“Pivoting” is a popular business buzzword, particularly in the context of startups, which often quickly change strategic direction. The global nuclear industry isn’t exactly a startup, but it is at or facing multiple pivot points.

That’s evident from recent U.S. developments, including the Nuclear Regulatory Commission’s (NRC’s) pivot on spent nuclear fuel: Onsite storage is now the only foreseeable disposition. The practice of collecting a “nuclear advance fee” from customers prior to bringing new capacity online may be another pivot point, at least in the case of Duke Energy Florida, which is under pressure to return $3.2 billion collected for the cancelled two-reactor Levy County nuclear project and the Crystal River plant upgrade.

The pivot culture was also evident at the first World Nuclear Exhibition (WNE) held just outside of Paris in mid-October.

Pivot: Competition to Cooperation

The WNE had nearly 500 exhibitors—evidence that nuclear power remains big business. Though sponsored by the Association of French Nuclear Industry Exporters, organizers emphasized that the event was intended to be a multinational one, to “encourage international alliances and partnerships.”

The 2011 Fukushima disaster was clearly a factor in the pivot toward increased international information and technology sharing, which, as AREVA CEO Luc Oursel noted, is “something new” for the nuclear industry. (Personnel pivots: Since the WNE, Oursel has resigned, and the French government announced that it would not renew the contract of his counterpart at EDF, Henri Proglio.)

In addition to safety initiatives and project execution, workforce development is another area requiring cooperation. With so many countries eager to join the nuclear club, the demand for appropriately trained personnel is growing. For countries like Saudi Arabia that lack a history of nuclear operation, that means partnering with more-experienced nations for training. That’s the route China has taken with France for decades.

Pivot: Domestic to Global

Although the civilian nuclear industry began as a domestically based one in the U.S., UK, former Soviet Union, and Canada, the resources needed to develop a nuclear power program meant that major suppliers soon entered foreign markets. Nevertheless, nuclear technologies and project development have tended to be largely associated with specific nations, with France being a prime example, where the state is at least partial owner of the major equipment manufacturers, utilities, and fuel-cycle players.

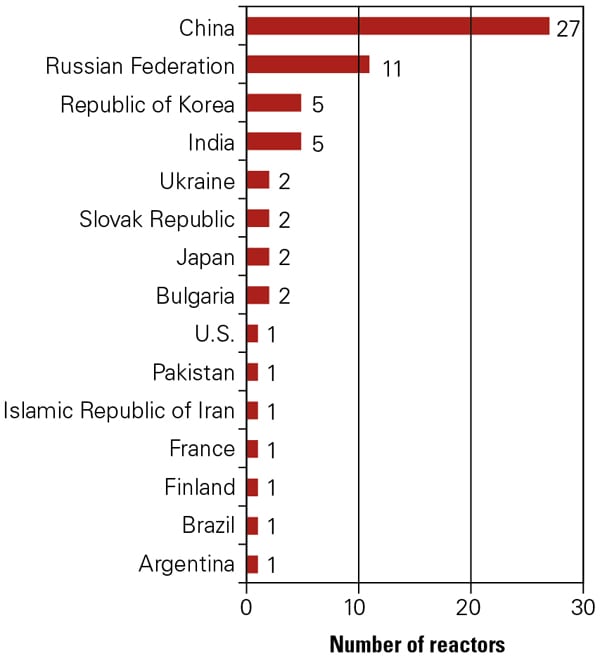

Yet even in France, which derives a higher percentage of its electricity from nuclear power than any other nation (roughly 75%), those nuclear industry players are looking abroad more than usual. France was a logical location for the WNE not only because of the number of industry participants based there—EDF’s Proglio said that the nuclear industry is the country’s third-largest—but also because France is not a growth market. In fact, the same week as the WNE, the French lower house voted to cut nuclear generation to 50% by 2025. That makes it imperative for French companies to increase global market share. Only six of the 70 projects under development worldwide (including the Hinkley Point C units) are using AREVA’s newest reactor, but that still leaves room for involvement with such areas as other plant components, training, and fuel reprocessing, transportation, and storage.

Rosatom CEO Sergey Kirienko also commented that the “future is multinational, not national.” In a different session, William D. Magwood, former commissioner of the NRC and current director-general of the Organisation for Economic Co-operation and Development Nuclear Energy Agency, observed that nuclear power is “no longer a market for countries…. It’s a global marketplace… whether you like it or not.”

In fact, “the overseas market is keeping the U.S. industry alive,” Daniel S. Lipman, executive director for policy at the Nuclear Energy Institute, told POWER. However, “a lot of that market is not available to the U.S.” Going “toe to toe with state-owned enterprises” is challenging, but while companies like Westinghouse will continue to license current technology, they will also continue to innovate, he added.

Pivot: Utility to Consortium Financing

Though cost challenges weren’t headlined at the WNE, they did seep into a couple of panel discussions. Anne Lauvergeon, chairman and CEO of ALP and former CEO of AREVA, admitted that utilities can no longer finance nuclear projects on their own; the future requires more cooperative ventures—a view also voiced by her successor, Oursel, in a different session. Most pointed was Gérard Mestrallet, GDF Suez chairman and CEO, who noted that “cheap, low-cost nuclear” days are over. “Today, for me,” he said, “it’s impossible to finance nuclear in a completely deregulated environment.”

That is part of the market dynamics for nuclear in the U.S. as well, though Joseph Dominguez, Exelon’s senior vice president, governmental & regulatory affairs and public policy, pointed to shale discoveries and resulting low gas prices as the reason that smaller and single-site U.S. units are not recovering their costs of operation. “The future for nuclear is bright,” he said, “but will require some policy adjustments,” including “a price on carbon” and a capacity market.

Magwood noted that financing nuclear power is “a country-specific issue.” In the UK, the latest approach is public subsidies and a guaranteed strike price for 35 years for electricity from the Hinkley Point C units for France’s EDF, which will own and operate the plant. The£92.50/MWh price for power from the new units, expected to be online by 2023, is double current rates. WNE panelists praised the “innovative approach” and the European Union’s approval of the plan, which came the week before the industry event, though project opponents have pointed to the cost as one reason for their opposition.

No Standing Still

Companies and countries won’t all pivot on nuclear issues in the same direction at the same time, but all are eyeing their next move. As for how current leaders maintain their stature while other nations increase localization levels and develop closed fuel cycles, the plan is what it has always been: Innovate. ■

— Gail Reitenbach, PhD is editor of POWER (@GailReit, @POWERmagazine).