Siemens AG, the parent company of Siemens Power and Gas, is contemplating the sale of its lucrative but lately troubled gas turbine business, according to one major news outlet.

Citing unnamed sources, Bloomberg on June 13 reported that the German giant may be considering the sale of its power and gas business, possibly to a rival. The sources reportedly also noted no final decision has been made yet, and the company could keep the business, which has seen a drastic plunge in operating income since the first quarter of 2017.

Siemens declined to comment on “market speculation” but it may issue a statement about the matter later today, a spokesman told POWER.

The company has been forthcoming about its Power and Gas division’s financial troubles. On May 7, it said it would shut down all Power and Gas division operations worldwide “within the current quarter” for seven days. The company cited “an ongoing unprecedented downswing in the market for power generation equipment,” and said “the power and gas division (PG) is planning temporary shutdowns.”

In November 2017, Siemens said it would cut 6,900 jobs, mostly in its Power and Gas division. It also said it would close some of its manufacturing locations in Europe.

The Power and Gas division employs about 47,000 workers. In a May 9 presentation to reporters, Siemens Chief Financial Officer Ralf Thomas pointed to “structural challenges” at the Power and Gas division, noting the share of the division’s revenue had fallen “clearly below margin range” by as much as 15%. Profit margins for the division plunged to 3.9% in the second quarter of 2018, compared to 10.8% at the same time last year, he said.

No Recovery in Sight

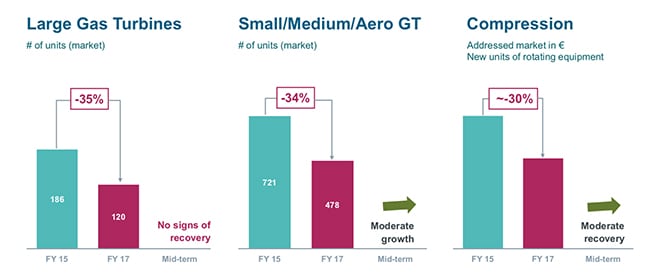

Thomas cited “industry over-capacities” that are creating “pricing pressure” on the beleaguered division. Sales of Siemens’ large gas turbine units fell precipitously by 35% in fiscal year 2017, compared to fiscal year 2015, and the market showed “no signs of recovery,” he said.

Sales of Siemens’ small/medium/aeroderivative gas turbine business also fell 35%, though that business is seeing “moderate growth.” Also hard-hit is its compression business. Unit sales of rotating equipment fell 30%, but that business, too, faces “moderate recovery” over the mid-term.

Possible Buyers

Analysts at Hamburg, Germany-based investment bank Berenberg have said they expect Siemens could seek a joint venture in the gas turbine business with another major competitor such as Mitsubishi Heavy Industries.

“A sale of the gas turbine business would be consistent with previous divestments of assets in wind and rail,” Morgan Stanley analyst Ben Uglow said in a note. The disposals would be “highly significant from a valuation standpoint.”

GE Also Bracing for Soft Power Market

Siemens’ gas turbine sales troubles are mirrored by General Electric’s (GE’s). As POWER reported in May, GE, which has historically pioneered and led global gas turbine sales, has fallen behind Japan’s Mitsubishi Hitachi Power Systems and Germany-based Siemens. In December 2017, the company said it would cut 12,000 jobs in its power unit, resulting in a savings of $1 billion this year.

In a first quarter earnings call on April 20, GE CEO John Flannery said GE Power’s outlook for new heavy-duty gas turbine orders in 2018 would need to be recalibrated. “With respect to Power, we came into the year expecting the overall market for new gas orders in 2018 to be 30 to 34 GW. Based on what we are seeing in the market, this is trending to less than 30 GW.”

In a webcast presentation on May 23, Flannery said the outlook for GE Power remains unchanged. “I’ll just say [the] end market continues to be very challenging for new gas turbines. So we built our 2018 plan around a 30-GW to 34-GW market size. It continues to be under pressure from energy efficiency, penetration of renewables. The storage things that are happening here will only accelerate those trends, geopolitical things, financing,” he noted. “The pricing environment is tough with everybody having excess capacity.”

Flannery said GE has been assessing market needs for power, trying to pinpoint where the company sees the likely development of projects as well as their flightpath and timeframes. “And so we see, I’d say, on a good granular level what’s going on in the market. And right now we’re looking at something that’s likely to be 30 [GW], maybe a bit below 30 [GW]. We see a pipeline that’s higher than 30 [GW], but I think a lot of these won’t close in the end in 2018. So we’re planning on this market, continuing to be like this for 2019 and 2020. So a soft end market.”

For now, the company will continue to expect flat operating profits, even as it takes steps to address the market environment. All roads to moving profit margins back to more than the 5% to 6% GE Power earned in 2017 “lead to extensive cost out,” Flannery said. “That’s really about reducing our manufacturing footprint, reducing our base cost.” Flannery also noted that GE was on track to meet its $1 billion savings. “There’s good visibility around headcount management and headcount down 12,000. So we think these—and there’s a series of other cost actions we keep looking at inside that business—but these steps can raise margin rates 300 to 500 basis points over time.”

—Darrell Proctor and Sonal Patel are POWER associate editors (@POWERmagazine)