The acquisition of Sherritt International’s Prairie and Mountain coal mining operations will push Westmoreland Coal Co. well into the top 10 of North American coal producers.

The purchase helps Westmoreland diversify its assets. As the oldest independent coal company in the U.S., it has established mining operations in Montana, North Dakota, Wyoming, and Texas. The $435 million deal, announced on Dec. 24, will add seven producing thermal coal mines in Alberta and Saskatchewan, Canada, as well as a stake in an activated carbon plant and a Char production facility, to the company’s portfolio.

Mergers and acquisitions have been the norm for quite some time in the coal mining industry. In October, Murray Energy Corp. nearly doubled its annual production through the purchase of Consolidation Coal Co. from CONSOL Energy Inc. That deal moved Murray firmly into fifth place in North American production.

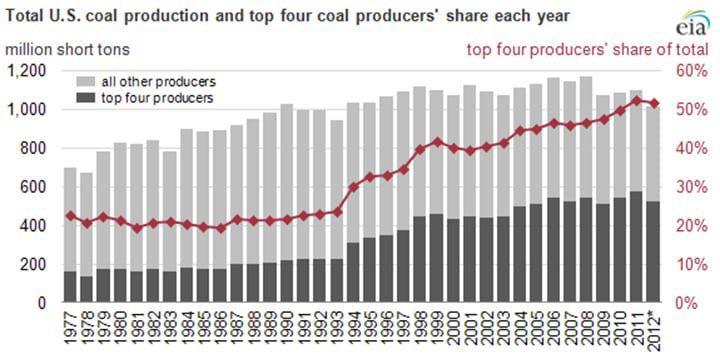

The top four coal producers have been entrenched for some time and produce more than half of all the coal mined in the U.S. Peabody, the world’s largest private-sector coal company with trading and business offices in the U.S., China, Australia, Singapore, Indonesia, Germany, Mongolia, India, and the UK, appears to be in no danger of losing the top spot, which it has held for decades.

For Westmoreland, the acquisition of Sherritt’s Mountain operations provides an entry point into the export market with its access to port facilities. Having the option of selling coal in the high-growth Asian markets is sure to add value for the company. Not to mention, Western Canada is regarded as one of the world’s most favorable mining jurisdictions, which is another plus for the company.

“This is an historic event for Westmoreland. The acquisition of Sherritt’s coal operations represents a transformational opportunity to acquire seven producing coal mines, which are highly complementary to our existing operations and expertise,” said Keith E. Alessi, Westmoreland’s executive chairman.

The deal is expected to close in the first quarter of 2014.

—Aaron Larson, associate editor (@AaronL_Power, @POWERmagazine)