Norwegian Group Buying Vietnam Wind Farm. Norway’s SN Power AS in November agreed to purchase 100% of the shares in the 39.4-MW Dam Nai Wind Power project in Vietnam from Mekong Wind Pte. Ltd., a group owned by the Singapore-based Armstrong South East Asia Clean Energy Fund. Dam Nai Wind is located in the Ninh Thuan province in the southern part of Vietnam. The region is known as the “renewable energy capital” of the country. The wind farm, built in two phases that opened in October 2017 and December 2018, respectively, features 15 Siemens wind turbine generators, each with a rated capacity of 2.625 MW. The farm has expected annual revenues of about $10.5 million under the 20-year feed-in tariff scheme for wind in Vietnam. The project has been financed by non-recourse debt from the Bank for Investment and Development of Vietnam. The deal is expected to close in the first quarter of 2021. Norway’s Scatec Solar, meanwhile, in October announced it was acquiring SN Power AS, a deal expected to close in the first half of next year. The Vietnam wind farm will now be part of that acquisition.

Hydro Projects Come Online in Russia. Russian hydropower developer PJSC RusHydro in mid-November announced it had inaugurated the 5.6-MW Ust-Dzhegutinskaya hydropower plant in Karachay-Cherkessia Republic in Russia. The project, engineered by Hydroproject Institute, is expected to have annual average electricity output of 25 GWh. It is equipped with two, 2.8-MW vertical hydropower units with radial-axial turbines. The electricity is supplied into the power system via 6-kV power lines to Golovnaya substation. The project is the second commissioned by RusHydro this year; the 10-MW Verkhnebalkarskaya hydropower plant in Kabardino-Balkarian Republic was brought online in June. Another project, the 5.25-MW Barsuchkovskaya facility in the Stavropol region, is expected to be commissioned by year-end.

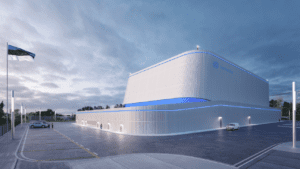

Battery Project Announced for Australia. The Australian state of Victoria, which has committed to sourcing 50% of its electricity from renewable sources by 2030, on Nov. 5 announced it will build what it called the “the largest battery in the Southern Hemisphere.” The state’s energy minister said the new lithium-ion battery will have a power capacity of 300 MW, with storage capacity of 450 MWh. Neoen, a French renewables company, signed an $84 million contract with Victoria and will build the battery using equipment from Tesla. The installation will be designed to provide backup power to the grid in an area that has been prone to blackouts. It is scheduled to come online in November 2021. The battery in part will help the region offset the expected closure of the 1,450-MW coal-fired Yallourn power station. “This is a game-changer for Victoria’s transition from old coal-burning power stations to clean energy,” Environment Victoria CEO Jono La Nauze said in a news release. The installation, near Geelong, will be more than twice the size of the storage installation at Hornsdale, South Australia, which was the world’s largest when it entered operation in 2017. Neoen won the right to build the Victoria battery through a tender run by the Australian Energy Market Operator. The company’s contract runs until 2032. The battery will provide backup power, along with network services needed to support renewable energy, including fast frequency control.

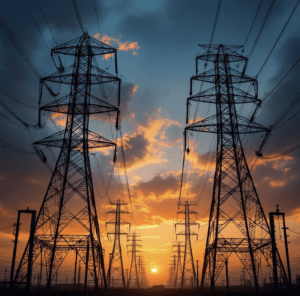

Power Link Between Belgium, Germany Comes Online. Germany and Belgium in November inaugurated the first power interconnector between the two countries. The 1-GW Alegro link is set to provide intraday capacity beginning in early December. Long-term capacity auctions will begin in 2021, according to Amprion, the transmission system operator. Alegro is a 90-kilometer high-voltage, direct-current underground cable connecting the Aachen and Liege regions. Testing of the link began in October; it was inaugurated in a ceremony at Aachen on Nov. 9. Integration of the link into flow-based market coupling (FBMC) across parts of Europe coincides with the start of a new power balancing regime by Germany’s transmission system operators, as they seek to improve the region’s electricity balancing. Belgium is working to ensure a steady supply of electricity as it plans to shut down its nuclear reactors no later than 2025. Belgium’s nuclear fleet has 6 GW of generation capacity; government data showed nuclear power supplied 43% of the country’s electricity at the start of November. The government has said it will make a final decision on the fate of its nuclear fleet by November 2021, as it assesses whether the country will have a secure supply of electricity. Government officials have said they could provide lifetime operating extensions to at least two reactors if needed.

Toshiba, Next Kraftwerke Have VPP Deal. Toshiba’s energy business in early November announced plans for a joint venture with Next Kraftwerke, the German developer of virtual power plants (VPPs), as the companies prepare for the opening of Japan’s grid control reserve market in April 2021. Toshiba will hold a 51% controlling stake in the $1.73 million deal. The companies said they will offer support services to owners of renewable energy assets that are looking to participate in the control reserve market. That market will pay power generators for grid frequency balancing services. Toshiba said the joint venture will utilize Next Kraftwerke’s expertise in forecasting and energy trading to help market entrants minimize the risk of grid imbalance, and maximize earnings from the wholesale power market along with power purchase agreements. Japan’s renewables incentives program is scheduled to move from a fixed feed-in tariff system to a feed-in premium system in April 2022. Toshiba in a news release said Next Kraftwerke already has experience in feed-in premium clean energy markets in Europe.

—Darrell Proctor is associate editor for POWER (@POWERmagazine).