Electricity produced from solar energy is being added to the grid—before and after the meter—in greater amounts each year. The uniqueness of this resource is pushing utilities, developers, users, and regulators to develop new and innovative interconnection rules and to rewrite some old rules that balance the costs and rewards among stakeholders.

The amount of installed solar generating capacity in the U.S. is almost laughably small.

According to a report released in mid-September by the Solar Energy Industries Association (SEIA), the U.S. solar industry added 742 MW of new capacity in the second quarter of 2012, its second-best quarter ever. Utility installations hit 477 MW during the quarter. And eight states posted utility solar installations of 10 MW or more: California, Arizona, Nevada, Texas, Illinois, North Carolina, New Mexico, and New Jersey. In total, the U.S. now has 5,700 MW of installed solar capacity.

Remember, however, that the U.S. had 319,000 MW of installed coal capacity and 413,000 MW of natural gas capacity in 2011. For many utilities, the 742 MW of solar capacity added between April and June is less than a single good-sized power plant. Solar’s growth still may be exponential, but that growth is from such a small number that it can’t hold a candle to the installed fossil base.

But in much the same way as a handful of fleas can drive a dog mad, distributed forms of generation in general are causing anxiety for many big-dog utilities from their nose to their tail. Voltage fluctuations, ramping episodes, and unpredictable availability and output are common challenges facing system operators tasked with dispatching distributed resources alongside traditional forms of generation. Roof-mounted, customer-owned solar also poses something of an existential threat to incumbent utilities by slicing away part of their load and a portion of their revenue.

Companies such as SolarCity and Lighthouse Solar operate on business models that typically don’t involve incumbent utilities; but should a cloudy day cut a residential rooftop solar system’s output to zero, those same utilities are expected to keep the lights on. Faced with a reduction in load and revenues caused in part by distributed solar, efforts are under way in some places to rethink utility business models to address problems such as how best to compensate utilities for providing what amounts to a safety net to back up growing amounts of distributed generation (DG). And, given the power industry’s history of regulation, reform of the regulatory model also may be necessary to integrate still more distributed generation into the grid.

For example, Georgia state legislators this year let die a proposal that challenged Georgia Power’s monopoly on the sale of power to and from utilities by allowing companies to lease rooftop space for solar panels and then sell the electricity to the property owner. Current law allows power to be sold only to utilities, and only utilities can sell to retail customers. The bill is expected to be revived in 2013.

And in Texas, Pedernales Electric Cooperative finalized agreements in October for two DG pilot programs with NRG SolarLife and CommunitySun to bring additional solar resources to members of one of the nation’s largest co-ops. NRG SolarLife offers residential solar array leasing, and CommunitySun offers a SolarCondo concept in which participants buy “shares” in a large-scale solar facility. Pilot programs are still in development; Pedernales plans to introduce the SolarLife pilot early next year.

“Some utilities say ‘solar sucks’ and others are constructive,” said Angiolo Laviziano, CEO of Mainstream Energy/REC Solar during a Department of Energy–sponsored solar conference in Denver last June. Culture clash is one problem. Some solar companies believe they are in business to change the world, not simply generate electricity, Laviziano said. “[Solar companies] don’t understand that utilities are not structured that way. We show up and speak different languages.”

Jared Schoch, managing director of utility sales at SunEdison, said the solar industry generally lacks an understanding of most utilities’ business models. “Solar guys don’t understand that right now [solar energy] costs too much.” Two challenges for the solar industry are to show that solar provides value for utility investors and that it can offer reliable service.

But Patrick Dinkel, vice president of Power Marketing, Resource Planning and Acquisitions for Arizona Public Service, told the DOE conference that distributed solar photovoltaic (PV) installations are now a part of his utility’s generation portfolio. Although he saw no “legitimate long-term conflicts” as a result of integrating more PV into the utility’s system, he said work still must be done when it comes to utility business models and regulation.

Learning New Tricks

That notion was echoed by others in the industry. “Often, technology is the smaller part of the problem,” said Karl Rábago in a recent interview with POWER. Rábago, a consultant and former Texas state utility regulator, DOE official, and executive with Austin Energy, said he agrees that although renewable integration issues have been debated for decades, the topic remains timely. And indications are that the flea-irritated electric industry dog may be learning a few new tricks.

Those “tricks” include new approaches to address operational, business, and regulatory challenges posed by DG. It’s worth starting with a look at how Public Service Electric & Gas (PSE&G) in New Jersey has coped operationally with large amounts of distributed solar generation resources.

New Jersey ranks medium in terms of solar resource quality but high when it comes to incentives and public policies aimed at promoting solar generation and expanding solar jobs in the state. Although the Beach Boys may never write a song praising New Jersey’s sun, for the last couple of years the state has ranked second only to California in terms of new solar generation connections. As recently as the first quarter of 2012, New Jersey ranked first in the nation for new solar connections, with projects brought online by 15 different developers, including PSE&G.

Indeed, since July 2009, PSE&G has invested $515 million to develop around 80 MW of solar energy resource, spending the equivalent of around $6,400/kW. That total includes 40 MW of capacity installed on vacant lots and brownfield industrial sites and 40 MW of capacity from around 150,000 5 x 2.5-foot, 235-W panels attached to utility poles across the company’s service territory (Figure 1). Finding a U.S. utility with more distributed solar generation may be difficult. But for all this distributed capacity, the ill effects on operations are almost nil for the 11,000-MW, summer-peaking utility.

|

| 1. Pole-mounted PV panels. Since mid-2009, PSE&G has invested $515 million to develop around 80 MW of solar energy resource, spending about $6,400/kW. The total includes 40 MW of capacity from some 150,000 5 x 2.5-foot, 235-W panels attached to utility poles. Courtesy: PSE&G |

“We are seeing no real impacts,” said Bill Labos, PSE&G director of asset reliability. Currently, PSE&G has about 358 MW of solar installed in its service territory, including 80 MW of utility-owned capacity; the rest consists of customer- and developer-owned capacity. Indeed, the utility expects little impact on its system until as much as 500 MW of solar are installed, a threshold the utility could approach in the next several years following its request to state regulators this summer for permission to add another 137 MW of solar capacity.

One reason for PSE&G’s ease in adding solar resources—and a key reason why utilities elsewhere may have integration problems—is that the utility’s distribution feeders have enough “stiffness” to accommodate the voltage fluctuations common with an intermittent solar resource. Labos said many of the utility’s feeders are 3 to 5 miles long and stiff enough to accommodate anywhere from 2 MW to 5 MW of distributed solar with little trouble.

The exceptions that prove the rule lie in rural southern New Jersey. There, solar farms larger than 5 MW are on feeder circuits that average 7 miles in length. In some places, high voltage fluctuations—the bane of grid operators elsewhere in the country—are large enough that the utility is taking advantage of advanced inverter technology, which can absorb volt-amps reactive (VAR). Inverters on the tail end of long feeders are set up to absorb VARs, thereby balancing the current flows and correcting the circuit voltage profile. Inverters are relatively straightforward pieces of equipment that convert DC output from a wind farm or a solar array to AC for distribution to a load or to the grid. Recent technology advancements enable increasingly “smart” inverters to play starring roles in efforts to integrate ever-larger amounts of solar into the grid.

For now, however, a principal factor limiting efforts to integrate an intermittent distributed resource such as solar or wind is voltage on a distribution feeder, said Jeff Smith, a senior project manager with the Electric Power Research Institute (EPRI) in an interview with POWER.

“Some distribution feeders are short and fat and others are long and skinny,” he said. Identifying which can best accommodate distributed solar can be difficult, since no two distribution systems are alike. As a rule of thumb, connecting an intermittent resource near a substation has less impact in terms of voltage fluctuations than connecting it miles away. Work by EPRI, utility partners, and the vendor community is intended to enhance inverter capabilities to bolster grid support and voltage control.

|

| FERC actions on variable energy resource integration. Source: FERC |

Solving for X and Y

For years, the equation that grid operators had to solve in order to balance supply and demand included a constantly varying load met by a generally stable and known amount of generation, most of it fossil, hydro, or nuclear. The accelerating addition of intermittent resources from renewable energy over the past decade tacked a big unknown—variability—onto the generation side of the equation.

Now, instead of dealing with one unknown variable involving demand, grid operators regularly face a second unknown variable, this time involving generation resources. That’s because intermittent resources differ from conventional and fossil-fired resources in a fundamental way: Their fuel source (wind and sunlight) cannot be controlled or (for now, anyway) stored in a practical and cost-effective manner (Figure 2). The challenge is particularly acute in areas where DG resources make a significant contribution to the generation mix, including New Jersey, parts of California, Colorado, and the Texas and Midwest grid operating regions.

|

| 2. Roof-top generation. Workers for Lighthouse Solar install microcrystalline PV modules on a residential rooftop last December. Projects such as these can present an existential challenge to incumbent utilities and are sparking a rethinking of existing business models. Source: Dennis Schroeder, National Renewable Energy Laboratory |

A further complication is that fuel availability for variable resources often does not match electricity demand in terms of time of use or geographic location. For example, peak availability of wind power often occurs during periods of relatively low electricity demand. And on hot, sultry summer days when consumers in general and grid operators in particular would kill for a breeze, wind production often drops to near zero.

Yet another complication is that the output of variable resources often is characterized by steep “ramps” that can be caused by clouds moving across a solar array or the passing of a weather front that changes how much wind is blowing. Managing these ramps can challenge system operators, particularly if “down” ramps occur as demand increases, and vice versa. These challenges can be intensified if the rest of the bulk power system lacks sufficient generating resources that can be dispatched quickly, whether that takes the form of a pumped hydro facility or a fast-start gas-fired machine.

Aidan Tuohy, senior project engineer with EPRI, told POWER that multiple issues must be addressed to successfully integrate large amounts of distributed energy resources.

First is the need for system flexibility as intermittent resources such as wind and solar ramp up and down. Flexibility to accommodate these fluctuations can be accomplished by dispatching generation resources such as combined cycle and combustion turbine units, pumped hydro storage resources, and even battery storage.

Second, forecasting tools are necessary to help system operators anticipate the amount of intermittent resource that may be available. Although accurate day-ahead forecasts can be difficult for solar and wind resources, even an hours-ahead forecast can help operators more efficiently utilize the generation system. For example, the Electric Reliability Council of Texas (ERCOT), among other balancing authorities, has integrated forecasting methods into its market operations, and accurate forecasting is proving important for Xcel Energy’s Colorado operations, where more than 50% of overall generation has been provided by wind a number of times.

Third, grid stability issues have grown in importance over the past 20 years as diminishing amounts of inertia from conventional power plants have impeded somewhat the grid’s ability to offer frequency response. Tuohy speculated that the grid’s frequency response ability has been declining and could be due in part to market design issues in which generators are sometimes disincentivized from providing frequency response services. The problem may be exacerbated as inverter-based energy from solar and wind resources displaces system inertia provided by conventional power plants. That’s because while large conventional generators spin at 60 Hz, inverter-based power sources don’t. While wind can provide what Tuohy called “emulated inertia,” the result is a decline in the system’s naturally occurring inertia, which may be a factor in grid stability.

Fourth, because most distributed PV systems are connected to the grid using standards spelled out under IEEE 1547 guidelines to prevent islanding, it can be difficult to control system ride-throughs when voltages drop. Tuohy said efforts are under way to reconcile IEEE standard with bulk system needs.

Fifth, wind resources in particular can increase conventional generator cycling, which can have long-term effects on operations and maintenance costs, outages, and lifetime efficiency.

Market Rules and Regulations

Operational issues are only one part of the story. It’s sometimes easy to forget just how regulated and controlled the electric power market is. Both state and federal regulators guide power market functions through policy mandates and incentives. Deregulation took hold in around half of the states during its high water mark in the late 1990s and led to a patchwork quilt of regulatory structures. Public policy makers—whether elected or appointed—apply a sometimes bewildering array of incentives, directives, and Band-Aids to achieve a variety of goals.

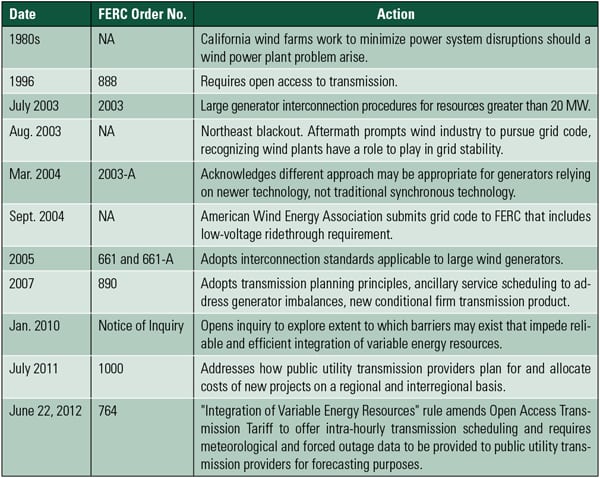

Many policy actions in recent years have focused on creating, supporting, and nurturing opportunities for renewable energy. The table highlights policy initiatives undertaken by the Federal Energy Regulatory Commission (FERC) since the 1980s to open transmission markets, cope with intermittent resources, and facilitate renewable energy’s integration into the grid.

Many federal and state policies seek to remedy the fact that wind and solar projects can be at an economic disadvantage with conventional generation resources, at least initially. In states where renewable resources are valued as a matter of public policy, the effort has been to pursue business and market reforms intended to open market opportunities for renewable energy. Those efforts are by no means simple.

Revising Net Metering

Take net metering, for example, which allows solar system owners to roll their meters backward as they generate electricity and sell excess output into the grid. Solar generation owners are paid retail rates for the electricity they feed into the grid. But they also may end up at the end of the month with a zero balance on their utility bill. In other words, net metering can enable solar owners to avoid paying the underlying cost of transmission and distribution that they themselves used to send self-generated power to the grid. Not surprisingly, many utilities—and perhaps even a few customers—find the arrangement inequitable.

Former Austin Energy executive Rábago said that one flaw behind net metering is that it is “directly tied to consumption; it’s an incentive not to conserve energy.” Austin Energy’s experience shows that many solar customers respond by using more energy on the mistaken assumption that their consumption is “free” once a solar system is installed.

The Texas-based utility earlier this year introduced what it hopes will be a fix to the problem: a “distributed PV value calculator” known as the “Value of Solar” rate. Beginning this fall, solar owners in Austin will be billed the same 1.8 cents to 11.4 cents per kWh that non-solar customers are billed, plus the same $10 monthly customer charge. Solar owners also will be credited with 12.8 cents for every kilowatt-hour they send to the utility. If the rate works, it may ensure the utility’s ability to recover the cost of providing ancillary and partial requirements services to solar customers, enable those costs to be more equitably spread among customers, and reassure solar owners that they will continue to receive a financial incentive for their investment.

Rethinking Dispatch Markets

Region-wide market reforms also are proving critical to integrating large amounts of DG into the generation mix. Both the Southwest Power Pool and the California Independent System Operator (CAISO) have proposed creating an energy imbalance market (EIM) in the Western Interconnect that would compress dispatch market intervals from 1 hour at present to 5 minutes. The market would pay generators for making power available on this more rapid timetable. Creating an effective EIM would require increasing the region’s footprint to include a larger number of generating units with the flexibility to respond rapidly to changing loads and intermittent resources. Putting such a market mechanism in place would require “significant upgrades” so that power producers could communicate with a centralized dispatch authority, said Thomas Veselka, a researcher with Argonne National Laboratory, who is working on the initiative.

Moving to larger balancing areas for dispatch purposes means that even more resources are available, lessening the overall variability effects of an individual wind farm or solar array, said Charlie Smith, executive director of the Utility Wind Integration Group. Moving to this sort of model is not cost-free, however, as transmission improvements to tie together far-flung generating units likely will be required. “Transmission is the critical issue,” Smith said. “You can’t have well-functioning markets with congestion,” which results from inadequate transmission resources. What’s more, efforts to move to a sub-hourly and even 5-minute market will likely require enhanced communication capabilities between regional dispatch authorities and generating resources.

CAISO views market rules as critical to developing products and services that incentivize efforts to balance the bulk power system as renewable resources are added. “The system in California and across the entire industry is very much in flux,” said Mark Rothleder, executive director of Market Analysis and Development for CAISO. In an interview with POWER, Rothleder outlined market mechanisms critical to keeping California’s grid in balance.

First, CAISO introduced incentives intended to compensate entities that provide ramping services, a condition that Rothleder said poses “significant challenges” for CAISO. The idea is to allow resources to bid into the market to provide both up and down ramping services as loads and resources change.

Second, because CAISO expects too much generation to be available at times, it set a bid floor equal to –$30. That negative price floor has proven inadequate given that wind and solar resources often operate with tax credits and power purchase agreements that make it economically rational for them to continue to produce power even after prices go negative. To correct that, CAISO wants the bid floor reduced to –$150 to incentivize a price-based reduction in supply.

“If the system is in an over-generating condition and at a point where we still have too much energy, we want an incentive for renewable resources to offer bids to back down to the minimum,” Rothleder said.

Revising Rule 21

Grid-balancing authorities and regional dispatch areas are not the only places where reform is under way to cope with increasing amounts of DG resources. State utility regulators also play an important role.

For example, the California Public Utilities Commission (CPUC) in September approved a deal involving the state’s major utilities and renewable energy advocates that is aimed at streamlining the process for connecting DG resources to the grid. The CPUC’s action will make it easier for small amounts of distributed resources—such as rooftop solar PV systems—to connect. The agreement also revises upward the amount of DG that can be connected to a specific power line segment without the need for supplemental studies.

The agreement revises the CPUC’s 13-year-old Rule 21, itself a landmark. Rule 21 set a threshold for instances where the amount of DG on a line section exceeds 15% of that line’s annual peak load. The so-called “15% threshold” was later adopted by FERC and by most states as a model for developing interconnection rules. The CPUC’s action revised California’s standard to allow aggregate interconnected DG capacity equal to 100% of minimum load on a distribution line section.

The settlement agreement was filed with the CPUC on March 16 and involved 14 parties, including Pacific Gas and Electric Co., San Diego Gas & Electric Co., Southern California Edison, Sierra Club, and the SEIA. The SEIA’s vice president of regulatory affairs, Don Adamson, told POWER his organization filed a motion in February with FERC (Docket No. RM 12-10), urging it to replace the federal 15% threshold with a standard equal to 100% of minimum daylight load. SEIA said that solar developers believed for years that the 15% screen for fast-track interconnection was more restrictive than necessary to maintain distribution system safety and reliability. This view was supported by a January 2012 report, titled “Updating Interconnection Screens for PV System Integration,” by the National Renewable Energy Laboratory, Sandia National Laboratory, and EPRI. The report suggests that an alternative fast-track screen—namely 100% of minimum daytime load—can be used when the 15% threshold is crossed.

SEIA said that should FERC adopt its proposed revision, the amount of solar wholesale DG capacity eligible for fast-track interconnection would roughly double and make interconnection faster and less costly for many solar projects.

Three Models

Traditional cost-of-service regulation remains a mainstay of public utility commissions in states that retain full regulatory authority over electric service. But that regulatory model may be impeding utilities from meeting some of the challenges posed by DG, said Ron Binz, a former Colorado public utility regulator and consultant at work on the Utilities 2020 project with funding from the Energy Foundation. He said critical concerns include the loss of load and revenue by incumbent utilities as a result of DG, similar to what Austin Energy faced. “Utilities have to decide in the face of some percentage of profitable customers going away how to adjust to that,” Binz said.

Three models are gaining attention as a way to cope with the challenges posed by DG’s ascendency.

The first is a model based on efforts in the United Kingdom to regulate utility prices without considering the utility’s underlying rate of return or profitability. By contrast, the typical U.S. regulatory model seeks to set prices that may be charged along with an allowable rate of return. In the UK model, regulators set a price ceiling and then allow the utility to figure out how to maximize its profitability. Binz said this model has the advantage of encouraging utilities to embrace operating efficiencies and pursue business decisions that improve the bottom line. Customers benefit because the price they pay for electricity can’t rise above a certain ceiling. The approach is intended to help utilities be more entrepreneurial—a potential benefit when it comes to working with customers with rooftop solar, for example. Both National Grid and Mid-American Energy have experience with the UK model through various business units, and Binz said their reaction so far has been positive.

The second approach, known as the “Iowa Model,” involves Mid-American and spanned the years from 1995 to 2012. Under a regulatory experiment, the utility went 17 years without changing the price of electricity (which included no fuel clauses, no adjustment mechanisms, and no formal rate case). The model set up a system in which Mid-American operated like a price-capped company. Prices remained steady, but the utility’s earnings were ignored by regulators. This approach relies on the utility turning inward to generate income growth and—according to Binz—resulted in rates of return for the utility in the high teens.

Binz called the third model the “Grand Bargain” and said that under this approach, regulators tell the utility and intervenors (everyone from industrial power users to consumer advocacy groups) to work out a multi-year deal that achieves specific goals. From the outset, regulators specify that not everyone needs to agree with the final bargain for it to be approved. This approach “takes a lot more work than typically is done,” Binz said, but it can lead to a positive outcome for most if not all of the involved parties.

Regulatory reform often requires statutory changes by state legislatures. But Binz said the three models he outlined can be employed by most regulatory authorities under legal structures already in place.

Tackling Tough Issues

Distributed generation—and distributed solar in particular—is making inroads into the generation mix. Even if its total installed capacity remains flea-like compared with big dogs coal and natural gas, distributed solar’s impact is magnified by the multiple operational, business, and regulatory challenges it poses.

Though utilities such as PSE&G and Austin Energy have done a good job accepting DG into their systems, market and regulatory challenges remain to be solved in many parts of the country, and efforts are under way to tackle even the thorniest of those issues. More difficult could be closing the cultural gap that exists between incumbent utilities and solar advocates. As Mainstream Energy’s Laviziano noted, utilities and solar advocates often “speak different languages.”

Many utilities continue to approach DG warily, an understandable reaction given the size of their infrastructure investment, their cautious nature as engineering-based businesses, and their responsibility to keep the lights on. They seek concrete proof that the bulk generation and distribution systems will remain intact. After all, “all utilities are from Missouri,” said Rábago. Their approach is “show me first.”

— David Wagman is executive editor of POWER.