Iberdrola’s global strategy to close its remaining coal-fired power plants has met with government opposition in its home country of Spain.

Days after Iberdrola, the country’s largest utility, said it would close its last two coal plants in the country, the government said it might step in to keep the plants operating. The country’s Ministry of Energy, Tourism and Digital Agenda in late November said it could seek a legislative veto on coal plant closures, saying the shutdowns threaten the security of Spain’s electricity supply, a similar argument to that used by the Trump administration’s Department of Energy (DOE) with its support of changes to pricing in U.S. electricity markets, designed to prop up struggling coal and nuclear facilities.

Álvaro Nadal, Spain’s energy minister, recently reiterated to Iberdrola that the government’s opposition to closing the coal plants is firm. In the wake of the government’s action, the European Commission has begun investigating Spain’s state aid for coal-fired power plants to determine whether it is in line with European Union (EU) rules, according to EURACTIV Spain. Environmental group WWF Spain in a statement said the government is trying a “desperate move” to block the country’s transition to a “100% renewable and fossil-free future.”

“If you pollute, you pay—this is a long-standing principle in EU environmental law. EU State aid rules do not allow member states to relieve companies of this responsibility using taxpayer money,” European Competition Commissioner Margrethe Vestager said in a statement. Vestager, from Denmark, said the commission thinks Spain’s lawmakers “did not incentivize coal power plants to reduce harmful sulfur oxide emissions—they were already under an obligation to do so under EU environmental law. Therefore, we are concerned that the support gave these coal power plants an unfair competitive advantage. We will now investigate this issue further.”

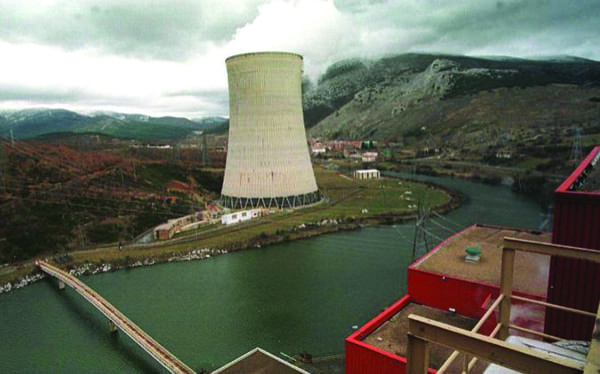

Iberdrola in early November submitted applications to close its 348-MW Lada and its 486-MW Velilla-Guardo (Figure 1) plants in Spain, both of which depend almost entirely on imported coal. Iberdrola since 2001 has closed 4 GW of thermal power generation capacity—a total of 10 plants in all—as it moves toward more renewable power generation. Those closures include two plants in the UK: the 1.2-GW Cockenzie facility, shuttered in 2013, and the 2.4-GW Longannet plant, closed in 2016. Iberdrola acquired those plants when it bought ScottishPower in 2007.

Energy analysts have said opposition to the closure is being led by labor unions fearful their members will lose jobs and by Spain’s powerful coal-mining lobby. Iberdrola has countered that none of the 170 employees at the two coal plants will lose their jobs; it has said it could restart idle gas-fired stations if needed to supply electricity; and has said the two plants account for less than 1% of Spain’s power generation capacity.

With government veto power, though, any new plant closures in Spain need approval from the Ministry of Energy. Coal-fired generation in Spain served about 17% of the country’s electricity demand from January to October 2017, according to government figures, second only to nuclear power and double that of hydropower. Regulators argue the country needs coal to guarantee a baseload supply of power. They pointed to nuclear outages in France this year and record low hydro output as evidence of coal-fired power’s importance.

Coal increasingly is being phased out across Europe. France has said it will end coal-fired generation by 2022. The UK and Italy have said they will phase-out coal by 2025, and the Netherlands, Finland, and Portugal have set an end date of 2030. Also in November, Denmark and Austria committed to joining an international “Powering Past Coal Alliance” that would accelerate those countries’ transitions out of coal.

But closure announcements have met with varying degrees of opposition. Enel, the world’s largest utility in terms of customers, has faced political opposition to its closures in Italy, and still needs government officials to sign off on the retirement of units in Genoa and Bastardo. In the UK, where debate over closing coal plants has focused more on investments in cleaner power generation technologies, officials have said concerns about future power supply and an overreliance on renewables could delay its phase-out of coal. Analysis from Imperial College London showed coal accounted for just 2% of the country’s power generation in the first half of 2017.

Iberdrola in a statement announcing its move away from coal said its action “firmly advances the company’s clean energy plan and its target of reducing its CO2 emissions intensity by 50% in 2030 [from 2007 levels].” The company said its emissions have been reduced by 75% since the year 2000. Iberdrola also has touted its renewable energy, noting it has “28,778 MW of green capacity” and “is one of the most influential companies in the global renewable energy market, with 15,902 MW in wind [onshore and offshore] and 12,756 MW in hydroelectric power.”

The utility in early October joined with other European energy companies in asking policy makers to increase renewable energy targets for 2030, raising the share of renewable sources for power generation to 35%, up from 27%.

—Darrell Proctor is a POWER associate editor.