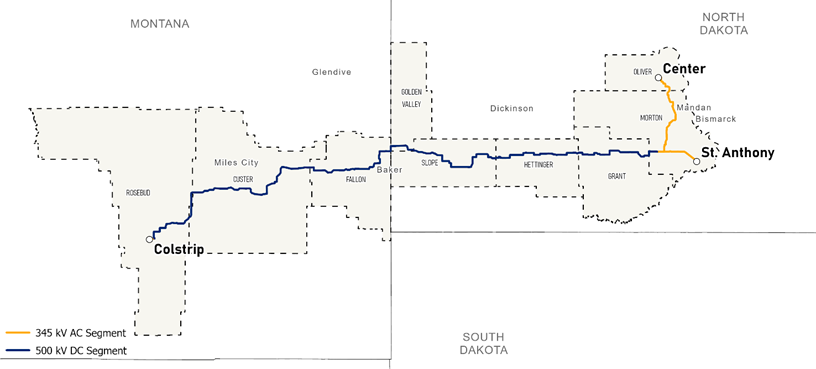

Hitachi Energy and high-voltage interregional infrastructure developer Grid United have launched the next phase of a collaboration to strengthen transmission capacity between three energy markets straddling the Eastern and Western grids in the U.S., formalizing an agreement for the North Plains Connector (NPC), a ±525 kV, 3-GW high-voltage direct-current (HVDC) line spanning roughly 420 miles between Montana and North Dakota.

The Engineering Services Agreement (ESA), announced Oct. 2, 2025, tasks Hitachi Energy with delivering early-stage engineering services—including technical specifications for two HVDC converter stations, covering electrical ratings, valve hall layouts, control-system architecture, and harmonic mitigation studies. It also includes dynamic and steady-state system modeling and AC–DC interface definitions for integration with Midcontinent Independent System Operator (MISO), Southwest Power Pool (SPP), and Western Electricity Coordinating Council (WECC).

Grid United will advance corridor refinement, land-rights acquisition, stakeholder engagement, environmental permitting support, and supply-chain sequencing for long-lead items such as transformers, smoothing reactors, and converter valves. Procurement timelines will be aligned with the project’s permitting and construction schedule.

Bridging the Crucial East-West Gap

The project marks a significant advance for Hitachi Energy’s ambitions to bridge the Eastern and Western electrical interconnections, a gap which federal studies have long identified as one of the nation’s most consequential grid vulnerabilities.

The U.S. Department of Energy’s (DOE’s) October 2024 National Transmission Planning (NTP) Study found that “significantly more transmission needs to be built in the U.S.—roughly two to three times the current transmission system—to meet future demand growth, reliability requirements, and achieve existing and potential future public policy goals.” The expansion, the study said, would “enhance grid reliability as it allows more resources to be shared across regions and energy to be moved from where it is available to where it is needed,” particularly during “large-scale extreme weather events.”

A crucial structural gap, according to a January 2025 study from the Pacific Northwest National Laboratory (PNNL), stems from the grid’s topology: the U.S. lacks coordinated interregional transmission planning and physical transfer capacity between its major electrical interconnections. The report found “a lack of comprehensive, multi-value interregional transmission planning processes … and no planning organization or authority responsible for interregional transmission planning.” It also concludes that “improving interregional transmission can enhance grid reliability as it allows more resources to be shared across regions and energy to be moved from where it is available to where it is needed.” The isolation, the authors caution, heightens system congestion, curtails low-cost renewable power in the Plains and Interior West, and undermines resilience “during large-scale extreme weather events,” when the ability to shift power between regions could avert outages and lower costs.

According to Hitachi Energy and Grid United, the NPC is designed to address that deficiency. The ±525-kV HVDC system will link eastern Montana and western North Dakota to create a controllable, bidirectional bridge between the WECC, MISO, and SPP to transport up to 3 GW in either direction between the eastern and western U.S. “NPC will help address fast-growing electricity demand driven by AI data centers and industrial electrification. It will play a key role in enabling the sharing of power between grids serving different parts of the country,” the companies said on Thursday.

The ESA builds on the companies’ first landmark announcement about the concept in March 2024. That announcement outlined a plan for Hitachi Energy to provide HVDC technology across multiple Grid United transmission projects. The companies framed the effort as a way to “dramatically boost transmission capacity across the U.S. to support the urgent need for smooth sharing of power between energy markets at a time of drastically increasing demand for electricity,” while “help[ing] overcome one of the most persistent bottlenecks in the energy transition in the U.S. by bridging the east–west divide.”

The 2024 collaboration, notably, also introduced a novel capacity reservation framework that allows Hitachi Energy to pre-allocate manufacturing capacity and streamline delivery across successive HVDC projects. Hitachi has said the mechanism echoes a business model the company had previously applied with European utilities to accelerate transmission build-out. Hitachi Energy executives characterized the approach as a supply chain innovation designed to “enable speed and scale in the supply chain” and “make important contributions to streamlining the development process to help accelerate the energy transition.”

Interregional HVDC Link Promises Major Reliability Gains

According to Grid United’s North Plains Connector website, the line is “entering the permitting phase and initiating regulatory filings, with approvals expected in 2026.” Construction could begin in 2028, and the line is expected to be operational in 2032. The company also notes that it is “coordinating with local utilities for long term operation and maintenance of the transmission line.”

In August 2024, the $3.2 billion HVDC project was selected to receive $700 million by the Biden administration under the Department of Energy’s (DOE’s) Grid Resilience and Innovation Partnership (GRIP) program. The DOE’s website indicates those funds have been awarded with a recipient cost share of $2.8 billion.

While the project is designed to be technology agnostic and bidirectional, a June 2024 independent reliability evaluation conducted by Astrapé Consulting and reviewed by the PNNL found that the North Plains Connector could deliver substantial reliability benefits across interconnections, with an effective load-carrying capability (ELCC) totaling roughly 3,550 MW (exceeding the project’s 3,000-MW transfer rating owing to complementary seasonal load diversity).

The study found the project “provides significant reliability benefit in all zones” and quantified its value at about 1,800 MW for WECC—primarily from winter reliability improvements—and 1,350 MW and 400 MW for SPP and MISO, respectively, tied to summer peaks. Astrapé attributed those benefits to the ability of the project’s east–west connection to take advantage of regional diversity in seasonal loads and resources, which could reduce the probability of simultaneous shortfalls and increase the effective reliability of all three systems.

According to Grid United, the project could also respond rapidly to peak demand, extreme weather events, and dynamic load shifts between the Eastern and Western Interconnections. It noted that in addition to increasing demand, “at least three primary factors affect the ability of the U.S.’s electrical grid to reliably deliver energy to consumers and are hastening the need for significant transmission infrastructure investment.” Changes in public policy, meanwhile, “are reducing reliable baseload generation, rapid changes in the generation resource portfolio mix are affecting reliability, and increasing frequency of extreme weather events are impacting system reliability,” it says.

Still, while the ESA represents a key step forward in development, it does not constitute a final investment decision. Under the ESA, Hitachi Energy will deliver early-stage engineering services, including the development of technical specifications for the HVDC converter stations. “This approach reduces project risk, enables proactive supply chain management, and accelerates and streamlines project execution,” Hitachi noted.

A Historic Project—And Other Efforts to Bridge the Divide

On Thursday, company officials hailed the historic nature of the project. “North Plains Connector will be the first transmission system connecting three major U.S. energy markets, supporting a key goal of the U.S. Department of Energy for interregional transmission connections to enhance grid reliability and resilience,” said Allie Wahrenberger, vice president of Engineering for Grid United. “We are excited to be moving forward with world-class engineering from Hitachi Energy, a company committed to our shared goal of improving grid reliability and resilience for millions of Americans.”

“This new agreement with Grid United is a perfect example of how a long-term collaboration built on trust and a shared vision can accelerate the project and mitigate risk,” said Nathanael Occenad, vice president, Regional HVDC Sales Manager for the Americas of Hitachi Energy. “We are proud to support Grid United to advance this project, which is so critical to the expansion of the U.S. grid in the face of skyrocketing electricity demand.”

The project, however, isn’t the first to explore bridging the East-West gap. The Tres Amigas Project, a project unveiled in 2009 by New Mexico’s then-governor, Bill Richardson, sought to unite the Eastern, Western, and Texas Interconnections with superconductor electricity “pipelines” (which combine conventional underground pipeline construction with DC superconductor power transmission cables and multi-terminal voltage-source AC/DC power converters).

While the 73-mile, 345-kV, 750 MW–capacity line project received DOE seed grants and early engineering, it faltered in 2015 when Xcel subsidiary Southwestern Public Service (the Eastern grid gateway) withdrew its interconnection agreement, leaving ERCOT unwilling to join under FERC jurisdiction. Efforts that followed to downsize the project’s scope and revise business models failed to regain momentum, and the project ceased in 2017. Its demise, however, echoed key barriers—fragmented regulatory authority, uncertain offtake commitments, and high upfront costs—that have hampered the large-scale build out of transmission infrastructure for decades.

Efforts to bridge the East-West divide appear to be burgeoning—again—under the pressure of AI-driven load growth and industrial electrification. The Biden administration’s National Transmission Planning Study and PNNL’s interregional pathways analysis have identified multiple ±500 kV HVDC corridors—including NPC—as critical to unlocking resource diversity and cutting congestion costs by up to $490 billion through 2050.

The Trump administration’s July 2025 America’s AI Action Plan directs federal agencies to enhance the efficiency and performance of the existing transmission system through advanced line upgrades and incentives, but it does not explicitly endorse or call for new HVDC corridors. In July, notably, the Trump administration halted a $4.9 billion loan commitment for the Grain Belt Express, an HVDC project intended to connect wind and solar across Kansas and Missouri.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).