Utilities are spending billions of dollars on nuclear plant uprate projects, and Southern Company has been offered $8.3 billion in federal loan guarantees to build Vogtle Units 3 and 4 (although the final deal has yet to be signed). Meanwhile, other nuclear developers have slashed preconstruction spending as the cost of the “nuclear renaissance” becomes evident.

The much-discussed U.S. nuclear renaissance promises to deliver tens of billions of dollars in equipment purchases and construction and after-market services work. However, during 2010 the nuclear renaissance has proceeded at a far slower pace than its supporters had hoped. Not even hotly debated concerns over climate change have jump-started the U.S. nuclear industry.

The nuclear industry has taken important steps over the years to position itself for future growth. The one-stop, combined construction and operating license (COL) process being used by the U.S. Nuclear Regulatory Commission (NRC) is a significant improvement in streamlining the licensing of nuclear power projects by providing advanced certification of standardized reactor designs. In addition, nuclear utilities, national craft labor organizations, and engineering, procurement, and construction (EPC) firms have been working collaboratively to ensure that there is an adequate supply of skilled craft labor to build the next generation of nuclear power plants.

Tough Getting Traction

Yet nuclear power remains a bet-the-company proposition, stubbornly resistant to efforts to manage its costs, risks, and delays. Nuclear power remains the highest cost new-build option for utilities: At an estimated $6 million per megawatt in the U.S., the installed cost of a nuclear generator is about six times the cost of a new-build natural gas–fired plant and about four times the cost of building a coal-fired generator with traditional environmental controls for SO2, particulates, and NOx.

The enormous cost and financial risk to a single company to begin building a new generation of nuclear plants makes the federal nuclear loan guarantees essential. Even so, there is much built-up industry frustration caused by the federal government’s unwillingness or inability to commit to offering all of its authorized total of nuclear loan guarantee funds. The original loan guarantee program was approved as part of the Energy Policy Act of 2005.

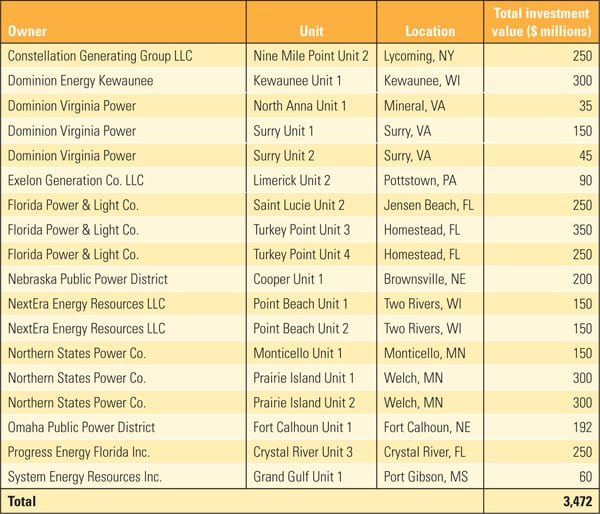

Today, EPC firms and subcontractors are staying very busy refurbishing and incrementally uprating the U.S. fleet of nuclear reactors. Many nuclear utilities are opting to invest tens of millions, or even hundreds of millions of dollars, to increase the output of existing nuclear reactors by between 3% and 20%. Industrial Info Resources is tracking nearly 20 separate nuclear uprate projects across the U.S. that have a total investment value of about $3.5 billion (see table). Some of these projects are well under way, while others are scheduled to begin in future years. A complete list of uprate projects approved or under consideration by the NRC can be found at http://www.nrc.gov/reactors/operating/licensing/power-uprates.html or http://tiny.cc/bt5o5.

|

| U.S. nuclear power plant uprate projects. Across the U.S., owners of nuclear power facilities have announced about $3.5 billion in a variety of uprating projects to increase the generating capacity of their plants. Source: Industrial Info Resources |

Promising Projects

During 2010, the nuclear industry’s high point was the Department of Energy’s decision to award Southern Company $8.3 billion in construction loan guarantees to begin construction of the first new U.S. nuclear plant in decades. Southern and its co-owners will build Vogtle Units 3 and 4 on the same Georgia site as Vogtle Units 1 and 2. Southern will use the NRC-certified Westinghouse AP1000 reactor for the new units, which will cost an estimated $14 billion. Vogtle Unit 3 is scheduled to begin operations in 2016, while Unit 4 is slated to begin generating electricity one year later. (Ed.: See “Plant Vogtle Leads the Next Nuclear Generation,” Nov. 2009 in our POWER archives at https://www.powermag.com.) Vogtle Units 3 and 4 are owned by Southern Company, Oglethorpe Power, MEAG, and Dalton Utilities.

Southern representatives have said the utility was committed to building Vogtle Units 3 and 4 with or without federal loan guarantees, but the details of the loan guarantee commitment have been under negotiation since the February announcement. Preliminary site work for the units began in late 2009, but actual construction cannot begin until Southern receives a COL from the NRC. Even so, the first reactor parts began arriving on site in early September.

Other utilities, including NRG Energy, Constellation Energy, and SCANA, were shortlisted for the pot of $18.5 billion in federal loan guarantees in mid-2009. That left those utilities scrambling for the remaining $10.2 billion in guarantees, and it’s unclear how the remaining allocation will be apportioned. A legislative proposal to add tens of billions of dollars in additional loan guarantees earlier this year failed before a suddenly budget-conscious Congress.

The owners of the South Texas Project (STP) Units 3 and 4 have touted their plan to use advanced boiling water reactor technology in their project. “It’s the only Nuclear Regulatory Commission–certified design that is fully engineered with a history of on-time, on-budget construction and superb operating results upon startup,” said Steve Winn, chief executive of Nuclear Innovation North America (NINA), the nuclear development company owned by NRG Energy and Toshiba.

In early 2010, NINA and CPS Energy, the San Antonio, Texas, municipal utility that owns a stake in STP Units 1 and 2, finalized a very public and acrimonious split over ownership of the planned STP Units 3 and 4. At issue were the dramatic price increases for the new units. The other co-owner of STP Units 1 and 2, Austin Energy, had already decided not to exercise its option to buy a stake in the expansion.

Then, in the spring, Tokyo Electric Power Co. agreed to invest up to $280 million in STP Units 3 and 4 once the project secures a DOE nuclear loan guarantee. But this summer, NRG Energy dramatically reduced its outlays on preconstruction site work at Units 3 and 4 from roughly $7 million per month to about $1.5 million per month. Toshiba is acting as the EPC for the 2,700-MW expansion project.

NRG Energy first applied to the NRC for a COL for STP Units 3 and 4 in 2007, expecting to receive its license by 2010 and anticipating that the new units would begin generating electricity in 2014 and 2015. Now NRG Energy estimates that it will receive its COL by 2012 and that Units 3 and 4 will begin generating electricity in 2016 and 2017, respectively. Unlike Southern’s Vogtle expansion project, NRG Energy has made it clear that building its new nuclear units will depend on receiving federal loan guarantees.

Meanwhile, on the East Coast, UniStar Nuclear Energy, a 50:50 joint venture between Constellation Energy Group and French utility EDF, this summer scaled back preconstruction spending for Calvert Cliffs Unit 3, a merchant plant on which the owners have already spent more than $600 million.

Calvert Cliffs Unit 3, a 1,600-MW generator using Areva’s EPR reactor design, would be built on the same Chesapeake Bay site as Calvert Cliffs 1 and 2. If UniStar receives a COL from the NRC in mid-2012, as it hopes, the unit should be ready to produce electricity by the end of 2017.

However, in a July conference call with financial analysts, Constellation Chairman Mayo A. Shattuck warned that the new generator could be in jeopardy if the project doesn’t receive federal loan guarantees by year-end 2010. “We can’t keep going at the rate that we’re going without clarity on the loan guarantee,” Shattuck said. “Time is a little bit of our enemy at this point.”

— Britt Burt (bburt@industrialinfo.com) is vice president of research and Shane Mullins (smullins@industrialinfo.com) is vice president of product development for the power industry at Industrial Info Resources (http://www.industrialinfo.com) in Sugar Land, Texas.