Power generators typically allocate construction risks through the process of aversion. Owners have a tendency to shift risk to a project’s primary contractor, who in turn pushes it to lower-tier parties in the contracting arrangement. Research by the Construction Industry Institute has found that there are more equitable ways to allocate project risk.

Risk is a reality that every contracting party faces, but construction companies often encounter elevated risk due to the nature of their business. Construction involves numerous contracting parties, technological challenges, and difficult working conditions. As a result, the allocation of risk in the construction industry is often a controversial process, with each party attempting to avoid as much risk as possible.

The following excerpts from a Construction Industry Institute (CII) report on equitable risk allocation address the 14 “hot-button” risks identified by a research survey of contractors and owners.

Ambiguous Allocation of Risk

The construction industry does not have a conclusive and widely accepted practice for allocating project risk. In fact, many CII members report that the prevailing risk allocation strategies are ineffective and possibly detrimental to overall project success. Risks are often allocated based on historical company practices. These methods become common practice because they are easy to implement and appear to eliminate risk for the party with the majority of the bargaining power. However, a continual shifting of risks can lead to controversial contracting relationships and result in severe ï¬nancial consequences if the risks are not assumed and controlled by the appropriate parties.

In attempting to protect the party with the higher bargaining power, one-sided onerous contracts often have the exact opposite effect. A contract that shifts risk inappropriately will frequently lead to a reduction in the quality of bidders, as the more sophisticated parties will not be willing to adhere to the contract terms; a bidder that does not recognize the inequitable contract terms may submit a contract bid price that does not reflect the inflated amount of risk. Whether the successful bidder is unqualified or bids too low, litigation and disputes may arise later in the project. If an unqualified or low bidder becomes insolvent, the owner will be left to deal with the financial consequences that it was trying to avoid when drafting the one-sided contract.

Bad business and poor performance risk are not typically allocated through direct contract language; instead, they simply exist due to the nature of the business. Some risks are best dealt with through direct contract language, while others are best dealt with through project execution and performance. However, even though there is no specific contract clause dedicated to these types of risks, all contracting parties should strive to draft contracts that will mitigate all risks.

A common example of inappropriate risk allocation is a no damages for delay clause that allows the contractor time relief as the sole remedy to an owner-caused delay. In this situation, the contractor cannot recover any other damages associated with the delay, even though it is out of the contractor’s control. Another example of inappropriate risk allocation is a turnkey contract that states that, if the subcontractor fails to review the plans and notify the general contractor of any design errors prior to construction, then it is the subcontractor’s responsibility to provide for the cost to correct the design errors.

Contractors and subcontractors often enter into contracts containing inappropriate risk allocation because they are in need of work and do not possess the bargaining power to achieve agreeable risk allocation. As a result, owners and contractors with the higher bargaining power often draft contract documents in their favor from the outset of a project to minimize risk exposure.

Inappropriate risk allocation has led to adversarial relationships between contracting parties and has thereby increased the frequency of claims and disputes. Alleviation of this problem requires that each risk on a project be identified prior to construction and be allocated, with separate consideration given to the party that may be in the optimal position to evaluate, control, bear the cost, or benefit from the assumption of the risk, recognizing the unique circumstances of the project. With this solution in mind, the research team began its collection of data.

Identifying “Hot-Button” Risks

Research by the CII points to the value of compromise and education on risk allocation while recognizing the unique circumstances of each speciï¬c project. In summary, the data collection purposes were threefold:

- To validate the observation that inappropriate risk allocation results in financial consequences.

- To establish a list of risks most frequently allocated in an inappropriate manner.

- To find data to support a constant, optimal allocation of these top risks.

The research team established a framework for data collection that included an initial questionnaire and a web-based survey. Phone interviews were used to better determine which risks were seen as the primary hot-button risks by the industry as a whole in terms of frequency. The team then focused on a smaller sample size of these risks to determine the severity of inappropriate allocation. Telephone interviews were conducted to investigate the specific financial impacts of inappropriate allocation of risk.

A total of 60 telephone interviews were conducted during the data collection phase of the research project. From these interviews, the research team identified many case studies of projects on which risk had been inappropriately allocated in the contract and had had a direct financial impact. The team next separated out the case studies that were examples of bad business or poor performance practices being the cause of the inappropriate contractual risk allocation that produced negative financial results.

The research team was able to isolate 17 case studies where an actual inappropriate risk allocation resulted in direct financial impact. Twelve of these case studies were of contractors and five were of owners. In each of these cases, both owners and contractors absorbed the financial consequences.

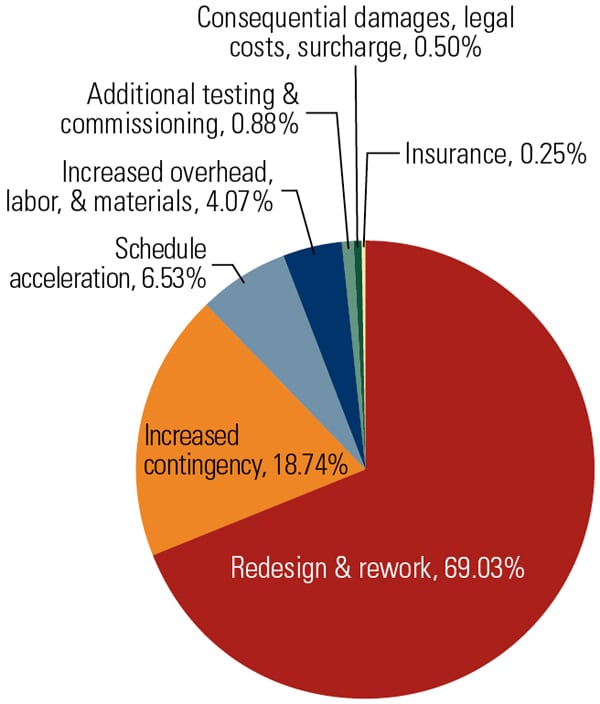

The cumulative estimated construction budget of all 17 project case studies came to just under $1.2 billion. The cumulative financial impact from inappropriate allocation of risk in all of the case studies totaled approximately $159 million, or 14% of the cumulative estimated construction budget. Figure 1 shows the overall percentage breakdown of that total $159 million impact.

|

| 1. The cost of poor project risk allocation. This chart shows the different categories of financial impact resulting from inappropriate risk allocation in 17 case studies. Source: CII |

The data collected showed that if risk is inappropriately allocated, resulting financial consequences can be significant. Nearly 20% of the overall impact resulted from contractors increasing their contingencies in response to inappropriate risk-shifting by the owner. This indicates that if risk is inappropriately allocated to contractors, increased contingencies will often be passed to the owner. It may be more cost-efficient to retain the risk and use mitigation and management techniques to lower the costs in-house.

The 14 Hot-Button Risks

Following are descriptions of the 14 hot-button risks reported by the CII survey.

- No Damages for Delay. Some owners frequently attempt to include contract clauses that severely limit or exclude recovery of damages for owner-caused delays. The primary contractor also may attempt to shift the risk of contractor-caused delay damages onto lower-tier subcontracted parties with similar clauses. As a result, lower-tier parties may assume the majority of the financial responsibility for all delays on a project. The U.S. judicial system has frowned upon the inclusion of no damages for delay clauses, because such clauses attempt to shift the responsibility for wrongdoing by the higher-tier parties.

- Consequential Damages. Consequential damages for an owner include loss of revenue and loss of beneficial occupancy resulting from delays. Consequential damages for a contractor include loss of potential business and loss of advantageous weather conditions resulting from delays. Many owners feel that contractors have a low incentive to perform in a timely manner if the contract waives the owner’s right to its consequential damages. In contrast, many contractors feel that it is inequitable for owners to attempt to hold the contractor responsible for consequential damages that could reach excessive amounts and drive the contractor out of business. Consequential damages are not limited to damages caused by delays.

- Indemnity. Indemnification (“hold-harmless”) clauses attempt to limit the liability for the personal injuries of contractor employees, owner employees, and third parties. Liability for damage to property also is often limited by indemnification clauses. Contractors will try to avoid indemnification clauses that provide full indemnification for the owner without qualification. In these cases, the owner could be 100% responsible for the damaging event, but the contractor could be forced to indemnify the owner nonetheless. Some owners feel that indemnification clauses that provide mutual, comparative indemnification for both contractors and owners are unfair to owners because there is a higher likelihood that a contractor employee will be injured than an owner employee.

- Ambiguous Acceptance Criteria. Frequently, acceptance criteria include phrases that specify that the work be completed so that it is “fit for purpose” or “to the owner’s satisfaction.” This can lead to a situation where the contractor may feel that it has achieved the acceptance criteria, but the owner views the contractor’s performance as falling well short of acceptance. Some contractors feel that ambiguously defined acceptance criteria can lead to the owner using the punch list as a catch-all to modify or fine-tune the design to make it “acceptable.” All parties will benefit when the acceptance criteria avoid qualitative statements and contain measurable, quantitative criteria.

- New or Unfamiliar Technology. With new or unfamiliar technology, it is important that the risk of its performance is appropriately allocated in the event of failure. Although it seems clear when a party should take the responsibility for new or unfamiliar technology, contracts often do not clearly specify risk allocation. As technology in the construction industry advances, it will become increasingly important that the functionality risk of new technology is properly allocated.

- Force Majeure. Force majeure (“Act of God”) clauses, particularly considering the catastrophic damage to the U.S. Gulf Coast in August and September 2005 as a result of Hurricanes Katrina and Rita, need to eliminate the risk for potential disputes. Often, contracting parties will rely on insurance companies to provide protection from force majeure events. However, the potential for insurance companies to go insolvent in the case of a force majeure event makes it even more important that the contract documents clearly address the risk factors surrounding force majeure events.

- Schedule Acceleration. Contractors feel that clauses that allow the owner to mandate acceleration at any time without providing relief of indirect costs due to lost productivity are inappropriate. Owners feel that there should be a limitation on the indirect costs that contractors are allowed. Ultimately, many projects have fixed end dates. Therefore, it is important that compensation for mandated, constructive, and recovery acceleration costs is appropriately specified up front in the contract documents, because there is a high likelihood that acceleration efforts will be required on many projects.

- Cumulative Impact of Change Orders. Current research shows that when a project has numerous change orders, the result is a negative impact on contractor productivity. Determining indirect costs associated with the resultant loss of productivity is not an easy task. Further compounding the problem is the fact that the cumulative impact is not fully realized until later stages of the project. Due to the difficulties in measuring productivity loss stemming from the cumulative impact of change orders, it is imperative that compensation measures be clearly and cooperatively defined in the contract documents.

- Owner-Mandated Subcontractors. When an owner specifies that a contractor use certain specialty subcontractors, there is a risk that the subcontractor will not perform adequately. A subcontractor’s default can be costly, so the allocation of an owner-mandated subcontractor’s performance risk should be clearly stated in a contract clause. Many contractors feel that if the owner limits the contractor’s choices in subcontracting options, then the owner should retain the risk of performance.

- Insurance Allocation. Many risks are most effectively allocated by obtaining insurance to cover the expected costs. The allocation of insurance deductibles commonly becomes a topic of dispute. If the contractor is required to obtain a large amount of insurance and the insurer becomes insolvent, the contractor could be liable to pay a majority of the losses that should have been covered by insurance. Furthermore, contractors find it difficult to estimate the cost of deductibles up front because they do not know if the events will occur. This puts the contractor in a situation where it may submit an uncompetitive bid if it increases its contingency to account for the probability of deductibles in excess of other contractors.

- Differing Site Conditions. If existing site conditions are materially different from those indicated in the contract documents or from what was expected by the contracting parties, costs can increase at an alarming rate. Because differing site conditions can increase costs drastically by causing severe delays and mitigation costs, differing site conditions clauses should clearly and appropriately allocate the risk of encountering such conditions. If a differing site conditions clause is not included in a contract, the contractor may dramatically increase its contingency to account for the risk.

- Design Responsibility. Design responsibility should be appropriately allocated to the party with the most control over the design who can survive the financial consequences of an insufficient design. Some owners shift responsibility by including clauses that expressly state that the contractor will guarantee the work to be free from fault and defect and has inspected the plans and specifications. Some contractors will include similar clauses in subcontracts with lower-tier parties. This is a clear example of inappropriate risk allocation, because the contractor and subcontractor have absolutely no control over the design documents.

- Waiver of Claims. Owners and contractors are commonly concerned with the time limits that are specified for delay claim waivers. Appropriate attention should be given to drafting delay claim waivers so that all parties are satisfied with the time limits and are aware of their respective responsibilities when a delay does occur. Final waivers of claims are sometimes not mutual, or the time limits are inappropriate; therefore, the contracting parties should discuss appropriate allocation of final waivers of claims so that neither party has an unfair advantage.

- Standard of Care. Engineering standard of care clauses frequently specify that design professionals should perform their duties to the “highest and best industry standards.” This type of language can lead to claims and disputes if the owner feels that the design professional did not perform to such “standards.” Similarly, construction standard of care clauses frequently specify that the contractor shall perform in a “workmanlike manner.” All contracting parties should take care to draft clear, unambiguous standard of care definitions. When possible, standard of care clauses should define measurable benchmarks that set out the standard of care expected.

Each Project Is Unique

To state that any particular risk should be allocated in a certain way or to a certain party to a contract is unwise. The research team strongly believes that the optimal allocation of a risk depends on the unique circumstances of the project in question.

The final report, available from CII, describes a risk allocation model that encourages contracting parties to consider the uniqueness of each project cooperatively in order to find the most efficient technique to allocate each risk.

—These excerpts from CII Implementation Resource 210-3, Equitable Risk Allocation: A Legal Perspective, are reprinted with permission from CII. This resource gives examples of contract language to help contracting parties rationally address each of these 14 hot button risks. It was prepared by the members of CII Research Team 210, Contracting to Appropriately Allocate Risk and is available from the CII. Bechtel’s Rick Bradford chaired the team and Dr. Awad Hanna, University of Wisconsin–Madison, was the principal investigator.