Seven major U.S. grid operators have raised a unified alarm about an impending capacity crunch, warning that the pace and scale of explosive demand—including from data centers, manufacturing, and electrification—pose a precarious misalignment with accelerating generator retirements and transmission constraints.

At a March 25 hearing before the House Energy and Commerce Subcommittee on Energy, the nation’s top grid officials testified that the U.S. power system is under mounting strain—and that without urgent structural reforms, the ability to maintain reliable electric service could falter. Their message was unusually direct: demand is accelerating, supply is lagging, and current tools may not be enough to bridge the gap.

House lawmakers heard testimony from Manu Asthana, president and CEO of PJM Interconnection (PJM); Jennifer Curran, senior vice president of planning and operations at the Midcontinent Independent System Operator (MISO); Lanny Nickell, president and CEO of the Southwest Power Pool (SPP); Rich Dewey, president and CEO of the New York Independent System Operator (NYISO); Gordon van Welie, president and CEO of ISO New England (ISO-NE); Elliot Mainzer, president and CEO of the California Independent System Operator (CAISO); and Pablo Vegas, president and CEO of the Electric Reliability Council of Texas (ERCOT).

Below is a breakdown of major takeaways from the hearing drawn directly from the operators’ statements and data.

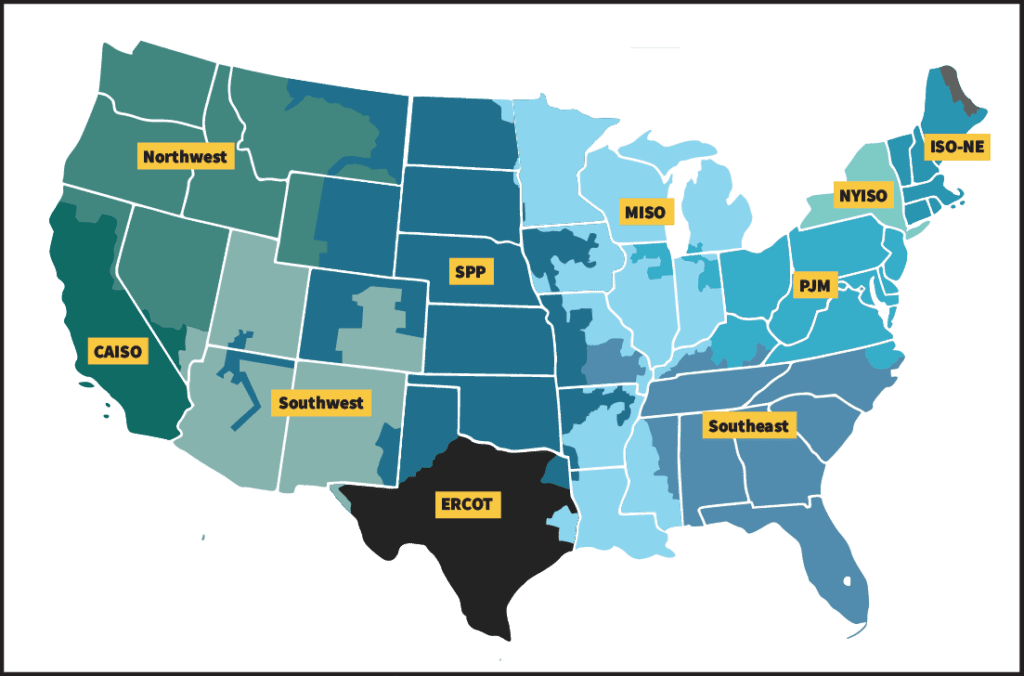

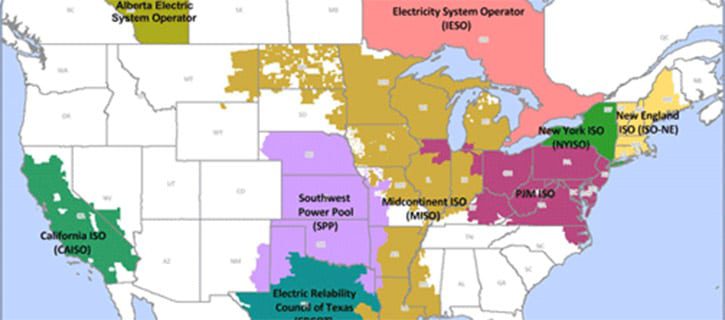

Who Runs the Grid?The entities represented at the March 25 hearing are regional transmission organizations (RTOs) and independent system operators (ISOs)-nonprofit entities responsible for planning and operating the high-voltage electric grid across large multi-state regions. All but ERCOT are regulated by the Federal Energy Regulatory Commission (FERC). Their core mission is to ensure reliable electricity delivery, manage wholesale power markets, and coordinate transmission investments. While utilities own the physical grid infrastructure, these operators are impartial grid managers and market administrators, balancing supply and demand in real-time and long-term planning horizons. Much like “air traffic controllers,” as PJM’s CEO explained, they do not generate electricity or own generation assets. Each operator’s footprint, governance model, and market structure reflect regional differences. Still, collectively, these operators oversee bulk power systems serving over 200 million Americans.

|

1. Explosive Load Growth Is Now a Certainty—Driven Largely by Data Centers and AI

The hearing provided a rare combined glimpse of each regional grid operator’s impending concerns. Each region is contending with its version of the same core tension: demand is rising quickly-in nontraditional and non-coincident ways—while the infrastructure needed to support it is being strained, delayed, or retired.

Here’s how each operator described the outlook, ranked by current peak demand where available:

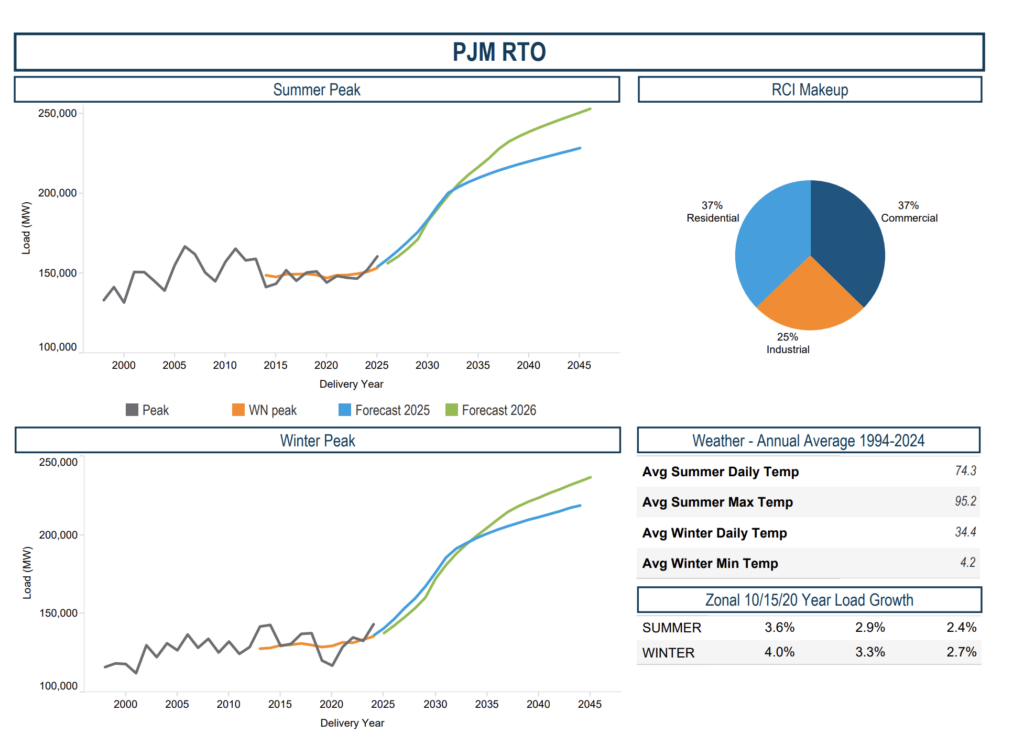

PJM

Current peak: 166 GW (summer 2006); 144 GW (winter, January 2025)

Projected growth: PJM expects its summer peak to increase by approximately 70 GW-from 150 GW in 2024 to 220 GW by 2039-nearly 47% rise over 15 years. Winter peaks could climb to 210 GW by 2039, a 45% increase from the current winter peak of 144 GW.

Demand growth drivers: “The rate of electricity demand is anticipated to increase significantly in the future due to the development of large data centers in the PJM service area,” said CEO Asthana. “There have also been increases in demand coming from the electrification of the transportation and heating sectors and from industrial growth.”

ERCOT

Current peak: 86 GW (summer, set on August 10, 2023); 80.5 GW (winter, February 2025)

Projected growth: An increase in summer peak demand of approximately 8,000 MW by 2025 and over 20,000 MW by 2030.

Demand growth drivers. ERCOT CEO Vegas testified that “Texas continues to experience unprecedented economic and population growth, driving electricity demand to record-breaking levels.” He cited new records set in 2023 and early 2024: “In the summer of 2023, ERCOT set a new all-time peak demand record of 85,508 MW. Last month, we set a new Winter Peak Demand record of 80,525 MW, a demand level normally experienced in the summer.” Texas has become “a magnet for industries that require increasing amounts of electricity, from semiconductor plants to data centers, broad industrial growth and large-scale industrial electrification in the Permian Basin,” he noted.

MISO

Current peak: 122 GW (2024)

Projected growth: 60% increase in electric load over the next 20 years

Demand growth drivers. Curran, MISO’s senior vice president of planning and operations, testified that “Over the last few decades, we have experienced growth in electrification through electronic devices, smart home products, and electric vehicles, but minimal growth in electric demand, largely due to increasing energy efficiency. Looking ahead, however, we expect much stronger growth from continued electrification efforts, a resurgence in manufacturing, and an unexpected demand for energy-hungry data centers to support artificial intelligence.” Curran added, “If electricity production and delivery from all sources cannot keep up with growing demand, then the planned growth of manufacturing, artificial intelligence, and data centers cannot occur.”

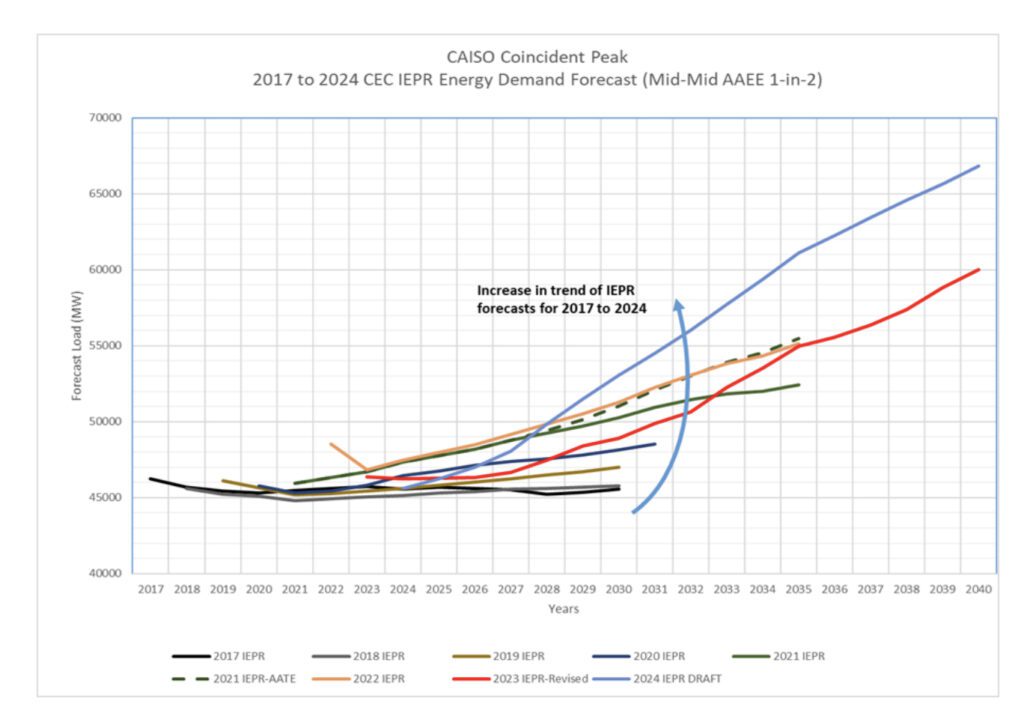

CAISO

Current peak: 53 GW (July 2021)

Projected growth: 33% growth in peak demand over the next 10 years and a 45% growth in peak demand over the next 15 years. (CEC)

Demand growth drivers. “Electrification of transportation and buildings has been the primary driver of load growth to date within the CAISO’s footprint,” noted CAISO CEO Mainzer. “Currently, there is about 1 GW of data center loads connected to the CAISO system. The [California Energy Commission (CEC)] projects an increase in data center loads over the next 15 years, with a sharp increase projected to start around the 2028 timeframe. The CEC projects data center load to increase by 2.3 GW by 2030 and 3.3 GW by 2035.”

SPP

Current peaks: 56 GW (summer, August 2023); 48 GW winter, February 2025)

Projected growth: Up to 50% increase in peak demand over the next 10 years.

Demand growth drivers. SPP’s annual consumption expanded 25% between 2014 and 2024, driven by “economic expansion, conversion of gas to electric heating, harsh weather conditions, and an emerging proliferation of data centers that require immense power,” said Nickell, who officially began as the grid operator’s CEO on April 1. “AI and high-performance computing are fueling a new wave of data centers that consume immense amounts of electricity. Our region’s affordable and reliable power has already attracted interest from companies looking to build these energy-intensive facilities within SPP’s footprint.”

NYISO

Current peak: 33 GW (July 2013). 24 GW (December 2022)

Projected growth: By 2034, summer peak demand is projected to reach 33,585 MW, and winter peak demand could reach 29,938 MW.

Demand growth drivers. Key drivers include building and transportation electrification, state policy mandates, and a rapid rise in new energy-intensive economic developments like data centers and semiconductor facilities. “The 2024-2034 Reliability Needs Assessment (RNA) finds that if demand on the grid grows at a rate greater than the buildout of new generation and transmission, reliability deficiencies could arise within the RNA’s ten-year planning period,” said CEO Dewey. “It also details how the advance of new technology and economic development is compounding the complexity of maintaining reliability and the combination of near-term growth in demand from data centers, semiconductor fabrication, and new manufacturing facilities highlights the challenges for grid planning over the next several years.”

ISO New England (ISO-NE)

Current peak: 28 GW (August 2006)

Projected growth: 17% increase in electricity consumption over the next 10 years.

Demand growth drivers. ISO New England attributes anticipated demand growth primarily to state policy initiatives aimed at decarbonizing the heating and transportation sectors. While investments in energy efficiency and behind-the-meter solar have historically slowed demand growth in the region, ISO-NE now expects that to change as electrification policies take hold. “State investments in energy efficiency and behind-the-meter solar have slowed demand growth in New England over the past decade. We do, however, expect this to change as policies aimed at electrifying the heating and transportation sectors take effect,” said CEO Gordon van Welie.

2. Resource Adequacy Risks from Retirements

Several regional grid operators warned lawmakers that dispatchable fossil generation is retiring at a pace that could jeopardize reliability if comparable resources do not come online in time. The trend, they said, is driven by public policy, regulatory constraints, and the aging of the thermal fleet.

“The early stages of the transition of the supply mix, driven by public policies, are resulting in the retirement of fossil fuel generation faster than renewable resources are entering service,” said NYISO’s Dewey. PJM’s Asthana added that “dispatchable generators, i.e., those generators that can quickly respond to directions from PJM operators regardless of weather, are retiring at a rapid, date-certain pace, largely due to state and federal policies.”

SPP’s Nickell cautioned that “these retirements have tightened our supply margins and almost exponentially increased reliability risks,” noting that “a large amount of around-the-clock generation was retired and largely replaced with weather-dependent resources.”

ISO New England’s van Welie warned that risks could mount “if the region could not maintain sufficient resource or energy adequacy to meet growing demand,” especially if “existing generators [retire] prematurely, or if electricity demand [grows] much more rapidly than the pace at which new resources come online.”

“The rapid retirement of existing coal and gas power plants threatens to outpace the ability of new resources with the necessary operational characteristics to replace them,” said MISO’s Jennifer Curran. CAISO’s Elliot Mainzer said retirements “could strain the system during net peak conditions” without timely replacements.

To mitigate risk, operators urged closer coordination between retirement schedules and system readiness. “Let reliability needs help inform the pace of retirement of existing electric generating resources,” Curran said.

3. A Structural Imbalance in the Portfolio of New Additions

While retirements are accelerating, most new additions in the interconnection queues are intermittent renewables—and that highlights a mismatch in reliability attributes, the grid leaders suggested. “Our interconnection queues are composed primarily of intermittent renewable resources that have different operating characteristics than the generation they are replacing,” said PJM’s Asthana. “Given these differences, one unit of nameplate capacity of retiring generation requires multiple units of replacement capacity. Longer duration batteries and potentially other technologies could change this equation in the future if they can become more cost-effective and be deployed at scale.”

MISO’s Curran echoed this concern, pointing to a projected drop in the amount of electricity available during the most critical periods. “MISO’s Future Planning Scenarios estimate that while the total amount of installed electric generation will increase significantly over the next 20 years due to the rapid growth of wind and solar,” she said, “the actual amount of electricity available to the system during critical hours could decline by about 32 GW due to the operational characteristics of these new resources.”

4. Winter Has Become the New Risk Season

Grid operators testified that winter is now emerging as the most precarious season for electric reliability, driven by a volatile mix of extreme weather, gas supply constraints, and renewable intermittency. “During extended periods of cold weather in New England, the gas pipelines are not capable of serving the coincident peak demand for gas from heating customers and power generation,” said van Welie. “The physical constraints on the gas pipeline infrastructure drive gas prices higher, resulting in the region shifting from using pipeline gas to oil and liquified natural gas (LNG).”

NYISO’s Dewey made a similar point: “Maintaining electric system reliability during extreme winter weather conditions increasingly depends on the availability of dual-fuel generation capability.”

SPP provided a vivid example. “On February 27, 2025, wind generation dropped by more than 12,000 MW in approximately two hours as a weather system moved through the region,” said Nickell. “To meet the continuing demand for electricity, we had to rapidly increase the output of the dispatchable generation available during that time, primarily natural gas generation. If dispatchable generation had not been available, we would have been forced to interrupt electricity consumption within the region.” SPP has since raised its winter planning reserve margin from 36% in 2026 to 38% in 2029 to account for similar risks, he said.

To bolster winter reliability, ERCOT has implemented several targeted measures following the 2021 legislative session. “To date ERCOT has conducted 3,362 inspections of generation resources and transmission facilities,” Vegas noted in his written testimony. “The weatherization program inspects facilities for various preparation measures intended to reasonably ensure sustained operation at weather zone-specific cold and hot conditions,” he said. He also highlighted the introduction of new reliability tools: “New programs such as the Firm Fuel Supply Service are available to ensure reliability during winter events in the event of fuel curtailments for gas generation resources.” Reflecting on the outcomes, Vegas said, “This combination of efforts has shown to be beneficial over the last several winter seasons, where the performance held to the standard that Texans have come to expect from their grid.”

5. Transmission Expansion Plans Are Unprecedented in Scope

As an especially notably takeaway, grid operators highlighted the scale of a planned transmission expansion—describing it as unprecedented. “Our latest assessment of the region’s transmission needs calls for $6.9 billion in upgrades across 33 projects,” said SPP’s Nickell. “This is more than five times the investment included in SPP’s 2021 plan.” He added that these projects are essential for maintaining resource adequacy and integrating the rapid growth in weather-dependent generation.

MISO, which operates one of the most expansive regional grids in North America, has already approved tens of billions of dollars in new transmission through its long-range planning process. “Over the last several years MISO has approved over $30 billion in new transmission lines through its Long-Range Transmission Planning efforts, with more expected in the coming years,” said Curran. “These projects are projected to have a benefit-to-cost ratio of approximately 2.6 to 1 and will substantially improve electric transfer capabilities and enable the electric reliability and associated economic growth being planned across the nation.”

In New England, ISO-NE and the states have for the first time initiated a forward-looking transmission solicitation to align future infrastructure with climate and reliability goals. “Since [2023], the ISO has been working with the New England States and our stakeholders to issue a first-of-its-kind regional solicitation under the region’s new longer-term transmission planning (LTTP) process,” said van Welie. “In December, the New England States Committee on Electricity’s (NESCOE) put forth the requirements for the Request for Proposal (RFP), guided by the ISO’s 2050 Transmission Study findings, which are focused on relieving future transmission bottlenecks between northern and southern New England.”

Still, grid leaders stressed that existing transmission systems are already limiting how quickly clean energy projects can be connected or delivered. “We must also recognize that the existing electric transmission infrastructure is inadequate to meet future needs,” Curran said. “It cannot carry the amount of energy that will be needed in future years, nor does it provide the connectivity to move energy from increasingly widespread generation fleets to population centers. It is notable too that approving and building new high-voltage transmission lines is a complex and lengthy process.”

Meanwhile, permitting and interconnection studies remain major hurdles even where plans are in place.“Currently, queue cycles are taking three to four years, as a dramatic growth in the number of project requests in recent years has exponentially increased the difficulty of the detailed studies that must be conducted,” she said.

6. Interconnection Queues Are Being Overhauled—But They’re Still Backlogged

In several regions, for now, major interconnection queue reforms are underway—shifting from “first-come, first-served” to a more efficient “first-ready, first-served” approach. But, backlogs remain a critical bottleneck to getting new generation online.

PJM noted that “as of the end of 2023, over 253 GW of generation and storage resources were waiting in the interconnection queue,” but reforms are already having an impact. “The recent approval of PJM’s queue reform filing by FERC in November 2022 was a necessary and significant step toward streamlining and expediting the process for projects ready to move forward,” said Asthana.

MISO, meanwhile, reported a record volume of pending projects. “Currently, MISO’s generator interconnection queue faces a significant backlog, with over 1,600 projects totaling over 296 GW of installed capacity currently under review,” said Curran. “While history has shown that not all projects submitted into the queue will be built, they all must be studied for potential system impact.” To address this, MISO has proposed an “Expedited Resource Addition Study” to FERC that would “provide a temporary framework, sunsetting by the end of 2028, for the accelerated study of electric generation projects that are required to address urgent resource adequacy and reliability needs.”

SPP’s Nickell also noted SPP’s reforms are beginning to gain traction. “SPP’s current queue has approximately 100 GW of generation requests in various stages of the study process,” he said. “We expect to clear our interconnection backlog by the end of 2025.”

7. Some Grid Operators Are Supporting Retirement Reversals

Amid the emerging difficulties, several grid operators emphasized that retaining existing dispatchable resources—particularly those previously slated for retirement—is becoming an essential part of their reliability strategies. “Since the beginning of last year, 1,100 MW of existing generation chose to remain as supply resources in PJM after previously submitting a notice to retire,” said Asthana. “With tightening supply conditions, we encourage all generation owners who have signaled an intent to retire their units to reconsider their decision to support resource adequacy and grid reliability.”

SPP’s Nickell pointed to efforts within the region to delay or reverse retirements while new capacity is developed. “Some are extending the operation of critical coal and gas units to avoid near-term shortfalls,” he said. Omaha Public Power District (OPPD) in Nebraska, for example, recently announced plans to add 900 MW of fast-start natural gas generation by 2030.

While ERCOT did not report reversals, it stressed the the importance of retaining aging but essential thermal capacity, underscoring that state policy in Texas is directly supporting this goal. “Natural gas, coal, and nuclear power still supplied 65% of the delivered energy on the ERCOT grid in 2024,” said Vegas. “These long duration dispatchable resources remain the backbone of reliability, providing critical generation around the clock.” ERCOT is seeing an “uptick in the generation interconnection queue from gas generation,” he added. Efforts spearheaded by the Texas Legislature, such as the Texas Energy Fund, “are providing incentives for dispatchable power plant development,” he said.

8. Market Reforms Are Accelerating

Several other grid operators also testified that market reforms are moving forward at a faster pace as system conditions tighten and reliability pressures mount. ISO New England is reshaping how capacity is procured to better align with seasonal reliability needs. “In February 2024, we announced reforms to our capacity market to transition from procuring an annual capacity product on a three-year forward basis to procuring capacity on a seasonal basis and closer to the timeframe when it will be needed,” said van Welie. He noted that ISO-NE has also “initiated a resource capacity accreditation project to better reflect each resource’s contribution to system reliability during stressed grid conditions.”

PJM is pursuing a wide-ranging set of reforms to bolster system reliability, including efforts to bring new resources online quickly and improve how the capacity market reflects system needs, said Asthana. A crucial action is the Reliability Resource Initiative, which opens a queue for new, shovel-ready resources that can contribute effectively to grid reliability. PJM has also launched significant interconnection process reforms—approved by FERC and supported by stakeholders—to shift from a “first-come, first-served” system to a “first-ready, first-served” approach, incorporating progress payments and milestones to filter out speculative projects. Additional proposals include the Capacity Interconnection Rights Transfer, which allows replacement generators to assume the interconnection rights of retiring plants at the same or similar location without reentering the full queue, and Surplus Interconnection Service, which enables underutilized interconnection capacity—such as at renewable sites—to be paired with resources like battery storage.

PJM is also investing in digital tools such as NextGen, Queue Scope, and InfraTrack to automate and streamline the interconnection process. And, on the market side, PJM is implementing capacity market reforms to improve price signals, including updated Must-Offer Requirements and changes to recognize the reliability value of “Reliability Must-Run” units—generators asked to remain in operation beyond planned retirement dates to ensure resource adequacy during peak conditions.

MISO is also making targeted updates. “Over the last few years MISO instituted, with FERC approval, electric resource accreditation reforms to better identify their ability to perform during hours of highest risk, and recently submitted a filing to update its shortage pricing to better incentivize electric resource availability during tight operating conditions,” said Curran. “Looking ahead, MISO is currently working with its stakeholders to update the framework governing the usage of Demand Response and Emergency Resources to improve the ability of those existing entities to support system reliability during challenging operating conditions.”

9. New Metrics and Risk Modeling Tools Are Being Deployed

In tandem, and as significantly, grid operators are investing in more sophisticated modeling tools to better quantify evolving reliability risks-especially those driven by weather extremes and the shifting resource mix.

ISO New England has developed and operationalized a detailed framework for evaluating energy adequacy in the face of climate volatility. “ISO New England has also created a Probabilistic Energy Adequacy Tool (PEAT) to evaluate the operational impacts of extreme weather events,” said van Welie. “The study tool provides an early warning system to inform the region on the magnitude of these risks and provides a basis for developing solutions.” He added that the ISO is now working with stakeholders to establish a formal benchmark. “Using this tool, we have been working with regional stakeholders to establish a Regional Energy Shortfall Threshold (REST) that determines the acceptable level of reliability risk,” he said. “Once established, we can evaluate if meeting the REST requires the development of specific regional solutions, which could range from market designs to infrastructure investments to dynamic retail pricing and price responsiveness by end-use consumers.”

Other grid operators are similarly refining risk metrics to align planning and operations with extreme-weather realities. “MISO’s recent Reliability Imperative work includes extensive scenario-based and probabilistic planning to help identify the seasonal risk profiles and ensure we are prepared for a wide variety of system conditions,” said Curran. Similarly, SPP’s Nickell said the RTO has upgraded operator tools with “new forecast metrics and outage coordination processes that improve our understanding of system risk in near real time.”

10. The Ultimate Warning—Reliability Gaps Must Be Addressed Now

Ultimately, the grid operators delivered a stark warning: unless structural grid challenges are resolved soon, they could jeopardize major national priorities-from economic growth to transportation electrification and leadership in AI and data infrastructure.

“Without significant and collaborative action,” said SPP’s Nickell, “grid operators, utilities, and infrastructure developers will find it increasingly difficult to keep pace with consumers’ future electricity needs.” He added that load growth driven by AI, EVs, and electrified heating could quickly outstrip the pace of new infrastructure unless action is taken.

ISO-NE’s van Welie cautioned that reliability and resource adequacy shortfalls could directly undermine decarbonization and electrification goals. “It remains to be seen whether load growth will outpace the net effects of generator retirements and new supply coming online,” he said. “This will have implications for the end of the decade.” MISO and NYISO both noted that growing uncertainty in resource planning timelines, long interconnection delays, and aging infrastructure could result in near-term capacity shortfalls—even as long-term clean energy goals accelerate.

ERCOT’s Vegas emphasized that maintaining reliability amid explosive demand requires a diversified strategy. “We cannot lose sight of a fundamental reality: a reliable grid must have a balanced mix of generation resources, especially with the ‘all of the above’ approach we see in the ERCOT power region,” he said. He also pointed to growing interest in demand-side solutions. “Additionally, flexible demand is becoming a more critical component of reliable operations, and we are exploring ways to best leverage that potential in the face of the significant forecasted demand growth ahead.”

11. The Value of Coordination

Finally, across all regions, operators stressed that grid reliability is no longer solely a market or operational challenge—it is a governance challenge, requiring coordination across federal, state, and regional boundaries, they said. “We need a national conversation on resource adequacy and reliability,” said MISO’s Curran. “The scale and urgency of the challenges ahead will require sustained coordination across planning, siting, permitting, and investment.”

MISO and SPP jointly pointed to their success with the Joint Targeted Interconnection Queue (JTIQ) as a model of interregional cooperation, which SPP’s Nickell said is “expected to enable 28 GW of new electric generation, providing reliability and economic benefits to both regions.” However, Nickell also called for a stronger federal-state partnership model. “It will take cooperation and collaboration between state, regional, and federal entities to meet our growing electricity needs and maintain a reliable grid,” he said.

ISO-NE’s van Welie echoed that sentiment, emphasizing the importance of regulatory alignment: “It is vitally important that there is collaborative support from both federal and state regulators for New England’s chosen resource adequacy construct.”

NYISO and PJM both emphasized FERC’s critical role—particularly in reforming transmission siting and interconnection policy. Dewey noted that enabling faster interconnection and needed transmission will require more efficient permitting processes and improved cost allocation mechanisms—areas where FERC can play a pivotal role.

PJM’s Asthana added that strong federal leadership will be essential to address structural reliability risks and support investment. “We appreciate the leadership of FERC and encourage it to continue to prioritize actions that preserve reliability and ensure the provision of reliable electric service at just and reasonable rates,” he said. However, he also urged FERC to maintain momentum on key reforms: “We also encourage FERC to continue its leadership on interconnection reform and queue management to ensure timely and efficient project delivery,” he said. And more broadly, Asthana called for greater regulatory alignment across jurisdictions. “A durable resource adequacy framework will benefit from clear policy direction and aligned jurisdictional roles at the state and federal levels,” he said.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).

Editor’s Note: Correction

April 7: An earlier version of this article (published on April 3) misattributed several quotes to Pablo Vegas, ERCOT president and CEO, that did not appear in his written testimony to the House Energy and Commerce Subcommittee on Energy on March 25, 2025. These included references to artificial intelligence, crypto mining, and specific interconnection requests for 50,000 MW of flexible load, which were not part of the written statement submitted for the record. The article has been corrected to ensure that all quotes attributed to Mr. Vegas reflect only language taken directly and verbatim from his submitted written testimony. POWER is committed to accuracy. We deeply regret the error and have updated the story in line with our editorial standards.