Constellation Energy is evaluating specific regulatory pathways to enable potential deployment of advanced nuclear reactors at its Clinton Clean Energy Center. The measure could mark the first concrete steps toward next-generation nuclear development at the Illinois site now that the competitive generator has finalized a landmark 20-year agreement with Meta.

Constellation disclosed on Tuesday that it is assessing whether to extend the site’s existing ESP or pursue a new construction permit from the Nuclear Regulatory Commission (NRC) to enable the potential deployment of an advanced reactor or small modular reactor (SMR) at Clinton. The regulatory strategy announcement represents new details beyond the broad advanced reactor “considerations” mentioned when the Meta power purchase agreement (PPA) was first announced in June.

Constellation’s PPA with Meta, announced on June 3, 2025, guarantees Meta’s offtake of the entire 1,121 MW of near-constant, emissions-free electricity produced by the Clinton Nuclear Power Plant starting in June 2027. The 20-year agreement includes a 30-MW uprate at Clinton, which Constellation expects to be fully complete in 2029 and to qualify for the federal technology-neutral 45Y clean electricity production tax credit preserved under the One Big Beautiful Bill Act. When it announced the deal in June, Constellation said the agreement would support the “relicensing and continued operations of Constellation’s high-performing Clinton nuclear facility for another two decades after the state’s ratepayer-funded zero emission credit (ZEC) program expires.”

Constellation Weighs NRC Pathways for Advanced Nuclear at Clinton

Constellation’s current ESP (ESP-001) for the site, adjacent to the Clinton nuclear plant, expires March 15, 2027, indicating some regulatory urgency around the expansion plans. The company received NRC approval in April to submit a renewal application 45 days before expiration, following a December 2024 exemption request. Originally issued in March 2007, the ESP allows deployment of up to 6,800 MWth of nuclear capacity at the site, independent of specific reactor designs. The permit was the first of its kind issued under the NRC’s streamlined licensing process established by the Energy Policy Act of 2005.

Constellation on Tuesday hosted labor leaders and employees to celebrate the Meta agreement, which it said secures the nuclear plant’s future. While Clinton Nuclear Power Plant (now known as the Clinton Clean Energy Center) entered commercial operation in 1987 and has long played a critical role in powering central Illinois, the power plant faced potential early retirement in 2017, owing to market pressures and persistent financial losses. Its closure was averted by state intervention through the 2016 Future Energy Jobs Act, which established the Illinois Zero Emission Credit (ZEC) program.

The program, in effect from June 2017 through May 2027, requires utilities to purchase all eligible credits each planning year (June–May). To limit costs for consumers, the Illinois Power Agency (IPA) caps total annual payments. When nuclear plants, including Constellation’s Clinton and Quad Cities, generate more credits than can be paid under the cap, the excess is carried forward into future years. For the 2025–2026 planning year, the IPA set the ZEC price at $1.17 per credit with a cap of $224 million. In its latest quarterly filing, Constellation reported recognizing $201 million in revenue for ZECs delivered in prior years, with payment expected in 2026. By contrast, for 2024–2025 the ZEC price was $9.38 per credit with a $222 million cap, but revenue recognized for earlier credits was minimal given the lower price and cap structure.

“With the future of the plant secure, Constellation can evaluate opportunities for additional nuclear capacity at the site,” the company said on Tuesday. “With confidence in the plant’s continued operation, Constellation is also evaluating opportunities to extend the site’s early site permit or pursue a new construction permit from the U.S. Nuclear Regulatory Commission to enable the potential development of an advanced reactor or small modular reactor at the Clinton site,” it noted.

The deal with Meta also enables additions of “new clean energy to the grid in the Midcontinent Independent System Operator’s (MISO) Zone 4 territory, which spans central and southern Illinois,” it said.

Crucial Certainty For Clinton’s Future

According to Kathleen Barrón, executive vice president and chief strategy and growth officer at Constellation Energy, the Meta investment has provided the crucial certainty necessary for the prospective expansion. “Now more than ever, it’s critical that we maintain and expand all sources of clean, reliable energy, and thanks to Meta’s investment, the future of the Clinton Clean Energy Center and its contributions to this community are secure,” she said.

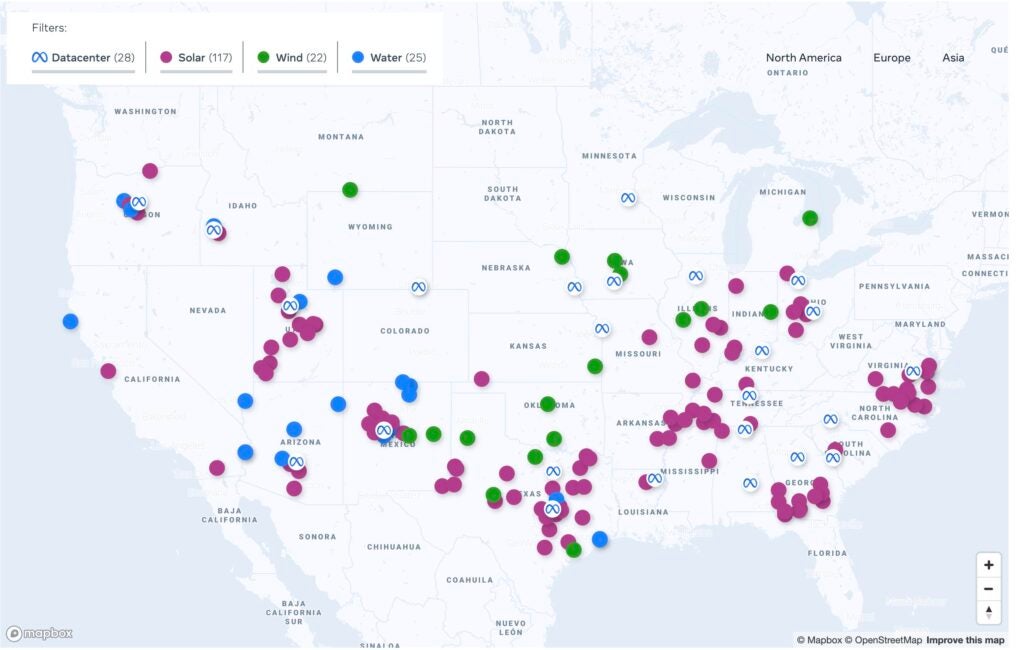

The Clinton plans reflect broader industry momentum as technology companies seek reliable clean power for AI and data center operations. Meta, in a blog post published in December 2024, said it expects to source 1-4 GW of nuclear energy across multiple states starting in the early 2030s. “We are looking to identify developers that can help accelerate the availability of new nuclear generators and create sufficient scale to achieve material cost reductions by deploying multiple units,” the blog notes. “We believe working with partners who will ultimately permit, design, engineer, finance, construct, and operate these power plants will ensure the long-term thinking necessary to accelerate nuclear technology.”

Meta has said nuclear “firm, baseload power” is essential to supporting both data center growth and broader grid reliability. But it notes nuclear “is more capital intensive, takes longer to develop, is subject to more regulatory requirements, and has a longer expected operational life,” suggesting that Meta intends to engage developers earlier and design contracts responsive to those realities.

On Tuesday, the company reiterated that strategy. “Nuclear energy is a vital component of our strategy to support Meta’s AI ambitions. By partnering with Constellation at the Clinton Clean Energy Center, we’re ensuring a stable and reliable power source that bolsters grid resilience and supports thousands of local jobs. This collaboration not only strengthens the grid’s infrastructure but also contributes to the economic vitality of the region and helps bolster American leadership in AI,” said Kevin Janda, Meta director of Global Data Center Strategy.

Dominguez Sees Rising Demand for Clean Megawatts

Earlier this month, during an earnings call, Constellation CEO Joseph Dominguez highlighted the Clinton-Meta PPA as a “big win for everyone,” noting the agreement “ensures that over 1,100 MW of emissions-free nuclear energy will be around for decades to come. And it actually allows us to make investments to increase the output and bring even more megawatts to the grid in Southern Illinois at a critical moment for America”.

Dominguez notably pointed to a growing pipeline of customer demand, describing “clean, reliable and available megawatts” as one of the most sought-after commodities today. “We continue to make very good progress with customers to reach additional agreements to sell our clean, reliable, and available megawatts from our nuclear plants,” he said, suggesting that further deals for both existing and new nuclear supply may soon follow.

Discussing new nuclear investment, Dominguez characterized Constellation’s approach as a “step-wise evolution.” He detailed the company’s ongoing technical and cost analysis: “With time, with the work that [Executive Vice President and Chief Generation Officer of Constellation Energy] Bryan Hanson and his team at Nuclear put into studying the designs, getting into the nitty-gritty of the cost line items for the different component parts, whether it’s modular in the case of an SMR, where the equipment is coming from, timelines, all of that stuff is work that we are literally refining every single day.”

Confidence in new nuclear is “growing incrementally, not in terms of major step changes,” he explained. “And so I think it’s quite viable. I think it’s very, very real. I don’t think that everybody’s design is going to actually work and be commercially viable. But we’ve got a pretty good beat on who we think the winners are going to be.”

He also pointed to Constellation’s unique advantages, including its real estate, operational skills, and construction experience, which he suggested could be pivotal as the industry moves forward. “I’m pretty pumped up about where this could go,” he added. However, he cautioned, “I’m not yet at a point where I could say on a call like this what the cost is going to be and here’s when we think we’re going to be able to do it. Do I think we’re going to get there? Yes, I do”.

During the earnings call, Dominguez described one major data-center transaction as already in the “late innings,” noting it was “past the seventh-inning stretch” with most terms resolved but awaiting final utility interconnection work. While he did not identify the project, he stressed its viability: “I wouldn’t be talking about it in the call if I didn’t think it was a viable thing.” Dominguez added that Constellation was “well on the way to being done” with the transaction once those external steps are complete.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).