There will be no shortage of important issues to keep utility executives and their staffs busy throughout 2010. Few of these will be surprises, although a number will emerge quickly and assume larger-than-life significance. The confluence of the great recession and the sturm und drang of environmental legislation will create the liveliest of the debates, but more subtle trends will drive additional stressors. The results of Black & Veatch’s 2009 fourth annual industry strategic directions survey can offer guidance as to how these issues will affect the industry in the coming year.

The focus of U.S. state and federal regulation is undergoing a fundamental change that will affect power utilities and merchant generation. Simply stated, the nation has reembraced heavy regulation. Not surprisingly, rate and regulatory issues rule the day among the utility industry respondents to Black & Veatch’s 2009 fourth annual survey, Strategic Directions in the Electric Utility Industry: What Does the Future Hold for an Industry in Transition?

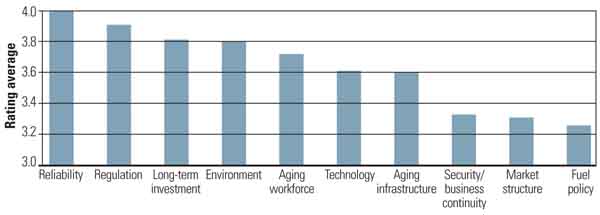

Reliability remained respondents’ number one concern, while regulation and long-term investment rose to second and third place respectively (Figure 1), up from sixth and seventh place last year. It is reasonable to believe that this remarkable ascension was largely attributable to the state of the economy, the financial markets’ meltdown, and a compelling — perhaps compulsive — national focus on greenhouse gas (GHG) legislation. The environment came in a very close fourth place. It seems that faith in free markets has been lost in the state and national capitals, and heavy economic and environmental regulation is back, at least for the balance of the current administration. The complete results of the survey will be available this month at www.bv.com.

1. Top 10 issues of concern to utility senior management. A rating of 5 signifies a very important concern; a rating of 1 indicates an issue of only average concern. Source: Black & Veatch’s 2009 Strategic Directions in the Electric Utility Industry survey

Upward Pressure on Rates

Tremendous pressures are forcing utility rates up. Sales and revenue are falling, the need for new infrastructure is increasing, and investments in smart grid, demand-side management (DSM) and energy efficiency (EE) programs are skyrocketing. Electric utilities are investing substantial sums in these technologies even as sales decline, driving up customer costs per kilowatt-hour, well before offsetting benefits can be realized.

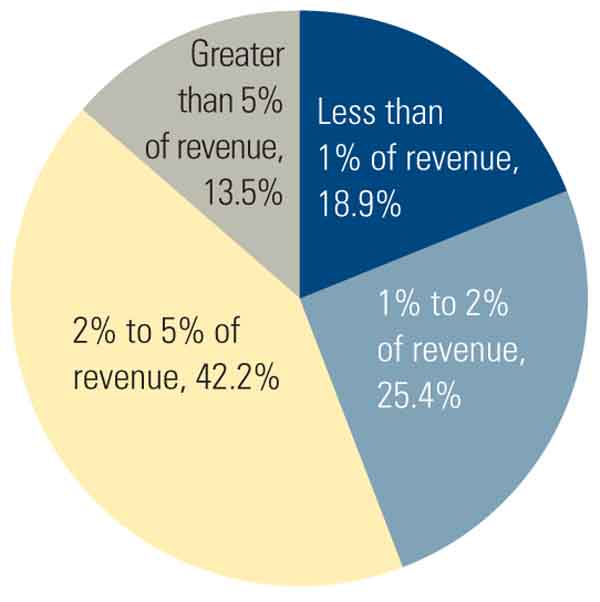

Last year, we estimated the costs of smart grid technology (which also enables some DSM and EE programs) at between 5% and 10% of an average residential customer’s bill before the realization of offsetting benefits. We have seen nothing in the past 12 months to change our estimate. Furthermore, our survey respondents indicated that their companies are spending, conservatively, the equivalent of about 2% of gross annual revenue on DSM and EE programs (Figure 2). In fact, 56% indicated that they are spending more than 2%, up from half of those responding at that level last year. Assuming that this is an accurate representation, the electric utility industry is spending somewhere in the order of $5 billion to $6 billion a year on these programs — roughly the equivalent of between 15% and 20% of investor-owned utilities’ pretax income.

2. Survey results: DSM and EE. Respondents reported the expected share of annual operating revenue to be spent on demand side management and energy efficiency over the next five years. Source: Black & Veatch’s 2009 Strategic Directions in the Electric Utility Industry survey

Combine this with declining sales, attributable in part to the success of these programs, the lack of decoupled rates in most jurisdictions, and the pressures for transmission and distribution system upgrades, and it’s no wonder that utilities have been under-earning and the need for rate increases has become great. In its "2009 Long-Term Reliability Assessment," the North American Electric Reliability Corp. (NERC) estimates that, of the overall decline between the 2008 and 2009 forecasts of summer peak load, 20% is attributable to DSM and EE, and 80% is attributable to changes in economic conditions.

Mixed Results on Controlling Carbon

Of course, it’s not just rate regulation that will keep CEOs and CFOs up at night in 2010. The potential for federal carbon legislation and its related costs are significant, although the odds of such legislation passing in early 2010 are very slim as of this writing. Ironically, the lack of certainty around carbon legislation, and the tension created by existing regional carbon markets in the absence of federal mandates, result in more executive migraines than a clear, federal mandate would.

The foundation of our national ambivalence about carbon legislation — and therefore Congress’s resolve — is pretty clear: Both the general public and utility management are increasingly skeptical. A poll conducted by the Pew Research Center shows that just over a majority (57%) of the population believes there is solid evidence of global warming, down dramatically from 71% in 2008. Pew says that only 36% of the population in 2009 believed global warming is a very serious problem, as compared to 44% in 2008 (see http://tinyurl.com/yf4ajkv).

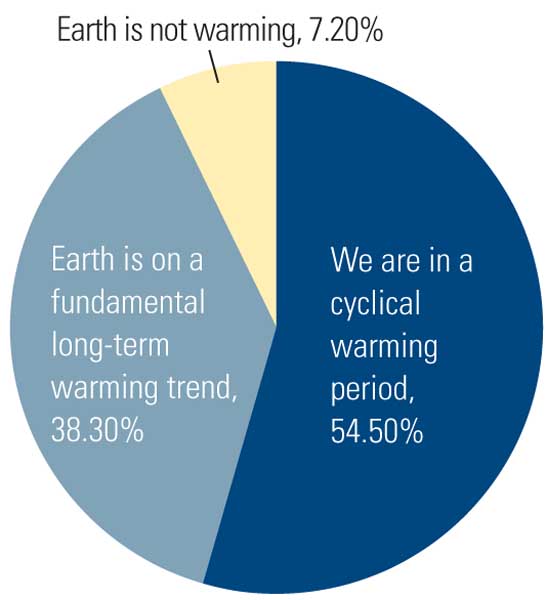

Black & Veatch’s survey reveals similar results. Sixty-two percent of respondents believe either that Earth is warming due to natural cycles (rather than human activities) or that it is not warming at all (Figure 3). Of all respondents who believe the planet is warming, half believe the cause is anthropogenic. A very large minority (just under 50%) had little or no confidence in the underlying science, while just under a third had some or a high level of confidence.

3. Survey results: climate. The majority of respondents believe Earth is warming due to natural cycles. Source: Black & Veatch’s 2009 Strategic Directions in the Electric Utility Industry survey

Though the scientific community has raised a number of valid and even compelling points concerning climate change, the Pew and Black & Veatch survey results hardly suggest a groundswell of popular or industry support for carbon legislation. The issue is not whether warming is occurring, but whether it is man-made. A recent hacking of the Climate Research Center computers at East Anglia University (UK) illuminates a division of opinion on this matter even inside the scientific community (see for example, "Climate Emails Stoke Debate," Wall Street Journal, November 23, 2009).

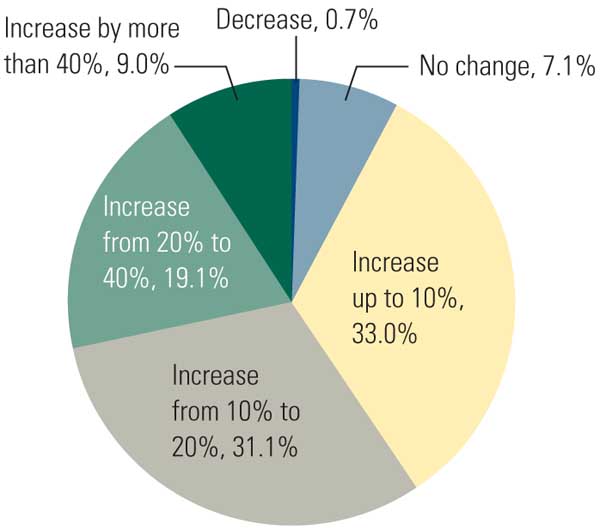

The widely diverse estimates of costs to the economy associated with carbon legislation don’t provide clarity, either, and the concern over the high-end estimates appears to prevail during these difficult economic times. A plurality of Black & Veatch survey respondents (40%) believed that Waxman-Markey (the reference legislation approved by the House of Representatives at the time the Black & Veatch survey was conducted in the summer of 2009) would result in an annual increase in customers’ bills of between $500 and $1,000 (Figure 4). Fifty-two percent of the respondents believed that the country can ill afford carbon legislation, while only 28% felt otherwise. Forty-six percent felt that the recovery of compliance costs by utilities would be most difficult. Less than a third believed these costs could be recovered fairly easily.

4. Survey question: How much do you anticipate the Cap and Trade Bill passed by the House will add to the average homeowner’s electric bill? Source: Black & Veatch’s 2009 Strategic Directions in the Electric Utility Industry survey

The Environmental Protection Agency (EPA) is standing by to fill the void should no federal GHG legislation pass. It has already declared its intentions to regulate not only greenhouse gases but also to regulate more heavily other air emissions and water quality under the existing provisions of the Clean Water and Clean Air Acts. Even if the utility industry isn’t trying to figure out how to manage under federal GHG legislation in 2010, it will certainly be working overtime to comply with revitalized EPA regulation.

Infrastructure and Security

There appears to be a race among our survey respondents for the most important infrastructure issue. The industry remains in need of substantial increases in capital investment for reasons of reliability, interconnection of renewable energy resources, security, and economics.

Nearly 44% of respondents to Black & Veatch’s survey regarded generation as the asset class most in need of replacement — those classes that are "near," "at," "past," or "well past" their planned service lives (Figure 5). Significantly, almost one-third of the respondents regarded their information technology infrastructure as most in need of replacement. Generation’s position in the rankings comes as no surprise; however, the stark reality of the IT focus is that the requirements associated with cyber security and smart grid could be overwhelming if not managed properly. Our survey also revealed that computers and networks were regarded as the asset class most at risk of harm by outside forces, such as acts of terrorism or cyber attack, having moved from last place in 2006 (the first year of our survey) to a solid first place this year.

5. Survey results: infrastructure. Respondents reported which parts of their company’s infrastructure are substantially within their planned service life or are at risk because they are beyond their planned service life. Source: Black & Veatch’s 2009 Strategic Directions in the Electric Utility Industry survey

In addition to the attention paid to cyber security by the Federal Energy Regulatory Commission (FERC), NERC, and the administration’s cyber security czar, a recent feature on CBS’s "60 Minutes" television show suggested why this might be the case. According to the program, the U.S. "knows" that the grid has been "probed" by hackers and that grids in other nations, such as Brazil, have been successfully attacked, resulting in significant economic damage (see the Brazil story in this issue). Hypothetical scenarios for the U.S. power system were discussed, but no claims were made that the grid had, in fact, been successfully attacked. Although the "60 Minutes" story should create a bit of angst in all of us, Black & Veatch survey respondents appeared somewhat sanguine. Only 13% felt that the nation’s transmission system had been "hacked" and that dormant programs were installed and resident on the system. Just over a third, 35%, believed that no hacking has occurred. Respondents seemed more concerned about generating facilities; 57% believed that a generating facility would be harmed by a cyber attack in the future.

Utilities expect to spend more on compliance with Critical Infrastructure Protection (CIP) security standards. In 2006, only a third of respondents expected their CIP compliance costs to increase in the future by more than 10%. In 2009, this number had increased to 59.2% (Figure 6). After three years of dealing with increasingly demanding and complex CIP standards, the realization seems to be setting in that this is serious stuff and compliance will continue to become an increasingly larger responsibility. Furthermore, the consequences of noncompliance could be extremely high in terms of penalties levied and real damage done by a successful cyber attack. The challenge for the industry will be to undertake a hardening of the grid at reasonable cost, and not appear to be resistant due to concerns over profits, as suggested by the "60 Minutes" broadcast.

6. Survey results: security. Survey participants were asked, “In light of new NERC Security Standards, how much do you expect your annual investments in security enhancements to change over the next five years?” Source: Black & Veatch’s 2009 Strategic Directions in the Electric Utility Industry survey

The Economy and Financial Performance

The investor-owned energy and utility sectors of the stock market fared significantly more poorly than the broad Standard & Poor’s Index (S&P) over the past 12 months (arguably, utility stocks would fare better under a total return analysis, given their relatively high dividend rates, rather than just stock price) as indicated by the Rudden Composite Energy Index from Black & Veatch’s monthly Energy Capital Markets Report (Figure 7). As of the end of October 2009, the Rudden Energy and Utility Composite was up by only 3%, while the S&P had gained almost 11%. Moreover, utilities in the local and regional regulated sectors — the traditional "defensive" stocks that conservative investors customarily seek in bad economic times — did even more poorly, increasing by only 1% and 2%, respectively.

7. Ups and downs. The Rudden Energy Composite Energy Index was very volatile during late 2008 and through 2009. Source: B&V Energy Capital Markets Report

Performance in the merchant subsegment of the composite group was not good, with stock values registering an average decline of 2% (Table 1). However, the merchants redeemed themselves after the bottoming of the market in March 2009, registering a staggering increase of more than 93%, as compared to the increase in the S&P of about 60%, perhaps because of improving financial markets, or perhaps because they started recovering from such a low point.

The beginnings of a mild recovery in capital spending will probably be seen in 2010 as utilities try to catch up on plant investments that were postponed or canceled over the past two years. These postponements and deferrals are estimated at between 10% and 20% annually, although the recovery in capital expenditures will be slowed by several factors.

The first is slower electricity load growth. Forty-five percent of Black & Veatch respondents believe that load growth after the recession will be less than 1% annually or flat; 42% anticipate growth on the order of 1.0% to 1.5%. These levels are generally below the historical industry-wide rate of approximately 1.5% and the previous NERC growth estimate of 1.6%, according to the NERC "2009 Long-Term Reliability Assessment." For the second year in a row, NERC has seen an improvement in reserve margins primarily attributable to declines in load growth induced by the slow economy and the effects of DSM.

Forecasts of revenue growth are equally dim. More than 71% of respondents expect revenue growth after the recession to occur at a rate slower than before. Slightly more than a third indicated that the recession has significantly affected their capital investments.

The second factor is financing. Even though conditions in financial markets appear to affect merchant and alternative energy project developers the most, utilities will continue to feel pain. Long-term debt markets have significantly improved in the past six months, but commitments for project debt (especially for renewable energy projects) have been smaller, tenors often shorter, and interest rates somewhat higher — and all conditioned by the lenders on significantly lower project leverage. Short-term working capital has also been affected by general market illiquidity and tighter bank lending practices.

However, cautious optimism is in order. The economy, at least as measured by GDP, does appear to be turning around, but concerns over continuing high unemployment levels going into mid-2010, as well as the acute crisis in state and municipal budgets, will dampen a quick recovery.

Municipal and other state-owned utilities will remain at risk of contagion from the problems of their parents. The state and local government budget crisis is affecting bond ratings and increasing the chances that utilities will be called upon to aid in fixing the budget deficits through taxes and surcharges, increased payments in lieu of taxes, and other transfers. These pressures are occurring at a time when the utilities themselves are experiencing declines in revenue, increasing numbers of uncollectible accounts, and softening coverage ratios. Utility revenue bonds have fared better than general obligation bonds, but declines in energy sales and revenues present continuing risk.

The American Recovery and Reinvestment Act of 2009 may help in 2010 — especially in smart grid funding — but by mid-2009, almost two-thirds of those surveyed had seen no impact on their operations.

Table 1. Comparable performance of elements of the Rudden Utility Indexes based on the data used to prepare Figure 7. Source: B&V

The third factor that will slow capital investment is the lingering concern by utilities that regulators will not permit recovery of incremental capital costs through retail rates in the face of continuing bad — and in some regions, devastating — economic conditions. Merchants, on the other hand, will remain concerned about continued soft wholesale electricity markets driven by extremely low natural gas prices and lower capacity values attributable to slowly (albeit temporarily) improving reserve margins.

In 2010, these factors will likely constrain earnings and deprive utilities of a portion of the cash flows necessary to fund capital investments. Few CEOs will risk seeking favorable rate treatment for new plants while the economy remains stalled and unemployment high. Regulators and legislators who have not already done so might be well advised to implement policies to ameliorate the disincentives facing utilities, such as preconstruction prudence certification and allowance of construction work in progress in the rate base.

Transmission

One of the most critical institutional and infrastructure challenges facing the U.S. power industry is transmission. The NERC "2009 Long-Term Reliability Assessment" says that transmission siting is the issue most likely to be the major challenge to long-term reliability. Without some near-term resolution, the nation will be unable to realize either the full potential of its vast renewable energy resources or the more secure grid deemed so essential to the nation’s well-being. Respondents to the Black & Veatch survey ranked transmission as the second-greatest barrier to the development of renewable energy resources, after low electricity market energy prices.

Two concerns rise to the top: siting and cost allocation. The industry is working with the Congress, FERC, and state regulators to perfect legislative language in the proposed Senate energy bill that addresses both areas. How much authority should FERC have over transmission siting? Should it (and can it legally) preempt state siting authority? What is the proper balance between state and federal regulation, and how is that institutionally achieved? Should Congress write specific language into the law regarding the allocation of transmission costs, potentially shackling FERC’s discretion, or should FERC retain its ability to establish rates on a case-specific basis?

A significant portion of the western transmission system resides on federal lands that are particularly well-suited for the development of wind, solar, and geothermal resources. Until recently, permitting on these lands needed to clear no fewer than nine federal departments before approval. In October 2009, a memorandum of understanding was signed by the nine departments that is intended to greatly expedite the siting process. This will be accomplished primarily through the designation of a lead agency for all federal authorizations, unified environmental documentation, and consolidated environmental reviews. The new procedures will unfold in 2010.

Enter the Dragon

China is vast. It is also an excellent laboratory for energy technology. With its centrally controlled, quasi – market economy, as well as its low-cost production infrastructure, it is emerging as a potential global market leader in solar cell manufacturing, wind equipment production, and carbon capture and sequestration technology. Penetrating the U.S. market is one of its trade objectives. For example, Duke Energy has announced deals (real and potential) with Chinese companies to develop solar photovoltaic (PV) projects in the U.S. as well as to explore the development of clean coal and carbon capture demonstration projects in China, where permits to accomplish such feats appear to be less daunting than in America.

The implications of the Duke deals and similar ones will be mixed in the coming years. On the one hand, it is likely that the PV cells involved will be produced in China. But the trend toward manufacturing solar arrays overseas is already occurring due to natural global economic forces. Just recently, General Electric announced plans to close its only solar panel manufacturing plant in Delaware, acknowledging the competitive advantages that China and other low-cost-producing nations have. On the other hand, the more rapid development and deployment of the systems co-developed by Duke and ENN Group will employ more Americans more quickly. Labor costs are by far the largest cost component (and source of value) in the full life-cycle value chain of PVs.

As if to further underscore the increasing role of China in U.S. electricity circles, AES Corp. recently announced that China’s sovereign wealth fund has acquired a 15% stake in the company. The pace of mergers and acquisitions in other industries that began in mid- to late 2009 will continue into 2010, creating a favorable environment for additional investment activities. Although outright acquisitions of, or mergers between, Chinese and U.S. energy and utility companies appear unlikely anytime in the near future, it is probable that more investments by the Chinese in U.S. energy companies and projects will occur, through joint ventures and outright purchase of stock.

Environmental Regulation

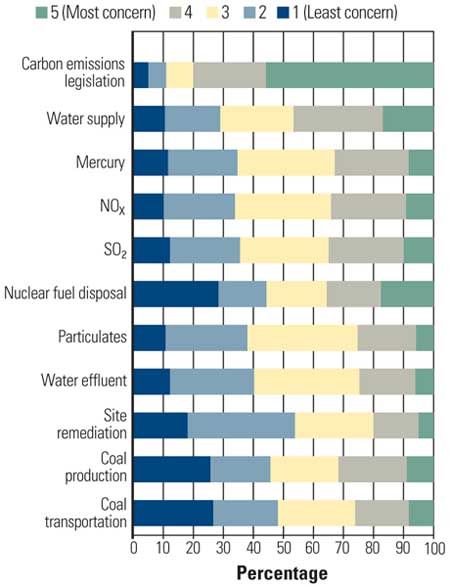

As in 2008, the 2009 Black & Veatch survey respondents ranked carbon emissions and water supply as the first and second top environmental concerns. This year, mercury replaced nitrogen oxides as number three (Figure 8).

8. Survey results: environment. Environmental concerns are near the top the list of problems causing anxiety in utility executives. A rating of 5 indicates a very important concern; a rating of 1 is for an issue of only average concern. Source: Black & Veatch’s 2009 Strategic Directions in the Electric Utility Industry survey

Last year was a year of initiation, development, and coordination among the new federal powers that will call the shots on environmental matters in 2010. In the next year or two, the industry will feel the full force and effect of the policies and regulations that are now under development. There is no doubt that this reinvigorated regulatory focus will be on the full range of critical energy, water, and environmental issues: trace metal and particulate emissions; new source performance and prevention of significant deterioration; water quality, use, and resources; hydrofracturing associated with nonconventional natural gas production; ash and nuclear waste disposal; and, of course, greenhouse gases. Furthermore, the EPA is seeking to replace the existing interstate trading protocols for nitrogen, mercury, sulfur dioxide, and nitrogen that would require the installation of scrubbers (or other technology) rather than emission credits trading. The agency will also review the need for new ozone rules.

Whether the origins of the new national focus on environmental regulation are federal legislation, state or regional regulation, EPA reinterpretation and enforcement of existing law, new state laws, or executive orders, the industry needs to gird itself for greater regulatory scrutiny, higher compliance costs, and elevated business risks in the new environmental milieu.

—Richard J. Rudden (ruddenrj@bv.com) is a senior vice president for Black & Veatch Corp.