Robert A. (Bobby) Hefner III, the doyen of deep gas in the 1980s, is back on the energy policy scene in a big way. That’s the only way Hefner has ever wanted to be seen: On a big canvas. He’s touting the rebound of natural gas as a dominant fuel, after several years of industry hand-wringing that the nation and the world were running out of gas.

Back in the 1970s and 1980s, Hefner’s GHK company was the prophet of natural gas finds down, way down, below where anyone else had ever expected to drill. He raised a lot of money, had some success (at high drilling costs), and landed in a lot of money and a lot of litigation. Most conventional oil and gas drillers viewed Hefner as a kook and a gadfly.

Hefner was a kook who may have known what he was talking about, it appears. These days, according to The Economist magazine, Hefner said he “feels vindicated.” That’s because the U.S. now has plenty of natural gas, much of it way down below 15,000 feet. “I used to say we were awash in gas,” Hefner told the magazine. “Now I say we are drowning in it.” That’s not a bad way to drown.

The ebullient Hefner, 74, an Oklahoman with a long tradition of gambling on gas, is now a bastion of the eastern energy establishment. He is associated with the Belfer Center for Science and International Affairs at Harvard’s Kennedy School of Government. He wears bow ties and tuxedo jackets with his Levis and cowboy boots, and underwrites Asian cultural projects with his Singaporan wife Meili (see photo).

Robert and Meili Hefner. Courtesy: Hefner Fund

Hidden Gas Getting Easier to Retrieve

In the 1960s, petroleum geologist Hefner, scion of a petroleum family, proposed deep drilling for natural gas, arguing that the gas resources in the U.S. had barely been touched. In 1969, according to Oklahoma State University, Hefner’s “Number One Green well, drilled to a depth of 24,454 feet in Beckham County, blew in at the highest pressure ever recorded.” Still, most exploration and production companies viewed Hefner skeptically, because his deep wells were considerably more expensive than the easier, shallower wells.

Since then, drilling technology has evolved, so that seismic analysis can provide a clearer view of the subterranean landscape, and drilling technology can reach the most promising strata. There’s a lot a gas, say the experts, and it’s getting easier to develop. The cheap plays have played out, but the more expensive plays that Hefner has sought are getting cheaper to develop by the day.

Prices Falling, Reserve Estimates Climbing

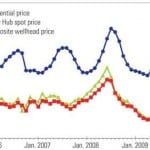

For electric generators, the good news as 2009 rolls to an end is that natural gas—the cleanest, by any measure, of fossil fuels—has defied most predictions and has turned into a plentiful producer of electricity. The most recent reports from the U.S. Energy Information Administration found natural gas prices at the Henry Hub at $2.76 per million Btu, and futures prices at the New York Mercantile Exchange September contracts were at $2.91 per MMBtu. A couple of years ago, the price was around $9.

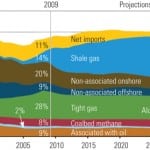

Bolstering the low gas price forecasts—after a period in which analysts said natural gas would rise to track crude oil prices—the U.S. Potential Gas Committee (PGC) issued a report that estimated U.S. reserves at 1.8 trillion cubic feet. That’s the highest in the committee’s 44-year history and 40% above its 2006 estimate. John Curtis of the Colorado School of Mines, and head of the committee, said that the estimate “reaffirms the committee’s conviction that abundant, recoverable natural gas resources exist within our borders, both onshore and offshore, in all types of reservoirs.” Wholesale prices fell, reflecting the optimistic supply predictions.

The PGC is an independent, industry-funded institution that examines natural gas reserves in the U.S. Said Curtis, “Our knowledge of the geological endowment of technically recoverable gas continues to improve with each assessment. Furthermore, new and advanced exploration, well drilling, and completion technologies are allowing us increasingly better access to domestic gas resources—especially ‘unconventional’ gas—which, not all that long ago, were considered impractical or uneconomical to pursue.” That’s a reference to gas contained in shale deposits, which have become a booming business for gas exploration and development companies, using hydro-fracturing technologies to release previously unattainable gas bound up in sedimentary formations. It’s a play that involves both western shale and the large Marcellus deposit in the Northeast.

In a press release, the PGC noted, “When the PGC’s results are combined with the U.S. Department of Energy’s latest available determination of proved gas reserves, 238 Tcf [trillion cubic feet] as of year-end 2007, the United States has a total available future supply of 2,074 Tcf, an increase of 542 Tcf over the previous evaluation.” That’s a stunning figure, representing an increase of over 25% above previous estimates.

LNG Left in the Dust

Among the implications of the latest natural gas estimates for the U.S. is a crash in plans for imported liquefied natural gas (LNG) terminals in the U.S. Three years ago LNG was the rage of the age, with predictions of terminals across the coastal U.S. Dan Yergin’s Cambridge Energy Research Associates firm was bullish on LNG, predicting a worldwide boom in LNG. The political foment over LNG projects in U.S. ports has vanished from public view, as reflected by Google searches.

I was unable find any recent, publicly available material on LNG on the CERA site, although there was reporting available to paying customers (the price tag is very high). I suspect, and I would like to hear from any CERA insiders or customers, that the consultancy’s enthusiasm for LNG has cooled considerably on current and projected natural gas prices.

—Kennedy Maize is MANAGING POWER’s executive editor.