The second World Nuclear Exhibition (WNE) began on June 28 in Le Bourget, just outside Paris, with the usual mixed messages about the need for and challenges of nuclear power globally. During the opening ceremony, Fatih Birol, executive director of the International Energy Agency (IEA), noted that the event was being held in the same location as last December’s historic COP21, at which 180 nations reached an agreement on addressing climate change. Nuclear, this event’s business-oriented attendees agreed, needs to be part of the solution to limiting the increase in global warming to 2 degrees Celsius.

Familiar Challenges for Nuclear Power Globally

However, the familiar challenges remain. As identified by the event’s president, Gérard Kottmann (also president of French Nuclear Industry Exporters Association, AIFEN), they are to make nuclear power “safer, cheaper, quicker, and more sustainable.” A fifth challenge is the political one, he added, noting that Europe doesn’t recognize nuclear power as “clean.”

Birol commented that the industry’s challenges include an aging fleet and low fossil fuel prices. It’s “extremely important” for governments to decide what to do in regards to replacements and lifetime extensions, especially in light of coal prices at 20-year lows and carbon prices that are nonexistent or very low, he said. Yet another challenge is what to do with long-term waste.

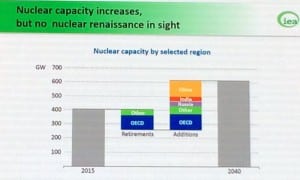

Given all of those challenges, Birol said, the industry “desperately needs some good news,” which he shared from the 2015 World Energy Outlook. IEA data show 2015 capacity additions the highest ever in 25 years, mostly driven, he said, by new builds in China. However, at the same time, existing plants are retiring, including in the U.S., so there is “no real nuclear renaissance in sight.”

Given the large volume of capacity additions and ongoing public concern about the safety of nuclear power, especially post-Fukushima, Birol emphasized the need for a “competent and independent” regulatory body.

Despite all of the headwinds, Birol insisted that the share of nuclear in the global energy mix needs to increase from 11% today to 18% to 20% by 2040 if global greenhouse gas emissions from the energy sector (about 40% of the total) are to be managed. Such an increase will require investment support, but the markets don’t send a strong enough signal, he acknowledged, so governments need to provide long-term capital surety to nuclear, he said.

Cross-Channel Back and Forth

An opening panel was reconfigured and rescheduled due to the late arrival of Emmanuel Macron, French minister of the economy, industry, and the digital sector, who spoke in French on the familiar themes of France’s nuclear history, experience, competence, and belief in nuclear. France continues to look for markets beyond its borders, including the UK, where the proposed 3,200-MW Hinkley Point C (for which the European Commission had just approved financing during the first WNE in October 2014) has been delayed.

Though two English-speaking reporters did not hear Macron utter the word “Brexit,” news coverage today suggested that the UK’s vote to leave the European Union would spell the death of that project. One UK energy advisor said that the two-EPR-reactor project, expected to be the most expensive in the world, is “extremely unlikely” to move forward given last week’s vote. The project’s main financial backer is France’s EDF, with the reactor technology to be supplied by AREVA.

Meanwhile, AREVA, which has a 10% equity position in the UK project, on June 15 announced restructuring plans that involve a three-way split of the company, with Areva NP going to EDF.

Regardless of the political, cost, and timeline challenges, Professor John Loughhead, chief scientific advisor to the UK’s Department of Energy and Climate Change, said that new nuclear capacity is the UK’s best hope for lowering its carbon footprint, even if much more onshore wind is deployed. Building 20 GW of nuclear capacity means that 50 grams/kWh carbon emissions can be achieved with 42 GW of onshore wind, he claimed. Biomass isn’t an option because of fuel supplies; carbon capture and storage are “technical viable” but very uneconomic; and storage and smart grids are still a couple of decades away, in his view. That leaves only nuclear, which is available today and economically comparable with offshore wind, he said.

Regardless of the fate of the Hinkley Point project, France remains committed to exporting its nuclear technology. As EDF CEO Jean-Bernard Lévy affirmed, “expanding to new geographic areas is a priority.” That is a goal shared by all countries currently building new nuclear plants.

Economics and Markets

Cost remains perhaps the biggest challenge to new nuclear capacity—even in China.

AREVA recently conducted a customer survey that found competitiveness (cost) the toughest challenge. The utilities it surveyed aim to reduce generation costs from 10% to 25% by 2020—just 3.5 years from now.

Costs remain an issue even once a plant is operating, and AREVA CEO Phillipe Knoche posted a slide showing that one way utilities are seeking to reduce production costs is through “digitization” and the use of “big data.”

Dave A. Heacock, president and chief nuclear officer of Dominion, noted that all U.S. utilities have agreed to focus on efficiency. He also noted that the Nuclear Energy Institute’s (NEI’s) Delivering the Nuclear Promise initiative focuses on streamlining standards. For example, in the area of work management, they are looking at a graded approach to walkdowns so that only those situations that actually require a walkdown receive one. Vendors are also being approved in a standardized way so that once they are approved, they can go into all U.S. nuclear plants.

Standardization of codes and standards—around the globe—rather than the current proliferation we are seeing, was also mentioned by former U.S. Nuclear Regulatory Commission Commissioner William D. Magwood IV, currently director general of the Organisation for Economic Cooperation and Development’s Nuclear Energy Agency, as a way to control costs in a later session.

China, with 25 nuclear units, is now third globally in total nuclear capacity, behind the U.S. and France. Speaking through a translator, Cao Shudong, vice president of China National Nuclear Corp. (CNNC), said that temporarily suspending work on several new plants in response to the Fukushima accident increased construction costs in his country. One way to lower costs, he suggested, is to construct plants “in batches,” as they are doing in China.

Another way, according to Jérôme Teissier, CEO of Betri, involves clients delegating control for components to the vendors. It’s an approach used successfully in aerospace, another industry in which Betri is active.

Magwood observed that of the 56 plants built since 2000, those that have been most successful have had experienced people. There are few people left, he said, with direct experience in large nuclear power plant projects. That lack of experience can lead to cost and time overruns. Some with the most success have had continuous build programs, like South Korea, he said. He sees similar capabilities building in China and Russia. But elsewhere there has been a leadership gap not only among key contract signers but also with contractors and subcontractors.

That leadership gap can also exist in regulatory bodies, Magwood added. They, too, need experienced people to make the right decisions that ensure safety without needlessly adding delays.

Sometimes there are just no shortcuts to lessons learned from first-of-a-kind projects, was the implicit lesson shared by Mark Marano, president EMEA & Americas Regions, Westinghouse Electric Co. Westinghouse, which is delivering its AP1000 at eight sites simultaneously—four in the U.S. and four in China—said they are pleased with where they are now with those projects and that each has learned from the others. The company’s Sanmen 1 project is expected to be online in 2017, with the projects in the U.S. expected in 2019 and 2020.

Supply chains, too, Marano, observed, need to be ready in order to keep costs and timelines under control. “Our own supply chains were not ready,” in the U.S., he said.

Multiple presenters commented on the “broken markets,” not just in the U.S. but also in Europe. In the UK, however, said Tom Samson, CEO of NuGen, a Toshiba-ENGIE joint venture formed to develop an AP1000 reactor based plant at Moorside, at least they have contracts for difference for funding support.

In the U.S., nuclear operators appear to be hoping for some breakthrough on the political or policy fronts. Scott Greenlee, senior vice president of engineering and technical services at Exelon Nuclear, said he’s happy to see environmental groups getting behind nuclear as a way to achieve a lower-carbon future. But more is needed, specifically, carbon legislation. He said he thinks the states will “wake up” on such legislation, particularly New York and Illinois. Should that happen soon, two Exelon plants recently announced for closure, Clinton and Quad Cities, could get a reprieve.

—Gail Reitenbach, PhD is POWER’s editor (@GailReit, @POWERmagazine)