Renewable energy is on the rise, and the Export-Import Bank of the United States (Ex-Im Bank) is playing its part to support American renewable exporters in the global marketplace.

Global installed capacity of renewable electricity over the last 10 years has increased by over 100%, to 1,560 GW, and now accounts for 23% of all electricity generation worldwide, with wind and solar being the dominant drivers of this growth. China, Canada, Germany, Brazil, and the U.S. are at the forefront in terms of installed capacity; however, smaller countries are breaking through on the renewables front and providing significant opportunities for exports supported by international financing.

Win-Win Financing

For more than 20 years, the Ex-Im Bank has been specifically mandated by Congress to support U.S. exporters competing globally for renewable energy transactions. Since 2009, it has financed nearly $2 billion in American-made renewable energy products and services, and in 2014 it authorized $336 million to support environmentally beneficial exports. Of this amount, a total of $151 million flowed to three wind farms in Latin America located in Uruguay and Peru, smaller markets that are up and coming. These projects benefit from the commercially reasonable terms of Ex-Im Bank financing for renewables, which include repayment periods of up to 18 years, fixed interest rates, capitalization of interest during construction, and various options for payment of the risk premium. Furthermore, the Ex-Im Bank brings in-house technical expertise to ensure that projects can operate to specification during the life of the loan, making it a win-win situation for all involved.

The Peruvian market, for example, recently developed a plan to encourage the development of renewable projects. This market is not a traditional power market, where borrowers as well as lenders are enticed by a standard power purchase agreement with a government utility that shares the same credit standing as the sovereign in many cases. In existence for the last 30 years, the Peruvian market is a decentralized wholesale market in which numerous buyers and sellers clear payments with each other directly, and the process is overseen by a government regulator. In the life of this system, buyers and sellers have always provided on-time payment, as the proper incentives are in place to motivate the participants to stand behind their obligations in a timely fashion.

In support of Siemens wind turbines built in and shipped from the U.S., the Ex-Im Bank was able to provide financing for the projects operating in this complex but historically reliable power market. These transactions represent the bank’s first power project financing in the Peruvian market, as well as Siemens Wind’s first sale in Peru. With a strong assurance of repayment, the bank will support U.S. exporters of renewable products in new markets to expand the reach of U.S. goods and services—thereby supporting good-paying U.S. jobs.

Opportunities in India

Another example of how the Ex-Im Bank supports the confluence of U.S. jobs, exports, and renewable technology in international markets is its role in India’s National Solar Mission (NSM). India is one of the fastest growing renewable markets, and the Ex-Im Bank was one of the first international lenders to show support in the early phases of the NSM, ultimately financing nine projects and over $350 million in the Indian market. The bank’s involvement ushered in additional capital and debt in the Indian solar market and created more opportunities for U.S. exporters.

As India increases its renewable targets in an ambitious quest to achieve a renewable mix for 16% of its total portfolio, it will need the deliberate and meaningful engagement of stakeholders of all types. Opportunities abound for U.S. exporters, who can partner with India to scale up in such a dramatic fashion.

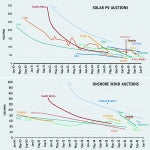

India’s focus on renewable energy is happening at an auspicious time, as the cost of photovoltaic (PV) solar panels has fallen dramatically and tariffs in India are near grid parity. According to First Solar, one of America’s leading solar PV manufacturers, the cost of panels has fallen significantly, to $1 per watt in the last few years. Even with the lower cost of oil, solar is generally expected to remain competitive.

Small Markets, Big Opportunities

The Export-Import Bank of the U.S. continues to seek ways to support the sale of proven renewable technologies abroad. Many countries in the Middle East, including Egypt and Jordan, have recently developed programs to facilitate renewable projects. Latin America has already demonstrated a strong pipeline in renewables, but some countries are just taking off and therefore creating even brighter prospects for clean technology exports from the U.S. These small markets create big opportunities for U.S. exporters to continue the strong growth of renewable electricity relative to electricity produced by fossil fuels. When there is reliable technology, the Ex-Im Bank can find a structure that works in the larger markets as well as the smaller ones.

To learn more about export solutions for your business, visit www.exim.gov. You can also visit http://grow.exim.gov/contact-exim to receive your free trade finance guide. ■

—Uduak Essien is managing director, alternative energy of the Export-Import Bank of the United States.