NuScale Power, Fluor Corp., and Utah Associated Municipal Power Systems (UAMPS) have executed a series of major agreements to prepare for licensing of the Carbon Free Power Project (CFPP) at Idaho National Laboratory (INL) in Idaho Falls, effectively driving forward the nation’s first small modular reactor (SMR) plant.

Fluor Corp., the majority investor in NuScale Power, on Jan. 11 said Utah state energy services intermodal agency UAMPS awarded the company a “cost-reimbursable development agreement to provide estimating, development, design and engineering services” for the CFPP. Portland, Oregon–based NuScale, which has also signed a development cost reimbursement agreement with UAMPS, noted separately on Monday that agreements it signed as a Fluor subcontractor will allow it to develop “higher maturity” cost estimates and initial project planning work for the licensing, manufacturing, and construction of the CFPP.

While the orders mark “the next major step in moving forward” with commercialization of NuScale’s SMR technology, and will be important to management and de-risking of the CFPP, they aren’t actual orders for the company’s NuScale Power Modules (NPMs). “This is the first step in a prudent deployment plan that could result in the order of NuScale Power Modules in 2022,” NuScale Chairman and CEO John Hopkins noted on Monday.

UAMPS confirmed to POWER on Monday that the agreements kick off preparation of a combined license application (COLA) for the CFPP, which could comprise several NPMs. But while the agency’s 27 participating members continue to target a 2029 operational date for the first module, all plant configuration options “are currently being evaluated,” it said.

An Option to Downsize

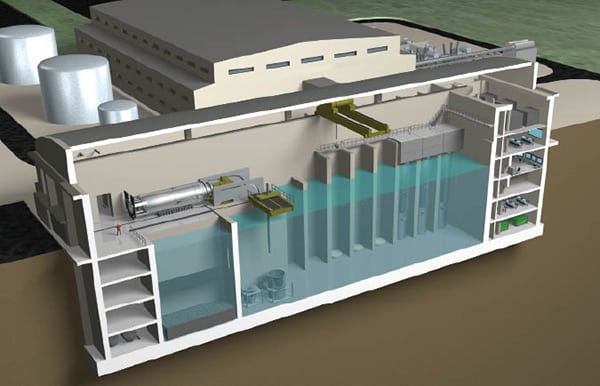

As originally envisioned, the CFPP was to be built as a 12-module, 720-MWe project. In November, NuScale determined its NPM can generate 25% more power per module, boosting its capacity from 60 MWe to 77 MWe. NuScale also launched two smaller plant solutions—a four-module plant of about 308 MWe, and a six-module plant of about 462 MWe—to provide its potential customers more options in terms of size, power output, operational flexibility, and cost.

UAMPS, NuScale’s first potential customer, told POWER in November that the power increase and new plant solutions gives the CFPP much-needed flexibility and could facilitate plant downsizing. “UAMPS will evaluate the possibilities of building a [308-MWe] 4-module or [462-MWe] 6-module plant instead of a 12-module plant,” it said.

NuScale said on Monday that UAMPS will continue evaluating the size of the CFPP as Fluor “refines the engineering of alternatives to ensure that the plant is the best overall cost of energy and size to meet the CFPP participants’ subscription needs.”

UAMPS, notably, wrapped up the first phase of the CFPP on Oct. 31, securing financial commitments for a potential 720-MW plant from 27 of its 48 members, which are mostly cities in Utah but also scattered across California, Idaho, Nevada, New Mexico, and Wyoming. During the tumultuous first phase, at least eight cities—Lehi, Logan, Murray, Kaysville, Bountiful, Beaver, Heber, and Salmon River Electric—dropped out of the the project, and at least one, Idaho Falls halved its share. The withdrawing cities cited a long list of reasons for their reluctance to commit to the project, but costs—which could increase for remaining subscribers—and uncertainty led their concerns.

As POWER has reported, the originally envisioned 720-MWe CFPP was estimated to cost $6.1 billion, and UAMPS is expected to shoulder $4.76 billion of that figure, which is based on a Class 4 estimate (and could decrease by about 10% or increase by 30%). The Department of Energy (DOE) will fund the remaining $1.355 billion through an award announced on Oct. 16. The award, which will be subject to yearly Congressional appropriations, replaces the DOE’s Joint Use Module Plant (JUMP) program, which would have seen the DOE lease and operate the first module for 10 years.

UAMPS, however, has maintained that the “most important” cost-associated figure for the project is its levelized cost of energy (LCOE) over 40 years, which hovers around $55/MWh.

“The orders executed today allow for important progress in the development of the Carbon Free Power Project, and we are excited to take this next step alongside our partners NuScale Power and Fluor Corporation,” Doug Hunter, UAMPS’ CEO and general manager, said on Monday. “We are confident that NuScale’s small modular reactor will deliver affordable, stable, carbon-free energy to participating members, complementing and enabling large amounts of renewable energy in the region.”

A Partnership to Pursue Licensing

NuScale, which is eyeing a 2027 technology delivery timetable, has already marked notable licensing in-roads. On Aug. 28, 2020, NuScale’s 50-MWe (160 MWth) module became the first SMR to receive a final safety evaluation report (FSER) from the Nuclear Regulatory Commission (NRC) as part of a Phase 6 review—the last and final phase—of NuScale’s Design Certification Application (DCA).

The NRC will review the latest power uprate as part of a Standard Design Approval (SDA) application, which NuScale has said it could submit in 2022. Though NuScale has not yet made a final decision on the size or configuration that will be reflected in the SDA application, it has said it could seek approval of 250 MWth modules.

Neither an SDA nor a DCA, however, constitute approval to build or operate a reactor, as the NRC notes. Full certification essentially only allows a nuclear plant developer to reference the design when applying for a COLA to build and operate a plant. In November, Diane Hughes, NuScale vice president of Marketing & Communications, told POWER that NuScale and UAMPS were mulling using the NRC’s 10 CFR, Part 52, subpart E process, which she noted “has been used for all new designs to date.”

Under that process, the SDA application must be submitted with or before a COLA, but the SDA must be approved before the COLA. “Those approvals can be close together (that is, within weeks),” she said. However, “Not all construction activities must wait for approval of the COLA. Some general construction, and under an NRC-approved limited work authorization (LWA) some nuclear-related construction, can occur in the period prior to approval of the COLA,” she said.

For now, UAMPS expects to submit a COLA to the NRC by the second quarter of 2023. The regulator’s review of the COLA is expected to be completed by the second half of 2025, with nuclear construction of the project beginning “shortly thereafter,” NuScale said.

Fluor Optimistic About NuScale Despite Recent Strategy Shakeup

Fluor, meanwhile, has strengthened efforts to push the NPM toward commercialization, even as it shakes up its core business strategy.

In November, the company teamed with another engineering giant Sargent & Lundy to collaborate with joint marketing and design services for the the execution of new NuScale Power small modular nuclear reactor plants in North America.

In December, in line with some major power sector engineering, procurement, and construction firms, Fluor told POWER it was no longer active in the power generation market “other than its investment in NuScale Power.” And on Monday, Fluor also announced it plans to divest its maintenance services business to Stork, a global technology company it acquired in 2016. While more details about the divestment will be announced during Fluor’s Jan. 28 Strategy Day event, the company said, “As a result of our strategic review, we have determined that maintenance services no longer fits within Fluor’s core service portfolio.”

Fluor’s executives have expressed support for NuScale’s pioneering efforts in the SMR market, though, according to the company’s December–released 2020 third-quarter report, delays in investment decisions have proven costly to the company. “In regards to NuScale, while we previously stated 2020 expenses would be fully funded by investors, investment decision delays due to the pandemic have required Fluor to provide $15 million of the funding in the third quarter,” said Fluor Executive Vice President and Chief Financial Officer Joseph Brennan in a Dec. 10 earnings call.

But Alan Boeckmann, Fluor’s executive chairman, noted in that call that events over the past six months of 2020 were “incredibly positive for the NuScale business and its development.” Along with the NRC’s FSER approval in August, the International Development Finance Corporation (DFC) in July announced lifting a prohibition on lending for nuclear projects internationally. “That has gotten a lot of attention and has resulted in probably two fairly good opportunities to turn into projects here within 2021,” Boeckmann said. In October, notably, the DFC announced it had signed a letter of intent to support the development of 2.5 GW of NuScale modules in South Africa. The DOE’s October-announced $1.4 billion grant for UAMPS also served as a lift, he said.

“So, the project side is starting to look good, but also, we’re having very serious discussions with investors who want to come into the equity side of NuScale. So, both sides of the equation are looking strong right now. The timing is the issue and getting—bringing—these projects onboard as well as investors onboard is taking a lot of our attention,” he added.

Political winds also appear favorable, Boeckmann noted. “It’s interesting that NuScale really got its boost and started moving forward under the Obama administration with Secretary Moniz as the head of DOE. And we’ve seen even during this last administration a very strong bicameral support for this effort,” he said. “So, we don’t think that will change at all. In fact, if anything, it may get a little bit extra push.”

On Monday, Boeckmann noted that Fluor “has been a preeminent player in the nuclear industry for 70 years.” Today, the company is “well positioned to assist UAMPS and the DOE to accomplish their objectives to provide carbon-free energy for its customers and to deploy a commercially viable small modular reactor with safety, security and performance characteristics that exceed the operational capabilities of current certified designs,” he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).