The new year always provides a great opportunity to take a look back to see what POWER got right (or wrong) in our previous industry forecast. More importantly, it gives us a chance to look ahead.

Some things that happened in 2024 were easy to predict. For example, record growth in solar power installations was widely expected going into the year, and the industry didn’t disappoint. Although the data has not been finalized yet, the American Clean Power Association (ACP) expects more than 32 GW of solar installations will be installed in the U.S. in 2024, surpassing the previous record set just a year earlier. The exceptionally high installation total was boosted by a requirement that modules imported during the anti-circumvention tariff moratorium be placed in service by December 2024. ACP said installations in 2025 will likely be 16% lower than in 2024, but it was optimistic that the market will recover fairly quickly and experience a 6.6% compound annual growth rate (CAGR) through 2030.

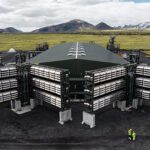

Another big development that occurred in 2024 revolved around artificial intelligence (AI) and data centers. I wouldn’t say POWER got this wrong per se, I just didn’t address the topic in our previous forecast. During the year, the growth in AI platforms and usage, and the projected expansion of data center capacity needed to support the trend, became a major focus of the power industry. Tech companies including Microsoft, Google, and Amazon began looking to nuclear power to supply their data centers, which was a welcome boost for the nuclear power sector.

Yet, announcing plans to build plants and actually commissioning units on time and on budget are two separate things. Many skeptics doubt that new nuclear projects will meet aggressive cost and schedule projections, and it’s hard to argue with the naysayers based on past history. Still, a lot of money is at stake both from government and private sources, so companies will be focused on delivering successful projects in the years to come.

Prospects for Solar Continue to Shine

As previously mentioned, U.S. solar installations are expected to decline year over year, but that will have little consequence on global solar growth. BMI, a unit of Fitch Solutions, said in a report published in late November that it expects solar power to remain the fastest-growing technology worldwide. It predicted the average annual growth rate for solar would be 12% from 2024 to 2033. Most of this growth is expected to occur in the Asia-Pacific (APAC) region, dominated by Mainland China followed by India and Japan. BMI said APAC will account for 74% of global solar capacity additions during the period, with North America and Western Europe accounting for 18% of additions over the timeframe. “Over the next decade, we expect solar power to remain the largest growth technology globally accounting for over 5,890 GW by 2033,” the report says.

The source of growth is expected to shift in coming years, however. The report says utility-scale projects (Figure 1) will decline in prevalence over the next decade, and growth in distributed solar installations will be key to the industry’s continued dominance. “Policies like subsidies and tax credits will boost distributed solar adoption in large markets like the U.S., China, and India, while emerging regions like sub-Saharan Africa and Latin America will also see distributed solar growth to enhance energy security,” the report says.

|

|

1. The Oberon Solar + Storage project, located in Riverside County, California, is a utility-scale facility completed in November 2023. The site generates 679 MWp/500 MWac of solar energy and also features 250 MW/1 GWh of co-located storage. Courtesy: Intersect Power |

In a separate report focused on solar investment opportunities, BMI called out Australia and Oman as its “solar power outperformers.” It expects Australia to have “one of the largest solar capacity additions over the coming 10 years,” and it said Oman would have an “average annual capacity growth rate of 37.0% over the same period.” Notably, BMI said Mexico was a market to beware of. “Mexico’s solar power growth is showing signs of slowing, after strong double-digit capacity growth rates from 2019 to 2023. We forecast that the market will experience slightly less than 5.0% growth rate in capacity for the coming 10 years,” the report says.

Meanwhile, a report published in October 2024 by the Energy Markets and Policy Department at the Lawrence Berkeley National Laboratory (LBNL) found that installed costs for solar in the U.S. continued to fall in 2023 relative to 2022. The report says capacity-weighted averages decreased by 8% to $1.43/WAC (or $1.08/WDC). “Costs, based on a 7.1 GWAC sample of 76 plants completed in 2023, have fallen by 75% (averaging 10% annually) since 2010,” it says. The levelized cost of energy (LCOE) of new 2023 solar projects increased slightly to $46/MWh prior to the application of tax credits, but continued to fall to $31/MWh when accounting for federal incentives.

Looking ahead, LBNL researchers found a massive pipeline of at least 1,085 GW of solar capacity in the U.S.’s interconnection queues at the end of 2023. Nearly 571 GW (53%) of that total was paired with batteries. Remarkably, in the California Independent System Operator’s queue, the percentage of solar-plus-battery projects was a staggering 98%, the report says. However, it must be noted that historically only about 10% of requested solar capacity has ultimately been built.

Executives Optimistic About U.S. Manufacturing

Lie Shi, CEO of AM Batteries, a Billerica, Massachusetts–headquartered equipment supplier that has developed a dry-electrode manufacturing technology for lithium-ion battery manufacturers, expects “Made in America” to become a major theme in the clean-tech space. “Despite the uncertainty, the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL) will endure,” Shi said. “First, they are legislatively challenging to dismantle. And second, 75% of the grants have been allocated to Republican districts, with 50% awarded in swing states, ensuring—if somewhat tenuous—bipartisan support.” Shi expects the new Trump administration to build “physical and financial walls” around the U.S. that will attract investment to the states.

Eric Dresselhuys, CEO of ESS Inc., a manufacturer of long-duration iron flow energy storage solutions, conveyed a similar message. “Fortunately, delivering a secure, lower-emission energy system is a goal shared by Republicans and Democrats. Today, lower-emission energy technologies make the most economic sense in many cases: Wind, solar, and energy storage are among the lowest-cost sources of new generation. The incoming administration’s focus on American manufacturing presents an opportunity to meet that growing demand with American-made energy infrastructure—a win for good jobs at home and for American manufacturers’ competitiveness globally,” Dresselhuys told POWER.

The effects are already being seen. Solar cell manufacturing resumed in the U.S. during the third quarter (Q3) of 2024 for the first time since 2019, marking a pivotal moment for America’s surging solar sector. A report released in early December by the Solar Energy Industries Association and Wood Mackenzie says the U.S. added a record-breaking 9.3 GW of new solar module manufacturing capacity in Q3 2024. It says five new or expanded factories in Alabama, Florida, Ohio, and Texas brought total U.S. solar module manufacturing capacity to nearly 40 GW.

“Our current outlook for the next five years has the U.S. solar industry growing 2% per year on average, reaching a cumulative total of nearly 450 GW by the end of 2029,” Michelle Davis, head of solar research at Wood Mackenzie and lead author of the report, said in a statement.

The Trump Effect

While a complete repeal of the IRA may be unlikely, partners with the global advisory firm Baringa believe the Trump administration will attempt to adjust provisions in the law. With Republicans controlling both chambers of Congress, President Trump should face little difficulty doing so.

Tom Harper, an expert in U.S. Power Markets with Baringa, and Nick Forrest, an expert in Policy and Economics with Baringa, studied historical Republican amendments to the IRA, among other things including failed bills, to get an understanding of what provisions could be targeted by GOP lawmakers. Based on their review, building energy efficiency rebates could be repealed, the availability of electric vehicle (EV) subsidies could be restricted, and the availability of manufacturing credits to foreign entities of concern could be limited. “These are designated by the Secretary of State and could be used to sanction firms associated with China,” the two experts wrote in a November-issued report they co-authored. They also suggested the Clean Hydrogen Production Tax Credit could be at risk.

“In addition to revising IRA stipulations, Trump can also reduce the efficacy of the IRA through influencing the processes within federal agencies. This is likely to involve a tightening on clean energy loan approval requirements and an extension of loan approval timelines, hence slowing renewables development for those not yet approved,” the report says. Notably, while many new clean energy loan commitments were made under the Obama and Biden administrations, no new clean energy loans were approved during President Trump’s previous term.

Baringa’s experts said Trump (Figure 2) branded China “a currency manipulator” during his first term and used trade tariffs to protect domestic industry, which the administration felt leveled the playing field to some extent. Biden continued and expanded the trade tariffs on China, for example, by upping 25% tariffs on Chinese solar cells to 50%. The report suggests Trump could take the tariffs to 60% or more in his second term. Similar steps could be taken on Chinese lithium-ion batteries, according to the report. Green tech is clearly “in the firing line,” it says.

|

|

2. Entering his second term, President Trump has the experience and know-how to manage his energy agenda more effectively from his seat in the Oval Office. Source: The White House |

The change in administration is expected to affect the power industry in several other ways, although not all are direct. For example, Trump expanded liquefied natural gas (LNG) export capacity in his first term and has indicated he supports further capacity growth in his second term. Baringa estimates there is about 30 million tonnes per annum of unmet U.S. LNG demand in the global market, which could easily be met with approval of roughly 35% of the LNG capacity that exists in the current export terminal development pipeline. However, such action could result in higher U.S. natural gas prices, potentially affecting the power industry, at least in the near term.

Another aspect that could hurt the power industry involves cost of capital. “Trump’s economic policy is expected to be inflationary. He is proposing $7.5 trillion of additional deficit spending pumping domestic demand with an extension and expansion of tax cuts. Similarly, proposed trade tariffs will raise input costs in the U.S. economy. Combined these push up inflation expectations,” the report says. Barring some unusual action by the Federal Reserve, this would keep the cost of capital elevated for the foreseeable future.

Meanwhile, there are wheels in motion that the Trump administration will be hard-pressed to stop, most notably, the shift away from fossil fuels and toward clean energy. “Since 2005, the U.S. has been reducing CO2 emissions from fossil fuel usage at a little over 1% per year on average. This rings true across the Bush, Obama, Trump 45, and Biden administrations. Said differently, the train has left the station and the U.S. will continue to decarbonize over the coming years,” Dave Cherney, head of PA Consulting Group’s Energy Policy and Regulatory Engagement team, told POWER.

“This is not to say federal policy is not important to new clean energy development; it is a highly important factor. However, it is one of many important factors in the development of new energy resources. Others include state policy, market structure, power market economics, interconnection processes, and siting, among others. Driven by tight supply-demand conditions enhancing the relative economics, state policies, and corporate ESG [environmental, social, and governance] demand, we will continue to see significant clean energy development over the next four years,” Cherney said.

Demand from Data Centers

As alluded to earlier, data centers are expected to dramatically impact the power sector and the industry is taking note. “Globally, electricity demand for data centers is projected to double by 2030, according to reports by the International Energy Agency and other industry reports. This is primarily driven by growth in the number of IoT devices, AI, and cryptocurrency, and is forecasted to be in key regions around the world, including the U.S., Mexico, Western Europe, India, and Southeast Asia,” Mario Sawaya, vice president and leader of the Global Technology Market sector at AECOM, a global infrastructure consulting firm, told POWER.

“The impacts of increased data center consumption are being felt today. According to EPRI, between 2017 and 2021, electricity used by the major data center providers more than doubled,” Sawaya said. In a data center load growth assessment EPRI released in May 2024, it estimated data centers will consume up to 9.1% of U.S. electricity annually by 2030 versus an estimated 4% today. “This unprecedented growth in electricity demand is forcing the power industry to re-evaluate business as usual,” Sawaya added.

Yet, some observers believe the load growth forecasts around data centers are overblown. Nathan Blom, co-CEO at Iceotope Technologies and an expert on advanced liquid cooling technologies, said unprecedented demand for high-performance computing will continue, but the energy needed to support this may be less than expected. “Sustainability will command center stage in data center design and operations, as a necessity to efficiently utilize limited energy from the grid,” Blom asserted. “Liquid cooling will become the new standard for HPC [high-performance computing] and AI workloads, reducing energy use by 40% over current air-cooled environments.”

Amory Lovins, adjunct professor and adjunct lecturer in Civil and Environmental Engineering at Stanford University, and co-founder and chairman emeritus of RMI (founded as Rocky Mountain Institute), also believes there is large potential for efficiency gains. “I think help is on the way, and there’s history behind this,” Lovins said during a press briefing hosted by Hastings Group Media in early October. “[From] 2010 to 2018, the amount of data center computing done—in, I believe it’s the world—rose by 550%, and the electricity they used to do that rose by 6.5%. In other words, the efficiency gains almost completely offset the growth in activities.”

Lovins said NVIDIA, the dominant supplier of AI microchips, has achieved two to four orders of magnitude gains in system efficiency in each generation of their chips and firmware. “That’s already happened and a lot more like that on the way,” he presumed.

Still, many power companies must deal with data center power demand today and can’t wait for efficiency improvements to alleviate the problem. “The challenge for the grid owner is the ability to construct the facilities to serve the data center loads in the time frame that they’re requesting it. Utilities generally have not forecasted these significant loads coming online in the short time frame that data centers are requiring, so the infrastructure and capacity to serve them is not available,” Sawaya said.

The problem has come to a head in Central Ohio. Electricity demand in the region is expected to more than double by 2030, driven largely by data centers. In May 2024, AEP Ohio, an American Electric Power company, filed a proposal to reconcile the costs of infrastructure improvements required for Ohio’s growing data center industry. A settlement agreement was filed in late October.

The agreement, which is subject to review and approval by the Public Utilities Commission of Ohio, requires large new data center customers to pay for a minimum of 85% of the energy they say they need each month—even if they use less—to cover the cost of infrastructure needed to bring electricity to those facilities. It also creates a sliding scale that allows small- and mid-sized data centers more flexibility. Additionally, it requires data centers to provide proof they are financially viable and able to meet those requirements, as well as to pay an exit fee if their project is canceled or unable to meet the obligations outlined in the electric service agreement contract. The requirements would be in place for up to 12 years, including a four-year ramp-up period. The agreement also outlines a process to end the moratorium on new Central Ohio data center agreements.

“The issues and challenges are not unique to Ohio,” said Sawaya. “AEP Ohio has taken the unique approach of proposing an industry-specific tariff for data centers. This could have impacts not only to data centers, but could also set the precedent of establishing tariffs by industry rather than usage characteristics.”

—Aaron Larson is POWER’s executive editor.