Though Canada is rich in fossil fuels, nuclear power may fuel a significant portion of the nation’s future electrical generation needs, especially in provinces that have traditionally relied on hydropower and fossil fuels.

Canada is in the enviable position of having an adequate electricity supply and multiple energy resources for future generation needs. Its challenge is balancing rising carbon emissions against rising electricity demand when renewables, principally hydroelectric power, already supply almost 60% of its electricity.

Given its ample natural gas reserves, a rapid short-term increase in construction of natural gas – fired combined-cycle plants is already under way to bring down carbon emissions and replace coal-fired baseload generation. In the longer term, new nuclear plants will likely supply the balance of power.

Focused Energy Policy

Canada’s energy policy is guided by a series of principles, agreements, and accords. As does the U.S., Canada relies on an active electricity market as the most efficient means of determining supply, demand, prices, and trade while ensuring an efficient energy system.

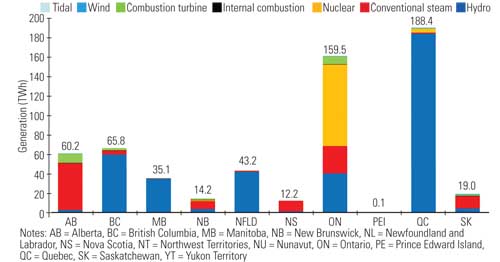

Canada is a federal state, comprising 10 provinces and three territories. The federal government is responsible for international and inter-provincial issues. But unlike U.S. states, provincial governments are given significant authority by the Canadian Constitution to manage electricity and natural resources within their borders. Hence, the Canadian electricity industry is strongly organized along provincial lines, and individual provinces have significantly different views of energy policy (Figure 1).

1. Provincial differences. In 2008, Canada generated a total of 598.8 TWh. Alberta, Ontario, and Saskatchewan are typically Canada’s three largest users of fossil fuels for the production of electricity. Overall, Alberta used 51% of all coal and 42% of all the natural gas consumed in Canada for the production of electricity; Ontario consumed 24% and 32%, respectively; Saskatchewan consumed 18% and 10%, respectively. Québec generated 30% of Canada’s total electric power and approximately 50% of all hydroelectric power while using about 1% of total fuels consumed for other forms of electricity production. Source: Statistics Canada

Electricity generation in Canada has been "unbundled" in most provinces over the past decade or so. Similar to the U.S. process, the typical vertical electric utility has been segmented into separate generation and transmission and distribution companies. Some provinces have introduced a competitive power market with independent power producers, although more than 90% of electricity consumed in Canada is still generated by electric utilities. Another key difference: Provincial governments own many of the major electric utilities.

North American Energy Interconnectivity

Goods and services are not the only commodities traded between the U.S. and Canada (see sidebar: "Major Trading Partners"). The electricity networks are heavily integrated, a dependency made clear by the 2003 Northeast blackout and the joint report on causes of the blackout released the following April that proposed bilateral solutions. A stable grid benefits both nations: In 2008, Canada exported 49.8 billion kWh to the U.S. while importing only 17.1 billion kWh from the U.S., according to Canada’s National Energy Board (NEB).

At the provincial and state level, it’s more of the same. For example, transmission lines connect Manitoba to Saskatchewan, Ontario, North Dakota, and Minnesota. On average, approximately 30% of the electricity generated in Manitoba is sold to other Canadian provinces or to U.S. markets. However, the intertie connections to Saskatchewan and Ontario have limited capacity. The Saskatchewan and Ontario interties can carry approximately 375 MW and 200 MW, respectively, and a significant portion of Manitoba’s output each year is exported into Minneapolis, Minnesota, the closest major population base to Manitoba generators.

Supply versus Preferred Supply

The NEB has stated that electricity supplies are adequate to meet expected demand for the next few years, with perhaps one exception. Ontario has determined that all coal-fired generation in that province must be phased out of operation by 2015 and replaced by a mixture of gas, nuclear, wind, and other renewable technologies.

Ontario Power Generation (OPG), a public company owned by the Government of Ontario that supplies 70% of the province’s electricity generation, operates five coal-fired power stations rated a total of 8,577 MW. Nanticoke Generating Station, with its eight units rated at 3,964 MW, is one of the largest fossil fuel power plants in North America and is at the top of the Ontario government’s list of plants to be mothballed.

Coincidentally, Ontario Power Authority (OPA), roughly equivalent to a U.S. independent system operator, noted that electricity demand is expected to exceed supply by 2014 in that province. The OPA estimates that the gap between declining supply and increasing demand will reach about 24,000 MW by 2025 if no additional generating sources are added and all the coal-fired plants are actually mothballed.

To avoid future imbalances, the OPA reviewed Ontario’s supply options and has made recommendations to the government on its projected future supply mix: Maintain the share of nuclear generation and replace coal by raising the share of gas-fired generation and renewable resources.

Hydro Holds the Most Power

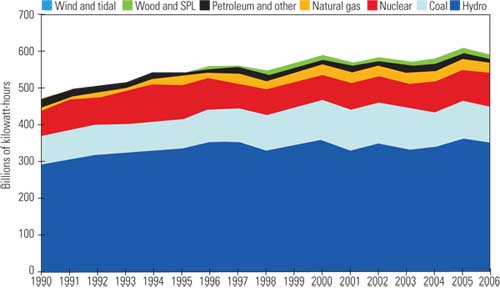

Hydropower plays a significant role in Canada’s electricity supply profile, accounting for 61.7% of its electricity supply and nearly 100% of its generation from renewables, according to Statistics Canada (Figure 2). Canada’s total hydroelectricity supply is second in the world to China’s. Some 25% of Canada’s energy demand is met by hydropower, compared to 3% for the U.S.; the balance, 34%, is exported to the U.S. The majority of Canada’s hydroelectricity is produced in Québec, British Columbia, Newfoundland and Labrador, Ontario, and Manitoba.

2. Fuel mix. Canada is the second-largest producer of natural gas in the Western Hemisphere, after the U.S., and natural gas constitutes about 27% of Canada’s primary energy mix—similar to the percentage in the U.S. and Mexico. In 2006, Canada exported 3.6 Tcf of natural gas to the U.S., representing 86% of total U.S. natural gas imports that year. Expect Canada to use more natural gas for power generation in future years, leaving less available for export to the U.S. Source: Natural Resources Canada

Even with its diversified energy mix, Canada’s greenhouse gas emissions have risen 24% above its Kyoto Protocol commitments since 1990, making it the sixth highest out of 40 developed "Annex 1" signatories to Kyoto. By 2010 these emissions could reach 45% above Canada’s Kyoto target. Alberta, for example, contributes 25% of Canada’s air pollutants, despite having 10% of its population.

In a November 2008 presentation on "The Future of Hydroelectric Power in Canada," NEB Chair and CEO Gaétan Caron noted that "extensive development of new hydroelectric projects" was planned for Newfoundland and Labrador, Quebec, Manitoba, and British Columbia, with smaller projects planned for Alberta and Ontario. He added that "Many of the hydro projects are located far from the customer base and will require major transmission investments."

The Nuclear Option

Though hydro is expected to continue providing the majority of power, Caron noted that, "After 2015 demand growth encourages the development of both traditional generation sources and alternatives to conventional generation. Growth is particularly strong in natural gas, wind and biomass. Nuclear grows on a net basis and coal declines, largely reflecting the phase-out in Ontario."

Demand-side management, energy efficiency, and nonhydro renewables, including solar photovoltaic and biomass, are also expected to play a role. But because nonhydro renewable generation sources "grow from a very small base, they do not have a great impact, that is, as a share of total power generation, over the period to 2030. However, they constitute significant localized opportunities and potentially pave the way to an important electric generation platform for the future."

Given these projections, it seems likely that in the longer term, nuclear power will provide the bulk of new baseload generation. That’s certainly the view of Atomic Energy Canada Ltd.’s (AECL’s) president and CEO, Hugh MacDiarmid. In a June 2008 address, "Nuclear Energy: The Third Pillar of Canada’s Energy Future," he identified oil and gas as the first pillar of Canada’s energy infrastructure, hydro as the second, and nuclear as the third "complementary" pillar. He observed that "across Canada, nuclear is being examined with greater interest than perhaps ever before."

In Canada, nuclear power provides 15% of overall electricity generation. (The U.S. percentage is 20%.) Canada’s 20 nuclear reactors make it the eighth-largest nuclear power generator in the world, and, according to MacDiarmid, "Ontario is already the third most nuclear-intensive power grid in the world — after only France and Lithuania — with over half its electricity coming from nuclear." However, to date, only three provinces — Ontario, New Brunswick, and Québec — have nuclear power assets (though Bruce Power is considering sites elsewhere in Canada):

-

Ontario Power Generation owns Pickering Units A1 and A4 – A8 (Figure 3) and Darlington Units 1 – 4; Bruce Power owns Bruce Units A3 and A4 and B5 – B8 (Bruce A1 and A2 are being refurbished, with an early 2010 restart date) (Figure 4).

-

New Brunswick Power owns Point Lepreau 1 (under refurbishment, with a late 2009 restart planned).

-

Hydro Québec owns Gentilly 2, a plant that has particular importance for grid stability and provides electricity during periods of low hydroelectric generation (Figure 5).

The same three provinces also account for about 62% of Canada’s total electricity generation capacity.

3. Pickering Nuclear Generating Station. The Pickering Station, at over 4,100 MW, is one of the largest nuclear plants in the world and uses the CANDU nuclear reactor. Courtesy: CANDU Owners Group Inc.

4. Bruce Nuclear Generation Station. This eight-unit nuclear plant was constructed in stages between 1970 and 1987. Bruce Nuclear Generating Station is the largest nuclear facility in the world, with a total output of over 6,200 MW, and is the only nongovernment-owned nuclear plant in Canada. Bruce A1 and A2 are currently being refurbished. Courtesy: CANDU Owners Group Inc.

5. Gentilly Nuclear Generating Station. Gentilly was constructed in stages between 1966 and 1983. Unit 1, a prototype CANDU reactor, is being decommissioned. Unit 2 has a net output of 638 MW. Courtesy: CANDU Owners Group Inc.

Canadian Nuclear Technology

There are two very significant differences between Canada and the U.S. with respect to developing and constructing new nuclear power plants. In the U.S., an investor-owned utility typically selects a privately owned nuclear technology and develops a new nuclear project with the federal government as regulator. In Canada, provincial governments, through their utilities, own the majority of nuclear plants. Bruce Power is Canada’s only privately owned nuclear power generator. It was formed by a partnership between Cameco Corp., TransCanada Corp., and BPC Generation Infrastructure Trust — a trust established by the Ontario Municipal Employees Retirement System, the Power Workers’ Union, and The Society of Energy Professionals.

The second key difference is that the U.S. federal government does not market a particular nuclear technology but is technology neutral.

AECL, established in 1952, is a Crown Corporation wholly owned by the federal government to foster the advancement of nuclear energy and nuclear technology. In 1994, the federal government altered the AECL’s mandate, requiring it to concentrate on "its role as a reactor designer and vendor." The AECL is still responsible for most nuclear research and development occurring in Canada, including the development, marketing, and management of the construction of Canada deuterium uranium (CANDU) power reactors internationally.

The CANDU Reactor Division, based in Mississauga, Ontario, is operated like a commercial enterprise and includes the management of nuclear reactor construction, life extension, and servicing projects. During this past year, the AECL increased its staff by approximately 14% to address growth and to sustain existing nuclear facilities.

The AECL is currently pursuing a "next- generation" CANDU design — the ACR-1000 — which is expected to have lower capital costs, require a shorter construction time, and produce less waste than current CANDU reactors.

The CANDU system, unlike U.S. light water reactors, uses natural uranium as fuel. When it comes to performance, CANDU-6 technology has been very reliable and has had an 87% lifetime capacity factor.

A memorandum of understanding with the AECL allows Canadian Nuclear Safety Commission (CNSC) staff to perform project design reviews of the ACR-1000. Marketing efforts for the ACR-1000 are currently focused on Canadian-based projects as a precursor to pushing the technology onto the international market. The CANDU-6 reactor continues to be marketed internationally, with a focus on mid-market countries and those where natural uranium is the preferred fuel.

Although no new reactors have been commissioned in Canada for over a decade, there are proposals to build new plants in Alberta, New Brunswick, and Ontario. In the meantime, the AECL has been delivering new CANDU reactors to other nations, including South Korea, Romania, China, India, and Pakistan. Jordan, Turkey, and Lithuania also have expressed interest in the new CANDU-6 to meet their rising electricity demand, and, in the case of Argentina, to develop its own nuclear supply chain.

Prior to 1990, the AECL sold and built only three reactors outside Canada: RAPS-1, Wolsong-1, and Embalse. Since then it has built seven additional reactors outside Canada, including three in South Korea (Wolsong), two in China (Qinshan), and two in Romania (Cernavoda), where the second unit was commissioned on October 5, 2007. Romania is considering two more CANDU units at the same location.

Nationally Sourced Reactor Fuel

The distinguishing benefit of Canada’s CANDU reactor technology is its ability to use natural uranium or uranium enriched less than is necessary for light water reactor fuel, making fuel acquisition, preparation, and handling safer and less expensive.

Critical to any proposed nuclear plant is a reliable, long-term supply of uranium to fuel the reactor. Currently, the world’s known recoverable uranium resources equal 4.7 million tonnes, half of which are found in Canada. Canada produces about one-third of the world’s uranium, placing it far ahead of Australia (23%) and Kazakhstan (10%). As an added benefit, Canada’s uranium is up to two orders of magnitude higher in quality than all other worldwide deposits.

All uranium mining activities are located in northern Saskatchewan. Saskatchewan’s center-right Saskatchewan Party government, which gained the majority in 2007, has actively encouraged and supported uranium mining in the province. This reversed a New Democratic Party policy that was established in the early 1990s to phase out uranium mining. The new government recognized that the jobs and benefits to the provincial economy from uranium mining were far too important to be eliminated by boycotting uranium mining and that the environmental impact of the mining could minimized.

Cameco operates the McArthur River mine, the world’s largest uranium mine (Figure 6). McArthur River started production in late 1999 and is known to have enormous high-grade reserves. Areva Resources operates the McClean Lake Mine, which also started production in mid-1999. Both McClean Lake and McArthur River mines have achieved ISO 14001 environmental certification.

6. Uranium strike. Located in northern Saskatchewan, the McArthur River mine has the world’s largest, high-grade uranium deposit. Courtesy: Cameco

Uranium, in the form of yellowcake (U 3 O 8), is trucked from Saskatchewan milling operations to the world’s largest uranium refinery in Ontario. The yellowcake is refined to remove impurities and is converted into uranium trioxide (UO 3) in a multistep chemical and physical process using solvent extraction. Most of the UO 3 is converted into uranium dioxide (UO 2) for use as natural uranium in existing CANDU reactors.

Because of the CANDU reactor technology, Canada does not have to enrich uranium. CANDU fuel bundles contain either 28 or 37 rods of tubular zirconium alloy sheaths with UO 2 pellets inside, each rod being about 50 cm long (Figure 7).

7. Bundle of energy. A fuel bundle used to generate electricity in CANDU reactors. Courtesy:Cameco

The UO 3 can also be converted into uranium hexafluoride (UF 6) for export and subsequent enrichment and conversion to UO 2 for use in light water reactors. Natural uranium contains 0.7% uranium-235 (U-235), the uranium isotope of interest. Enrichment increases U-235 content to the 3% to 5% range required for light water reactors. Each year, 15% to 20% of Canada’s uranium production is consumed domestically; the rest is exported to other countries that use light water reactors.

Managing Used Nuclear Fuel

In Canada, used nuclear fuel (UNF), defined as irradiated fuel bundles that are removed from operating nuclear reactors, is safely stored at licensed facilities located in Ontario, Québec, New Brunswick, and Manitoba. After UNF is removed from a reactor, it is placed in wet storage for seven to 10 years, during which time its heat and radioactivity are reduced through the radioactive decay process. The UNF is then placed into dry-storage containers. Although the design life of a dry-storage container is 50 years, its expected life is 100 years or longer, and it provides an acceptable option for interim storage. (See "How to Solve the Used Nuclear Fuel Storage Problem," POWER, August 2008 and "Patchy Progress in Europe with Radioactive Waste Management," January 2009.)

In 2002, the Canadian government passed the Nuclear Fuel Waste Act and established a Nuclear Waste Management Organization (NWMO) comprising utility representatives from OPG, Hydro-Québec, and New Brunswick Power Corp. Oversight of the NWMO is provided by Natural Resources Canada. The objective of the NWMO was to investigate and recommend the best options for long-term UNF management to the federal government.

The NWMO engaged interested Canadians, stakeholders, and specialists in a three-year study and reviewed the benefits, risks, and costs of three technical options:

-

Deep geological disposal in the Canadian Shield.

-

UNF storage at nuclear reactor sites.

-

Centralized UNF storage, either above or below ground.

In November 2005, the NWMO released its final study on "The Future Management of Canada’s Used Nuclear Fuel," which was sent to the Government of Canada as part of Canada’s long-term plan for UNF management. The study concluded that a process called Adaptive Phased Management be used for long-term UNF management.

The approach offers to maintain UNF at reactor sites in Ontario (at Bruce, Pickering, and Darlington Nuclear Power Stations and Chalk River Laboratories), Québec (Gentilly Nuclear Power Station), New Brunswick (Point Lepreau Nuclear Power Station), and Manitoba (Whiteshell Laboratories, a nuclear site undergoing decommissioning), while preparing for storage in a deep geologic repository.

Furthermore, the report proposed that centralized facilities should be in the provinces that have benefited from the nuclear fuel cycle. This includes the three that generate electricity from nuclear power as well as Saskatchewan, which has benefited economically from the uranium mining industry.

Deep geological storage involves storing UNF underground in the Canadian Shield, relying on natural and engineered barriers to isolate UNF from the environment over the material’s radiological lifetime.

Another big advantage: UNF could be removed in the future for reprocessing. For example, a single CANDU-6 fuel bundle can be reprocessed multiple times, with the final high-level waste product the size of a golf ball, or 0.5% the size of the original fuel bundle.

New Build Submissions

In August 2006, Bruce Power applied for a license with the CNSC to prepare a site for construction of up to four new reactors at its Bruce County facility in Ontario following the completion of a two-year feasibility study. The CNSC, much like the Nuclear Regulatory Commission in the U.S., is the agency that establishes health, safety, security, and environmental standards for the regulation of nuclear power reactors.

The CNSC accepted the company’s project description for a 4,000-MW project at the end of January 2007. In order to expedite its environmental assessment, it recommended to the federal environment minister that the project go straight to a public review panel rather than first negotiating an eight-month process to determine if such a panel were necessary.

Bruce Power submitted its environmental impact statement to the government in September 2008, showing that the project would not have significant environmental impacts. Depending on the construction start dates, the new plants are expected to come online between 2014 and 2018. Six different reactor types are under consideration.

In September 2006, OPG followed suit and applied for a license to prepare its Darlington site for construction of up to four new reactors and submitted a project description to the CNSC in April 2007. Applications from interested companies — AECL, AREVA, and Westinghouse — were submitted in February 2009 and are being assessed by Infrastructure Ontario with representatives from the Energy and Finance ministries, Bruce Power, and OPG. A decision, expected in June 2009, will be based on the lifetime cost of power, schedule, and investment in Ontario. The reactors, yielding a total of 2,000 to 3,500 MW, are expected to come online in 2018.

New build applications are even expanding into provinces such as Alberta that have traditionally used fossil fuels for electricity production. A current proposal by Bruce Power Alberta is to construct up to 4,000 MW from twin ACR-1000 reactors at Peace River costing up to C$10 billion. Energy Alberta Corp. has also applied to the CNSC for a site license for a C$6.2 billion 2,200-MW plant aiming for a 2017 start-up date.

Though a nuclear renaissance remains just beyond the horizon for the U.S., it appears to be in full flower in Canada.

—James M. Hylko (jhylko1@msn.com) is a POWER contributing editor.