Unmanned aerial systems—drones—have quickly found their place in the power sector. But as the industry moves out of test cases and experiments, and into full implementation of drones, it is facing a whole new set of challenges and opportunities.

The power sector—one of the world’s most rigid industries—is in the midst of a profound transition. Disrupted not just by economic and environmental forces, the industry is facing rapid technological changes that have forced companies to reevaluate business models to stay profitable. But while many companies are still considering integrating the Internet of Things, robotics, artificial intelligence, machine learning, and data analytics, the uptake of unmanned aerial systems (UAS) has been markedly faster and widespread.

The use of UAS, which include aircraft (technically referred to as unmanned aerial vehicles [UAV]), ground-based controllers, and connecting communications systems—or more simply, drones—has proliferated since 1916, when the U.S. Navy developed a rudimentary unmanned aerial torpedo that could fly a guided distance of 1,000 yards. Today, countless startups offer drone technologies with myriad applications.

According to an October report from PricewaterhouseCoopers (PWC), the addressable market of drone-powered solutions in the world’s power and utilities sector is worth $9.46 billion. And interest in the power industry is soaring, as evidenced by an inaugural drone-focused summit held in Houston, Texas, in June, which showcased 30 leading drone technology providers and drew hundreds of attendees.

The reason UAVs are being adopted so quickly in the power sector is because they make good business sense, several industry experts told POWER in December. Some key benefits are that they cut operation and maintenance costs; they boost worker safety because they are able to fly in potentially dangerous areas; they use little to no fuel; and they have a scant environmental impact.

“I think when you put [a drone program] in the safety plans, which is where we keep our focus, and when you put it in the performance lens, which is where we focus the business decision, it just keeps scaling into the business,” said Chris Shelton, chief technology officer at AES Corp., a firm that began its full drone program nearly three years ago. “The way our team has been working on it, it’s been driving value—and constantly driving value,” he said.

Growing Drone Applications for Power

Experts widely noted that the allure of drones rests on their multitasking capabilities. They’ve conventionally been used for years to augment inspections and for asset inventory, but technology advancements are now opening up even wider opportunities. These are some applications for drones in power today.

Asset Inventory. More energy infrastructure operators use drones to check inventory and plan maintenance work to avoid human trips. Drone-acquired data is also used for creating and updating documentation of assets’ technical condition.

Construction and Repairs. Drones have been used to perform dangerous tasks at great heights, such as construction work, repairs, or trimming vegetation. Increasing load-bearing capabilities are also allowing drones to transport building materials as well as assemble and weld components. A bird’s-eye view of major construction projects, especially in remote locations, can form the basis for planning subsequent steps in the construction process (Figure 1).

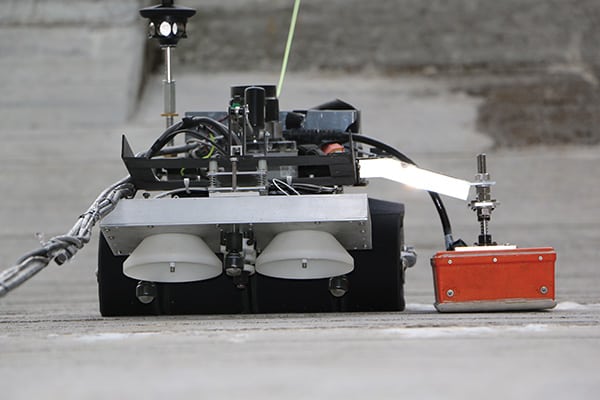

Maintenance Management. Facility owners, asset managers, and operation and maintenance contractors routinely deploy drone fleets to realize cost and operational benefits of aerial inspections today. However, solar panel inspections are growing more sophisticated as thermography and thermal orthomosaics evolve to pinpoint faulty panel infrastructure. A team of scientists from Purdue University, meanwhile, has created a drone system to automatically detect cracks or texture changes in steel components of nuclear power plants, alerting technicians about the potential danger.

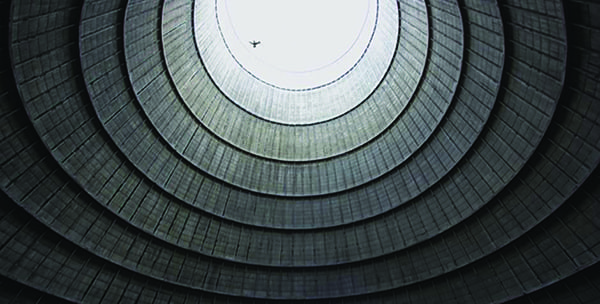

As notable are developments in geomatic technologies. Advances in GPS and radar technologies, for example, were recently used by drone inspection specialist Aetos Drones to methodically inspect a cooling tower at the Tihange Nuclear Power Station near Liege, Belgium (Figure 2).

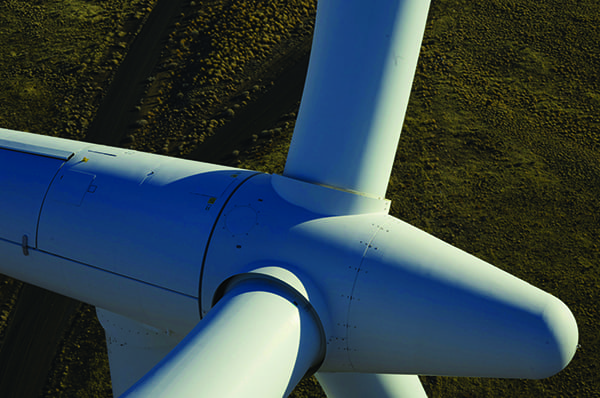

Another growing field is high-resolution imagery. Oregon-based manufacturer and system integrator of commercial and industrial drones ATI, for example, recently executed a wind turbine inspection project in Washington state to locate and photograph fissures on a wind turbine blade that were identified two years before (Figure 3). The combination of a high-resolution camera and a heavy-duty drone resulted in a more efficient process that saved money, eliminated human risk, and reduced shareholder liability, the company said.

Emissions Monitoring. As detection technologies grow more precise, some companies are using infrared cameras and other means to assess leaks. And big developments are on the horizon. NevadaNano and the U.S. Army are teaming on an effort to improve the company’s Molecular Property Spectrometer to sense and map multiple chemicals in a small, 110-gram sample. Stanford University’s Natural Gas Initiative is also currently hosting a challenged to boost methane detection and quantification technologies that could speed up and cheaply assess significant emission sources.

Disaster Recovery. Drones are also proving invaluable to assess damage from disasters. As part of goodwill that poured in to help Houston recover from the ravages of Hurricane Harvey last August, utilities nationwide sent scores of drone specialists.Southern Co. subsidiaries Georgia Power, Alabama Power, and Southern Co. Services alone sent a combined seven drone teams, including UAV operators and spotters, to help local utility workers determine the scope of repair work. Power companies along with independent researchers have meanwhile used drones to scrutinize the size of coal ash spills and assess contaminants using 3-D modeling software. One notable setback largely noted by recovery teams, however, is the proliferation of civilian drones after a disaster, which pose an extreme risk to crews on rescue missions. During Harvey, for example, the FAA issued a temporary flight restriction for non-commercial drone usage after the storm, warning it may violate federal, state, or local laws.

Making a Sound Business Case

Despite their myriad applications, some power companies postpone drone adoption until they can figure out how it will impact bottom lines, which is of primary interest to their shareholders. According to Mitch Droz, commercial development manager at Puget Sound Energy, a Bellevue, Washington–headquartered company that owns about 3.5 GW of generation capacity, before investing in an in-house drone program, a sound business case should be developed. The process requires assessing the need for and expected frequency of drone use; developing a timeline; analyzing the cost of a drone team and fleet, and comparing it to the costs of previously used methods and budgetary restraints; and determining metrics that would be improved with drone use.

If a program is a good fit, he recommends determining the best technology for specific applications, such as choosing between fixed-wing and multi-rotor drones, and determining which software will work best. An in-house drone program also requires operation documents, including flight operations, accident/incident procedures, training manuals, and company-specific standards.

For Puget Sound, he noted, a drone program has paid off, and the company has considerably reduced enterprise risk exposure, response speed, safety, and cost savings.

The Hybrid Alternative

Companies don’t have to do it alone, however. The proliferation of drone technology and applications has in recent years opened a sub-market worldwide for hundreds of “drone service” firms, which essentially operate commercial drones and capture data for clients.

The drone services sector has grown so large so quickly on the back of explosive demand for drone-acquired data that the U.S. market is already flooded with service providers and remote pilots. “The data shows that 85% of service providers make less than $50,000 per year, and 79% perform only one to five operations per month,” said Drone market research firm Skylogic Research in September.

For the power sector, drone services are a boon that can’t be understated. According to Shelton, AES’s efficiency of integrating drones into company operations has been boosted by a partnership with Measure, a company that provides drone services along with turnkey solutions to acquire, process, and deliver aerial data to its customers. For AES, the partnership with Measure formed in February 2017, implementing drones across its vast energy infrastructure that is spread out over 17 countries, has helped it improve safety and avoid 30,000 hours of hazardous work per year. Shelton said the partnership serves to “scale into opportunities. So, if we have a need for a lot of drone service, and we can’t only use our own people—which we have in place—we can augment those existing capabilities with Measure’s capabilities and be able to scale, either geographically or with intensity into different projects,” he said.

The global market for drone data service has also mushroomed of late. According to Grand View Research, that growth can be attributed to the increasing adoption of drones in commercial sectors, which is leading to a “revolution in big data cloud services.”

“Launching a drone to capture images is the preliminary step in the drone information acquisition process,” it said. “The captured images then require correction, calibration, processing, storage, and efficient evaluation.”

As the need to evaluate that imagery skyrockets, UAV companies like PrecisionHawk are transforming their business processes to focus on drone data processing rather than UAV manufacturing. It has also prompted a number of power companies to consider the use of cloud-based in-memory computing platforms that accelerate analytics, processes, and predictive capabilities. One example that stands out is the integration of industrial inspection drone data with General Electric’s Predix platform, which analyzes fused data from multiple sources (Figure 4).

Regulations, Legal, and Contractual issues

Shelton, whose company AES operates a sizable international fleet of plants, noted that regulations governing drone operation differ by country, but for the most part, “people have been very willing to embrace the technology and allow its use for exploratory purposes.” In the U.S., power companies are more wary about evolving federal and state rules for drones. The Federal Aviation Administration (FAA) in June 2016 promulgated new rules (Part 107 of the Federal Aviation Regulations) that limit the weight, flight height, speed, and time at which commercial drones can fly, and requires them to stay within unaided sight to avoid manned aircraft. Some industry experts pointed out that while the final rule was more lenient than anticipated, more rules are warranted to ensure additional flexibility—but their development has been hampered by the Trump administration’s two-for-one ban on regulations.

A report published by the Commercial UAV Expo projects, however, notes that logistics and scalability will prove to be of far greater concern in the power sector. Linda Rhodes, a key member of Commonwealth Edison’s Operational Strategy and Business Intelligence Department, agreed, noting that adoption was the bigger challenge. “With the exception of some of the more restrictive regulatory requirements, I do not believe regulations were a barrier to widespread adoption,” she said. “For most of us, the largest barrier was our learning curve. We needed to first understand and comply with regulations, and our safety and other protocols; we had to increase our collective UAS IQs related to the platforms themselves, the use cases and the value proposition. We had—and still have—grand ideas, but we simply were not ready for widespread adoption.”

Shelton, too, told POWER that filing air space jurisdictions doesn’t pose a major hurdle. “The FAA has been relatively flexible recently, and they’ve been trying to put in programs to make things go quickly. So, there’s progress being shown there.”

Technology and Operational Challenges

For Shelton, of more concern is acquiring the right talent. Having real skill on staff helps reduce human and technical errors, which could have grave repercussions, for example, if a drone crashes into a power line or other critical infrastructure, risking costly outages.

But it also boosts efficiency. “You definitely want folks like real pilots on staff who are used to filling out flight plans and putting a regimented process around what they are doing,” Shelton said. “In terms of skills, it’s just about having the discipline, like any other work we do, to have a job assessment and plan it out so it is specific to flight operations of a drone.” That aspect also benefits greatly from a hybrid partnership where a specialized company provides training, certification preparation, documentation, and equipment, he said.

A hybrid partnership may also serve the important function of shielding a company from committing to particular drone technology at a time when producers are constantly innovating, improving performance, and adding new functions, Shelton noted. Among technology considerations is that new developments are underway that could extend drone battery life, allowing for longer flights and speeding up data processing, which could cut costs even more. Camera resolution and sensor parameters—which are already noteworthy—are also being constantly improved and could allow data to be collected more precisely.

Security Challenges

Perhaps the deepest shadow cast by drone use for power company applications concerns their security implications. Travis Moran, a managing consultant with Navigant’s Risk Management, Compliance, and Security Team, noted at the June 2017 Energy Drone Coalition Summit that while drones offer many beneficial inspection uses, they can also be unlawfully used for surveillance, including video, audio, and spoofing. Also, he warned, they can disrupt operations if they malfunction, posing a danger to both employees and customers. Worse, he said, “drones can now truly be considered a threat due to weaponization,” and because they are adaptable, they can be used in “ugly” ways such as for biological and radiological “kamikaze” attacks.

The threat is real, noted David Kovar, founder and CEO of Kovar & Associates, a UAV “forensics” firm. A growing collection of UAVs are being found on corporate properties, and finding (or shooting down) a rogue drone will require a number of steps that could help in an investigation concerning potential threat actors.

For power companies, these dangers pose yet another security management concern that should be addressed in security plans. While a number of laws, rules, and ordinances protect companies, several detection and mitigation technologies also exist, such as Dedrone’s airspace security DroneTracker software, which is designed to assess and analyze drone threats by keeping track of how many drones are in a facility’s airspace.

“Situational awareness is the key variable,” Moran said. Companies should also educate employees about what should be done if they encounter unauthorized drones. On the flip side, drones can be used to enhance physical security, though companies, which should ensure they have an insurance rider, should also confirm commercial operators are licensed and have insurance.

Security concerns on the cyber front are an added worry for power companies, which are already constantly grappling with the vulnerabilities of other critical components. Industry experts have warned that data transmitted to a cloud by drones via Wi-Fi or Bluetooth is especially vulnerable to cyber threats. Hackers could also make use of unsecure connections to gain control of a drone’s interface and obtain sensitive data. Having a sound cybersecurity defense is imperative to thwart these types of drone attacks, experts noted. That will entail assessing vulnerabilities, ensuring security teams have a wide-ranging knowledge of security and privacy, and developing a constantly updated response plan. It will require, as Kovar said, learning, applying, and living security engineering. ■

—Sonal Patel is a POWER associate editor.