Overwhelmed by low wholesale power prices and changing customer needs in the Pacific Northwest, the Bonneville Power Administration (BPA) on January 30 unveiled a lifeline it hopes will allow it to remain commercially afloat.

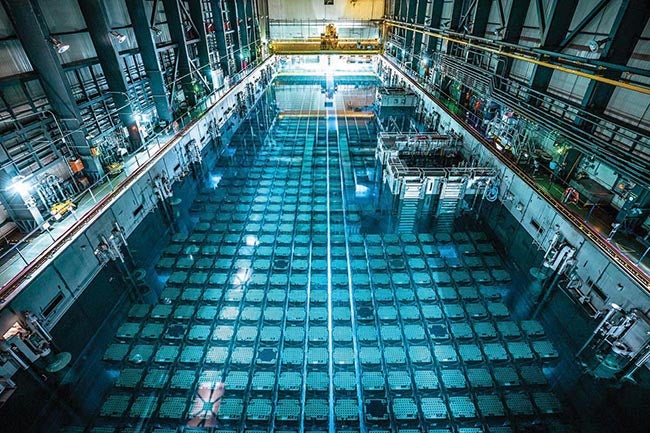

While the nonprofit federal power marketer headquartered in Portland, Oregon, is part of the Department of Energy, it is self-funding and covers its costs by selling products and services. The bulk of its revenues come from sales of 22 GW of power from 31 federal hydropower plants operated by the U.S. Army Corps of Engineers, the Bureau of Reclamation, and the region’s sole nuclear power plant—the 1.1-GW Columbia Generating Station—to 142 electric utilities throughout the Northwest.

Altogether, the BPA provides about 28% of power used in the Northwest. It also operates and maintains about 75% of the high-voltage transmission in its service territory, which includes Idaho, Oregon, Washington, western Montana and small parts of eastern Montana, California, Nevada, Utah and Wyoming.

A Model Under Siege

However, the entity has struggled to maintain cost competitiveness and commercial performance amid a slew of new wind and solar capacity additions in the region, which are driving down power prices. Because the BPA’s power profile is predominantly hydropower, the agency is also highly reliant on the amount and timing of precipitation in the Columbia River and the shape, or timing, of the resulting runoff.

The agency currently has sufficient liquidity and high credit ratings, but troubles lurk in plain view: “Our power customers have expressed significant concerns that BPA’s recent pattern of rising costs and rates is unsustainable,” it said on Tuesday. “They have noted that the resurgence of competition in power markets will provide them with alternatives when their long-term wholesale power contracts with BPA expire in 2028.”

For the BPA, not taking action is not an option, because it says financial troubles—particularly those around cost management, debt management, and reserves—would jeopardize its mission and put the region’s environmental and economic health at risk.

That’s why, in a strategic plan released on Tuesday, the agency said it will take aggressive actions to manage costs and strengthen its financial health over the next five years (2018–2023). Measures include establishing a cost management goal with firm cost constraints to keep the sum of program costs at or below the rate of inflation through 2028. It will also require reducing corporate costs through a long-term workforce reduction (to be met through attrition), consolidation, outsourcing, and process improvements, along with possible cuts in its supply chain and information technology.

If market prices and loads—which are already considerably uncertain—further impact the BPA’s total revenues and rates, even more aggressive cost management steps may be needed, the agency said.

Significantly, the BPA will also move to mitigate risks of being too highly leveraged, intending to target a debt-to-asset ratio of 75% to 85% over the next 10 years. Because the agency has historically used debt to finance nearly 100% of all capital investments—and repaid it under statutorily set terms, generally 50 years or less—the agency currently has a debt-to-asset ratio of about 90%. That compares to the utility industry average of 54%.

At the same time, it wants to look outside its traditional financing source—the U.S. Treasury—where its credit, capped at $7.7 billion, will be depleted by 2023, putting the agency’s future capital program at risk. “To continue investing in and maintaining the tremendously valuable federal power and transmission assets, BPA will need to look beyond its traditional financing source and consider an ‘all of the above’ capital financing strategy,” it said. That could include revenues, financial reserves, third-party leases, an additional Treasury borrowing authority, the authority to issue debt directly to capital markets, and funds that are freed up by working with Energy Northwest to refinance Regional Cooperation Debt.

Extracting the Highest Economic Value

Under the plan, the BPA will also adopt an asset management approach “to extract the highest economic value, while also preparing to operate these assets in evolving markets,” it said. “This includes taking advantage of new opportunities to maximize revenues and potentially decrease the need for transmission expansion.”

Other measures outlined in the plan to help offset risks include investing in energy efficiency and fish and wildlife. The BPA also plans to back negotiations to modernize the Columbia River Treaty, which is an agreement for transboundary natural resource cooperation that has existed between the U.S. and Canada since 1964 and is set to expire in 2024. For the BPA, the treaty’s modernization “could support the development of more competitive BPA products and services, among other benefits.”

On the transmission front, the BPA plans to standardize and streamline its transmission products, services, and processes to develop a more flexible and economical approach to meeting customer needs.

The agency also plans investments in grid modernization to support a more reliable and flexible system. “As California and other Western states increase the amount of variable energy resources on the grid, we will proactively seek more opportunities to market the valuable flexibility and capacity services that clean hydropower resources can provide. And in a more carbon-constrained world, power markets may place more explicit value on clean capacity, creating new revenue opportunities for BPA,” it said.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)