Markets

-

Gas

NET Power and CRC Team to Deploy 1 GW of Carbon-Free Gas Power Plants in California

NET Power, developer of a novel gas-fired power plant that captures all atmospheric emissions, will explore deploying up to 1 GW of power capacity in Northern California with partner California Resources Corp. (CRC), California’s largest oil and gas producer. CRC’s carbon management subsidiary, Carbon TerraVault (CTV), and NET Power signed a memorandum of understanding (MOU) […]

-

Nuclear

Six Companies Tapped for $2.7 Billion LEU Push to Boost Domestic Nuclear Fuel Supply

The U.S. Department of Energy (DOE) has named six companies that will compete for 10-year contracts totaling $2.7 billion for the supply of low-enriched uranium (LEU) to support the nation’s nuclear power fleet. The initiative seeks to reduce reliance on Russian imports and foster strong commercial sector investment to build out a resilient fuel supply […]

-

Connected Plant

Why Power Companies Are Turning to Refurbished Parts for Plant System Upgrades

Amid growing pressure to optimize costs, dependability, and green initiatives, some power companies are beginning to reconsider their approaches to upgrading dated equipment. Refurbished elements provide a viable option to realize these objectives, enabling companies to address the challenges of power plant maintenance and upgrade. All plants need to be updated at some point in […]

-

Nuclear

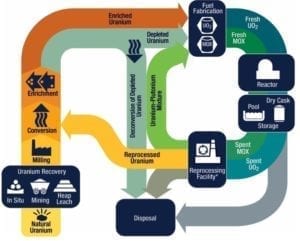

DeepGEO, Copenhagen Atomics Sign Pact to Align Nuclear Fuel Reprocessing with Spent Fuel Management

DeepGEO, a multinational spent nuclear fuel (SNF) repository developer, and Copenhagen Atomics, a Danish advanced thorium reactor innovator, have signed a first-of-its-kind collaboration agreement that seeks to revolutionize the nuclear fuel cycle by aligning emerging waste management solutions with next-generation reactor technologies. The landmark collaboration marks an industry-first effort to unite a reactor designer and […]

-

Trends

Texas Mandates Cryptomining Registration, Power Demand Reporting, to Bolster Grid Reliability

The Public Utility Commission of Texas (PUCT) has adopted a rule for reliability purposes requiring cryptocurrency mining facilities in the Electric Reliability Council of Texas (ERCOT) region to register with the state and annually report details about their location, ownership, form of business, and demand for electricity. The PUCT’s new rule, adopted on Nov. […]

-

Hydrogen

GE Vernova Unveils 100% Hydrogen-Fueled Aeroderivative Gas Turbine Solution, Secures First Customer

GE Vernova has unveiled a 100% hydrogen-ready aeroderivative gas turbine solution based on its LM6000VELOX package. The first-of-a-kind technology will be showcased at the 200-MW Whyalla hydrogen power plant in South Australia, with commissioning slated for early 2026. “It is projected to mark the first time a GE Vernova power plant project, at a commercial […]

-

Nuclear

Financing the Nuclear Renaissance

At the 2023 United Nations Climate Change Conference (COP28) in Dubai, United Arab Emirates, last December, 25 countries underlined the role of nuclear energy in their climate strategies by issuing a

-

Trends

Can Nuclear’s Big Recent Wins Propel a True Global Revival?

While the past year has marked stunning triumphs for nuclear energy, experts caution that high costs, regulatory bottlenecks, and the need for market alignment remain major hurdles on the path to a true

-

Nuclear

Oklo’s $25M Move into Radioisotope Production to Expand Advanced Nuclear Revenue Stream

Oklo has moved to acquire Atomic Alchemy, a U.S. firm specializing in high-value radioisotopes, in a $25 million all-stock transaction. The acquisition will add radioisotope production capabilities to Oklo’s advanced reactor and fuel recycling operations, creating a new revenue stream and strengthening the resilience of the isotope supply chain, the company said. Radioisotopes, unstable atoms […]

-

Trends

Power Shift: Trump’s Energy Agenda Sparks Cautious Optimism, Climate Concerns

Tuesday’s election, which will return Donald Trump to the White House and grant the U.S. Senate a Republican majority, could have sizeable implications for the power industry. In reactions sent to POWER, industry groups expressed a combination of cautious optimism, resilience, and preparedness for potential changes. Industry leaders are bracing for a pro-fossil fuel agenda […]

-

Trends

FERC Blocks PJM Proposal to Expand Amazon Data Center Load at Susquehanna Nuclear Plant

The Federal Energy Regulatory Commission (FERC) has rejected an amended interconnection agreement that would have supported expanded co-located load at an Amazon Web Services (AWS) data center connected to the 2,520–MWe Susquehanna nuclear power plant in Pennsylvania, citing grid reliability and cost fairness concerns. FERC on Nov. 1 voted 2–1, with Commissioners Mark Christie and […]

-

Nuclear

Major Microreactor Developer Enters Bankruptcy Amid Nuclear Industry Surge

Ultra Safe Nuclear Corp. (USNC), a developer of much-watched microreactor technology and advanced nuclear fuel, has filed for Chapter 11 bankruptcy. The move signals a critical restructuring phase through which the company will seek to secure new ownership while ensuring uninterrupted operations. The company’s Oct. 29 filings at the U.S. Bankruptcy Court for the District […]

-

News and Notes

Dominion Sells 50% Stake in $10B Offshore Wind Project

Dominion Energy has sold a 50% noncontrolling interest in its 2.6-GW Coastal Coastal Virginia Offshore Wind (CVOW) commercial project to infrastructure investment group Stonepeak. The Richmond, Virginia–headquartered utility in an Oct. 25 financial filing said it received proceeds of $2.6 billion for the sale. The amount represents “reimbursement of approximately 50% of project-to-date capital investment.” […]

-

Trends

AEP Ohio Proposes New Utility Tariff for Data Centers to Offset Infrastructure Costs

American Electric Power (AEP) subsidiary AEP Ohio filed a settlement agreement with the Public Utilities Commission of Ohio (PUCO) and key stakeholders on Oct. 23 to address the costs of power infrastructure improvements required for Ohio’s rapidly expanding data center industry. The agreement, which is subject to review and approval by PUCO, sets a precedent […]

-

Nuclear

DOE Releases $900M to Spur Gen III+ Nuclear SMR Deployment, Targets Two ‘First Mover’ Projects

A $900 million funding opportunity released by the Department of Energy (DOE) on Oct. 16 seeks to spur “first mover” teams that could deploy the first two Gen III+ light water small modular reactors (SMRs) in the U.S. It will also provide funding for “fast follower” deployment support by addressing critical gaps that have long […]

-

Sustainability

Google Bets Big on Nuclear: Inks Deal with Kairos Power for 500-MW SMR Fleet to Power Data Centers

In a deal that marks the first corporate agreement to deploy multiple small modular reactors (SMRs) in the U.S., Kairos Power and Google have signed a Master Plant Development Agreement to facilitate the development of a 500-MW fleet of molten salt nuclear reactors by 2035 to power Google’s data centers. The first reactor is expected […]

-

Engineering

Jackson Generation Pioneers North America’s First M501JAC Gas Turbines

The Jackson Generation plant, a 1.2-GW combined cycle power plant in Elwood, Illinois, debuted North America’s first M501JAC gas turbines. Developed by J-POWER USA, the facility has emerged as a model for

-

Commentary

The Renewables Revolution: Overcoming New Roadblocks

Singapore stands at a pivotal juncture in its journey toward sustainability, with renewable energy (RE) emerging as a beacon of hope in the fight against climate change. Post-COP 28, many countries, including

-

Hydrogen

Equinor Ends Plan to Export Hydrogen to Germany

Energy giant Equinor said it will not export blue hydrogen from Norway to Germany due to economics and a lack of demand. Equinor on September 20 said it would discontinue a project that would have supplied German gas-fired power plants with blue hydrogen via the world’s first offshore hydrogen pipeline. Blue hydrogen is a fuel […]

-

Legal & Regulatory

Net Metering Reform: Premature or Long Overdue?

The growth of distributed energy resources (DERs) has significantly increased over the past decade as the U.S. moves to decarbonize the electric grid. Growth has been possible by incentivizing the transition to clean energy; states and federal legislation, such as the Inflation Reduction Act (IRA), have used tax credits and other programs to accelerate deployment. […]

-

Gas

Major Project Rejected in Texas’ Flagship Dispatchable Power Loan Program

The Texas Energy Fund (TEF), a flagship loan program designed to boost the state’s dispatchable generation, faced its first setback on Sept. 4 when the Public Utility Commission of Texas (PUCT) denied Aegle Power’s loan application for a 1,292-MW combined cycle generating facility in Harlingen—its second-largest shortlisted facility. The PUCT said Aegle Power’s application, filed […]

-

Sustainability

Navigating the Transition to Sustainable MV Switchgear Amidst Decarbonization Initiatives

The push for decarbonization in Europe is reshaping the power sector. Stringent environmental regulations and ambitious renewable energy targets have necessitated the expansion and upgradation of the electricity distribution network. This is to accommodate the increased adoption of distributed energy resources (DERs) and electrification across sectors. These factors are expected to significantly drive the demand […]

-

Commentary

How Energy Services Businesses Can Adapt and Win in a Changing Market

Energy services businesses are poised to benefit from an unprecedented amount of government support for energy infrastructure. However, choppy waters lie ahead as business models and market conditions evolve

-

Solar

The State of the Residential Solar Market: What’s Next?

SEIA’s Solar Market Insight Report for Q2 2024 showed that the U.S. solar market set an industry record by installing 11.8 GWdc in the first quarter. Despite this impressive growth in the market overall, the residential segment experienced its lowest quarter since Q1 2022, with installations totaling only 1.3 GWdc—a decline of 25% year-over-year and […]

-

Nuclear

TVA Boosts Nuclear Funding with $150M for SMR Development at Clinch River

The Tennessee Valley Authority (TVA’s) board of directors has approved an additional $150 million for the public power utility’s $200 million New Nuclear Program to boost continued design work and development of potential small modular reactors (SMRs) at TVA’s Clinch River site near Oak Ridge, Tennessee. The combined $350 million funding for the project will […]

-

Trends

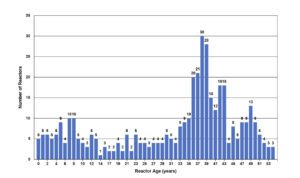

IAEA: Aging Nuclear Fleet Warrants Reactor Life Extensions, Much More New Capacity

While global nuclear power capacity has remained at a consistent level over the past decade, newly released data from the International Atomic Energy Agency (IAEA) suggests that more than two-thirds of the world’s nuclear reactors are more than 30 years old, and nearly a third have been in operation for 40 years. According to the […]

-

T&D

$2.2B for 13 GW of New Transmission Capacity: DOE Unveils Latest Boost for U.S. Grid Modernization

The Biden administration will invest $2.2 billion in eight projects under its Grid Resilience and Innovation Partnership (GRIP) program to bolster the nation’s power grid with nearly 13 GW of new transmission capacity across 18 states. The funding, announced on Aug. 6, marks the second round under the Department of Energy’s (DOE’s) GRIP program, a […]

-

Distributed Energy

Peak Performance: APS’s Virtual Power Plant Saves Big During Brutal Heatwave

Through its innovative virtual power plant (VPP), Arizona Public Service (APS) harnessed smart home devices to save 138 MW during a historic heatwave, shifting peak demand and proving critical for grid

-

Connected Plant

Vietnamese Distribution Grid Automation System a Winning Project

Vietnam Electricity Group’s Ho Chi Minh City Power Corp. (EVNHCMC) deployed a distribution automation system that facilitates automatic—and very quick—fault detection and handling with a success rate of

-

International

South Africa Announces Bold Shift to Renewables and Nuclear

Emerging from a historic election that stripped the African National Congress (ANC) party of its majority, South Africa’s new government has indicated it will accelerate the transition to renewable power to