Coal

-

Coal

Are Economics Trumping Regulation?

The fate of coal-fired generation remains fluid as owners weigh environmental rules, the effect of low natural gas prices, and the shifting cost of investing in emissions control technology. An analysis of generating unit data suggests that smaller, older, less-efficient, and less-frequently dispatched assets are most vulnerable to retirements. Recently accelerated retirement dates for some units indicate that economic factors are a more important determining factor than pending environmental mandates

-

Coal

China’s Power Generators Face Many Business Barriers

China’s five largest power generators own half of that country’s power generating assets. Faulty policies and the rapidly changing global economy have made it difficult for these companies to fulfill the high expectations arising from enactment of the Power System Reform Scheme of 2002

-

Coal

EMO Technology Promises Improved Mercury Removal

The latest Environmental Protection Agency mercury control limits in the Mercury and Air Toxics Standards present a significant technical challenge to the power industry. Shaw offers a cost-effective process that promotes mercury oxidation and removal in fossil fuel combustion applications that can potentially achieve consistent mercury oxidation above 95%. Shaw’s E&I Group EMO technology provides the industry with an alternative to halogen salt addition and activated carbon injection that can also be used to augment the performance of existing Hg control applications and strategies

-

Coal

EPA Stalls on Coal Combustion Residuals

In 2010, the U.S. Environmental Protection Agency (EPA) proposed federal rules regulating coal combustion residuals (CCRs) for the first time to address the risks posed by coal-fired power plants’ disposal of such waste byproducts. The need for new regulations remains a topic of debate, heightened by the EPA’s reticence to release the rule. The EPA says that it will release the new rule by the end of this year–over two years late.

-

Coal

Replacing Coal: U.S. Combined Cycle Development Trends, Challenges

There’s plenty of uncertainty in gas-fired power these days, with low prices and impending coal plant retirements. Even so, many generators are forging ahead with some ambitious projects and plans for the future.

-

Coal

Germany’s Reliance on Coal Grows

This August, instead of the usual fanfare at the official commissioning ceremony of RWE’s twin-unit 2.2-GW coal-fired BoA Units 2 and 3—a $3.3 billion lignite-fired power plant in Grevenbroich-Neurath near Cologne (Figure 1)—Germany’s premier of the state of North Rhine–Westphalia, Hannelore Kraft, and the newly installed federal minister of the environment, Peter Altmaier, requested a rapid cutback in power production. As 400 guests watched, the output of one unit was reportedly reduced by more than 150 MW in five minutes, and then restored just as fast. The demonstration was to show how quickly the plant could offset the intermittency of wind and solar power, the officials said, proclaiming the plant an “important element” of Germany’s energy strategy.

-

Coal

TOP PLANT: C.P. Crane Generating Station, Middle River, Maryland

A desire to do things right led Constellation Energy to invest $70 million to convert its 400-MW C.P. Crane Generating Station to burn Powder River Basin coal and develop the culture critical to making that conversion a success. In addition to being named a 2012 POWER Top Plant, the PRB Coal Users’ Group recognized the plant for its efforts with its Plant of the Year Award

-

Coal

TOP PLANT: Merrimack Station’s Clean Air Project, Bow, New Hampshire

To comply with the New Hampshire law governing mercury emissions, Merrimack Station management recently installed a single scrubber system on the facility’s two coal-fired boilers. The plant’s Clean Air Project was completed on Mar. 30, 2012, ahead of schedule and under budget. Now the 440-MW Merrimack Station has reduced its mercury and sulfur dioxide emissions by more than 95% and is one of the cleanest coal-fired power plants in the nation

-

Coal

TOP PLANT: Northside Generating Station, Jacksonville, Florida

Since the Northside Generating Station’s two repowered units were placed into service in 2002, a series of modifications and repairs have been undertaken to make its two circulating fluidized bed boiler plants reliable. The two chief problems were ash agglomeration on heat transfer surfaces and poor Intrex heat exchanger performance. JEA reports these problems have been permanently resolved, and data shows the two units have joined the top tier of reliable fossil plants.

-

Coal

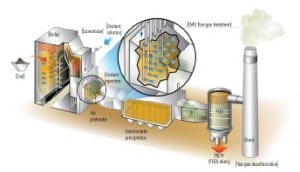

TOP PLANT: Tanjung Jati B Electric Generating Station, Central Java Province, Republic of Indonesia

Units 3 and 4 expand the Tanjung Jati Electric Generating Station’s capacity by adding 1,320 MW of reliable power that helps to boost Indonesia’s growing economy. Now the 2,640-MW coal-fired facility provides approximately 12% of the electricity available on the Java-Bali grid. The new units feature a flue gas desulfurization system and electrostatic precipitators that reduce air emissions and protect the environment.