FirstEnergy

-

Nuclear

FirstEnergy to Shutter Four Uneconomic Nuclear Units by 2021

FirstEnergy Corp. will close four uneconomic nuclear units—a total of 4 GW—in Ohio and Pennsylvania between 2020 and 2021, the company’s competitive arm notified PJM Interconnection on March 28. FirstEnergy Solutions (FES) told the regional transmission organization that it will close the 908-MW Davis-Besse Nuclear Power Station in Oak Harbor, Ohio, by 2020; the twin-unit […]

Tagged in: -

Coal

FirstEnergy Suffers Steep Losses, Will Close Massive Coal Plant

FirstEnergy Corp. bled $2.64 billion from its competitive businesses over 2017, financial losses exacerbated by marked declines in contract sales, higher operating expenses, and costs associated with asset impairment and plant exit. The Akron, Ohio–based company, which in January received a $2.5 billion equity injection from four private investment groups to boost its transition to […]

-

Legal & Regulatory

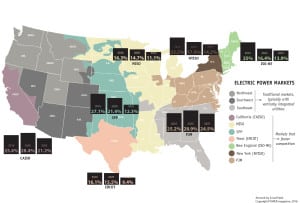

How Eight Major Power Companies Are Dealing with Market Turmoil

Dynegy Inc.’s pending merger with Vistra Energy will create a company of a significant diversification and scale designed to weather volatile markets. Over the past year, at least eight other major power companies have embarked on various strategies to guard against distress in unregulated markets. Duke Energy. Three years ago, Duke Energy announced it would move away from organized […]

-

Coal

FirstEnergy Cuts Sale Price in Revised Deal to Shed Assets

Ohio-based FirstEnergy Corp. has dropped the price of several assets as it continues to work toward closing a deal to sell five of the company’s natural gas-fired power plants, along with a hydroelectric facility, to an equity group that specializes in energy investments. FirstEnergy this week said it had cut the price of the facilities […]

Tagged in: -

Legal & Regulatory

Analysis Shows U.S. Nuclear Plants Losing $2.9 Billion Annually

Increased use of less-expensive natural gas and renewable sources of energy for power generation is putting financial pressure on U.S. nuclear power plants, according to an analysis of electricity costs from Bloomberg New Energy Finance (BNEF). Nicholas Steckler, an analyst for BNEF, in a June 14 report said nuclear operators are losing about $2.9 billion […]

Tagged in: -

Nuclear

Ohio Committee Suspends FirstEnergy’s Nuclear Power Rescue Plan

Ohio-based FirstEnergy’s plan for a rescue of its two uncompetitive Ohio nuclear plants took a nosedive May 17, as the Ohio House Public Utilities Committee suspended action on the company’s proposal to charge its customers a fee to subsidize the plants. FirstEnergy’s plan mimics programs adopted in Illinois and New York to create “zero energy […]

Tagged in: -

Coal

DTE Joins Growing Number of Power Companies with Carbon Goals

Detroit-based DTE Energy wants to slash its carbon emissions by more than 80% from 2005 levels by 2050, a reduction it said is in line with broad targets identified by scientists to address climate change. The company said on May 16 that it plans to substantially increase investments in renewables, transition its baseload capacity from […]

Tagged in: -

Coal

FirstEnergy Looks to Exit Competitive Business, Shutter or Sell Ohio Nuclear Plants

Financially hemorrhaging in 2016 due to uneconomic power plants in its fleet, FirstEnergy Corp. said it may exit the competitive generation business by mid-2018, and shutter its nuclear plants in Ohio, even though it will back legislation to subsidize nuclear power. In a fourth quarter earnings call on February 22, officials from the Akron, Ohio–based […]

Tagged in: -

Gas

FirstEnergy Unloading Five Plants in Virginia and Pennsylvania

As part of its ongoing drive to exit competitive power markets, FirstEnergy Corp. said on January 23 that it has agreed to sell four natural gas–fired power plants in Pennsylvania and its competitive share of a pumped-storage hydroelectric plant in Virginia to private equity firm LS Power Equity Partners III. FirstEnergy announced last year that […]

Tagged in: -

Legal & Regulatory

FirstEnergy Wants Out of Competitive Power Markets

FirstEnergy Corp.—one of the nation’s largest investor-owned electric utilities, serving customers in Ohio, Pennsylvania, West Virginia, Maryland, New Jersey, and New York—has made the strategic decision to exit the competitive power business. “We have made our decision that over the next 12 to 18 months we’re going to exit competitive generation and become a fully […]