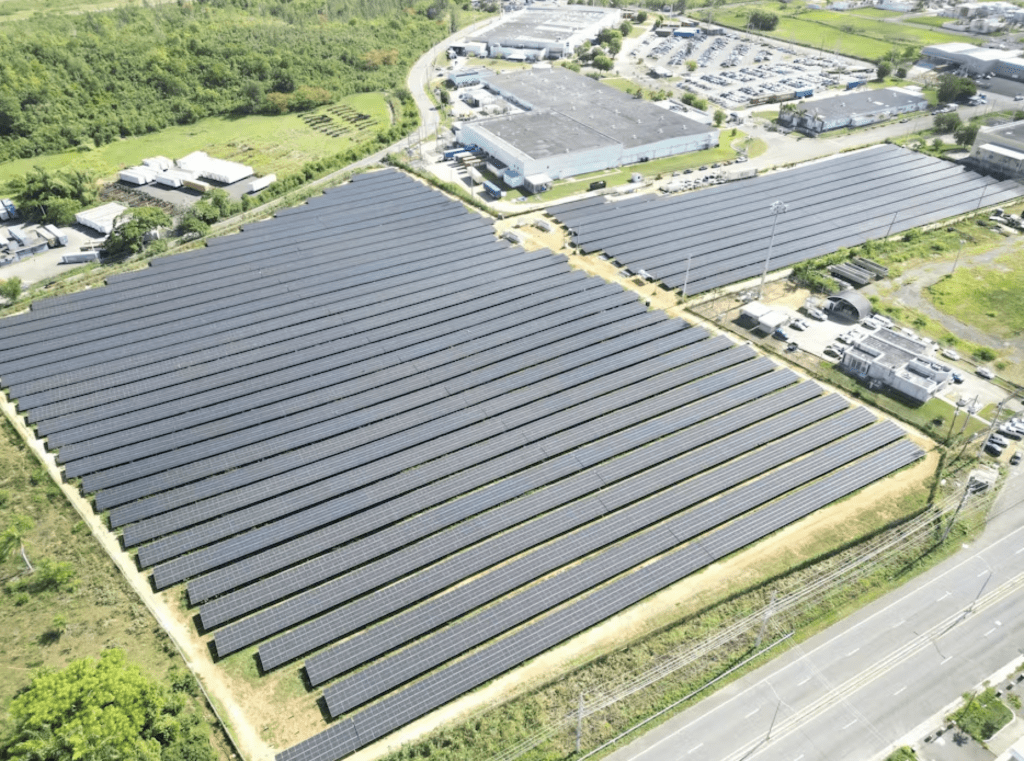

The growth of distributed power generation worldwide is increasingly reliant on microgrid systems incorporating several technologies, including solar power plus battery storage. The move toward more commercial and industrial generation, as companies look to control costs by producing some if not all of their own power, has brought on more microgrid adoption and increased the need for innovative distributed energy resource management systems.

“It speaks to trends driving these distributed energy projects,” said Bryan Huber, chief operating officer for San Diego, California-based CleanSpark, adding distributed generation is among the “needs and drivers from customers as it relates to energy security and sustainability.”

|

|

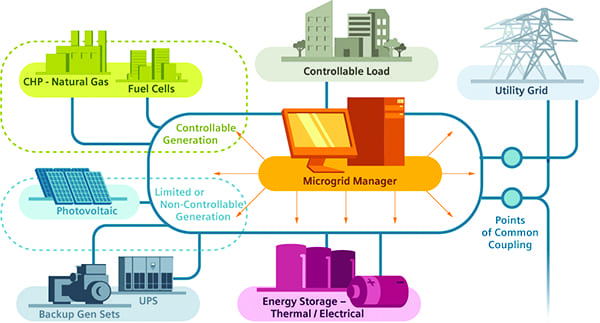

1. Microgrid controllers, such as CleanSpark’s system shown here, enable the digitization of distributed energy resources, often deployed as part of microgrids. Courtesy: CleanSpark |

Huber is a member of the advisory board for POWER’s upcoming Distributed Energy Conference in Denver, Colorado, Oct. 30-Nov. 1. He also will speak at the event. CleanSpark in August was awarded a contract to provide software controls and energy storage for an industrial facility in Costa Rica. The company will integrate a scalable 223 kWh of battery storage paired with a 221-kW solar photovoltaic system, and a backup generator for use during extended utility outages. The installation includes CleanSpark’s mPulse controls platform, with a software-as-a-service agreement to support the system (Figure 1). It is expected to be commissioned in November.

“Costa Rica has really prided itself on preservation of natural resources given its large eco-tourism industry, and this is evident with a very renewable energy mix led with a fair amount of hydropower,” Huber said. “Sustainability has been a major driver. As it relates to solar power, the drive to use more solar power onsite is quite high in Costa Rica. There’s a lot of solar going onto the grid and used behind the meter.” Huber said that while solar power is growing, “what is not happening at scale is pairing that solar with energy storage,” though that appears to be changing.

“We’re seeing multiple cases here,” he said. “We’ve been a part of looking at a number of projects behind the meter, specifically commercial, industrial, and hospitality customers looking to reduce their bills given utility ‘time-of-use’ rate structures, which benefit from reducing a facility’s demand during expensive peak times using energy storage. The core drivers of what they’re looking for are energy cost avoidance being number one with energy security, sustainability, and in some cases, power quality, being important because the national grid has voltage droop characteristics and some outages. Energy improvement is an important factor.”

Groups that study energy markets are forecasting large growth in energy storage projects, particularly as part of installations in concert with renewable energy. Wood Mackenzie in its “Global Energy Storage Outlook 2019” said energy storage deployments would grow from 12 GWh in 2018 to 158 GWh in 2024, with the U.S. accounting for 34% of that 2024 capacity. Other countries in the top five include China, Japan, Australia, and South Korea.

Mike Byrnes, vice president of marketing and sales for Veolia, told the audience at a Microgrid Knowledge conference earlier this year that “Batteries are clearly the technology of the future. Any microgrid we look at is solar-plus-storage plus generation. Customers want a cleaner renewable solution. You must understand it if you want to include it: How does the cost of storage affect [the] value proposition?”

Patrick Lee, president of San Diego, California-based PXiSE Energy Solutions, told POWER earlier this year that “a battery is a generator. It stores energy and releases energy again and again. It is used as a spinning reserve. It’s a resource to allow you to reshape the load, and key to capturing external value.”

CleanSpark’s foray into international markets includes a solar-plus-storage microgrid development incorporating six buildings on a single campus in Costa Rica, a project announced earlier this year. The system integrates solar and storage into a system with existing diesel-fueled standby power, with utility interconnections. “It’s in an industrial development zone,” said Anthony Vastola, chief strategy officer for CleanSpark, in an interview with POWER. “No project like this has ever been built in Costa Rica.”

CleanSpark also helped integrate a scalable 40-kW solar photovoltaic system paired with 32 kWh of battery storage for a hotel in Costa Rica. That project will be commissioned this October. Vastola commented when the project was announced: “The system was designed with economic efficiency in mind and will provide our customer with a lower cost of energy. Additionally, it will provide backup power in the case of an outage and power quality improvements to protect the hotel’s critical equipment from power surges that have caused costly damage to equipment in the past.”

Vastola said the most recent project announced in August “is [with] an existing generator sales company. They built a new building, and they do service work in that building. It’s a greenfield project. The load data is being monitored right now, built with backup generation to a critical load panel. The renewable assets are connected at the critical load panel. In an outage, they would be using the batteries to reduce the generator usage. The project is operated in multiple modes including an off-grid environment, utilizing the battery only supported by renewable assets with or without generator, and grid-tied, running economic dispatch operating against the rate structure for cost savings. There are onsite controls for generation and storage.”

Vastola said the control system enables operators to “refine operations through machine learning [and] push all the data into the cloud. It’s presented to the customer through a portal in the cloud, in a visual interface so they can see it. And we can see how it’s performing, to optimize it against the rate structure.” Vastola said Costa Rica’s time-of-use structure “is not unlike in California. And those rate structures are part of what is driving energy storage. Users like being able to operate against that cost of use, and incorporate their existing standby generation. And that standby generation, they don’t want to use it. They want to get through outages by using energy storage.”

The CleanSpark execs echo those in the power generation space who have said that battery storage must prove its worth beyond just providing backup power; it must also generate value. Said Vastola: “They want peak demand management, the ability to reduce charges.” Battery storage also should enable users to sell power, or arbitrage the market, during periods of peak demand, as a tool to be used both for storage and for demand response. A step in that direction came last year, when the Federal Energy Regulatory Commission voted to allow grid managers to compensate energy storage as they do traditional power generation, a decision that paved the way for more energy storage activity in wholesale U.S. markets.

—Darrell Proctor is a POWER associate editor (@DarrellProctor1, @POWERmagazine).