The growth of renewable energy, and with it the need for reliable backup generation, along with the increase in combined heat and power applications, is contributing to a rise in the use of reciprocating technology for power production.

The growth of renewable energy has increased opportunities for industries beyond those that manufacture wind turbines and solar panels. The intermittent nature of renewable generation brings with it the need for reliable backup power that can balance the wind and solar output during periods of high demand.

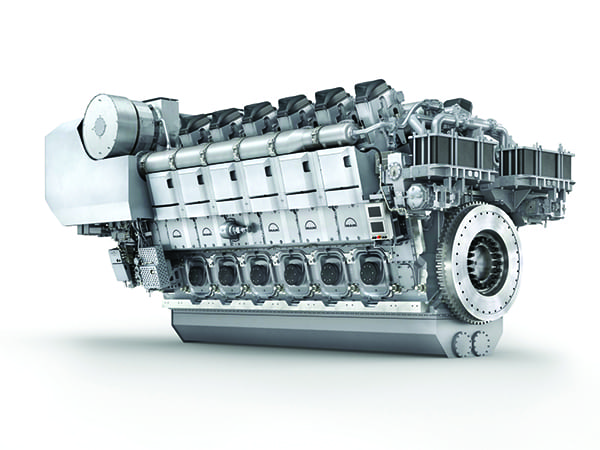

Enter reciprocating engines, which have increased in popularity over the past few years thanks to advances in technology that make the highly flexible and low-maintenance, quick-starting, and fast-ramping units well-suited for many of today’s generation projects. The units are being used in several areas, from transportation to industrial facilities, and for utility-scale projects (Figure 1). They’ve proven to be an economic choice for combined heat and power (CHP) applications. The engines also are being increasingly used as a lower-emission power source, in addition to powering marine vehicles, and for heating greenhouses.

“We’ve seen reciprocating engine technologies in a number of areas, from diesel-driven reciprocating engines, to backing up nuclear generation, to helping produce power for municipalities (munis) and co-ops,” said Paul Paxson, a senior manager for generation, operations and maintenance, and plant performance for ICF International based in Greeley, Colorado. Paxson, in a recent interview with POWER, said, “I think that in the last five to seven years, because of performance enhancements on the heat rate, with the quick-start capability, and penetration of renewables, utilities are using reciprocating technology more often. It’s become more competitive with simple-cycle gas turbines.”

“When it comes to reciprocating technology for power generation, there are a handful of key trends that stand out in the industry—power density and efficiency, fuel flexibility, integration with renewables, and the incorporation of telemetry,” Cory Nelson, director of product management for Aggreko, a company known for providing temporary power worldwide, told POWER. “Power density is simple in the sense that we’re looking to get the most power out in smaller packages. In designing generators, looking at the enclosure and weight of a particular unit has to be taken into consideration just as much as sizing the appropriate engine to meet a particular node requirement. End-user customers, particularly those in construction and events, are looking to utilize generators that ultimately fit into smaller spaces and are easier, lighter to transport.

“The market for reciprocating engines and technology is definitely growing,” Nelson said. “Over the next few years, we will start to see more advancements in fuel efficiency, renewables, and telemetry that will make generators more attractive and efficient than ever before.”

Utilities Embracing New Reciprocating Units

Entergy Corp.’s ETR subsidiary, Entergy New Orleans, in March received approval from the New Orleans City Council to build a new, $210 million natural gas-fired power plant in the city. The 128-MW New Orleans Power Station, expected online by January 2020, will use seven gas-fired reciprocating engines with self-start capability, enabling startup even when there is no power on the grid. The plant, designed to help with grid stability, and with power restoration after major storms, is also part of Entergy’s efforts to support renewable energy in its generation portfolio.

Tucson Electric Power (TEP) in July 2017 said it plans to build a new power plant with 10 gas-fired reciprocating engines that would have a combined generation capacity of 200 MW near its gas-powered H. Wilson Sundt Generating Station in Arizona. The Sundt plant’s coal-fired units were retired in 2015. TEP wants the new plant to provide flexible capacity that will help it integrate more renewables into its generation portfolio.

TEP has said it would bring half the new units, powered by Wärtsilä 18V50SG engines, online by mid-2019, with the remainder put into service by mid-2021. At the time of last summer’s announcement, David Hutchens, TEP’s president and CEO, said, “The addition of these efficient natural gas resources will help us to preserve safe, reliable and affordable service for customers as our community continues to expand its reliance on renewable energy.” The company said the reciprocating engines would provide fast power during demand peaks, along with balancing the grid due to the intermittency of renewable energy such as solar.

“Reciprocating engine technology tends to be a good fit for prospective owners looking to supplement their respective generation portfolios by adding fast and flexible resources that can provide shaft diversity while meeting the real-time and day-ahead demands of today’s evolving energy marketplaces,” Jolly Hayden, chief operating officer with Golden Spread Electric Cooperative (GSEC) in Texas, told POWER. “[Reciprocating engines] are especially attractive to owners in geographic areas where there have been significant increases in renewable resources, specifically wind generation.”

That’s a big reason the technology has taken hold in Texas, which leads the U.S. in power generation from wind, and where the installed generation capacity of the state’s wind farms—at more than 20 GW—now tops the generation capacity of coal-fired power, according to the Electric Reliability Council of Texas (ERCOT), the agency that oversees more than 90% of the state’s power grid. ERCOT, in fact, has said it expects power produced from wind will outpace coal-fired generation as soon as 2019, as coal plants continue to be retired in the state.

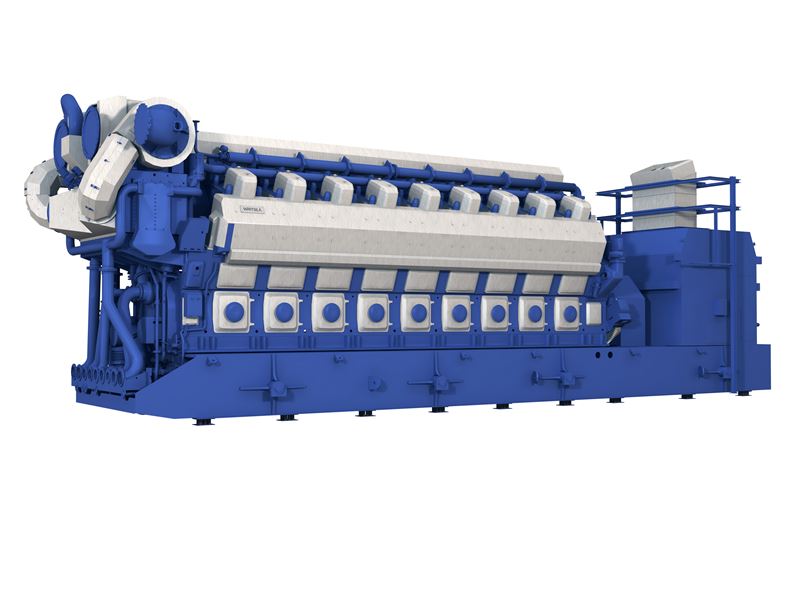

South Texas Electric Cooperative’s (STEC’s) 202-MW Pearsall Power Plant (Figure 2) in Pearsall, Texas, one of the largest CHP facilities in the U.S., features 24 Wärtsilä 20V34SG engines. STEC’s 220-MW Red Gate Power Plant in Edinburg, Texas, has 12 Wärtsilä 18V50SG gas-fired engines; each generates more than 18 MW.

“We are most familiar with Wärtsilä reciprocating engine technology,” said Hayden, noting “South Texas Electric Cooperative has the same technology we do.” GSEC’s 16 member co-ops serve customers in the Texas Panhandle, the South Plains and Edward Plateau regions of Texas, the Panhandle of Oklahoma, southwest Kansas, and part of southern Colorado. “We currently have 168 MW of Wärtsilä 20V34SG engines installed in our portfolio,” said Hayden.

The Denton Energy Center in Denton, Texas, expected online this summer, has 12 Wärtsilä 18V50SG engines that will generate up to 225 MW for city-owned utility Denton Municipal Electric (DME), which proposed the plant to replace coal-fired generation. DME has said the plant will enable it to negotiate long-term contracts for wind and solar power. The utility’s “Renewable Denton” plan calls for 70% of DME’s generation to come from renewable sources by early 2019.

Technology Has Widespread Applications

Several companies offer reciprocating technologies, including Wärtsilä, Caterpillar, Cummins, Perkins, MAN Diesel & Turbo, GE Power, Siemens, Mitsubishi Heavy Industries, Niigata Power Systems, and Generac, among others. Wärtsilä’s technology is used in North America’s largest natural gas-fired peaking power plant (Figure 3), the Plains End I and II in Arvada, Colorado, a suburb of Denver. The plant, with a total generating capacity of 231 MW, was developed in two phases. Plains End I utilizes 20 Wärtsilä 18V34SG reciprocating engines, and Plains End II has 14 Wärtsilä 20V34SG natural gas combustion engines. The plant is able to ramp from low load to full load and back quickly.

“To this day, Tyr Energy, the owner, and Xcel Energy continue to see additional value when analyzing the Plains End plant,” Phil Rutkowski, business development manager for energy solutions for Wärtsilä North America, told POWER. “It is still one of the most flexible and efficient plants available for Xcel, and with its extremely high availability, Plains End has recently picked up the role as being the black-start facility for Xcel’s Denver metro service territory.”

Wärtsilä’s engines also are used at many other facilities, such as the Goodman Energy Center in Hays, Kansas, which was recognized as a POWER magazine Top Plant in 2009. The plant, built in 2008, originally utilized nine 20V34SG gas-fired engines, each with selective catalytic reduction technology to meet local air emissions limits, and with a generation capacity of 76 MW. The facility added three engines in 2015, and the expansion entered commercial service on April 1, 2016, with an increased generation capacity of 102 MW.

At the time of the expansion, Bill Dowling, Midwest Energy’s vice president for engineering and energy supply, said, “The continued development of the regional energy market in the Southwest Power Pool places a premium on owning gas-fired generation that is both flexible and reliable.”

The wide applications for reciprocating engines are noted in the projects where Wärtsilä’s engines are used, including the Barrick Goldstrike Mines in Nevada; the Gyorho CHP plant, which powers the city of Gyor in Hungary; the CHP plant at the Linate Airport in Italy; and the 175-MW Sasolburg power plant in South Africa.

On Land and Sea

“There are a lot of suppliers for reciprocating engine technology,” said ICF’s Paxson. “They’re being used on big utility-scale projects, coming from a number of manufacturers such as MAN Diesel & Turbo, Caterpillar, and Waukesha. They work with a variety of control systems… you can kind of pick from a cafeteria menu, depending on who the integrator is. Today, a small to mid-size power plant equipped with high-output reciprocating engines can effectively compete against a gas-turbine plant of the same size.”

MAN is among the leaders in engines for marine use. ESL Shipping, a leading carrier of dry-bulk cargoes in the Baltic region, recently ordered six MAN L23/30DF generator sets for cargo carriers being built in China.

MAN also supplies engines for power plants. Seven of its 51/60DF gas-fueled gensets will power the new 127-MW Maria Gleta plant near Cotonou, Benin, in West Africa. The plant is scheduled to come online in 2019. Late in 2017, MAN unveiled its 20V45/60 (Figure 4), a four-stroke diesel engine that the company says is “the most powerful four-stroke engine in the market,” capable of producing 26 MW. It also offers a marine diesel engine, the MAN 45/60CR, with 12V and 14V versions rated at 15,600 kW and 18,200 kW, respectively.

U.S. Department of Energy (DOE) reports released over the past several months highlight the increased use of reciprocating engines, particularly in commercial and industrial environments, for power generation and combined heat and power applications. The DOE notes how “industrial and commercial companies have discovered cogeneration utilizing natural gas-fired reciprocating engines, not only for high thermal output but also low maintenance costs, low emissions, and high reliability for onsite generation and standby power.”

A DOE-sponsored report written by the Gas Research Institute said the use of gas-fired reciprocating engines in cogeneration resulted in “lower operating costs for the user and potential reductions in emissions of criteria pollutants and CO 2.” The report also noted the increased use of reciprocating engines for standby power, in part due to rapid start-up capability and strong load-following characteristics.

The engines’ “black-start” capability has a role in keeping electric grids humming. Black start is required when a power plant goes offline due to a malfunction or other incident, and the facility needs an external power source to resume operation. Operators can then start their on-site reciprocating engines for the electricity needed to restart the plant. They are often used at nuclear power plants to safely shut down and maintain reactors if there is a loss of power, coolant issue, or other operational anomaly.

“Reciprocating engines are used in almost all commercial and industrial markets globally,” said Aggreko’s Nelson. “Primarily used for backup, standby, or emergency power, generators can be crucial in situations where primary power sources are not reliable, are constrained, or non-existent. In the last few years, an increase in natural disasters has driven the need for large generators [1 MW and above] to provide power for local grid stabilization or for large manufacturers and producers to continue operations.

“During the shale boom in the United States in the early 2010s, remote well sites in the Permian Basin, Eagle Ford, and Bakken required generators to power large pumps,” Nelson said. “Utility power was non-existent and an integrated power solution was needed where 40 to 50 well sites existed in a single location. Petrochemical, refining, and manufacturing plants require off-grid, temporary power during turnarounds and shutdowns.”

Simplicity Breeds Popularity

The simplicity of reciprocating engines also is part of their popularity. “Reciprocating engines are basically the same technology you see in your car,” said ICF’s Paxson. “It’s a fairly simple piece of equipment compared to an aero-derivative [combustion turbine], and the munis and co-ops see [it] as much easier to absorb and digest. It’s a little less scary. The complexity of commercial turbines makes them nervous.”

The flexibility of reciprocating engines is cited as a major part of their appeal. Aggreko touts its Next Generation Gas generators as “versatile and flexible on any gas fuel type,” including associated petroleum gas, compressed natural gas, liquefied natural and petroleum gas, as well as stranded or flared gas. The company says its “mobile and modular plant design also delivers plant flexibility and full scalability, with the ability to increase or decrease capacity according to demand,” and says its generation sets are “ideal for harsh or remote locations.”

Though the market for reciprocating engines is partly tied to the increased use of renewable energy, another technology—battery storage—could limit the engines’ market share.

“The future of power generation will definitely be impacted by the implementation of renewables, and what happens in the storage arena,” said Paxson. “The cost of storage is going to drop precipitously over the next three to five years, much like we saw with [solar] panel and inverter pricing. Once storage technology gets close to parity, and it’s clean, it’s going to be a real mover and shaker in the marketplace, just as we’ve seen coal replaced with gas.”

GSEC’s Hayden agreed. “The more renewables we integrate into the grid, the more need for quick-start and quick-ramping resources,” he said. “The biggest threat to [reciprocating engines] is batteries as the prices continue to fall.”

More renewables and more storage, along with low prices for natural gas, have changed the face of power generation—and that shift will continue.

“We’re going to continue to see coal falling off the map. All the technology will be clean. One would expect in our lifetime that fossil could be replaced entirely with storage. In the mid-term, reciprocating technology is a good solution for institutions and munis,” Paxson said, noting that when it comes to technology advancements for power generation, “it’s going to be a brave new world.” ■

—Darrell Proctor is a POWER associate editor.