Supply Chains

-

Legal & Regulatory

Europe Faces Capacity and Cost Challenges in 2014

This is expected to be the year when modest economic growth at last returns to a recession-hit Europe. Recent depressed power demand from industry has already allowed the 27 countries of the European Union

Tagged in: -

Gas

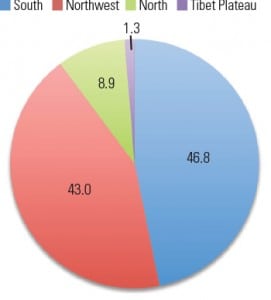

China’s Shale Gas Development Outlook and Challenges

Thanks to sustained and rapid development of China’s economy, demand for natural gas has been increasing. From 2000 to 2010, China’s demand for natural gas increased from 24.7 billion cubic meters (bcm) to

-

Commentary

The When, Where, and Why of Energy Patents

New research conducted by Massachusetts Institute of Technology and Santa Fe Institute researchers finds that the number of energy patents is increasing faster than patents overall. However, the trend lines

Tagged in: -

Supply Chains

TREND: Rare Earth Minerals and Free Markets

Far from precipitating a crisis in high-tech manufacturing, the Chinese attempt to corner the market on rare earth minerals has instead inspired some healthy competition and adaptation.

-

Supply Chains

TREND: Down Go Electricity Prices

A variety of factors have exerted downward pressure on wholesale electricity prices the past few years. EIA data suggest this may be a long-term spiral, not just a temporary hiccup.

-

Legal & Regulatory

Coal Ash Recycling Stalls During Regulatory Struggle

As 2013 opens, the coal industry is waiting anxiously on a variety of proposals for regulating coal ash. A reclassification as hazardous waste could deal another blow to coal, but some industry observers suspect the worst is not yet to come.

-

Legal & Regulatory

Trend: The Nuclear Tortoise and the Natural Gas Hare

The pendulum has recently swung back against nuclear as gas-fired power has surged in response to low prices and abundant supplies. Can nuclear ever regain its edge?

-

Supply Chains

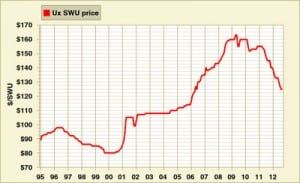

Why Swooning SWU Prices Will Continue

Long a tightly controlled near-monopoly, the market for enriched uranium is finally about to see some meaningful foreign competition.

-

Supply Chains

Rare Earths: China Strikes Back

Facing increasing competition and a slumping economy, China is moving to strengthen its already robust monopoly over rare earth minerals vital to many advanced energy technologies.

-

Supply Chains

Uranium and Nuclear Fuel: No Bottlenecks Ahead

In addition to low prices for coal and natural gas, prices for uranium oxide are also gently falling. New supplies of uranium and enriched fuel should keep nuclear fuel prices stable for years to come.