U.S. wind power is becoming more widespread and costs are generally on the decline, but the sector is troubled by policy uncertainties, a new report from the Energy Department says.

After a lackluster year in 2013, wind power capacity additions in the U.S. rebounded nearly 8% in 2014, driven by recent improvements in the cost and performance of technologies, growing corporate demand for wind energy, and state-level policies, the 2014 Wind Technologies Market Report says.

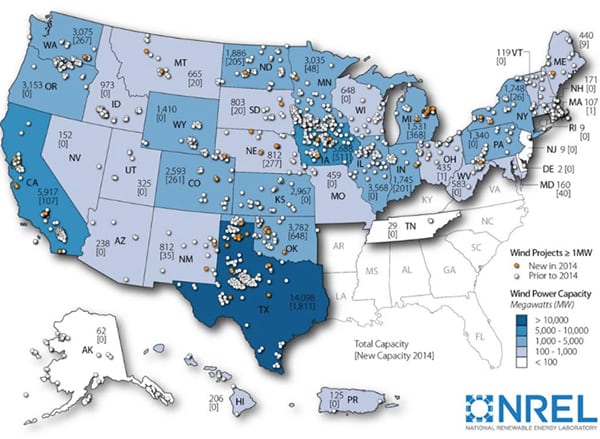

Among its key findings are that wind power was the third-largest source of new generation capacity in 2014 after natural gas and solar. Substantial wind capacity is also under consideration, it notes. Compared with the 4,854 MW of capacity installed in 2014 (Figure 1), there were 96 GW of wind power capacity within transmission interconnection queues—higher than all other generating sources except natural gas. Over 2014, 29 GW of gross wind power capacity entered the interconnection queues, compared to 65 GW of natural gas and 20 GW of solar.

1. 1.Where wind power is being developed in the U.S. Numbers within states represent cumulative installed wind capacity. Numbers in brackets represent annual additions in 2014. Source: NREL

1. 1.Where wind power is being developed in the U.S. Numbers within states represent cumulative installed wind capacity. Numbers in brackets represent annual additions in 2014. Source: NREL

However, prospects for growth beyond 2016 are uncertain. “The [production tax credit (PTC)] has expired, and its renewal remains in question,” the report says. “Continued low natural gas prices, modest electricity demand growth, and limited near-term demand from state renewables portfolio standards (RPS) have also put a damper on growth expectations. These trends, in combination with increasingly global supply chains, have limited the growth of domestic manufacturing of wind equipment.”

A Troubled Industry

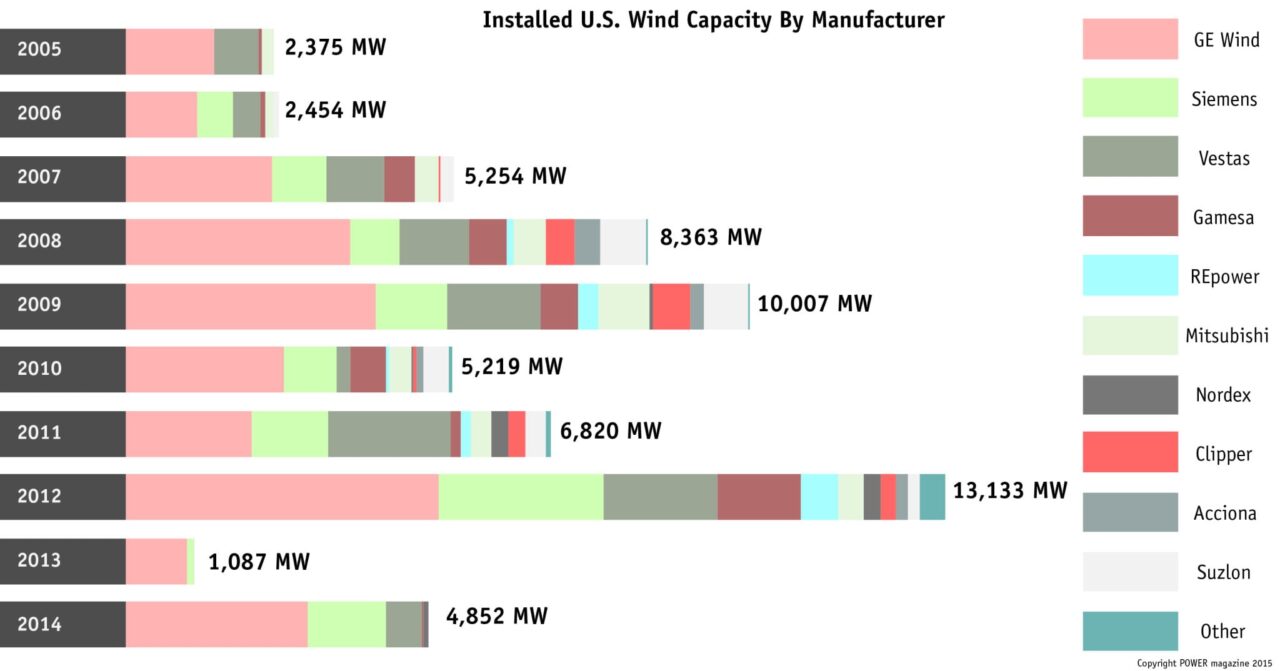

After years of flux, today the U.S. market is dominated by three turbine suppliers. In 2014, about 60% (2.9 GW of deployed turbines) were from GE Wind, 26% from Siemens (1.2 GW), and 12% (584 MW) were from Vestas. Other suppliers included Nordex (90 MW), Gamesa (23 MW), PowerWind (0.9 MW), and RRB (0.6 MW). Worldwide, Vestas led the pack in 2014, followed by Siemens, GE, and Goldwind. “Other than GE, no other U.S.-owned turbine manufacturer plays a meaningful role in global or U.S. large-wind-turbine supply,” notes the report.

2. Annual U.S. turbine installation capacity by manufacturer. Source: DOE

2. Annual U.S. turbine installation capacity by manufacturer. Source: DOE

One reason for that is that the domestic supply chain continues to grapple with swings in demand. “As the cumulative capacity of U.S. wind projects has grown over the last decade, foreign and domestic turbine equipment manufacturers have localized and expanded operations in the United States. But with uncertain medium- to long-term demand and growing global competition, expectations for further supply-chain expansion have become more pessimistic,” the report explains. “As a result, though many manufacturers increased the size of their U.S. workforce to meet near-term demand, market consolidation and restructuring were also major trends.”

The Utility Factor

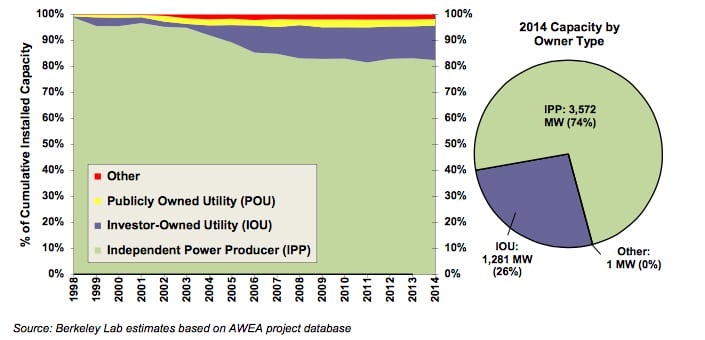

Another noteworthy trend is that investor-owned utilities own a growing share of the nation’s wind power capacity. Of the cumulative 65.9 GW capacity installed by the end of 2014, 82% was owned by independent power producers (IPPs), while utilities owned 16%. Utilities, however, bought power from 53% of all wind power capacity installed in the U.S.

3. Cumulative and 2014 wind power capacity categorized by owner type. Source: DOE

3. Cumulative and 2014 wind power capacity categorized by owner type. Source: DOE

Of the 4.9 GW of new capacity installed over 2014, 74% (3.6 GW) was owned by IPPs, while the remaining 26% was owned by investor-owned utilities.

An interesting revelation is that merchant and quasi-merchant projects—those whose electricity sales revenue is tied to short-term contracted or wholesale spot electricity market prices rather than being locked in through a long-term power purchase agreement (PPAs)—accounted for 33% of all new capacity in 2014. Merchant and quasi-merchant projects accounted for 25% of projects installed in 2013 and about 20% in the years from 2010 through 2012.

Most merchant capacity is located in Texas—the state that leads the nation in wind installations and which put up 1,1811 MW in 2014 alone. Some reasons this is happening, according to the report, are that “wind energy prices have declined to levels competitive with wholesale market price expectations in some regions, wind PPAs remain in short supply, most projects currently under construction will come online this year or next in order to stay within the IRS safe harbor with respect to the PTC, and the recent completion of the CREZ transmission lines in Texas provides market access to a significant amount of new wind capacity within a hedge-friendly market.”

Technology Trends

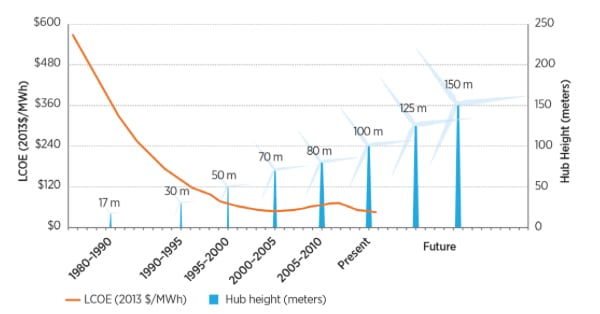

Wind turbines have transformed since 1998, the report finds. The average hub height in 2014 was 82.7 meters (m)—up 48% since 1998—while the average rotor diameter was 99.4 (m), up 108% since 1998. That’s a 333% growth in rotor swept area.

4. 4. Average hub heights trends. Source: DOE

4. 4. Average hub heights trends. Source: DOE

Meanwhile, the U.S. wind market has become increasingly dominated by IEC Class 3 turbines (designed for lower wind speed, gusts, and turbulence) in recent years, marking a substantial decline in Class 2 turbines (for medium wind speed sites of up to 8.5 m/s) and Class 1 turbines (for higher wind speed sites) since 2009. “In 2014, 68% of the newly installed turbines were Class 3 machines, with another 27% Class 2/3 machines; only 6% of turbines were Class 2 or lower,” says the report.

Cost Trends

Particularly noteworthy are dropping wind turbine prices despite increases in hub heights and rotor diameters. Reasons for this, says the report, are “continued stiff competition among turbine [original equipment manufacturers (OEMs)] and related cost-cutting measures.”

Prices were about $750/kW between 2000 and 2002, then rose through 2008 to an average $1,500/kW, it says, citing a Berkeley Lab finding. Since then, turbine transactions show pricing in the $850/kw to $1,250/kW range. Globally, prices have dropped to about $1,175/kW.

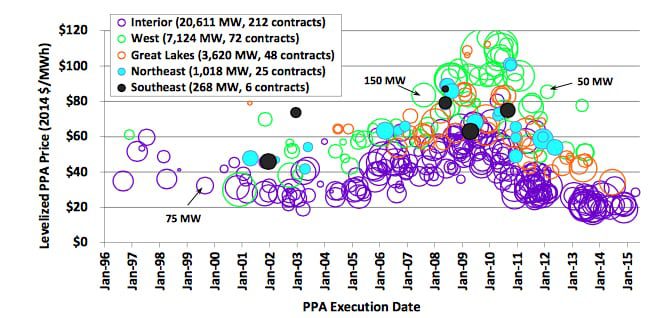

PPA prices have also seen a downward slide since 2009, though they vary by region. Compared to nearly $70/MWh for PPAs executed in 2009, the national average levelized price of wind PPAs signed in 2014 fell to around $23.5/MWh nationwide.

5. Levelized wind PPA prices by PPA execution date and region. Source: Berkeley Lab

5. Levelized wind PPA prices by PPA execution date and region. Source: Berkeley Lab

The O&M Cost Gap

Finally, though report notes that operations and maintenance (O&M) costs are an important component of the overall cost of wind energy and “can vary substantially among projects,” it laments the general lack of publicly available market data on actual project-level O&M costs. “Anecdotal evidence and recent analysis … suggest that unscheduled maintenance and premature component failure in particular continue to be key challenges for the wind power industry,” it says.

Financial statements of public companies with sizable U.S. wind project assets, for example, “indicate markedly higher total operating costs,” it says. “Specifically, two companies—Infigen and EDP Renováveis (EDPR), which together represented 4,864 MW of installed capacity at the end of 2014 (nearly all of which has been installed since 2000)—report total operating expenses of $25.1/MWh and $21.4/MWh, respectively, for their U.S. wind project portfolios in 2014.”

That’s more than twice the $10/MWh estimate reported the Berkeley Lab using a thin data sample of 86 projects nationwide installed since 2000.

—Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)