Offers of nuclear loan guarantees are pending, construction permit applications are at an industry high, and the political stars seem to be properly aligned. However, there remains one obstacle in the development path of the next-generation of nuclear plants: How will these plants be financed?

"This time, we have got to get it right," says Fluor’s Chris Tye. Tye is the giant construction company’s senior vice president for nuclear construction and a veteran of the 1970s and 1980s, when the nuclear industry did not always get it right when building new nuclear plants. The historical record demonstrates a pattern of overbudget, off-schedule performance that drove up plant costs and soured utilities, regulators, investors, the public, and the government when it came to nuclear power.

With federal loan guarantees now in hand for at least some new projects — the Southern Company’s two-unit, $14 billion Vogtle expansion has won an $8 billion-plus guarantee from the U.S. Department of Energy — Tye argues that failure on constructing the next generation of nuclear plants will be fatal to a nuclear renaissance. (See "Plant Vogtle Leads the Next Nuclear Generation," POWER, November 2009.)

Tye was on a construction issues panel at the annual Platts nuclear conference in Rockville, Md., in February. Looking at the critical steps for a real nuclear revival — something the industry has been awaiting since the 2005 Energy Policy Act and its loan guarantee provisions — Tye told POWER in an interview, "We have got to get the first one [of the new generation of nuclear plants] right. If we fail, the whole enterprise fails." Tye said the key to getting new nuclear generating plants built is "Construction 101 — basic blocking and tackling."

Industry Optimism Returns

The Platts atomic confab, which has traditionally had a fingers-crossed feel about new nukes, was abuzz with optimism this year, according to many of those who attended. The passage of the 2005 Energy Policy Act and its authorization for over $18 billion in nuclear loan guarantees had the industry on a policy high four years ago. But the Bush administration’s inability (or unwillingness) to implement the loan guarantees over the next few years demoralized the industry.

Now the Obama administration, which many in the industry feared would be reflexively anti-nuke when it arrived in Washington, came through with an $8 billion loan guarantee for the planned Vogtle expansion (Figure 1). This announcement from the White House — a quick walk from the U.S. Nuclear Regulatory Commission’s White Flint, Md., headquarters — made just before the conference started, struck many observers as intentional, not accidental.

1. We have a winner. Plant Vogtle received the DOE’s first offer of an $8 billion loan guarantee for the construction of two new nuclear units. Courtesy: NRC

In introductory remarks at the conference, Nuclear Regulatory Commission (NRC) Chairman Gregory Jaczko noted, "A decade ago, I doubt many people inside or outside the NRC would have foreseen any significant increase in new reactor applications. Even five years ago, the outlook for new reactors remained uncertain."

Now, said Jaczko, times have changed, and the NRC is prepared to deal with the challenge of licensing new reactors under its untested combined construction and operating licensing (COL) process. The regulatory agency, he said, "is well-prepared to continue completing licensing reviews in an efficient and predictable manner."

The nuclear industry pushed hard for the new COL process for many years. In a speech in February to Wall Street analysts, Nuclear Energy Institute President and CEO Marvin Fertel said that, as a result of regulatory changes, financial incentives, and excellence of operations at nuclear plants, 2010 looks to be a "transformational" year for the industry. "We have nothing less than a new political mandate for nuclear energy," Fertel said.

The new regulatory regime is going to put advanced planning and staging in the forefront of plant construction, Tye said. "The licensing process is all different" than the way it was in the last cycle of nuclear construction, he noted.

The "way the new process is designed to some extent drives way the plant gets delivered," Tye said. The combined license means that all design must be done before the NRC will grant a license. That, in turn, means that a lot of equipment must be bought and ready to be delivered in advance of breaking ground. Construction, he said, will occur "more quickly" and will "peak more rapidly" than in the old days. The prior construction model involved a lot of "design on the fly," said Tye, "but that can’t happen now." There will have to be design certainty "before construction begins."

In his talk at the Platts conference, NRC’s Jaczko focused on serious supply chain challenges — including fuel cycle issues — that arrive in a new nuclear boom, if it occurs. "In the next few years," he said, "the agency anticipates as many as 24 applications for new uranium recovery facilities or requests to expand or restart uranium recovery facilities." When it comes to in situ recovery (from tailings piles left from previous mining), Jackzo said the NRC "has sought to make our environmental review more efficient and effective," including a generic environmental impact statement to provide "a starting point" for site-specific reviews.

Show Me the Money

While Fluor’s Chris Tye stressed the need to avoid the errors of the past when it comes to nuclear generating plants, John Reed, CEO of Concentric Energy Advisors Inc., a nuclear consulting firm, warned that there are signs of the recurrence of past problems. He laid out five areas that concern him:

-

Commodity cost changes have taken cost estimates on a ride.

-

Design/scope changes are being re-priced.

-

Demand reduction will lead to deferrals.

-

Cost recovery challenges are coming.

-

Regulators are facing public opposition to rate hikes.

Reed’s concerns are already surfacing in the general media. A Washington Post article ("Nuclear Projects Face Financial Obstacles," March 2, 2010) published following the Platts meeting, reported, "Hopes for a nuclear revival, fanned by fears of global warming and a changing political climate in Washington, are running into new obstacles over a key element — money."

The newspaper article noted that consumers, including large businesses, and environmental groups are already raising objections in states where new nuclear projects have won regulatory "construction work in progress" (CWIP) financing, which begins charging consumers for the price of the new generating project well before it comes into service.

CWIP was a major sticking point in the first nuclear go-round of the 1970s and 1980s, when consumers were saddled with costs for plants that were, for a variety of reasons, including economic, cancelled. "It’s a terrible idea," Jim Clarkson, a consultant with Resource Supply Management, a Georgia firm that advises companies on how to reduce electricity use, told the newspaper. "We’ve had decades of subsidies for nuclear plants and all sorts of preferential treatment. They still require loan guarantees because the smart money won’t touch them."

Preventable Problems

Performance issues also continue to dog the nuclear power industry, although it has vastly improved the way it runs its plants from the miserable days of the 1980s.

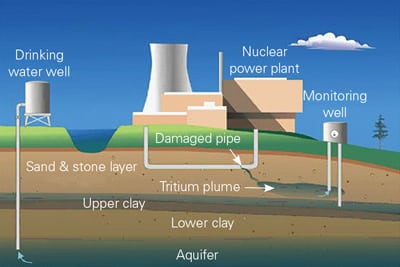

The latest problem has been at Entergy’s Vermont Yankee plant, a relic from the early 1970s (Figure 3). The 540-MW General Electric boiling water reactor (BWR), licensed to operate in 1972, has was leaking radioactive tritium offsite until repairs were made in late March (see sidebar).

3. Tainted reputation. Vermont Yankee is battling Vermont residents for approval of a 20-year license extension. Leaking tritiated water from the plant has further alienated residents, even though there are no public health effects. Courtesy: NRC

As a result, the company now faces possible state criminal charges related to plant officials possibly having lied under oath about the pipes carrying tritium. And the Vermont state senate has voted overwhelmingly to oppose Entergy’s proposed 20-year license extension for the plant at the NRC. If that vote stands, under Vermont law the plant would be forced to shut down in 2012.

The Vermont vote has implications beyond the Green Mountain State. Entergy tried for several years to spin off six of its reactors — merchant plants acquired after the collapse of electric utility restructuring a decade ago — into a publicly traded nuclear generating company dubbed Enexus. The convoluted financing of the deal stalled approvals in Vermont and New York. On March 25, the New York Public Service Commission rejected the spin-off plan, unconvinced that customers would benefit and concerned about the new company taking on too much debt. According to Vermont Public Radio, the tritium issue at Vermont Yankee and the state senate vote complicated the deal further.

Finally, on April 5, Entergy announced it would cancel the proposed spinoff transaction because of the potential for a protracted legal process.

NRC Chairman Jaczko made note of the Vermont tritium issue in his remarks at the Platts conference. "The headlines have not been pretty," he said. "As a scientist, I know the relative risk of tritium. In the grand scheme of radiation, it is well down the scale, but in the area of public perception, it takes on greater significance."

Jaczko added that the Vermont Yankee problem echoed an earlier problem at the Oyster Creek plant in New Jersey, an iconic GE BWR that went into service in 1969 and the oldest reactor now in commercial service. Oyster Creek also had offsite tritium leaks. "That episode told us great deal about how buried pipe behaves over the years," he said, "and the importance of ensuring that the right piping is installed in the first place."

In other words, as Fluor’s Chris Tye advises, get it right the first time.

—Kennedy Maize is a POWER contributing editor and executive editor of MANAGING POWER, www.managingpowermag.com.