Driven by artificial intelligence (AI), cloud computing, and the digital transformation, U.S. data centers consumed an estimated 150 TWh of electricity in 2023—equivalent to around 3% of the nation’s power demand. Globally, data center demand hovered at 340 TWh in 2023—about 1.3% of worldwide electricity use. Multiple sources project this demand will surge dramatically through 2030, albeit at varying rates, amplifying the pressure on power infrastructure and sustainability efforts.

Key Data Center Markets: Clusters of Consumption

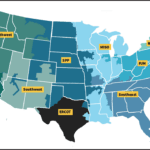

The U.S. remains a global leader in data center capacity, hosting half of the world’s 10,655 data centers as of early 2024. Notable regions include Northern Virginia, Dallas-Fort Worth, Phoenix, Chicago, and Silicon Valley.

Virginia’s so-called “Data Center Alley” alone hosts more than 3 GW of data center capacity (with 94 facilities connected since 2019)—making it the world’s largest data center market. Projections suggest an additional 11 GW of capacity by 2030—equivalent to more than 40% of Virginia’s current peak demand, according to Aurora Energy Research. The surge is expected to push Dominion Energy’s peak demand up by 50% over the next six years—equivalent to adding New Jersey’s total power demand to Virginia over the next 15 years.

Meeting this rapid load growth will require 10 to 15 GW of firm generation capacity, but challenges like low market prices, transmission constraints, and infrastructure delays could hinder progress, Aurora suggests. The firm’s analysis indicates that this growth will also drive up wholesale power prices by up to 30% by 2035, potentially deterring new data centers from the region. States like Texas and North Carolina are competing aggressively with Virginia, offering incentives to attract future data center expansions.

Meanwhile, the Electric Power Research Institute (EPRI) estimates that the data center share of electricity load in Virginia could climb to 50% by 2030, with similar trends expected in other major U.S. states. In a May 2024 white paper, EPRI explored four scenarios for potential data center load growth, combining estimates of increased data processing needs with assumptions about efficiency gains. It suggests that electricity usage by hyperscalers—data centers capable of rapidly scaling up their operations to meet the vast computing needs—more than doubled between 2017 and 2021. “This increase is expected to continue, with data centers projected to consume 5% to 9% of U.S. electricity generation annually by 2030, up from 4% today,” EPRI says. That boils down to energy consumption that ranges widely, from 214 TWh to 404 TWh.

In a significant initiative, EPRI in October partnered with major utilities, power companies, grid operators, and tech firms like Google, Meta, and NVIDIA to demonstrate how data centers could transition from passive energy consumers to active, flexible grid resources. The Data Center Flexible Load Initiative (DCFlex) will establish five to ten “Flexibility Hubs” starting in 2025 to explore innovative strategies for integrating data centers into the grid, including load management, advanced cooling technologies, and clean backup power generation.

A Strain on Power Markets

For now, the surging demand growth is poised to put immense pressure on power markets like PJM, which has sustained flat load growth over the past decade. “PJM’s current summer peak load forecast predicts a significant increase in load growth, with the share of total load attributable to data centers (currently 4%) expected to rise to 12% by 2030 and 16% [an increase of 42 GW] by 2039,” said Aftab Khan, PJM executive vice president of Operations, Planning, and Security during the Federal Energy Regulatory Commission’s (FERC’s) annual Reliability Technical Conference on Oct. 16. Khan added that other factors also pose challenges for resource adequacy and planning, including the anticipated retirement of aging generation assets and the growing penetration of electric vehicles (EVs), which are expected to account for 11% of total PJM load by 2039.

ISO New England is also preparing for potential wildcard growth. “Every year, we refresh our data center load growth,” said Stephen George, director of Operational Performance Training and Integration at ISO New England, during the conference. “We need to get better short-term over the next five years—a better line of sight of what’s really coming from data center load growth because that is probably our biggest challenge with resource adequacy, to understand what’s really coming.”

Similarly, the Electric Reliability Council of Texas (ERCOT) in April estimated an additional 40 GW of load growth by 2030 compared to last year’s forecast, driven by large industrial projects, increased electrification, and the rapid expansion of data centers and cryptocurrency mining operations.

Similarly, the Electric Reliability Council of Texas (ERCOT) in April estimated an additional 40 GW of load growth by 2030 compared to last year’s forecast, driven by large industrial projects, increased electrification, and the rapid expansion of data centers and cryptocurrency mining operations.

A critical issue across all regions is the mismatch between the rapid pace of data center construction and the lengthy timelines required for power infrastructure development. “We have a very simple math problem. The trend lines for electricity’s supply and demand are moving in the wrong direction to sustain reliability, ” said Jim Robb, president and CEO of the North American Electric Reliability Corporation (NERC).

“A data center can be built in 2 to 3 years, while power plants and transmission lines take 7 to 20 years,” Robb noted. “Those are the realistic timeframes that we have to deal with. We need to shorten the development of infrastructure in a way that at least starts to come close to matching the development of new load coming onto the system.”

Varied Projections Highlight the Uncertainty

But pinning down how much infrastructure will be needed is challenging, given that projections for U.S. data center electricity consumption through 2030 vary so widely depending on growth assumptions, efficiency improvements, and the pace of AI-driven workloads. Most assessments present data center electricity consumption growth over time using a compound annual growth rate (CAGR) to account for annual compounding effects.

- EPRI (May 2024): Four scenarios range from a 3.7% CAGR (196 TWh) to a 15% CAGR (404 TWh), reflecting rapid AI expansion and limited efficiency gains.

- Goldman Sachs (April 2024): 15% CAGR, reaching 455 TWh by 2030, representing up to 8% of total U.S. electricity demand.

- McKinsey (September 2024): 22.3% CAGR, projecting 606 TWh by 2030, with data centers accounting for up to 40% of net new U.S. electricity demand.

- DOE (2024): Projects data center demand reaching 675 TWh, or approximately 9% of total U.S. demand, by 2030.

- Rystad Energy (June 2024): Forecasts U.S. data center demand growing to 307 TWh by 2030, a cumulative increase of 177 TWh from 2023 levels.

Global Context: Data Centers on the Rise

Globally, data centers are also poised to grow significantly. The International Data Corp. in September 2024 that total electricity consumption by data centers will more than double, reaching 857 TWh by 2028—a CAGR of 19.5%. AI-specific workloads are anticipated to grow even faster, with energy consumption increasing at a CAGR of 44.7%, reaching 146.2 TWh by 2027.

The International Energy Agency (IEA) also echoes expectations of rapid growth but emphasizes that data center electricity demand will remain a relatively small share of total global demand through 2030. However, the IEA also warns of potential constraints on this expansion. Supply chain bottlenecks, particularly for AI chips and advanced cooling technologies, could slow the pace of growth. Additionally, delays in developing local grids and adding new power generation capacity contribute to the uncertainty.

The IEA further notes that projections for this phase of data center expansion remain tentative. Sparse data availability and the sector’s relatively early stage of development complicate long-term forecasting, even as technology companies and AI start-ups ramp up investments in compute-intensive workloads.

Broader Electrification Trends

The surge in data center demand is set against a backdrop of broader electrification trends. The IEA projects global electricity demand will increase by 6,760 TWh by 2030, driven by transport electrification, industrial processes, and space cooling. Notably:

- Electric Vehicle (EV) Demand: Electricity demand from EVs is expected to rise from 115 TWh today to 1,000 TWh by 2030—an amount equivalent to Japan’s total electricity consumption.

- Space Cooling: Rising incomes and global temperatures could add over 1,200 TWh in cooling demand by 2035.

While data centers remain a smaller driver of overall electricity demand growth, their concentrated impact on key regions amplifies the challenge of ensuring reliable and sustainable power, it suggests.

Sources

- International Energy Agency (IEA). World Energy Outlook 2024. October 2024.

https://www.iea.org/reports/world-energy-outlook-2024 - International Data Corporation (IDC). The Financial Impact of Increased Consumption and Rising Electricity Rates in Datacenter Facilities Spending. September 2024.

https://www.idc.com/getdoc.jsp?containerId=US52548324 - Electric Power Research Institute (EPRI). U.S. Data Center Electricity Consumption Scenarios. May 2024.

https://www.epri.com/research/products/000000003002025478 - Goldman Sachs. U.S. Data Center Power Demand and Generation Needs. April 2024.

https://www.goldmansachs.com/insights/pages/us-data-center-power-demand.html - Rystad Energy. Data Center Demand Growth and Projections. June 2024.

https://www.rystadenergy.com/newsevents/news/press-releases/data-center-demand-growth-projections-2024/ - McKinsey & Company. Data Center Demand Projections Through 2030. September 2024.

https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/data-center-demand-projections-through-2030

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).