Building new solar PV plants and wind farms, and supporting an expansion of electric vehicles (EVs) and green hydrogen as is planned to meet decarbonization goals, will dramatically expand demand for copper, nickel, cobalt, lithium, and rare earth elements. But the supply of these critical minerals is already fraught with risks, and that is raising serious concerns about their future availability.

According to the International Energy Agency (IEA), at the core of this dilemma is its assessment that the world’s energy system is rapidly morphing beyond its traditional fuel-intensive emphasis into a “material-intensive” system. But while fuel commodities—such as the hydrocarbon resources that have powered the world for decades—continue to be carefully monitored and balanced, little thought is given to the vast array of mined minerals necessary to support the required boom in clean energy. One reason may be that they are difficult to prioritize because the type and volume of mineral needs vary widely across the spectrum of clean energy technologies.

Solar PV. Mineral needs and intensities for solar PV plants—which typically comprise modules, inverters, trackers, mounting structures, and general electrical components—vary by module type. Today’s solar PV market is dominated by crystalline silicon (c-Si) modules, followed by the thin-film technologies that use cadmium telluride (CdTe), copper indium gallium diselenide (CIGS), and amorphous silicon (a-Si). c-Si technologies generally require about 5% silicon, 1% copper, and less than 0.1% of silver and other metals. Thin-film technologies require more glass but fewer minerals, mainly cadmium, tellurium, indium, gallium, and selenium. Distributed solar PV systems, which tend to have string inverters or microinverters, require 40% more copper than utility-scale projects. Combined, these requirements have massive implications for future supply.

If the world moves to triple its solar PV capacity by 2040 as the IEA has called for under its “sustainable development scenario” (SDS)—a scenario that meets the goals of the Paris Agreement—it will result in a “near-tripling” of its copper demand and ramp up production of silicon by 45% compared to 2020. The IEA, however, is optimistic that further progress on alternative technologies—including CdTe, perovskite solar cell, and new semiconducting materials—will counter current mineral projections for c-Si modules.

Wind Turbines. Wind turbines, which comprise a tower, a nacelle, rotors, and a foundation, require concrete, steel, iron, fiberglass, polymers, aluminum, copper, zinc, and rare earth elements. While gearbox double-fed induction generators dominate more than 70% of the current wind market, the rapid growth of direct-drive permanent magnet synchronous generators (DD-PMSGs), including for offshore turbines, has prompted a scrambling for neodymium and dysprosium. Under the IEA’s SDS, demand for the two elements from the wind industry is set to more than triple by 2040. Copper demand is also slated to reach 600 kilotons (kt) per year in 2040 because offshore wind outgrowth will require more cabling.

Geothermal. Geothermal projects rely on specialized steel, which is high in chromium, molybdenum, nickel, and titanium. If geothermal capacity more than quadruples by 2040 as the SDS envisions, geothermal mineral demand will account for 75% of total demand for nickel from all low-carbon power sources, nearly half of the total chromium and molybdenum demand, and 40% of titanium demand.

Hydropower. While hydropower has a relatively low mineral intensity compared to other sources of low-carbon power, it uses more concrete than any other power resource. Hydropower will also require future copper and chromium supplies—up to 2% and 11% of total demand from all low-carbon power capacity in 2040, according to the IEA.

Nuclear. Nuclear, like hydropower, is a low-carbon technology with a low mineral intensity. It generally needs chromium, copper, nickel, hafnium, and yttrium (as well as uranium, but that is an already established commodity). A 60% large-scale nuclear buildout as envisioned in the SDS could ramp up demand for chromium, copper, and nickel. Advanced nuclear fuel, next-generation reactors, and small modular reactors, however, could require other minerals.

Grid Requirements. With spending picking up to modernize and expand existing grids, experts across the power sector worldwide anticipate a large amount of minerals and metals, including copper and aluminum, will be used to enhance the grid. “It is estimated that some 150 [million tonnes (Mt)] of copper and 210 Mt of aluminum are ‘locked in’ the electricity grids operating today,” the IEA said. Under the SDS, that demand could double.

EVs and Battery Storage. Battery storage, which is set to grow exponentially over the next two decades, is notably the most mineral intensive of all low-carbon technologies. Lithium-ion batteries used in EVs and energy storage contain several minerals in the active cathode material (for example, lithium, nickel, cobalt, and manganese), anode (which needs graphite), and the current collector (which needs copper). Still, the amount of each mineral varies depending on the cathode and anode chemistries.

EV motors are also mineral intensive. Permanent-magnet motors require rare earth elements like neodymium, copper, iron, and boron. While experts generally expect breakthroughs in EV technologies, including their batteries, under the IEA’s SDS, nickel demand will grow 41 times, cobalt demand will grow 21 times, and demand for lithium will grow 43 times. Battery demand from EVs will also need 25 times more graphite, 4,600 times more silicon, and 15 times more rare earth elements. Utility-scale storage, meanwhile, will require 140 times more nickel—from 0.4 kilotonnes (kt) in 2020 to 57 kt in 2040; a 70-fold surge in cobalt demand; and a 58-fold increase in manganese to meet demand.

Green Hydrogen. While electrolyzer technology is still evolving, the IEA pointed out that existing technologies, including alkaline, proton exchange membrane (PEM), and solid-oxide electrolysis cells (SOECs), will require nickel, zirconium, aluminum, cobalt, and copper supplies. PEM technologies are especially mineral-intensive, requiring platinum and iridium. SOECs will also need lanthanum and yttrium.

|

|

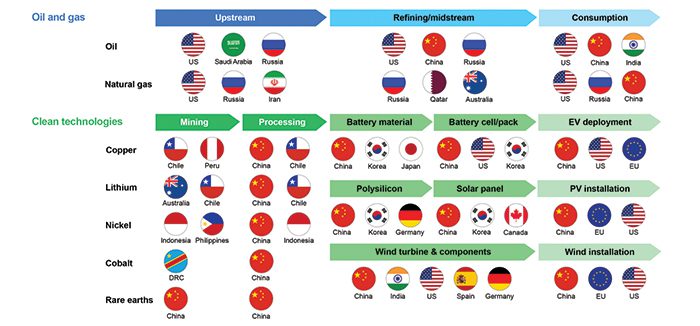

7. The transition to a clean energy system has brought “new energy trade patterns, countries and geopolitical considerations into play,” the International Energy Agency (IEA) said. This figure shows indicative supply chains for oil and gas—traditional hydrocarbons—and selected clean energy technologies. Courtesy: IEA |

Geopolitics a Mineral Supply Concern

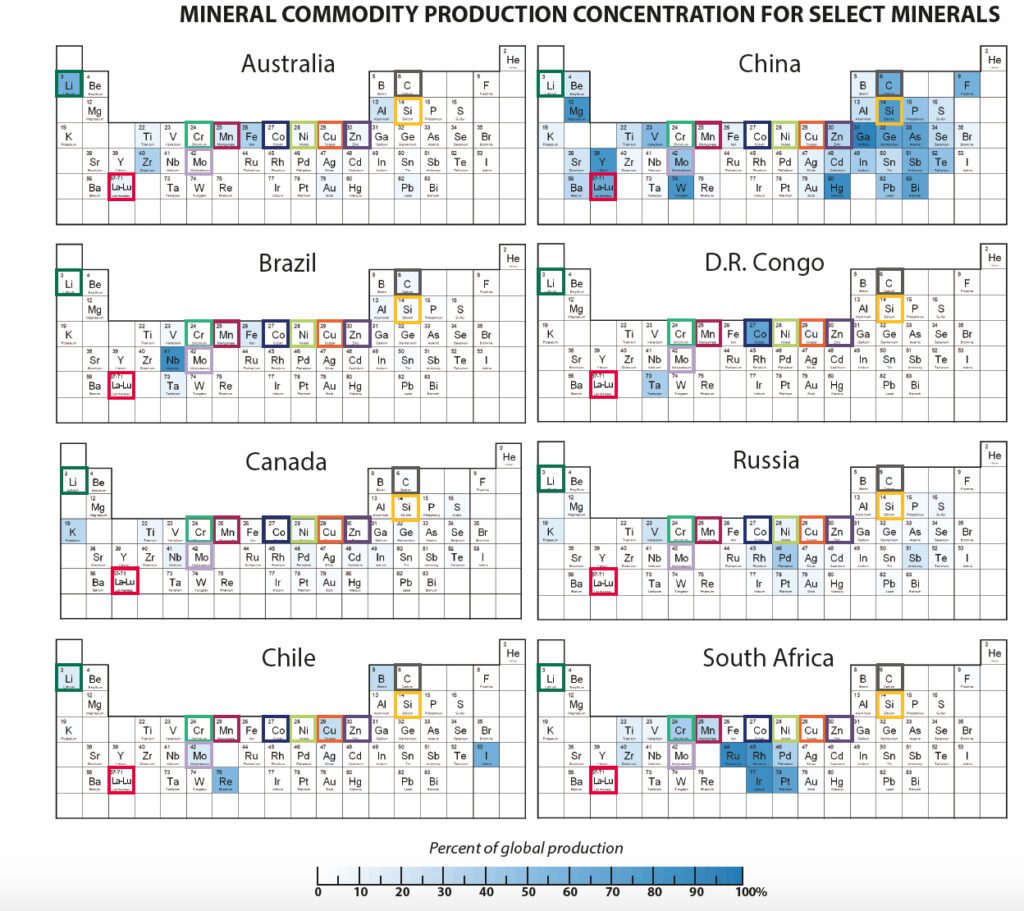

Compounding the supply of this diverse set of necessary minerals is that their production, processing, and consumption is flourishing among a narrow group of countries (Figure 7), and this is necessitating “new energy trade patterns, countries, and geopolitical considerations into play,” the IEA said. For lithium, cobalt, and rare earth elements, for example, the top three producing nations controlled well over 75% of global output. South Africa and the Democratic Republic of Congo (DRC) dominate 70% of global production of platinum and cobalt, respectively. And China, which accounted for 60% of global rare earth production in 2019, has snagged substantial shares of global mineral refining capacity. It holds 35% of the nickel market, 50% to 70% for lithium and cobalt, and as high as 90% for rare earth processing that converts mined output into oxides, metals, and magnets.

Then there are cost concerns. The prices of certain minerals have been on the rise, even though there is no shortage of resources. If supply is to keep up with demand as energy transitions gather pace, countries reliant on clean energy technologies may have no option other than to diversify their supply sources, the IEA said. That will require a robust and broad investment in technology, supply chain resilience, and a coordinated effort to implement sustainability.

Crucial to that effort will also be helping resource-owning governments support new project development and shorten lead times. Reducing material intensity and encouraging material substitution will also play a sizable role. That has worked for the solar industry, which reduced its use of silver and silicon in solar cells over the past decade by 40% to 50%. Emerging technologies such as direct lithium extraction (DLE) and enhanced metal recovery from waste streams or low-grade ores could also make a dent in future supply volumes.

Several initiatives on this front are already underway, notably as they relate to lithium production. In July, French startup GeoLith SAS snagged a contract to pilot its Li-Capt DLE technology at UK-based Geothermal Engineering’s (GEL’s) United Downs Deep Geothermal Project in Cornwall, UK, by the end of March 2022. GEL in August told POWER that third-party tests revealed that there are more than 250 milligrams per liter (mg/L) of lithium in the geothermal fluid at the United Downs site, “which is the highest concentration ever discovered in geothermal fluids anywhere in the world.” Testing has also shown that the water contains magnesium. GEL said the results support its goals to produce 4,000 tonnes of lithium per year by 2026.

Another company, Vulcan Energy Resources, is meanwhile exploring the Upper Rhine Rift, which lies between Frankfurt in Germany and Basel in Switzerland, an area which it says may be the largest lithium source in Europe. Vulcan plans to invest €1.7 billion ($2 billion) to build geothermal power stations and facilities to extract lithium, and it has reportedly already cemented deals with carmaker Renault and South Korea’s LG Chem battery unit.

Finally, another much-encouraged solution relates to recycling energy transition metals like lithium and rare earth elements. “The amount of spent EV batteries reaching the end of their first life is expected to surge after 2030, at a time when mineral demand is set to still be growing rapidly,” the IEA noted. “Recycling would not eliminate the need for continued investment in new supplies. But we estimate that by 2040, recycled quantities of copper, lithium, nickel, and cobalt from spent batteries could reduce combined primary supply requirements for these minerals by around 10%.”

—Sonal Patel is a POWER senior associate editor.