Supply Chains

-

Supply Chains

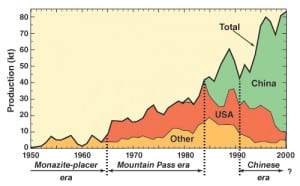

TREND: Rare Earth Minerals and Free Markets

Far from precipitating a crisis in high-tech manufacturing, the Chinese attempt to corner the market on rare earth minerals has instead inspired some healthy competition and adaptation.

-

Supply Chains

TREND: Down Go Electricity Prices

A variety of factors have exerted downward pressure on wholesale electricity prices the past few years. EIA data suggest this may be a long-term spiral, not just a temporary hiccup.

-

Legal & Regulatory

Coal Ash Recycling Stalls During Regulatory Struggle

As 2013 opens, the coal industry is waiting anxiously on a variety of proposals for regulating coal ash. A reclassification as hazardous waste could deal another blow to coal, but some industry observers suspect the worst is not yet to come.

-

Legal & Regulatory

Trend: The Nuclear Tortoise and the Natural Gas Hare

The pendulum has recently swung back against nuclear as gas-fired power has surged in response to low prices and abundant supplies. Can nuclear ever regain its edge?

-

Supply Chains

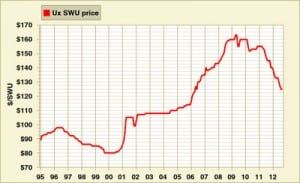

Why Swooning SWU Prices Will Continue

Long a tightly controlled near-monopoly, the market for enriched uranium is finally about to see some meaningful foreign competition.

-

Supply Chains

Rare Earths: China Strikes Back

Facing increasing competition and a slumping economy, China is moving to strengthen its already robust monopoly over rare earth minerals vital to many advanced energy technologies.

-

Supply Chains

Uranium and Nuclear Fuel: No Bottlenecks Ahead

In addition to low prices for coal and natural gas, prices for uranium oxide are also gently falling. New supplies of uranium and enriched fuel should keep nuclear fuel prices stable for years to come.

-

Supply Chains

TREND: U.S., Energy Exporter

The U.S. has been blessed with enormous quantities of natural resources yet has long been a net energy importer. The shift from global purchaser to global supplier of fossil fuels is accelerating.

-

Supply Chains

End Game for Rare Earth Dispute?

The end of the long-running flap over access to markets for rare earth minerals may be in sight, driven by a combination of political and diplomatic pressure at high levels and the normal workings of the marketplace.

-

Supply Chains

Bulls Beating Bears in Shale Gas Inquiry

As the resource gets increased and more sophisticated scrutiny, natural gas from shale looks increasingly like a revolutionary force in energy markets. Most recently, the Washington-based environmental and energy think tank Resources for the Future rolled out a serious analysis of the new method of developing gas, and the issues it presents. The preliminary results look very positive for gas.

-

Finance

Solar Power’s Elephant in the Living Room

Understanding the reliability and failure mechanisms of photovoltaic modules is crucial to understanding how well they will perform over time. But today there are no test standards in place to judge this crucial issue.

-

Finance

TREND: Geothermal Heats up after Fukushima

While the vast power of one form of energy below Earth’s crust (tectonic plate shifts) doomed the Fukushima nuclear power plant in Japan last March, using another form—heat and steam—is getting renewed attention in the wake of the Japanese meltdown.

-

Legal & Regulatory

WTO China Ruling Could Impact Rare Earths

Uncertainty about China’s role in world trade and its current monopoly over critical rare earth minerals continues to roil supply chains in energy technology markets. Will the World Trade Organization bring China into the fold, or will China ignore the international forum that it lobbied hard to join several years ago?

-

Supply Chains

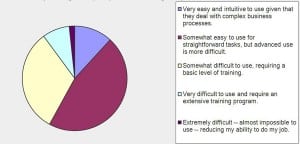

IFS Study: ERP Too Complicated and Inflexible for the Electric Power Industry

Enterprise resource planning software has swept the power industry, promising to improve coordination and management. Has it lived up to the hype? One ERP vendor says the programs often underperform.

-

Supply Chains

TREND: Markets and Critical Materials

While China seems determined to exploit its current control over the market for rare earths and other minerals critical to high-tech and green energy technologies, and while governments engage in conventional hand-wringing and head-scratching, markets appear to be reacting in the ways that markets are supposed to react.

-

Legal & Regulatory

Japan, Critical Materials, and Weak Links in Supply Chains

The devastation in Japan has focused new attention on supply chain issues and the impact of the partial collapse of that country’s manufacturing infrastructure on both Japanese imports and exports.

-

Supply Chains

Is Peak Coal the Latest Supply Threat?

We’ve heard—endlessly, it seems at times—about "peak oil," the idea that the world is rapidly running out of oil and will face catastrophic consequences. Now talk is emerging about "peak coal."

-

Supply Chains

TREND: Uranium Business Heats Up

The long-struggling uranium business, hoping that demand for nuclear fuel will increase, is slowly stretching its muscles and strengthening exploration and production efforts in the U.S. and elsewhere.

-

Legal & Regulatory

Will Critical Materials Become a Green Roadblock?

Critical minerals—such as rare earth metals—are important to many new energy technologies. However, the U.S. Department of Energy is concerned that foreign control of supply, particularly by China, could limit the ability of these technologies to develop fully, so the DOE is developing a strategy to keep the supply chain open. Meanwhile, some analysts say China is playing a losing game with its hold on the minerals.

-

Finance

MIT: Uranium Supplies Adequate

Uranium remains plentiful around the world, says a new resource study from MIT, obviating the need to "close" the nuclear fuel cycle by reprocessing and developing breeder reactors.

-

Legal & Regulatory

Uranium Enrichment: Boom or Bust?

The prospects of a worldwide nuclear power renaissance have spawned many plans for increasing uranium enrichment capacity. Could those plans swamp the world in SWUs?

-

Legal & Regulatory

NRC Chairman Floats Plan for Long-Term Spent Fuel Storage

A sea change in thinking about how to deal with spent nuclear fuel in the U.S. appears to be on the policy and political horizon, rekindling battles last fought in the 1980s about how to pay for the disposal of nuclear waste and where to put it. Holes in the ground look increasingly unlikely.

-

Supply Chains

TREND: Solar Doldrums

While the Obama administration in Washington is lauding solar energy as a major part of an alleged transition to renewable energy, the U.S. companies that make solar modules to turn the energy in sunlight into electric power are hurting. Prices for PV cells are falling, and domestic firms are seeing waves of red ink on their books, falling investor interest, and are responding by moving production offshore.

-

Supply Chains

DOE Helium Shortage Hits Nuke Security, Oil And Gas Industry

The Energy Department’s failure to recognize an impending supply squeeze for helium-3—a nonradioactive gas produced in the agency’s nuclear weapons complex—has created a national crisis requiring White House intervention and threatening key U.S. nuclear and homeland security programs, a wide range of medical and scientific research activities and development of U.S. oil and natural gas resources, according to testimony before a House subcommittee.

-

HR

How Clipper Windpower Jump-Started Itself . . . Big Time

Clipper Windpower didn’t have the luxury of a decade or more of product development. Instead, it started big—with a 2.5-MW wind turbine. Here’s the story of how they did it.

-

Supply Chains

Trend: Natural Gas Is Hot, Hot, Hot

Despite the political kerfuffle over Obama administration loan guarantees for new nuclear generating plants, the ubiquitous hand-wringing about fossil fuels and climate change, and the hype about wind and solar renewable power generation, the new reality of natural gas may be a game-changer.

-

Supply Chains

Kazakhstan and Uranium: It’s About Transparency

Kazakhstan is a leading supplier of uranium fuel to the former Soviet Union and has global ambitions. A transparent uranium market and honest leaders must come first.

-

Finance

Rare Earth and Lithium Supplies Cloud Renewables

Ensuring an adequate supply of rare earth elements and minerals may be a hurdle in the renewable energy supply chain. The metals and their compounds are used in battery technologies, windmills, catalysts, and communications technologies. Add lithium (not a rare earth) to that mix, as Latin American politics could cloud the prospects for new lithium supplies.

-

Legal & Regulatory

Power Owners in Strong Position to Collect Liquidated Damages

Although law varies by jurisdiction, a recent case demonstrates arbitration panels’ willingness to uphold liquidated damages clauses in power plant engineering, procurement, and construction contracts.

-

Finance

U.S. Wind Capacity Soars, Manufacturing Doesn’t

Wind generating capacity hit new highs in 2009, but that didn’t mean much for the wind power manufacturing sector, meaning fewer “green” jobs than the Obama administration hoped to see.