With national electricity demand surging—driven by artificial intelligence (AI) and data center developments, widespread electrification, and challenging legislative and regulatory policy shifts—utilities are scrambling to keep pace. Add to that mounting supply chain strain and aging infrastructure, and it’s no wonder utilities are facing a costly balancing act.

Just two years ago, analysts estimated a cost of $2.5 trillion by 2030 to upgrade the U.S. grid, and that number continues to climb in tandem with demand growth and climate-driven disruptions. In 2023 alone, U.S. utilities spent more than $78 billion on transmission and distribution infrastructure.

COMMENTARY

While large-scale grid modernization is unavoidable, one immediate and cost-effective path forward already exists: optimizing the behind-the-meter (BTM) distributed energy resources (DERs) that are often already available in communities.

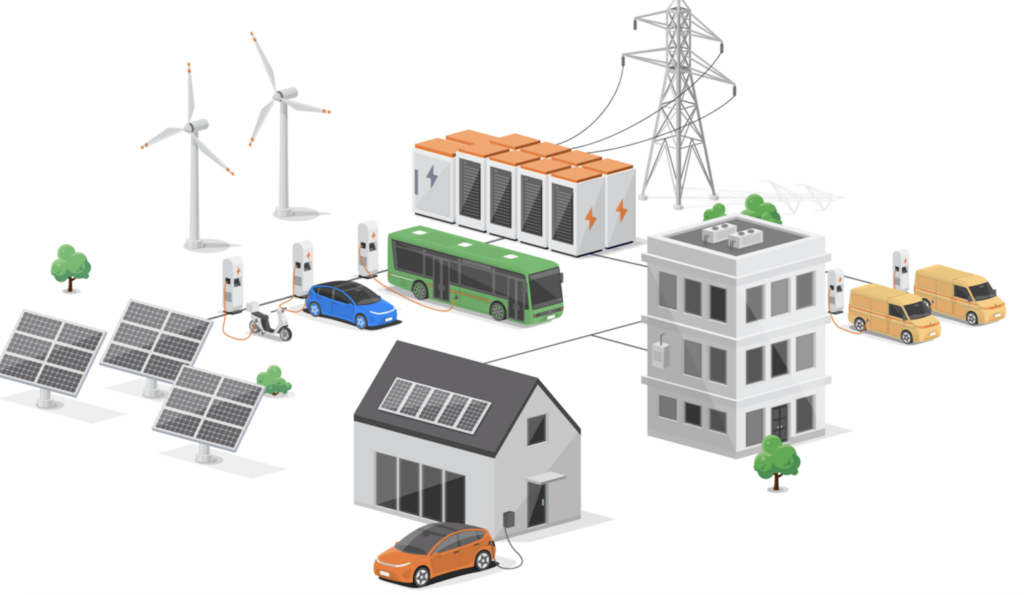

These assets—rooftop solar, smart thermostats, electric vehicle (EV) chargers, battery storage, and more—are already in homes and businesses across the country (Figure 1). With the right management strategy, BTM DERs can play a central role in expanding virtual power plant (VPP) capacity, reducing demand during peak periods, and ultimately defraying the need for costly new power plants and transmission investments.

Supply Chain, Policy Pressures Add to Infrastructure Constraints

Utility leaders aren’t just challenged by surging demand. They’re also contending with material shortages, regulatory headwinds, and trade policies that complicate long-term planning. For example, transformer backlogs remain a critical issue, with delivery lead times exceeding three years in some cases. Meanwhile, tariffs on solar and battery components have caused uncertainty in DER adoption and slowed progress on distributed generation. New appliance standards rollbacks are also expected to drive up residential and commercial energy use. At the same time, ongoing global tensions around critical minerals and manufacturing are disrupting supply chains across energy sectors.

This article is part of POWER’s annual special edition published in partnership with the RE+ trade show. This year’s event is scheduled for Sept. 8-11, 2025, in Las Vegas, Nevada. Click here to read the entire special issue, and if you’re attending RE+, be sure to connect with the POWER team at our booth on Venetian Level 1—V3046.

Fortunately, many DERs—particularly those behind the meter—are already deployed and waiting to be activated. With proper integration through Grid-Edge distributed energy resource management systems (DERMS), these customer-sited assets can support demand flexibility programs that reduce stress on the grid.

Programs such as demand response, EV managed charging, and virtual power plants offer the potential to both redistribute energy back to the grid and/or dynamically reduce or shift load during critical times. In doing so, utilities can avoid expensive energy market purchases, maintain grid stability, and defer large capital projects.

Growing the Virtual Power Plant Footprint

The Department of Energy estimates that the U.S. will need between 80 GW to 160 GW of additional VPP capacity—roughly 10% to 20% of national peak load—by 2030. As of 2023, the country had achieved only 30 GW to 60 GW, mostly through demand response. Already, states are beginning to act. For instance, Virginia utilities are now required to submit VPP pilot proposals to regulators, highlighting a growing recognition that DER aggregation must play a central role in energy planning.

By definition, virtual power plants coordinate the performance of numerous DERs to operate collectively as a dispatchable energy resource. This includes solar inverters, battery energy storage systems, EVs, and grid-interactive appliances—all energy assets that can be aggregated and managed intelligently to reduce system-wide peaks.

Demand Response: Legacy Meets Modernization

One of the longest-standing tools in a utility’s toolbox, demand response has evolved dramatically from the radio-activated HVAC switches of the 1970s. Today, with broadband and IoT capabilities, demand response programs are increasingly powered by smart thermostats and other connected devices.

More than 10 million U.S. households currently participate in some form of demand response, helping shave over a terawatt of load annually. And with smart thermostat penetration expected to grow well beyond the current 16% of broadband-connected homes, the opportunity for further expansion is substantial.

Regulatory developments are reinforcing this trend. The Federal Energy Regulatory Commission (FERC) has recently expanded the regulatory framework for demand response participation, further legitimizing it as a dispatchable asset in organized markets.

EV Charging: A New Frontier in Load Flexibility

EV adoption may have slowed in recent months, but the long-term trajectory is still upward, and with it, a major opportunity for load management.

EV charging represents the most dynamic type of BTM load, with managed charging programs that pause or shift load during peak periods now common across leading utility service areas. Advanced programs include vehicle-to-grid (V2G) capabilities, which discharge stored battery energy back to the grid during high-demand windows.

Moreover, EV telematics—a technology that transmits real-time data directly from vehicles—allows utilities to gather invaluable insights about charging behavior and mobility patterns. This improves forecasting and program performance, providing grid operators greater visibility into load shaping opportunities.

Grid-Edge DERMS: Unlocking the Full Potential of BTM

Not all DERMS platforms are created equal. Grid DERMS solutions manage utility-owned assets. In contrast, Grid-Edge DERMS platforms focus on managing customer-sited DERs, introducing variables—like opt-in rates, customer attrition, and device diversity—that must be handled intelligently.

To address these challenges, utilities are increasingly turning to advanced solutions like Topline Demand Control (TDC). TDC leverages AI, model predictive control, and localized forecasting to ensure predictable outcomes from decentralized assets. Unlike traditional demand response, which depends on customer behavior, TDC delivers precise, pre-modeled load reductions, removing uncertainty from demand flexibility events that involve behind-the-meter DER assets.

Final Thought: Meet Demand Without Building

The urgency to modernize America’s electric grid is evident, but utilities must remain strategic. New construction is not only capital-intensive and resource-constrained—it’s slow. By contrast, behind-the-meter DERs are already available, already installed, and ready to be integrated into advanced load flexibility programs. Leveraging these assets through VPPs and Grid-Edge DERMS platforms offers a faster, smarter, and more affordable path to grid resiliency—one that meets demand without breaking the bank.

—Amber Mullaney is VP of Marketing at Virtual Peaker.