The Indiana Office of Utility Consumer Counselor (OUCC) has said it is concerned that Duke Energy has not demonstrated any “budgetary constraints” on the Edwardsport integrated gasification combined cycle (IGCC) project under construction near Vincennes, Ind. And, in a reversal of position, the state agency representing utility ratepayer interests recommended that the Indiana Utility Regulatory Commission (IURC) should not approve the company’s request for cost recovery for more than $2.35 billion.

Compared to the original project estimate of $1.985 billion, Duke’s most recent revised cost estimate for the project is $2.88 billion—an increase of 45%, the OUCC said. “Duke should no longer have a direct and endless line of project funds supplied solely by the ratepayers. Duke shareholders should bear some of the risks,” Barbara Smith, OUCC director of the Resource Planning and Communications division, testified on July 1 to the IURC.

Smith alleged that “there appears to be a lack of responsibility or accountability on the part of those causing these multi-million dollar cost overruns. In addition, there has been no evidence presented to indicate that Duke management, or any other entity, has conducted any kind of timely prudency review regarding these cost overruns.”

The OUCC was initially supportive of the Duke IGCC project because, compared to a pulverized coal facility or other generation options, it also addressed environmental concerns and “and included the promise of carbon capture and sequestration at the project site,” she told the commission.

“The OUCC agreed that Duke’s most recent [integrated resource plan] supported a need for baseload generation. Duke chose to address that need by building a coal-fired facility. Indiana remains a coal-rich state and the governor’s Homegrown Energy Strategy places an emphasis on clean coal as a part of the future solution to Indiana’s energy needs,” she said. “The OUCC continues to support this objective.”

But, she alleged, just six months after it was granted a certificate of public convenience and necessity (CPCN) in 2007, Duke requested approval of a new cost estimate of $2.35 billion. Duke also then testified—contrary to a previous position in its original CPCN proceeding—that the Edwardsport site was not conducive to carbon sequestration/storage.

In November 2009, Duke forecast a cost increase for the project, saying the project would cost $2.5 billion. In April 2010, it updated the cost estimate yet again to $2.88 billion, she said.

Duke Energy Indiana, the OUCC, the Duke Energy Indiana Industrial Group, and Nucor Steel in September entered into a settlement agreement, but the agreement was withdrawn later, in December. Smith testified that the OUCC supported withdrawal of the agreement after a scandal broke implicating Duke Energy Indiana and the then-chairman of the IURC.

“Second, while investigating the records pertaining to the improper communication, additional information was discovered regarding Duke’s imprudent project management, raising questions about whether Duke’s actions constituted fraud, concealment, and/or gross mismanagement,” Smith testified. The commission was probing into whether Duke was prudent in its actions that resulted in the $550 million cost estimate increases and whether its actions constituted fraud in two separate sub-dockets, she said.

Duke Energy refuted the OUCC’s allegations. “We have prudently and diligently managed Edwardsport costs, and we’re focused on completing a project that is now about 90% done,” Duke Energy Indiana spokesperson Angeline Protogere told POWERnews. “We recognize the importance of managing the cost impact for customers, which is why we’ve proposed capping the plant’s construction costs that customers pay. If our proposal is approved by regulators, the near-term rate impact to customers would be approximately the same level as it would have been under the previous cost estimate.”

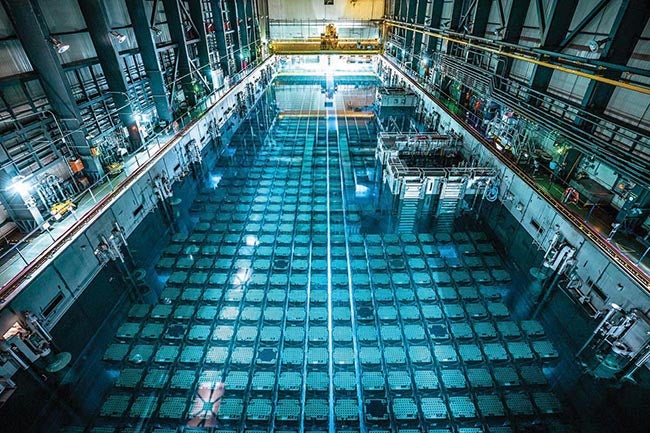

Construction of the IGCC project—factoring in aspects such as procurement and engineering as well as construction—is about 90% complete, and the project is on track to begin commercial operation in September 2012.

Sources: POWERnews, OUCC, IURC, Duke Energy Indiana