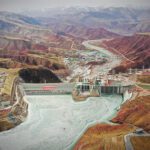

China in late June began operating two of the world’s first 1-GW hydropower turbines at the Baihetan Hydropower Station in southwest China. When the project’s 16 generating units are completed by July 2022 as slated, the 16-GW Baihetan will become the second-largest hydropower facility in the world after the giant 22.5-GW Three Gorges Dam.

Baihetan, which sits on the border of Ningnan County in Sichuan province and Qiaojia County in Yunnan province, is part of a cascade of mammoth hydropower projects China is building to generate power (and provide flood control) from the hydro-rich southwest and deliver it to power-intensive regions on the eastern coast.

|

|

1. China Three Gorges Corp.’s 10.2-GW Wudongde hydropower plant began full operation of its 12 GE Renewable Energy 850-MW units in June, less than six years after construction kicked off. Located on the mountainous borders between Yunnan and Sichuan provinces, the facility marks several records, including for the world’s thinnest 300-meter high arch dam. Wudongde is now China’s fourth-largest and the world’s seventh-largest hydropower project. Courtesy: GE Renewable Energy. |

Located downstream on the Jinsha River (which is the upstream section of the Yangtze River), it is 182 kilometers (km) away from the upstream Wudongde hydropower station—a 10.2-GW project that began full operation on June 16 (Figure 1)—and 195 km away from the downstream 13.8-GW Xiluodu hydropower station, which began full operations in September 2013.

Four-Year Construction for Technically Challenging Hydropower Behemoth

But startup of the Baihetan’s two turbines is especially notable because owner and operator China Three Gorges Corp. (CTGC) marked the milestone only four years after construction began. And as President Xi Jinping in a congratulatory letter to the Baihetan station noted, it was ridden with complexity. “As a major project in China’s west-east power transmission program, Baihetan is the largest and most technically difficult hydropower project currently under construction in the world,” he wrote.

|

|

2. The 16-GW Baihetan hydropower plant features 1-GW hydropower turbines. This image shows crews hoisting the rotor for its right bank No. 13 power unit in April 2021. Courtesy: China Three Gorges Corp. |

The $34 billion project has a 289-meter (m)-high concrete double-curvature arch dam, and it adopts an all-underground powerhouse layout. Sixteen 1-GW Francis turbines (Figure 2)—each 438 m long, with a top arch span of more than 34 m, a height of 88.7 m, and weighing 8,000 tons—will be split along the left and right banks. The turbine design, owned by the Chinese government and wholly domestically manufactured, reportedly has a maximum efficiency of 96.7%, and a rated efficiency exceeding 99%.

The plant’s generator’s runner also reportedly achieved “zero-counterweight” runner balancing, which essentially means that in its manufacturing state, the runner could meet the residual required torque imbalance without the need for a lead-filled counterweight during a static balance test. Chinese media widely quoted Qin Daqing, deputy chief engineer of Harbin Electric Group Motor Co., who explained: “The smaller the distribution weight, the higher the manufacturing technology level and the higher the manufacturing quality of the runner, and the better the running performance after installation in the unit in the future.”

Finally, the project also has a total of eight throttled tailrace surge chambers on the right and left banks with a diameter of 42 m to 48 m—one of the largest in the world. The total length of the Baihetan tunnel spans 217 km. In total, CTGC said, the project required the excavation of 25 million cubic meters—“enough to build 10 Egyptian Pyramids of Khufu,” as Chen Jianlin, chief engineer of the Baihetan Hydropower Project, and a member of the East China Institute of Technology, told reporters.

Hydropower Emerging as China’s Carbon-Free Power-Generation Backbone

Baihetan will be connected to the eastern province of Jiangsu via an ultra-high-voltage (UHV) line in 2022, and another UHV line to another eastern province, Zhejiang province, is also awaiting government approval. That power is much-needed for reliability in some industrial regions. Guangdong province in the south, a major manufacturing hub, this May imposed short-lived power restrictions on industry, owing in part to a rare drought in neighboring Yunnan province in the southwest, which provides a crucial hydro-dependent power supply to the region.

According to China’s National Bureau of Statistics, China boosted its power generation nearly 15% over the first five months of this year, though it noted the growth rate fell compared to the same period year. Earlier this year, the nation’s National Energy Administration (NEA) set a target to expand its installed renewable power capacity to 934 GW—42.4% of total capacity—by the end of the 14th five-year-plan (2021–2025).

In 2020, hydropower generated the bulk (61%) of its renewables generation and 17.8% of its overall 7.62 TWh. Though China has bulked up on wind and solar capacity, wind only generated about 6% and solar, 3.4%, of the nation’s total power. Last year it relied on coal power for 60.7% of its total generation.

To meet its September 2020–announced ambitions to become carbon neutral by 2060 and peak coal consumption by 2025, the 14th plan calls for building a series of giant hybrid “clean energy complexes,” with energy storage as a new priority. China, which last year notably also brought online the 1.8-GW Jixi pumped storage facility (it’s largest to date), has emphasized medium-term and long-term planning for pumped storage. Efforts include adoption of a two-part tariff mechanism based on capacity and energy after 2023. And adding to its 13th-year-plan priorities to build 60 GW of capacity in the southwest, the 14th plan calls for new hydro construction in the Yarlung Tsangpo River “hydropower base,” in the Tibet Autonomous Region. Developments will also continue on the Jinsha River, Yapan River, and Yellow River.

In a hydropower-focused report released this July, the International Energy Agency (IEA) suggested China is set to expand its hydropower capacity, currently at 370 GW, by 93 GW by 2030—which is 40% of the 383 GW global hydro capacity growth (split between greenfield and brownfield activities) it forecast for the period. Wudongde and Baihetan alone add 26 GW to the greenfield additions. However, China’s pace of hydropower development has slowed due to “growing concerns over environmental impacts and the decreasing availability of economically attractive sites,” it noted.

Still, China, which towers over every country with 370 GW of installed hydropower capacity (followed by Brazil at 109 GW; the U.S. at 102 GW; Canada at 82 GW; and India at 50 GW), has notably also emerged as a substantial developer of hydropower in emerging and developing economies. Half of all new hydropower projects in sub-Saharan Africa, Southeast Asia, and Latin America through 2030 “are set to be either built, financed, partially financed, or owned by Chinese firms,” IEA said. That includes 70% of capacity in Africa (including the 6.4-GW Grand Ethiopian Renaissance Dam), nearly 45% of capacity in Asia, and 40% in Latin America.

—Sonal Patel is a senior associate for POWER.