And, in what is likely to be an increasingly carbon-constrained future, electricity will be the fuel of choice, powering computers and other electric appliances as well as electro-technologies such as electric vehicles and the Smart Grid.

Climate Change Legislation

Of course, our optimism for 2010 may be tempered somewhat by the very challenging year ahead in Washington. The partisan divide on Capitol Hill remains wide. There seems to be little room for finding common ground, and little appetite for compromise. Healthcare legislation is still on the table, and that debate has left many tired and wary of tackling a big energy bill.

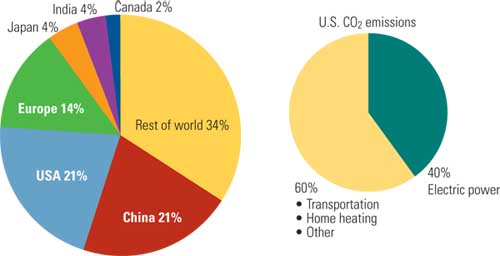

Nonetheless, we will continue our efforts to pass climate legislation. About three years ago, the EEI Board of Directors endorsed a set of principles that serve as the basis of our approach to this legislation. At our winter CEO meeting in Scottsdale a few weeks ago, the Board reaffirmed its commitment to those principles. We want legislation that will achieve the twin goals of reducing U.S. carbon emissions by 80 percent by 2050, and mitigating price increases for our customers. In fact, strong consumer protections are crucial to building the public support necessary to sustain U.S. climate policy over the long haul, particularly with so many Americans and businesses focused on a still-struggling economy.

To help contain costs, we are advocating that a full 40 percent of emission allowances should be allocated—and not auctioned—to the electric power sector, with the vast majority going to local electric companies for the direct benefit of their customers, under the strict supervision of state public utility commissions.

A year ago, we were faced with legislative proposals that would have auctioned all emissions allowances. Through a lot of hard work, we were able change that. In the current thinking, Congress will allocate most of the allowances to help offset cost increases to consumers. That approach was reaffirmed just last week in President Obama’s 2011 budget proposal to Congress, which, unlike the previous year’s budget outline, omitted any revenue projections associated with an auction.

We believe that Congress should place upper and lower limits on the price that companies would pay for any additional allowances they would need to meet their emission reduction obligations. Ensuring that prices do not go too high helps protect consumers from price volatility and market manipulation. Such a hard “price collar” is especially important during the early years of a climate program when utilities will have relatively few options for reducing emissions, and compliance costs are likely to be high for many utilities and their customers.

Moreover, emissions reduction targets and timetables should be aligned with the availability of climate-friendly technologies and measures, including wind, solar and other sources of renewable energy; energy efficiency improvements; increased nuclear energy; advanced coal technologies with carbon capture and storage; natural gas; and plug-in hybrid electric vehicles.

Electric utilities will need this full suite of technologies to meet the growing demand for electricity, reduce emissions, and soften the economic impact on our customers. The right federal legislation would provide a much clearer path to carbon reductions and help stimulate investment in clean energy technologies.

There are some hopeful signs. Senators Graham, Kerry, and Lieberman have been working to build support around the climate legislation framework that they recently outlined.

Another factor we hope may motivate Congress is that the Environmental Protection Agency (EPA) is waiting in the wings to begin regulating greenhouse gases under the Clean Air Act (CAA)—which it is now required to do under its endangerment finding last year that followed in the wake of Massachusetts v. EPA in 2007. In addition, many states are enacting their own energy legislation that differs widely from state to state and would result in a patchwork that will make compliance very difficult and very expensive.

Moreover, a couple of adverse federal appellate court decisions have raised the specter of federal and state common law climate tort suits.

EEI continues to believe that comprehensive federal legislation is preferable to CAA regulation of GHG emissions. Although EPA can set limits on carbon emissions, it cannot provide incentives to achieve those limits. EPA can impose penalties for non-compliance, but it cannot create a system to protect consumers from price shocks. Only Congress can do those things. Only well-designed comprehensive climate legislation can contemplate economy-wide GHG emissions reductions within the context of the current and projected economic landscape, the availability of technology, the reliability of the nation’s power sector, and the affordability of its energy supply.

You’re probably aware that the Securities and Exchange Commission (SEC) recently issued interpretive guidance on climate change disclosure. EEI has been working this issue for several years, and our industry is a leader in disclosing environmental and climate-related information. For example, our power plant carbon dioxide (CO2) emissions have been reported to the EPA since the early 1990s. Furthermore, virtually all EEI members currently address greenhouse gases in their financial disclosures. And we have been deeply involved in working with Congress and the Administration on climate legislation for many years.

Against this backdrop, we believe the SEC guidance pushes the envelope on climate disclosure. As you know, the legislative situation in Congress is fluid and it is unclear what climate legislation—if any—will emerge by the end of the year. Our fundamental goal in the SEC disclosure arena is to provide clear information to investors. In our view, the SEC guidance may just muddy the waters with respect to climate disclosure, and we are still analyzing the implications of that guidance.

A Host of Environmental Issues

Although the focus on carbon legislation may be diminishing at the moment, there are many other environmental issues pending for the electric power industry.

The coal ash issue is of great and immediate concern. EPA is considering an approach to regulation of the disposal of waste from coal combustion as “hazardous waste.” This may lead to the closure of existing disposal facilities (i.e., ash ponds), result in significant compliance costs—as much as $20 billion annually—and threaten industries that “recycle” coal ash for use in concrete and wall board among other beneficial uses. A new rule could be in effect next year.

More than 136 million tons of coal combustion products (CCPs) are generated annually and are currently managed under state regulatory authority. And nearly 45 percent (more than 60 million tons) of CCPs are recycled.

We are working with the EPA to make sure that they consider all of the ramifications of a reclassification of CCPs as hazardous waste. In addition to working directly with EPA, we have joined with a broad group of stakeholders—including governors, mayors, state environmental regulatory agencies, and ash end-users and recyclers—to add their voices to our support for the regulation of CCPs as non-hazardous waste.

Within the next two years, EPA is expected to take action on a number of air and water issues including:

- A replacement for phase 2 of the Clean Air Interstate Rule, which attempted to govern power plant emissions of sulfur dioxide and nitrogen oxide in the eastern U.S.

- New standards addressing mercury and other hazardous air pollutants.

- A re-examination of its rules for all pollutants regulated under the National Ambient Air Quality Standards, including ozone, particulate matter, sulfur dioxide, and nitrogen dioxide.

- More stringent standards for water discharged by utilities that could result in the need to install cooling towers on more than 40 percent of the industry’s existing power plants.

Clearly, we are working on all of these issues and making the case at EPA. But at the same time, we are continuing our actions to reduce emissions. Our industry’s emissions of sulfur dioxide and nitrogen oxide were 55 percent lower in 2008 than they were in 1980. And when data from 2009 are complete, we expect to see that sulfur dioxide emissions will be down by 65 percent versus 1980. As a side benefit, these efforts have also reduced emissions of mercury by about 40 percent. What makes these emission reductions even more impressive is that we are generating 75 percent more electricity today than we did in 1980.

Advancing Technologies for Cleaner Electricity

Behind these dramatic emissions cuts is our industry’s commitment to advancing the technologies we use to generate, transmit, and use electricity.

The debate around climate change tends to focus on treaties and legislation. And while those instruments are critical to reducing carbon emissions, the real solution is in technology. We are committed to the development and deployment of a suite of technologies that will be needed to achieve emission reductions—while keeping costs under control. Last year, we saw some remarkable progress in technology and we look for continuing progress in 2010.

Energy Efficiency

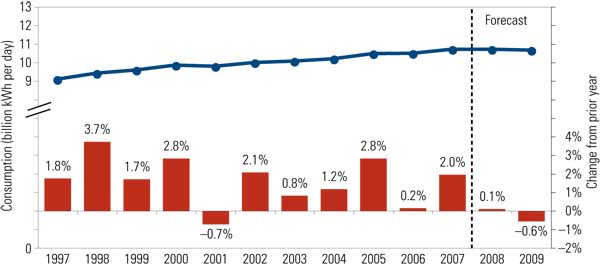

Energy efficiency is arguably the single most important asset we have for curbing carbon emissions in the near term. And our industry is making major strides in taking energy efficiency to the next level.

According to a recent survey by the Consortium for Energy Efficiency, utility budgets for energy efficiency activities have grown from about $2.5 billion in 2007 to $4 billion in 2009, for a 60 percent increase over the past three years. This spending is translating into dramatic energy savings.

A new report by the Energy Information Administration found that electric utility programs and initiatives helped to save almost 27.3 percent more electricity in 2008 than they did in 2007, and 37.62 percent more than in 2006.

On a cumulative basis since 1989, electric utilities have spent almost $40 billion ($38.3 billion) on efficiency efforts through 2008. In terms of energy savings, utilities have saved more than 1 trillion (1,016.8 billion) kilowatt-hours (kWh) through its energy efficiency activities between 1989 and 2008. To provide some context, a trillion kWh is enough electric energy to power about 93 million homes for one year.

Behind this trend toward bigger energy efficiency budgets and bigger savings is the progress that electric utilities and state regulators are making in turning energy efficiency into a sustainable business for utilities. About half the states now have either a method to compensate the utility for the sales it loses as a result of encouraging energy efficiency, or some form of financial incentive that puts energy efficiency on par with other investments made by the utility, or both.

To do even more with energy efficiency, EEI and its members advocated for many energy efficiency-related tax and appropriations provisions contained within the stimulus package signed last year. These include increasing the homeowners’ tax credits from 10 to 30 percent for energy-saving improvements and authorizing $6.3 billion for energy efficiency and conservation grants to the states and $5 billion for the Weatherization Assistance Program for low-income households.

In addition, the Institute for Electric Efficiency, which is part of EEI’s Edison Foundation, continues to help the industry focus its efforts, providing a forum to share information, ideas and best practices on what is working and what is not.

Coal

Because of its low cost and abundance, coal comprises almost 50 percent of the U.S. generation portfolio. In today’s environment, however, building new conventional pulverized coal plants is increasingly difficult. To maintain coal’s viability in a low-carbon future, we are developing advanced clean coal plants and carbon capture and storage capabilities. We are excited to see demonstration projects now taking place with carbon capture and storage across the country.

One such project is taking place in West Virginia, where American Electric Power has begun testing a chilled ammonia process to capture CO2 emissions from its 1,300-megawatt (MW) Mountaineer Plant. [Ed.: More information about the Mountaineer Plant, see this POWERnews story.] Approximately 100,000 metric tons per year of CO2 will be captured, injected, and stored in deep geologic formations beneath the Mountaineer site.

Another demonstration project is set for Mobile, Alabama, where Southern Company will capture between 100,000 and 150,000 metric tons of CO2 per year from its Barry plant.

Both of these projects are part of a $3 billion public-private partnership announced by DOE Secretary Chu last December to accelerate the development of commercial scale carbon capture and storage technologies.

We are encouraged to see that President Obama has announced the formation of an inter-agency task force on carbon capture and storage to develop a plan to bring five to ten commercial carbon capture and storage demonstration project on-line by 2016. Although large-scale deployment of carbon capture and storage is years away, these demonstration projects hold great promise for not only helping America to meet its environmental goals, but also for the world.

Nuclear

President Obama affirmed his commitment to building a new generation of safe, clean nuclear power plants in this country in his State of the Union address last month. And the U.S. Department of Energy announced in January the formation of a blue ribbon commission to evaluate policy options for management of spent fuel from commercial nuclear power plants and high-level radioactive waste from U.S. defense programs.

Support for nuclear power at the federal level is welcome and vital, but state activity is critical as well. This is why the growing number of license applications for new reactors is so encouraging. These include Georgia Power, which is building two reactors at its Vogtle site near Augusta, Georgia, [Editor: see this POWER magazine story on the Vogtle plant.] and DTE Energy, which has applied for a construction and operating license for its Fermi III plant in southeastern Michigan and expects to receive it in 2012. Given that nuclear is the largest source of carbon-free electricity production, and that construction of new plants will create tens of thousands of jobs, I am confident that the states will support the development of advanced nuclear power plants.

Natural Gas

In looking at natural gas, we see it as a vital fuel for a lower-carbon future for the electric power industry. This makes the new supplies of natural gas from U.S. shale formations particularly significant. These capacity additions already have increased natural gas’s share of the fuels we use to generate electricity.

Today, natural gas accounts for almost one quarter of our industry’s generation fuel mix (23-24 percent). For perspective, natural gas’s share of the fuel mix was about 16 percent in 2000 and 19 percent in 2005.

Wind

Wind power continued its rapid growth last year with the wind industry installing nearly 10,000 MW of new generating capacity in 2009. Electric utilities are increasingly adding wind to their power supply portfolios and signing wind contracts to supply their customers. Two of the leading companies behind the remarkable growth of wind power are FPL Group, whose subsidiary NextEra Energy Resources is the largest generator of wind and solar power in North America, and Xcel Energy, which delivers more wind power than any other utility in the nation—enough to power approximately 300,000 households.

Solar

The stimulus package’s cash grants, loan guarantees, and tax incentives are helping to jump start solar-power projects—both central station and rooftop—and increase the pace of new installations. Examples of the many innovative electric utility solar projects include:

- A plan by New Jersey-based Public Service Enterprise Group’s Solar Source to build the “Mars Solar Garden,” a 2.2-MW facility adjacent to Mars Snackfood’s U.S. headquarters in western New Jersey.

- Nevada Solar One, the largest solar plant built over the past 16 years. [Ed.: See POWER magazine for more on Nevada Solar One.] The 64-MW solar-thermal power plant near Boulder City, Nevada is part of the commitment of NV Energy to spend approximately $2 billion to purchase and invest in new renewable energy by 2015.

Hydropower

Our industry is also advancing technology that underscores the critical nature of hydropower to America’s energy future. Pilot programs are underway, such as Pacific Gas & Electric’s Humboldt WaveConnect project, that are studying new turbine designs that offer the potential to capture energy from waves, tides, and ocean and river currents. This means hydro can play an important role in addressing our nation’s future renewable energy needs in most locations across the country.

Energy Storage

Finding ways to economically and efficiently store energy will be essential for expanding the use of renewable energy systems. And today, our industry is working on a wide variety of large-scale energy storage technologies.

These include the joint venture between American Electric Power and MidAmerican Energy Holdings Company called Electric Transmission Texas (ETT) to build a 4.8MW battery storage facility in Presidio, a small, remote city on the Rio Grande. While ETT is working to upgrade the line that connects the project to the grid, the $23 million battery—which will be the largest in the U.S.—will provide up to eight hours of uninterrupted power for the city.

Altogether, last year was the first time that our industry added almost as much renewable energy capacity as it did natural gas capacity last year. Together, new wind and natural gas projects alone accounted for about 80 percent of all new generating capacity added.

Smart Grid

A lot of progress was made on Smart Grid [Ed.: For more on the smart grid, see the January 2010 POWER magazine story on the topic.] over the past year and that will continue in 2010. Utilities are installing smart meters and offering smart rates in pilot programs or in full-scale deployment in 33 states. Today, about six percent of electricity consumers nationwide have smart meters, and electric utilities are installing between 15,000 to 20,000 smart meters every day. By 2019, over 58 million smart meters will be in use.

In addition to installing meters, the industry is also working to make possible all manner of gadgets, from in-home energy displays that show real-time energy usage and offer efficiency tips, to “prices-to-devices,” where electricity price signals are relayed to smart appliances like thermostats and refrigerators, which in turn process the information and respond automatically based on the homeowner’s wishes.

David will give you more information on the smart grid and the remarkable transformation potential it represents for our industry.

Electric Vehicles

Few technology arenas have become as exciting as electric vehicles. For proof, you just need to look at the annual auto shows around the country to confirm this. For years, the plug-in vehicles (PEVs) were relegated to a remote corner of the hall; this year, in Detroit and elsewhere, the electric vehicles were front and center, generating buzz amidst an “Electric Avenue” filled with PEVs.

This progress is a testament to our industry’s strong partnership with the auto industry. Electric utilities are committed to making electric transportation a success. Our message is simple: PEVs can save consumers money at the pump, they can reduce our country’s dependence on foreign oil, and they can lead to an overall reduction in air emissions.

We made a strong commitment to electric transportation last October in Detroit. We pledged to:

- Get the charging infrastructure ready.

- Get the necessary incentives to encourage the purchase and use of PEVs.

- Educate our customers and stakeholders about their value.

- Expand PEV adoption in utility fleet operations.

We took our pledge to the National Association of Regulatory Utility Commissioners (NARUC) in November. State regulator support will be essential, both for recovering our investments, and for getting electric rates that will encourage consumers to charge their PEVs when electricity costs are lower.

Now, I would like to call upon EEI’s Executive Vice President of Business Operations, David Owens. David will offer you insights on our smart grid initiatives, as well as our efforts on Capitol Hill to maintain access to capital on reasonable terms. As you know this will be vital for continuing all of our efforts to reduce emissions and keep electricity reliable and affordable.

David Owens:

Smart Meter/Smart Grid Activity

As Tom mentioned, the smart grid promises a transformation in the way electric power is transmitted, distributed, and consumed. Electric utilities, their customers, and the planet, all stand to benefit as a result. Giving customers smart meters and smart rates puts them in control of their electricity use. They will know not only how much electricity they are using, but also what it costs when they are using it. With this information, consumers can take specific actions to lower their bills. And smart appliances are on the way that will help them to take this action automatically.

The Smart Grid will also facilitate the integration of renewable technologies and enhance the reliability of the system. With two-way communications between the utility and the customer, we will be able to detect outages or service problems faster and be able to restore service more quickly.

Beyond introducing smart meters and smart rates, the industry is also promoting a smarter grid for both energy- and carbon-savings. A smart grid can promote the use of electric transportation technologies, particularly PEVs whose many benefits Tom just outlined.

Stimulus Funding

Grants under the American Recovery and Reinvestment Act of 2009 (ARRA), or federal stimulus package, have been enormously helpful in moving the smart grid forward. The President’s economic stimulus package included $3.4 billion in funding for 100 smart grid projects across the country, which will lead to even more smart meter deployments.

The grants comprise the bulk of the $4.5 billion in stimulus money set aside for smart grid development. We are already at work to make sure that every dollar goes to help get the smart grid up and running. We are also working to make sure that the stimulus grants qualify as non-shareholder contributions to capital and, thus, treated as non-taxable by the IRS.

EEI and NARUC are reaching out to both the Secretaries of Treasury and Energy to urge that these grants be non-taxable. Taxing these grants could increase ratepayer costs or preclude the execution of certain smart grid projects. In addition, this tax burden decreases the capital available for the projects, increases the cost of companies’ investments and effectively would blunt the stimulus goals.

Reinforcing and expanding the nation’s transmission system also will be essential for moving toward a smarter grid, and we are investing. Shareholder-owned electric utilities and stand-alone transmission companies invested an unprecedented $9.1 billion in our nation’s transmission infrastructure in 2008. Industry transmission investment in 2008 represented a 67 percent increase over 2000 levels, and in the past eight years combined, the industry has invested almost $63 billion in transmission. Looking ahead, EEI member companies plan to spend nearly $56 billion on transmission system investments through the year 2020.

Cyber Security Concerns

With the move toward the smart grid, where utilities use the Internet or phone lines instead of internal networks to control their electric systems, we have broadened our efforts to protect against the potential of cyber attacks.

We are developing a closer working relationship with the governmental agencies that have the best access to intelligence about cyber threats to electric utility systems. EEI and its member companies already have been working with a wide variety of governmental agencies—the national laboratories, the FBI, Department of Homeland Security, Department of Energy, the Office of the Director of National Intelligence, the Federal Energy Regulatory Commission (FERC), as well as the North American Electric Reliability Corporation.

We also are supporting the process underway at the National Institute of Standards and Technology to develop a framework of equipment standards that will become the foundation of a secure, interoperable smart grid. And we are encouraging the development of a security certification program that would independently test smart grid components and systems and certify that they pass security tests. This certification process would help utilities select only those systems that provide appropriate cyber security.

OTC Derivatives Legislation

Access to capital on reasonable terms is vital for our efforts to adopt innovative technologies and move to a smart grid. It is also essential for keeping our customers’ electric rates down as well. And as Tom mentioned, we are working closely with federal and state legislators and regulators to achieve this goal.

Maintaining the OTC derivatives market for utilities and other energy end users as part of Financial Reform is one of the industry’s top legislative efforts this year. Although we support the goals of the Administration and the Congress to improve transparency and stability in OTC derivatives markets, it is essential that policy makers preserve the ability of end-users like electric utilities to access critical OTC energy derivatives products and markets. Our members rely on these products and markets to manage price risk and help keep rates stable and affordable for retail consumers.

EEI continues to lead an energy end-users coalition, which includes ALL of the electric and natural gas trade associations, to make our voice heard on Capitol Hill. Our efforts are beginning to show results. In mid-December, the House passed H.R. 4173, the Wall Street Reform and Consumer Protection Act, paving the way for Senate action in early 2010. Our energy end-users coalition continues its strong outreach campaign to make sure that progress continues on this important legislation.

Bonus Depreciation

Another tax issue we are addressing in the House and Senate is an extension of the 50 percent expensing or “bonus” depreciation, which is set to expire at the end of this year. EEI is working with 40 other associations in a bi-partisanship outreach effort to deliver our message that, while the outlook for the overall economy has improved over the past few months, we still need pro-growth policies to ensure that economic growth continues. We are meeting with the House and Senate leadership, and the Chairmen and Ranking Members of the House Ways and Means and Senate Finance Committees. Our member companies are also carrying this message to Congress and the White House.

Our member companies believe that allowing businesses to continue expensing 50 percent of capital equipment in the tax year it is purchased and placed into service, at least through the end of 2010, is needed to promote continued investment. Treasury studies have shown this would promote substantial economic growth. President Obama included extension of this provision last year when he introduced his jobs legislative proposals.

Dividend Tax Rates

Importantly, we are continuing to work to preserve our customers’ dividend income. Today’s 15-percent dividend tax rate in effect for most taxpayers could, without any action, jump to more than 39 percent at the end of this year.

EEI and the American Gas Association (AGA) have cooperatively launched a multi-faceted “Defend My Dividend” campaign to educate lawmakers and industry stakeholders about the benefits of the dividend tax rate reduction and the importance of making it permanent.

In 2009, EEI ramped up its efforts to recruit grassroots and grasstops supporters, promoting our messages at the AARP annual convention and at a number of state utility shareholder association annual meetings across the country.

This year we will re-double our efforts to win congressional support to make today’s dividend tax rate permanent. The Defend My Dividend campaign will encompass a major Web-based initiative to galvanize support and outreach to Congress.

Significantly, President Obama’s 2011 budget proposal calls upon Congress to retain the bulk of the current tax treatment of dividends. The President’s plan would continue taxing dividends at 15 percent for individuals with Adjusted Gross Income (AGI) under $200,000 and households under $250,000AGI. Above those thresholds, federal taxes on qualified dividends would be 20 percent—still far less than the marginal rates that would go into effect next January if Congress does not act. We will be watching Congressional developments on this issue very closely.

Regulatory Issues

We are also involved with FERC on a number of key proceedings involving the expansion of our transmission networks.

Siting needed new transmission is especially crucial, not only for reliability purposes, but also to expand our renewable energy resources. The recent decision by the U.S. Supreme Court not to review the decision by the Fourth Circuit U.S. Court of Appeals precluding FERC from approving transmission lines denied by states was especially disappointing.

At the heart of the matter was the authority granted by the Energy Policy Act of 2005, which allowed the Commission to approve interstate power lines located inside federally designated congestion zones” after affected states had “withheld approval for more than a year.” We will continue to emphasize a legislative solution to this issue in Congress.

Interestingly, the very day after the High Court declined to review the Fourth Circuit case, the DOE’s National Renewable Energy Laboratory released a study whose key finding was that 20 percent of the entire Eastern Interconnect’s electricity demand could be met with new wind capacity by 2014. Yet, that same study was completely silent on whether—and how—the new transmission needed to serve that load would be built. That disconnect underscores just how dramatic our transmission challenge is.

LIHEAP

I would like to close by saying that just as our industry is facing challenging economic circumstances, we understand that our customers are feeling the full brunt of the economic crisis as well.

To help, electric company outreach to Congress was instrumental in getting policymakers to pass a continuing appropriations resolution in December that allocated $5.1 billion for the federal Low Income Home Energy Assistance Program or LIHEAP. This is the highest funding level in the 28-year history of the program, and it marks only the second time that it will be fully funded. We have already begun efforts to maintain full funding of LIHEAP in 2011.

[Back to Tom Kuhn]

Tom Kuhn:

Conclusion

Thomas Edison’s characterization of opportunity as hard work rings as true today as when he first said it. The electric utility industry is no stranger to hard work. We are ready for the challenges and look forward to the opportunities.

Personally, I like to keep busy. With all of the issues facing our industry, I have to say that I am one of the happiest people on the planet!

Thank you.

—Thomas R. Kuhn is president and David K. Owens is executive vice president, Business Operations Group of the Edison Electric Institute. These remarks were presented in their annual “state of the industry” speech to the financial community on February 10, 2010, and are reproduced in their entirety with the permission of EEI.