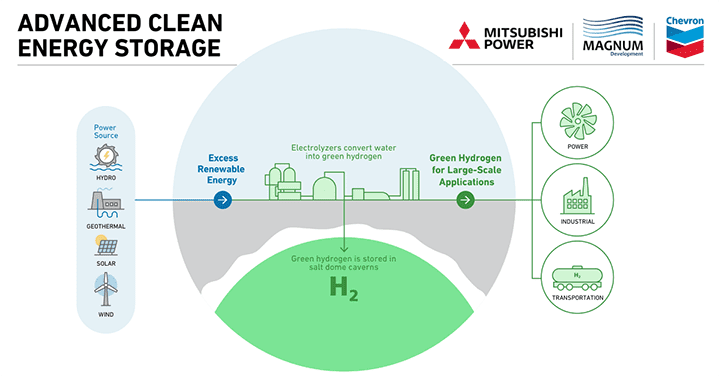

Mitsubishi Hitachi Power Systems (MHPS) and Magnum Development, the owner of a large and geographically rare underground salt dome in Utah, have teamed to develop a massive project that could store up 1,000 MW of renewable energy year-round and provide it to variability-challenged Western power markets.

The companies this week signed a memorandum of understanding (MoU) to develop the $1 billion Advanced Clean Energy Storage (ACES) project in Millard, in central Utah, MHPS CEO Paul Browning told POWER on May 30. The project has the backing of Utah Gov. Gary Herbert (R), who lauded the project for its potential to “put Utah on the map as the epicenter of utility-scale storage for the Western U.S.”

A Rare Opportunity

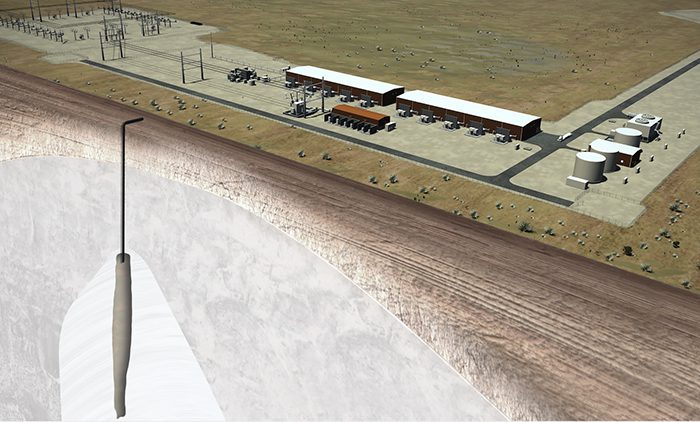

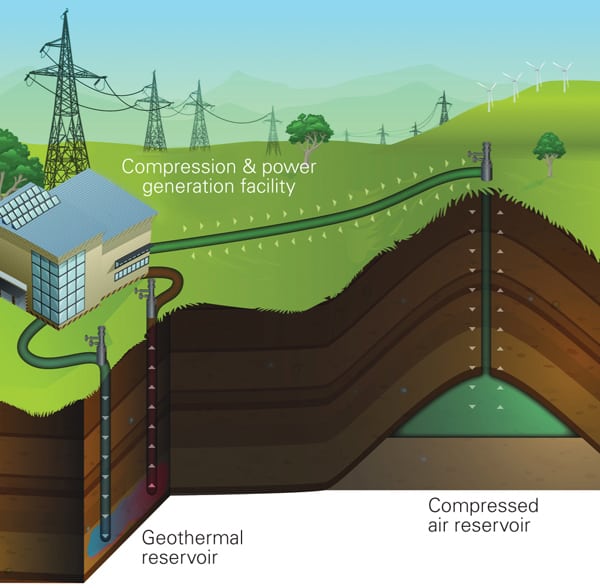

ACES will comprise a series of facilities above and within the Magnum Salt Dome, a geologic formation that was tectonically developed from a bedded salt deposit, and which seismic mapping suggests measures at least one mile thick and about three miles wide. Magnum has proposed future facilities at the site that could form a “Western Energy Hub”—essentially a series of mined caverns capable of storing natural gas, compressed air, and liquid energy products underground.

“With five salt caverns already in operation for liquid fuels storage, Magnum is continuing to develop compressed air energy storage (CAES) and renewable hydrogen storage options,” the company said in a statement Thursday. “Strategically located adjacent to the Intermountain Power Project, the Magnum site is positioned to integrate seamlessly with the Western U.S. power grid utilizing existing infrastructure,” it noted.

MHPS, meanwhile, is looking to build facilities to convert renewable power from Western power markets into renewable hydrogen, which would then be combusted at a 600-MW JAC-series combined cycle power plant it plans to build with a partner above ground at ACES. ACES will also be outfitted to harness CAES stored at the caverns, and MHPS plans to supplement the facility with solid oxide fuel cells and large-scale flow batteries, to ensure it can store energy 24/7, 365-day and flexibly dispatch as much as 1,000 MW at grid-scale to balance variability from renewables that are increasingly flooding Western markets.

A Clarification of the 1,000-MW Figure

Responding to POWER’s request for clarification about the 1,000-MW figure attributed to the facility—which will comprise both storage and power generation—MHPS said on May 31 ACES is still in the project scoping phase, and that the next step, which entails securing off-taker agreements for power, would determine the mix between renewable hydrogen, CAES, solid oxide fuel cells (SOFC), and flow batteries. The size of the salt dome “means the amount of storage is virtually unlimited and ultimately constrained by the market demand and technologies that create the power,” the company said. The 1,000-MW figure also takes into account transmission lines—AC and DC—that are now in place. “The salt dome is large enough to store enough energy that we can max out the transmissions lines if the off-taker agreements are in place,” the company said.

Browning on Thursday told POWER that the storage capacity would be 24-7. “So if you wanted to convert that to megawatt-hours, you would multiply that by 365 in 24 hours to turn 1,000 MW of capacity into how much storage there is,” he said. MHPS clarified that Browning “was giving an example of a technology that could provide a large amount of instantaneous power.” The 600-MW combined cycle plant powered by renewable hydrogen “could be larger and could provide the full 1,000 MW,” it explained. “CAES is also a large power generation source that can be dispatched, so it could easily be a mix of the two.” SOFC would also use renewable hydrogen to convert the storage into power, and the flow batteries can also supply power, it said.

“The mix will depend on market demand,” MHPS said.

Prospective Timelines and Costs

For now, however, the companies plan to build an initial 250-MW phase of underground storage by 2025, Browning said. As the project is currently in the development phase, MHPS still needs to find partners to build the power plant, as well as suppliers for the SOFC and flow battery technology, he said.

Storing hydrogen in salt domes is “very common” across the Gulf Coast, he said, noting similar formations have been used to store everything from liquid fuels to natural gas and hydrogen. “The challenge with hydrogen is that it’s a very small molecule,” he said. “So they’d need to inject a polymer in there to help seal the cavern walls. But again, it’s all been done before and demonstrated.”

Browning also acknowledged the undertaking would be a “big financial investment.” But the payoff could prove substantial, he said. “What we’re targeting its that we want to have a levelized cost of storage that is equal to or less than lithium-ion battery in the same period,” he said. “Lithium-ion is really the benchmark for electrical storage right now, but it is generally used for shorter duration storage—anything from seconds to maybe a few hours. If you want to have longer-term storage, that’s where hydrogen and compressed air really have a huge advantage. They have the ability to store hydrogen on timescales that range from seconds to seasons—and do it affordably.”

Economies of scale will be critical to achieving the desired economics, he said. “A huge underground storage capacity with one of the world’s largest combined cycle power plants—that kind of utility-scale economies of scale are what we need in order to reach that levelized cost of storage that is competitive with lithium-ion on really any timescale.”

‘The Time is Right in the Western U.S.’

For MHPS, a bigger draw to develop the project is that all the market conditions are positive, Browning noted. “The reason we got in now is we feel like the time is right in the Western U.S,” he said. “We’re seeing the market signals that storage is a necessity and that utility-scale storage is going to be important. And also that, again, timescales all the way out to seasonal storage capability are going to be important. Most market signals are things like the duck curve in California, where they’re curtailing power and setting negative electricity prices during some periods of the day.”

The site is also ideally located. “We’ve got this unique location in Utah that is centrally located within the Western Interconnect. It’s already connected to the [Los Angeles Department of Water and Power], Nevada Energy, and PacifiCorp,” Browning said.

MHPS and Magnum together can provide the right technical capabilities, he added. “We’ve also gotten the support of the governor. We’ve got the renewable hydrogen gas turbine technology, and we’ve really thought through the entire value chain for hydrogen and compressed air,” he said.

For Browning, a project of this size and stature—if built it would be largest in the world of its kind—could exploit storage at a large scale as the critical link between renewable energy and reliability. “Having this kind of massive storage capacity and in the only location in the Western Interconnect that has this geological formation, we feel like we’ve sort of got the linchpin of the future hydrogen and compressed air storage infrastructure,” he said.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

Updated (May 31): Adds an important clarification from MHPS about the 1-GW number, which is attributed to the storage and power facility. The final number and technology mix will be determined by market demand, and more details will emerge as developers secure off-taker agreements for power, which is the next phase of the project.