As global nuclear ambitions surge, the industry’s fuel supply chain faces critical gaps. Can advanced fuels like HALEU (high-assay low-enriched uranium) and TRISO (TRi-structural ISOtropic particle fuel) bridge the demand for next-gen reactors or will supply limits hold back nuclear’s potential?

For nearly six decades, the nuclear industry’s fuel landscape has marked a relatively stable trajectory. The world’s commercial nuclear power plants, 95% of which are water-cooled, have generally relied on a mature front-end supply chain for low-enriched uranium oxide (UO 2) pellet fuel. “Demand was more or less stable,” keeping pace with an expansion of the nuclear fleet in the 1970s and 1980s, explained Jacopo Buongiorno, director of the Center for Advanced Nuclear Energy Systems (CANES) at the Massachusetts Institute of Technology (MIT). Since the speculative “nuclear renaissance” bubble in the late 2000s, uranium prices have been in flux, driven in part by “an imbalance between projected demand and capacity for enrichment, conversion, and fabrication,” he said.

Between 2020 and 2024, all three components saw a surge “by a factor of three,” Buongiorno noted. While exacerbated in part by a pushback against Russian fuel in light of its aggression in Ukraine, the market’s unprecedented volatility is caught between ambitious global decarbonization targets and supply limitations. At the 2023 U.N. Climate Change Conference (COP28), a coalition of 22 nations set an aspirational goal to triple nuclear power capacity by 2050—a vision that could skyrocket uranium demand, with projections for 2040 ranging from 63,000 tonnes of uranium (tU) in a low-demand scenario to a staggering 184,000 tU if small modular reactors (SMRs) become widely adopted.

The implications could be stark, Buongiorno suggested. “Don’t get me wrong, I think, honestly, this community is in the best position it has been in decades. There is a lot to be excited about. The opportunities are massive, but there are also many challenges.”

New Needs to Accommodate Advanced Nuclear

Buongiorno’s blunt assessment came as an introduction to a symposium MIT hosted at the end of October aptly titled “No Fuel? No Party.” The event brought together industry leaders, nuclear technology developers, research scientists, and fuel cycle specialists who laid out how integral a reliable and diversified fuel supply chain will be to the nuclear industry’s aspirations.

A central takeaway from the symposium was clear: the nuclear industry must urgently scale up its technical and production capabilities for advanced fuels to power the reactors of tomorrow. “Virtually all advanced reactors require higher-enrichment fuel, for which, at the moment, we don’t have facilities at commercial scale,” Buongiorno underscored.

The diversity of fuels is significant. High-temperature gas-cooled reactors often rely on TRi-structural ISOtropic (TRISO) particle fuel for their enhanced safety properties, while fast reactors may use metallic fuels or mixed oxide fuels (MOX) to achieve high burnup and efficient transmutation of long-lived isotopes. Innovative fuel types, such as uranium nitride and uranium silicide, are also being explored for their higher uranium density and thermal conductivity, which could improve fuel performance under extreme conditions.

So far, more than 20 advanced reactor designs are actively pursuing high-assay low-enriched uranium (HALEU), a specialized fuel enriched to levels between 5% and 20%. However, while HALEU could enable extended fuel cycles, improve reactor safety, and more efficient utilization of uranium resources, currently, “there is no market,” Jonathan Hinze, president of nuclear fuel market intelligence firm UxC, said bluntly. “We have concepts of a market, but we don’t have the actual market.”

For now, the advanced fuel cycle will need to rely on the low-enriched uranium (LEU) supply chain. But, that supply chain is already under stress. “We’re moving away from 100% Russian supply in the U.S., and other markets are similarly moving away,” he said. “That’s a huge supply source, and there are going to be implications of that that are still not felt for years to come.” Meanwhile, compounding that challenge is that the advanced fuel cycle will require a host of new facilities that don’t currently exist, including specialized enrichment plants to deconversion and fuel fabrication processes.”

|

|

1. Urenco USA in October 2024 won a 10-year Indefinite Delivery/Indefinite Quantity contract from the U.S. Department of Energy to produce high-assay low-enriched uranium (HALEU) from new domestic capacity at its New Mexico facility. Currently meeting one-third of U.S. utilities’ enrichment needs, Urenco USA is already expanding and in the licensing process to enrich up to 10% for LEU+. Courtesy: Urenco |

Nuclear fuel suppliers have begun stepping up to the challenge. Enrichment giant Urenco (Figure 1) is investing billions of dollars to deliver HALEU enrichment capabilities in the UK and U.S. by the mid-2020s, as well as developing a dedicated HALEU enrichment plant in the UK, targeting the early 2030s for initial material availability, said Magnus Mori, head of Market Development and Technical Sales at Urenco. “It’s a paradigm change, it’s a shock to the system.” But it poses immense risks, he suggested. “We can take orders, but we don’t have the momentum, the critical mass for a private investor to take all the investment risk,” he said.

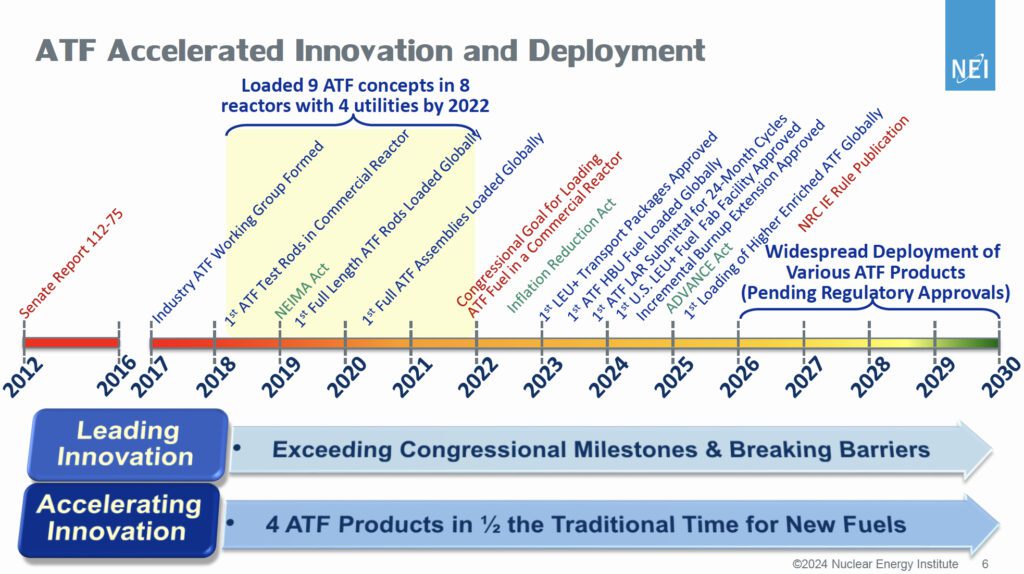

Innovation in Action: Accident-Tolerant FuelsAn especially notable triumph for the nuclear industry over the past decade has been its development and commercialization of accident-tolerant fuels (ATFs). An industry concept used to describe new technologies in the form of new cladding and/or fuel pellet designs, ATF technologies essentially leverage new materials that improve fission product retention and are structurally more resistant to radiation, corrosion, and high temperatures. And because they could be paired with fuel enrichments of up to 10% (LEU+), they could potentially extend the time between refueling from 1.5 to 2 years and reduce the amount of fuel needed by about 30%, resulting in less waste and used nuclear fuel. While ATF technologies have been under development since the early 2000s, they received a marked boost in the wake of the March 2011 Fukushima accident as the Department of Energy (DOE) aggressively implemented plans under its congressionally mandated Enhanced Accident Tolerant Fuel (EATF) program to develop ATFs for existing light water reactors (LWRs). The DOE championed different fuel designs from three major fuel vendors: Framatome, General Electric/GNF, and Westinghouse/General Atomics. But the push for ATF has regained dramatic momentum in recent years, driven by a confluence of policy, regulatory, and market forces. Advancements have generally aligned with broader nuclear sector goals, including commercialization and economies of scale, establishing a robust regulatory infrastructure, and maintaining international leadership in fuel technologies. “We’ve hit the limits of 62 GW-days per metric ton uranium burnup and 5% enrichment,” explained Al Csontos, director of Fuels at the Nuclear Energy Institute (NEI), in October. “We now want to go higher,” with the goal of reaching 10% enrichment and 75 GW-days per metric ton burnup for two-year cycles. The economic implications are profound, he noted. Longer fuel cycles could reduce the frequency of refueling outages, which are both costly and disruptive. “If you go to 24-month cycles, now you’re doing one outage every year,” said Csontos. “At sites like Vogtle, where there aren’t enough hotel rooms nearby to handle all the contractors during outages, fewer outages would make a big difference,” he said. Higher burnup levels also address a critical issue in waste management. “You can have more fuel efficiency, less waste,” Csontos added. “It’s about using the plants differently to produce more power.” Progress has been swift. Industry loaded its first ATF lead test assemblies (LTAs) in reactors in 2018 (at Southern Co.’s Hatch plant, which included two types of GE/GNF ATF cladding designs. By 2023, it had marked a stunning list of milestones, including the Nuclear Regulatory Commission’s (NRC’s) first-of-a-kind approval for the use of ATF fuel. More recently, in October 2024, Framatome’s GAIA fuel assemblies with PROtect Enhanced Accident Tolerant Fuel (E-ATF) completed their third 18-month fuel cycle at Plant Vogtle in Georgia, marking the conclusion of a four-and-a-half-year evaluation. That milestone marked “a lifecycle of operation of the world’s first full-length PROtect E-ATF fuel rods with both pellets and cladding in an operating pressurized water reactor,” Framatome noted.

However, to meet the growing power demand driven by electrification and digitalization while ensuring the reliability of the existing fleet, new urgency is ramping up to expand deployment of ATF and LEU+ technologies, Csontos suggested. Utilities require up to 13 GW of additional capacity by 2030, and new nuclear projects are still a decade away from completion, he noted. A recent NEI survey of 56 nuclear sites estimated more than 70% have a level of interest or are planning one or more uprates with a combined capacity increase of 3 GWe, he noted. About half of the nation’s fleet, meanwhile, has “varying interest or plans” for one or more of the enabling changes associated with ATF, LEU+, extended fuel cycles, and risk-informed Loss of Coolant Accident (RI-LOCA) methodologies, with deployment targeted in the 2028 –2030 timeframe, he said. Industry remains, so far, on track to deploy batch quantities in the mid-to-late 2020s. However, for now, the NRC’s regulatory path for efficient licensing for ATF/LEU+/high burnup fuels is targeting a 2027 timeframe. This includes the critical “Increased Enrichment Rulemaking,” which is designed to take “the top off of the 5% enrichment limit,” Csontos said. The regulatory change will be essential to accommodate the industry’s move toward enrichment levels of up to 10% for LEU+ fuels, with the potential to reach up to 20% for advanced applications, he noted. While “sites have risk mitigation as their main goal,” licensing and regulatory hurdles pose risks, he said. “Really, it’s about risk mitigation in terms of time and money,” he added. “They want the power uprate, but they don’t want to risk it going longer or failing because there’s something going on with the regulatory part.” Efforts to address these challenges have gained momentum, with the ADVANCE Act playing a key role. “The ADVANCE Act is there to try to push the regulator to be more modern and to try to be helpful considering the positive aspects of nuclear power,” he said. To accelerate deployment timelines, industry stakeholders are collaborating with the NRC to streamline licensing processes. “We’re trying to get those efficiencies locked in now for all the advanced reactor fuels and everything else, so we can start moving forward with that in a better, more timely way, so we don’t spend 20 years licensing new fuel,” Csontos said. |

Global Laser Enrichment (GLE), which is working to commercialize laser enrichment as an alternative to the traditional gas centrifuge enrichment process and targeting production by 2030, anticipates a role for government support to kickstart the market. Unlike Centrus Energy, “We don’t need the DOE [U.S. Department of Energy] to be a buyer of any product we produce,” said Nima Ashkeboussi, GLE vice president of Government Relations. “We see utilities ready to buy that material. But we do think there is a space for DOE to enter in some sort of cost-share or milestone-based awards with us to add capacity to the marketplace.”

The DOE has already taken steps to incentivize the HALEU market. In October, it announced awards for both HALEU enrichment and deconversion projects. Incremental progress is also surfacing for spent nuclear fuel (SNF) recycling. As Temi Taiwo, director of the Nuclear Science and Engineering Division at Argonne National Laboratory, suggested, recycling could dramatically improve the sustainability of the fuel cycle. Taiwo acknowledged, however, that demonstrating the feasibility and cost-effectiveness of scaling up recycling technologies poses a key challenge.

The Chicken-Egg Dilemma of Fabricating Novel Fuels

Fabricating fuel to meet emerging demands faces similar challenges. According to Dave Petti, an industry veteran who has been instrumental in advancing high-temperature nuclear reactor fuels, fabricators face the ultimate “chicken-and-egg” problem. “You’d need a sustained demand, kind of like a metric ton per year, to really support a fuel fabrication facility,” he said. Without that consistent, high-volume demand, Petti noted that suppliers are tasked with using highly enriched uranium and blending it down for each individual reactor concept. Petti also underscored that the lack of clarity on how quickly reactors will come online makes it difficult for fuel vendors to properly size their production facilities. Bridging that gap will require strategic investments, both from the private sector and government, Petti suggested.

|

|

However, some companies are already preparing to meet demand. BWX Technologies (BWXT), the only company currently producing TRISO in the U.S., is considering a “purpose-built,” Category 2 TRISO production facility, noted Andrew Davidson, BWXT project manager of Specialty Fuels Fabrication and Uranium Recovery (Figure 2). However, it would only consider the investment, which could require “several hundreds of millions” of dollars if the company is “confident that the market exists to pay back that investment before we go off and take that step.”

Ultimately, the gap could perhaps be resolved by emerging concepts of a shared international fuel cycle infrastructure that could help mitigate risks and costs for individual players. Buongiorno suggested the U.S., European Union, UK, Canada, South Korea, Japan, United Arab Emirates, and perhaps Australia should think about creating joint enrichment facilities, which would add some security on the enrichment side. “Perhaps even a shared LEU reserve in the form of UO 2,” he said could be worthwhile. “It’s not a zero-cost investment, but it’s not enormous in the greater scheme of things, and it could actually insulate our countries from big fluctuations in the prices of uranium and uranium enrichment.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).