No one can accuse the officials who oversee California’s energy market of lacking ambition.

Fresh on the heels of Gov. Jerry Brown’s January promise to raise the state’s renewable generation target from 33% in 2020 to 50% in 2030, the California Independent System Operator (CAISO) in April announced that it and Oregon utility and Berkshire Hathaway subsidiary PacifiCorp were beginning discussions on PacifiCorp’s joining the ISO as a participating transmission owner.

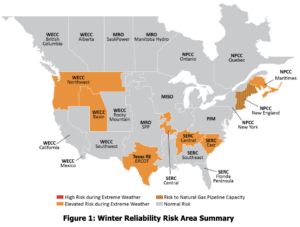

PacifiCorp and CAISO are already cooperating with the Energy Imbalance Market (EIM) they launched in November. This move would go further, to put PacifiCorp’s grid under CAISO control. The plan—which would expand CAISO’s territory by a whopping 40%—is certain to shake up energy markets throughout the western U.S.

Too Much of a Good Thing

The reason this move matters so much is that CAISO and PacifiCorp operate the two largest grids in the Western Electricity Coordinating Council. Putting both under the same management means not just a broader pool of power supplies to draw on but also more resources to balance the region’s substantial—and rapidly expanding—wind and solar generation. That means fewer curtailments for renewable generators.

A harbinger of things to come can be found in CAISO’s fourth-quarter report on the EIM, which it released in February. The report estimates that gross benefits to the participants in November and December alone came to almost $6 million. Most of this—about $4.73 million—accrued to PacifiCorp. (These figures do not include additional benefits from reduced flexibility reserves.) During that period, PacificCorp sent 180,786 MWh south to CAISO, while CAISO sent 27,361 MWh to PacifiCorp. Though these numbers are not huge, they represent a significant amount of generation that would likely have otherwise been curtailed.

Electricity oversupply events have been a perennial problem in the Pacific Northwest for decades, one that has grown worse as the region’s wind capacity has expanded. Spring is typically the worst, as this is when peak runoff coincides with peak wind volumes and low demand. Dam operators can only spill over a certain amount of water without causing problems for aquatic life, so this has often meant wind generation has to be shut down so water can keep flowing through the turbines. Neither wind farm owners nor transmission owners like this solution, but with nowhere to put the excess power, there has been little choice. PacifiCorp’s entry into CAISO would help change this.

Regional Tensions

Some observers in the Pacific Northwest have complained for years that generators in the region have been unfairly blocked from the California market because of that state’s regulations. One of the biggest issues is AB32, California’s cap-and-trade greenhouse gas (GHG) emissions scheme, which has been in force since 2012. Among other things, it places certain restrictions on power generated out of state—the price asked must reflect the cost of GHG emissions.

How this will affect PacifiCorp—which has about 8 GW of coal and gas generation—should it join CAISO, remains to be seen. Currently, EIM participants have to include a price adder if they want to avoid dispatch into CAISO, something neither the Federal Energy Regulatory Commission (FERC) nor some participants are happy with. In response to FERC’s concerns, CAISO has proposed a different method by which participants can flag bids they do not want dispatched into California.

The complication here is that there are constitutional limits on the degree to which regulations in one state are allowed to affect economic activities in other states. One can certainly expect that authorities in Wyoming, where PacifiCorp has operated four large coal-fired plants for decades, will look askance at the possibility that their generating resources might be negatively affected by California emissions regulations.

Environmental groups in California, which have made much of the state’s progress in “getting off coal” also will surely object to the possibility that CAISO might import more coal-fired power.

Balancing Act

That being said, a CAISO-PacifiCorp joinder would be a clear win for renewable generation.

I’ve written in the past about the issues surrounding renewable intermittency, issues that have continued to grow. Dealing with renewable intermittency generally requires three things: dispatchable generation (typically gas-fired), robust energy storage resources, and enough transmission capacity to balance fluctuating generation across a large grid. This proposal would be a big contribution to the latter element.

California, with its Mediterranean climate, can often suffer from stifling heat in the spring (trust me on this one), the very period when the Pacific Northwest has traditionally experienced overgeneration. Having an outlet south means that hydro and wind in the Northwest can reduce the degree to which they have been offsetting each other.

Meanwhile, California’s summer-to-late-summer spikes in solar generation, which have had CAISO officials worried for years as the state’s installed capacity continues to explode (California installed about as much solar as the rest of the U.S. combined in 2014), would have an outlet north to replace the fall lull in hydroelectric generation—a lull that would require less fossil generation to backstop.

The losers here are merchant generators in CAISO with gas-fired plants, who are already complaining that the proposal threatens their bottom lines. With the large amounts of gas-fired power added to the CAISO grid in recent years—capacity built with expectations of profiting off renewable fluctuations—this isn’t a trivial concern.

Obviously, much work remains before a seamless integration between CAISO and PacifiCorp can be achieved. But with other utilities like NV Energy and Puget Sound Energy moving to join the EIM, and the Bonneville Power Administration looking at starting its own EIM—one for which CAISO submitted a bid to operate—the hopes of renewables advocates for widespread grid integration appear bright. ■

—Thomas W. Overton, JD is a POWER associate editor.